Will USD/CHF Sustain Its Bullish Structure with Layered Entries?🎯 USD/CHF "THE SWISSY" - BULLISH SWING SETUP | Multi-Layer Entry Strategy 💰

📊 MARKET OVERVIEW

Pair: USD/CHF (The Swissy)

Trade Type: Swing Trade - Bullish Bias

Strategy: Thief's Multi-Layer Entry Method 🎭

🔥 THE SETUP

💎 ENTRY STRATEGY - LAYER METHOD

Using Multiple Buy Limit Orders (Layering Style):

Layer 1: 0.79000 🎯

Layer 2: 0.79200 🎯

Layer 3: 0.79400 🎯

📝 Note: You can add MORE layers based on YOUR capital & risk appetite. This averaging-down approach works when trend aligns with your direction!

🛡️ RISK MANAGEMENT

Thief's Stop Loss: 0.78600 ⚠️

⚠️ IMPORTANT: Ladies & Gentlemen (Thief OG's) - This is MY stop loss level. You MUST adjust YOUR stop loss based on:

Your own risk tolerance

Your account size

Your trading strategy

Your psychology

I'm NOT recommending you copy my SL blindly. Trade at YOUR OWN RISK! 🎲

🎯 PROFIT TARGET

Primary Target: 0.81000 🚀

📍 Why This Level?

Moving Average acting as STRONG resistance zone

Overbought conditions expected

Potential bull trap zone - ESCAPE with profits here!

⚠️ DISCLAIMER: Ladies & Gentlemen (Thief OG's) - This is MY take profit level. You can exit earlier/later based on YOUR strategy. Make money, TAKE money at YOUR OWN RISK! 💪

🔗 CORRELATED PAIRS TO WATCH

📈 POSITIVE CORRELATION (Move Together):

EUR/CHF - Swiss Franc weakness benefits both

GBP/CHF - CHF weakness across the board

DXY (US Dollar Index) - USD strength drives USD/CHF up

📉 INVERSE CORRELATION (Move Opposite):

EUR/USD - When USD strengthens, EUR/USD typically falls

XAU/USD (Gold) - Gold often drops when USD gains

CHF/JPY - Inverse CHF movement

🎯 KEY CORRELATION INSIGHTS:

DXY above 106.00 = Bullish fuel for USD/CHF 🔥

Swiss National Bank dovish = CHF weakness expected

US Treasury Yields rising = USD strength catalyst

Risk-ON sentiment = CHF (safe haven) typically weakens

📊 KEY TECHNICAL FACTORS

✅ Bullish Catalysts:

Multiple support levels holding

USD showing relative strength

CHF facing headwinds from SNB policy

Layer entry allows better average price

⚠️ Watch Out For:

Strong resistance at 0.81000 zone

Potential overbought conditions near target

Risk-OFF events trigger CHF safe-haven demand

SNB surprise interventions

💡 THIEF'S FINAL WORDS

"The market is a device for transferring money from the impatient to the patient."

This is a SWING trade - not a sprint! 🏃♂️

Layer your entries, manage your risk, and let the trade breathe.

Remember:

✅ YOUR money = YOUR rules

✅ YOUR risk = YOUR decision

✅ YOUR profit = YOUR timing

Trade smart, not hard! See you at 0.81000! 🎯💰

#USDCHF #ForexTrading #SwingTrade #TheSwissy #LayeringStrategy #RiskManagement #TradingView #ForexIdeas #PriceAction #TechnicalAnalysis 📈💪🔥

Drop a 🚀 if you're watching this pair! Drop a 💬 with your TP level!

Usdchfforexsignal

USD/CHF Bulls Charge Forward – Key Breakout Setup Unfolding🎯 USD/CHF "THE SWISSY" - FOREX PROFIT PATHWAY SETUP

Bullish Momentum | Day Trade | Moving Average Breakout Confirmed

📊 TRADE SETUP OVERVIEW

🔔 Asset: USD/CHF (The Swiss Franc Pair)

📈 Bias: BULLISH ✅

⏱️ Timeframe: Intraday (Day Trade)

🎲 Strategy: Moving Average Breakout + Layered Entry System

💡 ANALYSIS BREAKDOWN

The USD/CHF has successfully confirmed a bullish breakout above key Moving Average resistance levels. Price structure indicates a strong push higher with multiple confluence zones supporting upward momentum. The setup respects recent market structure and provides a clean risk-to-reward opportunity for tactical intraday traders.

