USDJPY Daily Forecast -Q3 | W36 | D5 | Y25📅 Q3 | W36 | D5 | Y25

📊 USDJPY Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:USDJPY

Usdjpyidea

USDJPY Daily Forecast -Q3 | W36 | D4 | Y25📅 Q3 | W36 | D4 | Y25

📊 USDJPY Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:USDJPY

USDJPY Daily Forecast -Q3 | W36 | D2 | Y25📅 Q3 | W36 | D2 | Y25

📊 USDJPY Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:USDJPY

USDJPY Long Bias Forecast Q3 W35 D28 Y25 – NY Session 🗓️ USDJPY Long Bias Forecast

Q3 W35 D28 Y25 – NY Session

Top-Down Technical Outlook

🔹 Weekly Timeframe

Price Action: Strong rejection from the Weekly 50 EMA, acting as dynamic support.

Note: With two trading days left in the week, the previous weekly wick remains a key area — it may still fill, suggesting further upside potential.

Implication: Structure suggests continuation to the upside, but current price must confirm with internal shifts before entry.

🔹 Daily Timeframe

Current Price: Hovering around the Daily 50 EMA – a key equilibrium level.

Expectation: Potential bullish reaction if buyers defend this zone.

Risk Consideration: Aggressive long entries must be approached cautiously without a confirmed change in internal structure (CHOIS).

🔹 4H Timeframe

Confluence:

Bullish wick closure on the last candle suggests rejection from lower prices.

Order Block (OB) identified near Daily 50 EMA – an ideal POI.

Narrative: Structure is preparing for a potential shift. Look for breaks of internal structure (BOS) to confirm bullish intent.

🔹 1H Timeframe

Candlestick Confirmation: Last 3 consecutive bullish candles forming a classic bullish continuation pattern.

Order Block in alignment with 4H and Daily 50 EMA adds weight to the area.

Bias: Bullish – pending confirmation via BOS and clean pullbacks.

🔹 5-Minute Timeframe

Microstructure:

Refined entry points within OB zone.

Ideal for tight stop entries post BOS and retest of lower-timeframe OB.

Watch For:

Shift from bearish to bullish market structure.

Entry following a break + retest of a demand zone or OB.

✅ Confluences for Longs

Rejection from Weekly 50 EMA.

Price respecting Daily 50 EMA.

4H OB + Bullish candle closure.

1H Bullish formation + OB.

5M potential BOS/CHOIS for refined entry.

⚠️ Cautions / Trade Management

Wait for internal structure shift on lower timeframes before full commitment.

Liquidity sweeps below current price are still possible before upside continuation.

Maintain awareness of macroeconomic catalysts (e.g., U.S. or Japan economic data or central bank commentary).

FRGNT

FX:USDJPY

USDJPY – DAILY FORECAST Q3 | W35 | D28 | Y25📊 USDJPY – DAILY FORECAST

Q3 | W35 | D28 | Y25

🔍 Daily Forecast | USDJPY

Here’s a concise breakdown of the current chart setup 🧠📈:

📌 Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

We wait for a confirmed break of structure 🧱✅ before executing any position.

This keeps us disciplined, and in sync with what the price action is actually telling us — not what we want it to say.

📈 Risk Management Protocols

🔑 Core Principles:

Max 1% risk per trade

Execute only at pre-identified levels

Use alerts, not emotion

Stick to your RR plan (minimum 1:2)

🧠 You’re not paid for how many trades you take — you're paid for how well you manage risk.

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work for you. 🎯📊

FRGNT

FX:USDJPY

USDJPY — Q3 W35 Mid-Week Forecast Top-Down Analysis | USDJPY — Q3 W35 Mid-Week Forecast - Top-Down Analysis |

mid-week forecast for USDJPY — let’s break it down top to bottom:

🕰️ Weekly Outlook:

No clear structure or trend bias from the weekly candle 🕯️

However, price closed below the Weekly 50 EMA 📉, leaving a bearish upper wick

This signals a possible continuation to the downside this week

But — as always — wicks tend to get filled first on lower timeframes before short setups play out

📌 Key Reminder:

"Sell from the highs, buy from the lows." 🔁

📆 Daily Structure:

Daily candles have been pushing into lower-timeframe POIs

This aligns with potential sell zones, building confluence

If candles continue to push up, we're watching closely for rejection from the Weekly 50 EMA

⚠️ Don’t be thrown off by a bullish weekly candle midweek — we're anticipating a rejection wick and bearish close.

