Usdhkdlong

USDHKD monthly demand level is playing out. New leg expectedUSDHKD monthly demand level mentioned a few weeks ago is playing out as expected. New leg expected. New bullish price action and strong daily and H4 bullish impulses are happening as a reaction to this strongly monthly demand level at $7.77.

Expecting a new bullish leg in the following weeks.

USDHKD Forex Pair is exploding as expectedMost traders keep chasing candles on the 5-minute chart, hoping to find magic. But magic doesn’t happen there — it happens when you learn to wait.

The USD/HKD Forex pair is the perfect example. We called the monthly demand level at 7.77 weeks ago, and look at it now — it’s reacting beautifully.

The big boys are buying while everyone else is still guessing. Let’s dive into the chart and see why this pair is offering both swing and intraday opportunities right now!

USDHKD Forex Analysis and Forecast

The USD/HKD Forex pair is doing exactly what supply and demand imbalances told us it would do.

The monthly demand level at 7.77 — the one we discussed in our last analysis — is playing out beautifully. Price reached this imbalance, and once again, demand took full control.

This isn’t the first time the US dollar has bounced hard from around the 7.75–7.78 range. Historically, whenever the dollar dips near that area, strong buyers step in, triggering a powerful bullish reaction.

Now, as the pair rallies from this strong monthly demand, we can already see strong impulses on the daily, 4H, and 1H timeframes. These are early signs of new buyers entering the market — perfect for Forex swing traders and intraday traders alike.

USD/HKD Forex. US Dollar getting stronger vs Honk Kong DollarStrong weekly demand level at $7.779 on USD/HKD forex cross-pair. We're expecting the US Dollar to get much stronger against the Hong Kong dollar in the following days and weeks. You can use this weekly imbalance to trade or use the smaller timeframes to take intraday and scalping Forex long positions.

USDHKD LONG - Buy Entry - H4 ChartUSDHKD LONG - Buy Entry - H4 Chart

Buy @ Market

Symbol: USDHKD

Timeframe: H4

Type: BUY

Entry Price: Buy @ Market

TP - Resistance @ 7.82777

TP - Resistance @ 7.82250

Support @ 7.81570

ULong

USD/HKD Uptrend Established LongClear trend presenting itself with the US dollar vs Hong Kong Dollar

With most of April crushing the USD it appears we are now turning the tables

with a curved bottom and a clear uptrend painted thus far for this pair.

I have outlined the green box for LONG entries which is sitting at the point of control

with a fib pull from previous swing high to low for confluence with the above mentioned factors.

Resistance levels have been drawn using standard Fibonacci pulls and align well with volume Profile.

Ensure you have a trading plan and know your invalidation .

Support my work with a Like and a follow for Regular analysis and signals

The most simple swing/position trade of all time.USDHKD FX:USDHKD has been acting the same since 2007, it is currently at the same bottom which has been a turning point since 2007 as well. Technically speaking this should be a turning point once again. I'm considering starting 10K account and risk 50% of my capital to avoid a margin call if it decides to break it's all time low which it has never done before.

I need more opinions on this trade, is there anyone who's sitting on some fundamental information regarding HKD?

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

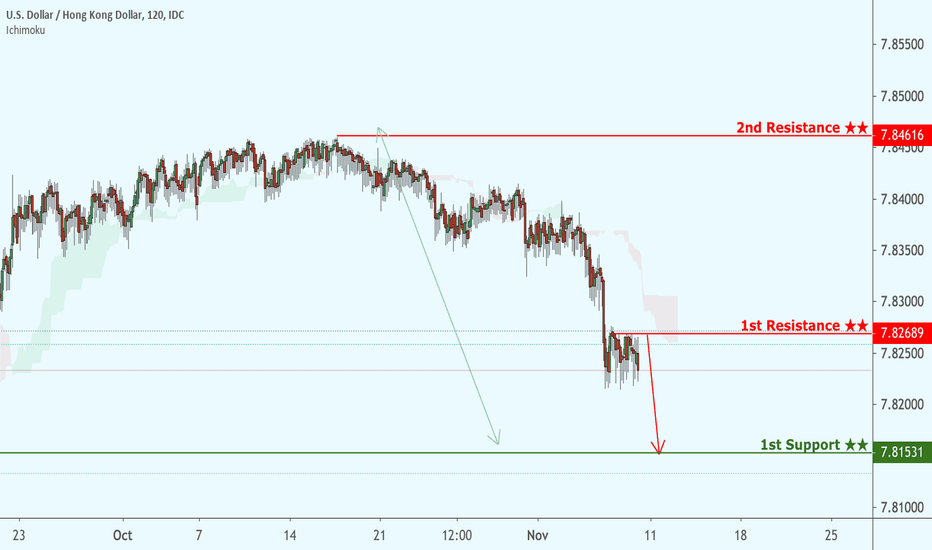

USDHKD (1D): Take Advantage of the PegUSDHKD

Timeframe: 1D

Direction: Short

Confluences for Trade:

- Pegged currency, strongly defended at 7.85 (Limited risk; any break above the 7.85 levels is gonna be a crisis issue)

- Stochastic Overbought momentum

- Not directly related but Double Top Resistance for the DXY, helps support the drop in USD strength

Suggested Trade:

Entry @ Area of Interest 7.8365 - 7.8499

SL: 7.8573

TP: 7.7935

RR: Approx. 2.91 (Depending on Entry Level)

May the pips move in our favor! Good luck! :D

*This trade suggestion is provided on an advisory basis. Any trade decisions made based on this suggestion is a personal decision and we are not responsible for any losses derived from it.