🎪 ENTRY STRATEGY - "The Thief Method" 💼

Layered Buy Limit Entry System (Multiple Order Placement):

🔹 Layer 1: Buy Limit @ 0.80000

🔹 Layer 2: Buy Limit @ 0.80250

🔹 Layer 3: Buy Limit @ 0.80500

🔹 Layer 4: Buy Limit @ 0.80750

💡 Pro Tip: Adjust layers based on your risk tolerance and account size. Scale into positions rather than going all-in.

🛑 STOP LOSS - "The Thief's Insurance" 🎯

Stop Loss Level: 0.79500

Reasoning: Previous market structure | Nearest Lower Low | Candle Wick consideration

This SL respects mechanical support and provides defined risk parameters.

🚨 TAKE PROFIT - "Police Barricade Zone" 💰

Target Level: 0.81900

Resistance Indicators:

Strong Historical Resistance 📍

Overbought Zone Alert ⚠️

Profit Taking Trap Zone 🎣

⚡ Recommendation: Consider taking partial profits at 0.81900 to secure gains before potential pullback.

📌 RELATED PAIRS TO MONITOR 🌍

Correlated Pairs & Key Levels:

💵

EURCHF

- Watch for inverse correlation; if USD/CHF rallies, EUR/CHF often consolidates. Key level: 0.94500

📊

GBPCHF

- Similar dynamics; acts as confirmation. Watch resistance near 1.08200

🎲

USDJPY

- Risk sentiment indicator; strong risk-on when USD/CHF pushes higher. Level: 155.500

🔗 CHF Crosses Generally - When USD strengthens, all CHF pairs weaken; observe overall CHF weakness

🧠 KEY TECHNICAL POINTS

✅ Moving Average Alignment - Price above key MA(s) = bullish continuation signal

✅ Breakout Confirmation - Clear resistance break with momentum

✅ Risk/Reward Ratio - Favorable setup with defined entry zones

✅ Layering Advantage - Multiple entries reduce average cost and emotional decision-making

✅ Structure Respect - SL places at logical market structure levels

⚠️ IMPORTANT DISCLAIMERS & NOTES

🎪 "Thief Style" Trading Strategy - This is a tactical, fun-oriented approach to forex trading. NOT financial advice.

Risk Warning:

🔴 Past performance ≠ Future results

🔴 Forex trading involves substantial risk of loss

🔴 Position sizing is YOUR responsibility

🔴 Stop losses and take profits are RECOMMENDATIONS, not guarantees

🔴 Only risk capital you can afford to lose

Your Trading Journey:

YOUR entry decisions = YOUR profits/losses

YOUR stop loss placement = YOUR risk management

YOUR take profit timing = YOUR discipline

Manage your own risk. Make your own choices. Own your results.

🌐 CORRELATION & WATCHLIST

Monitor these instruments for USD/CHF confirmation:

🇺🇸 DXY (US Dollar Index) - Strength confirmation

🇨🇭 SNB Policy - Swiss National Bank decisions = CHF mover

📊 Interest Rate Differentials - USD vs CHF rate spreads

🎯 Risk Sentiment - Risk-on favors USD, risk-off favors CHF

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#USDCHF #ForexTrading #DayTrading #TechnicalAnalysis #BullishSetup #MovingAverage #Breakout #ThiefStyle #SwissFranc #TradingCommunity #FXTrading #RiskManagement #TradingPlan #ProfitPathway

Will the Swissy Bounce Back? LSMA Pullback Setup Inside!🥳 Swissy Heist: Bullish Swing Playbook (LSMA Pullback Strategy) 💰

Alright, Thief OGs! 👋 The USD/CHF ("Swissy") is setting up for a potential bullish move, and we've got the blueprints. This isn't a "get rich quick" scheme; it's a calculated swing trade plan using a classic pullback strategy. Let's get into it!

📊 The Master Plan (Analysis)

Bias: Bullish ✅

Strategy: LSMA Moving Average Pullback & Continuation.