Let structure confirm.

⏱️ Lower Time Frame Confluence:

🔻 Primary Short Bias (High Confidence Zone):

🔸 4H POI containing:

A clean Order Block (OB)

A void (imbalance)

🔹 Within that, a 1H OB + void adds strong confluence 🔐

Once price enters the zone:

⬇️ Scale to 5-min

Wait for Break of Structure (BoS)

Execute the short ✅

🔺 Optional Long Setup (If Structure Shifts):

While short bias is primary, longs are not off the table

A separate POI based on 4H / 1H / 15' exists for a possible long

If price hits this zone:

Wait for LTF BoS (1' or 5')

Consider long entries, only if confluence stacks

🧠 Key Takeaways:

Weekly close below 50 EMA = bearish tilt, but lower timeframe confirmation needed

Let the wicks fill before forcing shorts

Only take longs with strong confluence

As always — one trade at a time, risk managed, confluence stacked

Trade safe, stay disciplined.

FRGNT

FX:USDJPY

USDJPY may drop to daily low!USDJPY from the daily there is a sideway move, with a strong rejection from the daily resistance 148.78. Today's price so far tested the daily high and currently from the hourly perspective price is creating multiple doji with liquidity grab from the daily resistance giving a high probability for the price to drop to daily support level.

A possible buy trade is high probable.

USDJPY has done false breakdown?USDJPY trade setup for today :

Before we look at potential entry in this pair first let’s look at multiple timeframe analysis in this market.

Monthly: 150.79 Monthly resistance price has got rejection strongly from the top

Weekly: After multiple doji formation, price is about to bounce off the support level potentially move back to the upside.

Daily: With a massive rejection on Friday, USDJPY started to fill the imbalance and price may continue to move back to the upside.

Entry timeframe 4H : Upon rejection from any previous candles support, price may continue to bounce.

Possible trade recommendation : Bullish entry with SL above sessions high

USDJPY Set to drop to support?USDJPY trade setup for today :

Before we look at potential entry in this pair first let’s look at multiple timeframe analysis in this market.

Monthly: 150.79 Monthly resistance price has got rejection strongly from the top

Weekly: Previous weekly closed with bearish engulfing patter with liquidity grab.

Daily: Upon formation of head and shoulder price has got rejection with a strong momentum and price may continue to drop to support level.

Entry timeframe 4H : As price has confirmed cross over of 20ema and 10ema we may see price continue to drop to daily support level.

Possible trade recommendation : Bearish with SL above the sessions high.

USD/JPY) Bullish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY (2H) analysis you shared:

---

Technical Breakdown

1. Price Action & Zone

Price retraced into a Fair Value Gap (FVG) / demand zone (yellow box) around 147.00 – 147.40.

Strong buying interest is visible from this zone.

2. Falling Wedge Pattern

A falling wedge has formed, which is typically a bullish reversal pattern.

Price is attempting to break out above wedge resistance, showing potential for upside momentum.

3. EMA (200 Close)

Price is interacting with the 200 EMA (147.58), serving as dynamic resistance.

A sustained breakout above this EMA would confirm bullish continuation.

4. RSI (14)

RSI currently around 46–50, suggesting neutral momentum with room for upside.

---

Trade Idea

Bias: Bullish

Entry Zone: On breakout & retest of wedge / demand zone.

Target: 148.680 (as marked).

Invalidation: Below 146.60 (clear break under demand/FVG zone).

Mr SMC Trading point

---

This setup suggests a bullish reversal from support, with a likely push toward 148.68 after wedge breakout.

please support boost 🚀 this analysis)

USDJPY: Multi-Timeframe Liquidity Hunt Setup - Monthly OutlookSharing my longer-term perspective on USDJPY with a two-phase liquidity scenario. 📊

**🎯 The Big Picture:**

I'm expecting a classic two-phase move: first a liquidity hunt down to the lower purple line (white-boxed zone), followed by a strong rally up to the upper purple line. This would represent my ideal scenario for the coming months. 📈

**📍 Liquidity Zones Explained:**

The purple lines (highlighted in white boxes) represent key liquidity zones where stops are likely parked. Markets love to sweep these levels before making their real moves - it's textbook institutional behavior. 💰

**⏰ Timing Expectations:**

I expect the downside liquidity hunt to occur within the remaining days of this month or early next month. These moves often happen faster than people anticipate. ⚡

**🛡️ Invalidation Level:**

The yellow line marks the low of a strong weekly bullish candle - a significant structural point. If price breaks below this level, it would invalidate this bullish scenario entirely. 🚨

**🧠 Why This Setup Makes Sense:**

This type of liquidity grab followed by reversal is classic market mechanics. The lower liquidity zone represents trapped shorts and protective stops - perfect fuel for the eventual rally to the upper target. 🔄

**⚠️ Risk Management:**

Clear invalidation point below the yellow line, targeting the upper liquidity zone for a clean setup with defined parameters. 🎯

📈 **This trade setup offers a risk-to-reward ratio of 5:1.** Without including fees, the breakeven win rate for this trade would be approximately 16.67%. Knowing these figures in advance helps me avoid emotional trading. 🧠

💡 **Pro Tip**: If you often find yourself trading based on emotions, I recommend doing this type of pre-planning and quantifying your setups before execution — it can be a simple yet highly effective improvement. ✅

---

**Trading is simple.** You don't need multiple indicators or dozens of lines on your chart. A clean and simple chart often works best — it keeps your decisions consistent and reduces uncertainty. Sure, it might not look flashy, and my analysis may seem a bit "plain" compared to others… but that's how I like it. If you find this analysis useful, feel free to follow me for more updates.

---

*Disclaimer: This post is for general informational and educational purposes only. It does not constitute financial advice, investment recommendation, or a service targeting specific investors, and should not be considered illegal or restricted information in any jurisdiction.*

USDJPY Next Week | Short From 147.56 Targeting Liquidity SweepHere’s my outlook for USDJPY in the coming week.

If price rises to around 147.56 in the early part of next week (Aug 18–22), I believe it’s a good area to consider going short. This level has acted as resistance several times recently, and I expect it could hold once again.

If price fails to reach 147.56, I won’t take the trade — in that case, the risk-to-reward profile would likely deteriorate, and I prefer to avoid setups where my predefined advantage is weakened.

The stop loss should be placed above the white line. From experience, once price breaks above that line, it often continues to take out the highs above it. That’s why I believe placing a stop here is both reasonable and sufficient.

The purple line below marks a level where I expect price could extend to if it sweeps the liquidity (stop losses) resting around recent lows. This purple line is located roughly halfway between the previous low and the nearby high beneath it. Based on my years of trading experience, when price breaks a low, it rarely reverses immediately; more often, it continues a bit further before turning around.

For that reason, I allow a small buffer and set my take profit around the 0.382 Fibonacci level between those two price points.

My plan is to hold the short position until that level, then take profit and start looking for a potential long setup from there.

In my view, 147.56 is likely to be reached sometime next week, so I will post an update once we see how the market reacts.

This trade setup gives a risk-to-reward ratio of 6.5. Without including fees, the breakeven win rate for this trade would be approximately 13.33%. Knowing these figures in advance helps me avoid emotional trading.

If you often find yourself trading based on emotions, I recommend doing this type of pre-planning and quantifying your setups before execution — it can be a simple yet highly effective improvement.

I’ll be sharing updates on how this idea plays out, so if you want to follow along and see the outcome, consider following me here on TradingView.

---

*This post is for general informational and educational purposes only. It does not constitute financial advice, investment recommendation, or a service targeting specific investors, and should not be considered illegal or restricted information in any jurisdiction.*

USDJPY - ShortUSDJPY Analysis - SELL 👆

In this Chart USDJPY H4 Timeframe: By Nii_Billions.

❤️This Chart is for USDJPY market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BEARISH trend in USDJPY, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

USDJPY ready to drop another 100 pip?USDJPY has done a fake out with retest of the daily high price started to move back to the major direction of the trend with second step liquidity grab 147.27 level with a price action confirmation to reject further back below. As the last day of trading week price may continue to drop to long term support 145.90 with further possibility to reject back below.