Confirmation: We're looking for a pullback to a key demand zone where price respects the dynamic support offered by the LSMA (Least Squares Moving Average). A bounce from here signals the next leg up is likely starting.

🎯 Entry, Stop & Target (The "Thief" Logistics)

This is where the "Thief" layer strategy comes into play. Instead of one all-in entry, we scale in with precision.

🎪 Entry Method (Layered Limit Orders):

We're setting multiple buy limit orders to catch the dip at these key levels:

Layer 1: 0.79000

Layer 2: 0.79200

Layer 3: 0.79400

Layer 4: 0.79600

Pro Tip: You can adjust the number of layers and levels based on your own risk appetite and market structure.

🚨 Stop Loss (Risk Management):

A decisive break below the structure suggests the plan is invalid. The suggested stop loss for this setup is below the key support at 0.78800.

Disclaimer: This is MY stop level. You are the captain of your own ship—manage your risk according to your own trading plan and risk tolerance! 🧭

🎯 Take Profit (The Escape Plan):

Our primary target is 0.80400.

Why? This area represents a confluence of resistance: the moving average may act as resistance, and we could see some overbought pressure. The goal is to "escape with profits" before any potential trap snaps shut! 🪤

Reminder: Just like the SL, this is MY target. Feel free to take partial profits earlier or trail your stop—you do what's best for YOUR pockets!

🔍 Related Pairs to Watch

$EUR/CHF: Often moves in correlation with USD/CHF due to the shared CHF (Swiss Franc). A strong CHF will affect both pairs.

$EUR/USD: The "anti-dollar" pair. A strong bullish move in USD/CHF often coincides with a bearish move in EUR/USD. Watch this for overall USD strength clues.

$GBP/CHF: Another CHF-cross that can show similar sentiment towards the Swiss Franc.

Key Correlation Point: If the USD is strengthening broadly, we'll likely see bullish momentum in USD/CHF and bearish momentum in pairs like EUR/USD and GBP/USD.

✨ Final Notes from the "Thief" Vault

This is a swing trade idea, so patience is key! ⌛

The "Thief" style is all about strategic, layered entries—not reckless gambling.

Always trade with a plan and never risk more than you can afford to lose.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Forex #USDCHF #Trading #SwingTrading #TechnicalAnalysis #LSMA #TradingSetup #ForexSignals #DXY #Swissy

Setupsfx_ | USDCHF: A Big Major Swing Sell In Making 760+ Pips The USDCHF pair has dropped significantly since our last update. We anticipate another drop before price may reverse. DXY is also dropping and may continue to decline. There’s a major swing target that will take time to complete successfully. Use risk management according to your own risk tolerance.

Thank you for your continued support!

Team Setupsfx_

USD/CHF Swing Trade Plan — Breakout Setup + Layered Entries📊 USD/CHF "SWISSY" | Swing/Day Trade + Market Sentiment Report 🕶️💵

Date: September 2, 2025 (🟢 +0.56% daily change)

📈 Key Market Metrics

52-Week Range: 0.7871 - 0.9202

Day's Range: 0.8000 - 0.8061

1-Month Change: +0.21%

12-Month Change: +5.24%

😰 Fear & Greed Index (Market Sentiment)

Current Value: 64/100 (Greed 😊)

Driven by rate cut hopes + strong equity performance

1-Year Average: 49 (Neutral)

Greed Signals: Stocks outperform bonds, low volatility, bullish options

🧠 Trader Positioning

Retail Traders: 55% Long 📈 | 45% Short 📉

Institutions: 60% Long 🏦 | 40% Short 💼

➡️ Overall sentiment: Moderately bullish, with Fed rate cut expectations supporting USD, but CHF safe-haven flows capping upside.

🏦 Macro & Fundamental Drivers

US Dollar (USD):

Fed rate cut probability: 90% (Sept) 🕊️

CPI: 2.7% (above 2% target)

Labor market cooling (weak NFPs)

Tariff/political risks pressuring USD

Swiss Franc (CHF):

SNB policy rate: 0.0% (room for negatives)

CPI: 0.2% (ultra-low, no hawkish push)

CHF demand supported by Ukraine-Russia tensions

CHF up +5.24% YoY vs USD

🛠️ Trade Plan (Thief Strategy)

📌 Bias: Bullish (Pending Order Setup)

📌 Entry Trigger: Breakout above 0.80700 ⚡ (Set TradingView alert to catch breakout fast!)