USD/JPY 1D Forex Chart - August 12, 2025daily performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) as of August 12, 2025. The current exchange rate is 148.277, reflecting a 0.09% increase (+0.136). The chart includes a trendline indicating a potential upward movement, with a buy signal at 148.277 and a sell signal at the same level. Key support and resistance levels are marked, with a notable range between 146.786 and 151.234. The chart spans from early 2025 to mid-2026, showing historical price action and future projections.

USDJPY potential buy area!USDJPY 4H price has formed 2 important impulse and started to move back to the upside with new series of higher high and higher low showing a potential trend continuation.

Daily price is just crossed above 10ema and may pullback to daily 10ema which is also 4h support an important level where a bullish trade is high probale.

USD/JPY Poised for Breakout as Fundamentals & Technicals AlignUSDJPY is entering a critical juncture where both macroeconomic conditions and price structure are pointing toward a potential bullish continuation. The pair has been consolidating just under a descending trendline after a sharp drop from July’s highs, but strong US fundamentals, a persistently dovish Bank of Japan, and upcoming political catalysts are creating the perfect environment for an upside breakout. If buyers can reclaim momentum above near-term resistance, the path toward retesting multi-month highs appears open, with yen crosses likely to follow the lead.

Technical Analysis (4H Chart)

Price is consolidating around 147.46 after falling from the 150.91 high.

A descending trendline from the late-July peak is being tested. A confirmed breakout would likely accelerate bullish momentum.

Key upside targets:

148.96 – immediate resistance & short-term target (previous swing high).

150.91 – major resistance at July’s high.

Stop-loss at 146.43 safeguards against deeper retracements.

The structure reflects a series of bullish continuation patterns (flags, breakouts, retracements).

Fundamental Analysis

Current Bias: Bullish

USD Strength: Strong US data and anticipation of Trump’s “major” economic announcement are lifting the dollar.

JPY Weakness: Despite better-than-expected Japan Eco Watchers Survey, the BoJ’s ultra-loose stance continues to suppress yen demand.

Rate Differentials: Still heavily in USD’s favor, sustaining upward pressure on USD/JPY.

Risk Sentiment: Even with mild geopolitical tensions, USD’s safe-haven appeal is preventing JPY from benefiting.

Risks:

Disappointing US political announcements.

Hawkish surprises from the BoJ.

Sharp swings in risk sentiment favoring the yen.

Key News/Events Ahead:

Trump’s economic policy reveal.

US CPI & PPI releases.

BoJ policy signals or commentary.

Leader/Lagger Dynamics:

USDJPY is the leader for yen crosses, often setting the tone for GBPJPY, AUDJPY, and CHFJPY.

Summary:

USDJPY’s bullish outlook is reinforced by the combination of favorable fundamentals and a technical setup pointing toward a breakout. A move above 147.80–148.00 could open the door to 148.96 in the short term and 150.91 in the medium term. With yen crosses closely tied to USDJPY’s movements, this pair’s breakout could spark broader JPY weakness across the board, making it a pivotal chart to watch in the days ahead.

USDJPY Looks Bearish, Your thoughts ?USDJPY Looks Bearish, It has been falling hard after touching resistances. Now it will continue to glide. Check your support and resistances and open positions accordingly. Wait for Price Again and strong solid breakouts to enter the market.

Disclaimer:

The content presented in this IMAGE is intended solely for educational and informational purposes. It does not constitute financial, investment, or trading advice.

Trading foreign exchange (Forex) on margin involves a high level of risk and may not be suitable for all investors. The use of leverage can work both for and against you. Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk tolerance.

There is a possibility that you may incur a loss of some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be fully aware of all the risks associated with foreign exchange trading, and seek advice from a licensed and independent financial advisor if you have any doubts.

Past performance is not indicative of future results. Always trade responsibly.