Layered Entry (Thief Method):

Limit Buy Orders at: 0.80300 | 0.80400 | 0.80500 | 0.80600

Add more limit layers as per your risk appetite ✅

Always confirm breakout (0.80700) before layering in

Stop Loss (Thief SL):

Protective SL @ 0.80000 (after breakout confirm)

Adjust based on your risk & strategy

Take Profit 🎯:

Target @ 0.81800

⚡ Expect resistance + overbought signals near this zone

Reminder: Secure profits quick — “escape with the bag” before reversal 🏃♂️💨

🎯 Market Outlook

Bullish Score: 65/100 🐂

Bearish Score: 35/100 🐻

➡️ Bias is short-term bullish on Fed dovish stance, but upside capped by CHF safe-haven demand.

⚠️ Risks to Watch

Fed Decision (Sept 17)

US NFP Data (Upcoming)

Swiss CPI (Sept 4)

Geopolitical tensions (Ukraine-Russia)

💡 Quick Summary

USD/CHF shows bullish momentum with breakout potential above 0.80700. Thief strategy layering provides multiple low-risk entries. Fundamentals support USD strength short term, but CHF safe-haven demand could slow gains. Trade with alerts, protect capital, and execute layered entries wisely.

🔍 Related Pairs to Watch

💲 FX:EURUSD | FX:GBPUSD | FX:USDJPY | OANDA:XAUUSD (Gold)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#USDCHF #Forex #SwingTrade #DayTrading #BreakoutTrading #ForexStrategy #LayeredEntries #ThiefTrading #PriceAction #TradingViewIdeas #MarketSentiment

Swiss-Dollar Bank Job: Breakout or Bust!💵🕵️ USD/CHF "Swiss-dollar" Forex Bank Heist Plan (Swing/Day Trade) 💎🚀

🌍 Dear Thieves, Robbers & OG’s of the Market Vault,

This is our master robbery blueprint based on 🔥Thief Strategy🔥 using layered entries & alarms to catch the breakout in real-time.

📈 Plan: Bullish (Pending Order Plan)

Breakout Entry ⚡: 0.81100 (set your alarms, don’t miss the crack in the vault 🚨)

Pullback Entries (Layer Method) 🧱:

0.79000

0.79300

0.79500

0.79700

0.80000

(add more layers if needed, stack your bullets 🎯)

💡 Thief Layer Strategy: Place multiple buy limit orders like thieves placing ladders at different points of entry. Confirm every layer only after breakout @0.81100.

🛑 Stop Loss (SL)

Breakout Entry SL: 0.80000

Pullback Entry SL: 0.78500

⚠️ Place your SL only after breakout/pullback confirms. Adjust as per your own risk appetite & layering style.

🎯 Target

Police barricade spotted 🚓 around 0.83000

Escape Target 🎒: 0.82500 (collect profits before the cops close in 🚔💨)

🔔 Important Reminder

✅ Always set alarms in TradingView so you catch the breakout without missing it.

✅ SL & Target levels are based on Thief OG method — tweak them for your style.

✅ This is not financial advice, just a robbery blueprint.

💖 If you enjoyed this heist plan, boost the idea & join the Thief Crew 🚀💵.

Together we raid the market vaults daily! 🏆💸

USDCHF longs due to better than expected eco dataFor the week ending August 23, 2025, U.S. initial jobless claims were 229,000, below the forecast of 231,000 and down from the previous week's revised figure of 234,000. This suggests a slight improvement in new unemployment filings.

Real gross domestic product (GDP) increased at an annual rate of 3.3 percent (0.8 percent at a quarterly rate) in the second quarter of 2025 (April, May, and June), according to the second estimate released by the U.S. Bureau of Economic Analysis.

Due to the above data being better than expected, we can expect the dollar to increase in strength over the short term.

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

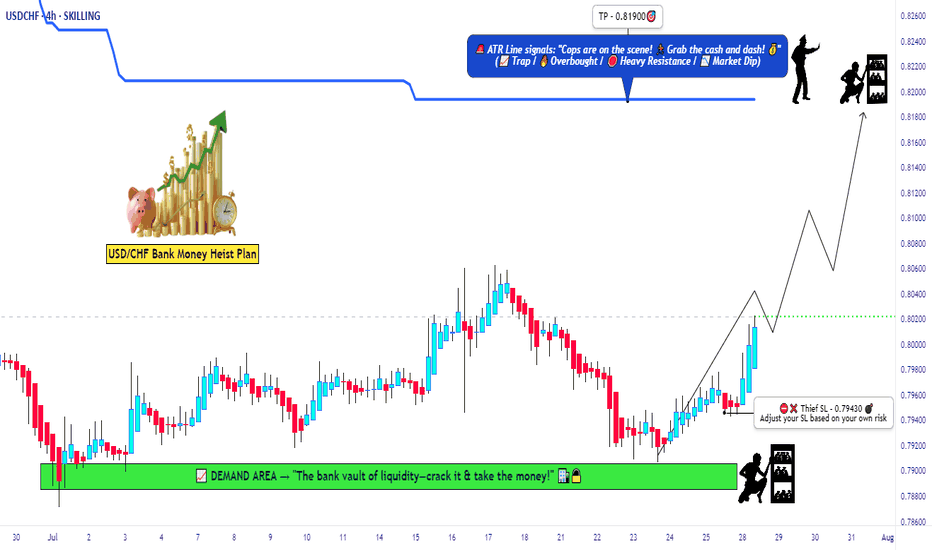

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79430)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81900

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

USDCHF Precision Heist Strategy – Buy Dips, Bag Pips💼💸 USDCHF "SWISSIE" – Bullish Vault Infiltration Plan 🕶️📈

"Plan the Layer. Stack the Cash. Escape Clean."

🧠 Mastermind Setup (Thief Trader Blueprint)

🔍 Asset: USDCHF – “The Swissie”

📊 Market Bias: Bullish

🎯 Method: Multi-limit Entry via GRID / Layering / DCA Strategy

🔓 Entry Point: Any live price – thief never waits for permission

🛑 Stop Loss: 0.80000 – the trapdoor in case of reversal

🎯 Target: 0.82400 – cash out before the sirens blare

🧰 Tactical Details:

🎯 Entry Strategy:

Layer entries like a precision bank job – DCA into support zones or pullback levels. Let price come to your ambush.

“A wise thief doesn't chase the vault – he waits in the shadow.”

🧠 Thief Psychology:

We're hunting liquidity pools. Every fake-out is a distraction. Our plan? Predict the move, then ambush it.

🔥 Fundamentals Fueling the Heist:

✅ USD Strengthening on macro pressure

✅ CHF weakening under global risk reset

✅ Institutional net long bias in USD

✅ Intermarket confluence supports USD/CHF upside

“Read the tape. Watch the flows. Follow the smart money.”

📛 Stop Loss Plan:

Set SL below 0.80000 – deeper than the market’s false traps.

Use dynamic SL with trade size + risk model.

SL = Exit plan, not an emotion control leash. Be tactical, not scared.

🎯 Take Profit Tactics:

Target zone at 0.82400 – near historical resistance vault.

Use trailing SL as price flies to protect the bag.

Partial exit if momentum wanes.

⚔️ Scalper's Mini Mission:

🕵️♂️ Focus ONLY on longs – counter moves are traps

💰 Fast fingers? Ride intraday pullbacks

📍 Secure profits fast – alarms ring quick in Forex banks

🚨 Risk Event Alert:

🗓️ Avoid execution during major USD/CHF economic reports

⚠️ Pause entries

⚠️ Use trail SLs if active

⚠️ Expect fakeouts – vault traps trigger easily during news bombs

🔊 Call to Thief Army – Boost This Plan 📣💥

If this setup lights up your chart like a vault scanner:

👍 Smash that LIKE

💬 Drop your entry below

🔁 Share with the crew

Every boost = another brick stacked in our empire 💼

“Pips build pyramids. But unity builds empires.”

#TradeLikeAThief #ForexHeist #SwissieSnatch

📌 Legal Escape Note:

This is not financial advice. It’s a battle plan.

Stay sharp. Manage risk. Execute with precision.