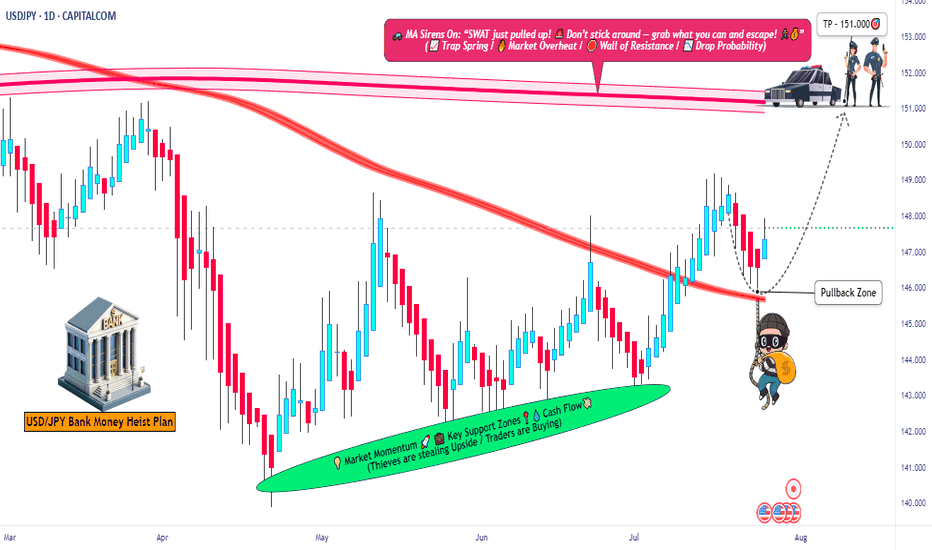

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

USD/JPY) support boost Bullish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, based on a rejection from a key support zone and signs of trend continuation toward a higher target.

---

Technical Breakdown:

1. Support Level:

Price has bounced from a clearly defined support zone around 146.00 – 146.50, which has held multiple times in the past.

This zone is acting as a strong demand area where buyers are stepping in.

2. Bullish Rejection + Structure:

A bullish candle has formed from the support area, signaling potential reversal.

The drawn projection suggests higher highs and higher lows forming — indicating bullish continuation.

3. EMA (200):

Price has respected the 200 EMA (blue line), bouncing off it — a strong confluence for bullish trend continuation.

EMA is slightly upward sloping, indicating a longer-term bullish bias remains intact.

4. RSI (14):

RSI is rising from oversold territory (42.09), indicating a bullish momentum shift.

A potential bullish divergence might be forming (price made lower low, RSI made higher low).

5. Target Point:

Price is projected to reach 150.904, giving a potential move of ~2.91% (426 pips) from current levels.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: 146.90 – 147.30 (current levels or slight pullback)

Stop Loss: Below the support zone (~145.90)

Take Profit (TP): 150.900 (key resistance / previous high)

Risk-to-Reward Ratio: Attractive, based on the size of the support zone vs. projected move

Mr SMC Trading point

---

Key Insights:

Strong confluence between price structure, support zone, and 200 EMA bounce.

Favorable risk-reward ratio for swing or intraday traders.

Best confirmation would come from a bullish engulfing candle or break above minor resistance near 147.80.

Please support boost 🚀 this analysis)

USD/JPY) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, using a combination of trendline support, key horizontal levels, and EMA 200 confluence to identify a potential bounce.

---

Technical Breakdown:

1. Market Structure:

USD/JPY experienced a sharp decline from the resistance zone near 150.445, but price is now testing a strong confluence support area:

Horizontal support zone

Rising trendline

200 EMA (146.907)

2. Support Confluence Zone:

Marked as "trend support level", this zone has historically acted as a springboard for bullish moves.

Recent price action shows a wick rejection at this zone, indicating buying pressure.

3. Resistance/Target Zones:

Target 1: 149.190 – 149.208

Target 2: 150.445 (major resistance zone)

4. EMA 200:

Price is reacting just above the 200 EMA, strengthening the bullish case for a bounce.

5. RSI (14):

RSI has dipped to 35.92, near oversold territory, suggesting the downside may be exhausted.

Prior bounce from similar RSI levels led to strong upward moves.

6. Projected Path:

The chart outlines a potential bullish recovery, targeting a climb back into the upper channel and retesting previous highs.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish (Reversal from trendline + support zone)

Entry Zone: Current level near 147.40–146.90 (support confluence)

Targets:

TP1: 149.190

TP2: 150.445

Invalidation: Daily close below trendline and 200 EMA (~146.70 or lower)

Indicators: RSI supports a bounce; EMA and trendline confirm structure

Please support boost 🚀 this analysis)