🕶️ Until next vault… Lock it. Load it. Loot it.

🔥 The Swissie won’t rob itself.

Liquidity Grab Complete? Why USDCHF Could Be Heading South📉 USDCHF remains firmly in a downtrend on both the weekly (1W) and daily (1D) timeframes. The recent bullish retracement is now confronting a critical resistance zone 🔒 — defined by a descending trendline and a daily order block between 0.8150–0.8200.

🧱 Price action at this level shows clear signs of rejection, aligning with a bear flag formation, which could pave the way for continued downside toward the 0.7800–0.7600 region.

📊 Fundamentally, the Swiss Franc (CHF) continues to gain strength, supported by Switzerland’s stable economic outlook and ongoing safe-haven demand. Meanwhile, the US Dollar faces headwinds from dovish Fed expectations and rising political uncertainty in the US 🇺🇸.

🔮 From a Wyckoff/ICT perspective, this upward move appears to be a liquidity grab into a premium zone, with smart money likely distributing positions before initiating a new markdown phase. A sell bias is favored below 0.8200, with downside targets set at 0.8000 and beyond.

📅 Keep a close eye on this week’s US NFP and Swiss CPI releases — both could inject fresh volatility into the pair.

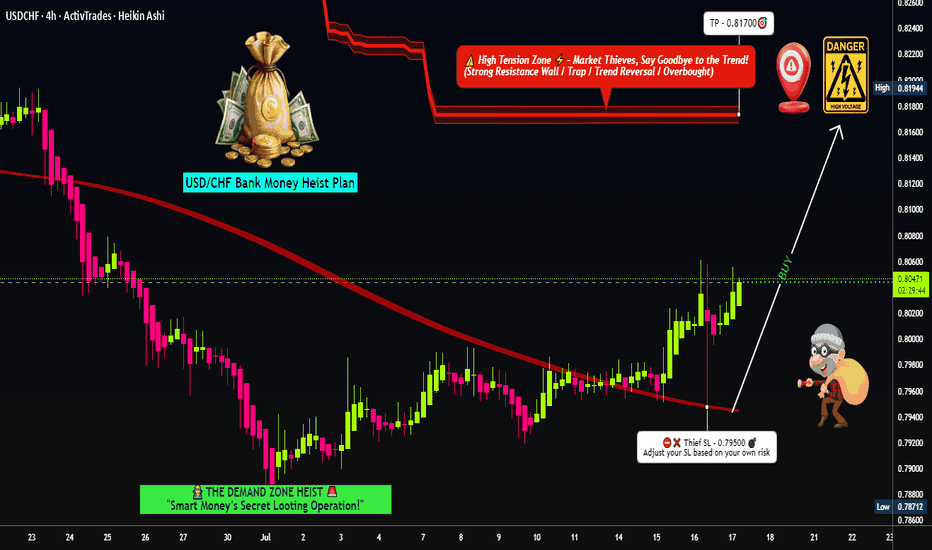

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79500)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81700

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all of these three are positively correlated. Other fundamental reason is the blooming fear of recession in the US Market, on Friday we saw indices and stocks drop record high similarly to the first announcement of covid lockdown. USD index saw sharp drop due to this and it is likely that price will continue to do that on dxy index.

How to Trade USDCHF 's Downtrend with Precision📉 Market Breakdown: USDCHF Under Pressure

Currently keeping a close watch on USDCHF 💵🇨🇭 — the pair has been in a strong, sustained bearish trend 🔻, and the overall pressure remains clearly to the downside.

My bias is firmly bearish 📊, but I’m not rushing in. Instead, I’m patiently waiting for an optimal entry 🎯 — one that offers the right balance of confluence, structure, and reduced risk 🧠🛡️.

🎥 In today’s video, we dive into:

✅ Market structure

✅ Price action

✅ The prevailing trend

✅ Entry zones with minimized risk

I also walk you through my personal entry strategy and trading plan 📋, it's not just an idea drop.

📌 Disclaimer: This is not financial advice — the content is for educational purposes only.

USDCHF..SHORT📌 USDCHF – Multi-Scenario Setup

This pair has two key levels: one short-term, the other long-term.

If price reaches the first level and shows solid bearish reaction, I’ll enter a short.

If that level breaks and confirms, I’ll go long—but manage the long aggressively, since I’ll look to exit around the higher level.

If the price pushes beyond even the second zone, I’ll be ready to buy again.

❗️I’m never upset by a loss or a broken level.

The market leads—I follow.

Claiming “it must drop from here” or “it has to rise” is wishful thinking, not trading.

✅ Stay calm, stay flexible, and stay prepared for every scenario.

Swissy Heist: USD/CHF Bearish Breakout Blueprint🚨 Swissy Heist Alert: USD/CHF Bearish Breakout Plan for Swing/Day Traders 🌐💸

Hello, Wealth Chasers and Market Mavericks! 👋😎

Welcome to the Thief Trading Strategy, a cunning blend of technical precision and fundamental insight to conquer the USD/CHF Forex market. This is your blueprint to pull off a masterful heist on "The Swissy." Follow the plan, target the high-reward Green Zone, and navigate the traps where bullish players lurk. Let’s grab those pips and treat ourselves to the spoils! 💰🎯

📈 Trade Blueprint: USD/CHF Setup

Market: USD/CHF (Forex) 🌍

Bias: Bearish Breakout 📉

Timeframe: 4H (Swing/Day Trade) ⏰

Entry Plan 📊:

Breakout Strategy: Wait for a confirmed break below the Neutral Zone at 0.81800. Set Sell Stop orders just below 0.81800 to surf the bearish momentum. 🚀

Pullback Strategy: For safer entries, place Sell Limit orders at the nearest 15M/30M swing high (e.g., 0.82100–0.82300) after a support break. 📍

Pro Tip: Activate a price alert at 0.81800 to catch the breakout live! 🔔

Stop Loss 🛑:

📍 Set your Stop Loss above the nearest 4H swing high (e.g., 0.82750) for swing/day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open positions.

Target 🎯: Aim for 0.80700 or exit early to secure profits.

💡 Why the Bearish Bias?

The USD/CHF is showing strong bearish momentum, fueled by technical patterns and fundamental drivers. Key factors include:

Technicals: Recent support at 0.81931–0.82120 held briefly but failed to sustain bullish momentum, reinforcing a bearish tilt below key moving averages (100/200-hour MAs).

Fundamentals: Safe-haven demand for the Swiss Franc persists amid global uncertainties, with bearish patterns like an inverse cup and handle signaling further downside. For a deeper dive, check fundamental reports, COT data, sentiment analysis, and intermarket trends via Linkks🔗

⚠️ Volatility Warning: News Impact 📰

News releases can spike volatility and disrupt price action. To protect your trades:

Avoid opening new positions during major news events.

Use trailing stops to lock in gains and shield running positions.

💪 Join the Heist!

Support this Thief Trading Strategy by smashing the Boost Button! 🚀 Let’s strengthen our crew and make pips effortlessly. With this plan, you’re equipped to navigate the USD/CHF market like a pro. Stay sharp, and I’ll be back with the next heist plan soon! 🐱👤💸

Happy trading, and let’s steal those profits! 😎🎉

USDCHF LONG FORECAST Q2 W22 D26 Y15👀 USDCHF LONG FORECAST Q2 W22 D26 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USD/CHF "The Swissy" Forex Market Heist Plan Bearish (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.81400) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.79300 (or) Escape Before the Target

💰💵💸USD/CHF "The Swissy" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDCHF's 4H Bullish Structure Break – Is It Time to Buy?After a bearish phase, the USDCHF has turned its momentum around following Trump's announcement of a 90-day tariff pause. This news injected fresh optimism into the markets, triggering a rally that overturned previous downtrends. On the four-hour chart, we observe a break of structure that hints at a bullish reversal. The ideal entry point appears to be the pullback to the 50% Fibonacci retracement level—a historically reliable support zone—setting up a clean long opportunity. Current market sentiment, bolstered by easing geopolitical tensions and renewed risk appetite, supports this bullish outlook. As always, use appropriate risk management strategies and treat this analysis as a trade idea rather than financial advice. 🚀📈💹

USD/CHF Swiss-dollar Forex Bank Heist Plan (Day/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "Swiss-dollar" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (0.87900) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.89150 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CHF "Swiss-dollar" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