DXY, USDXDXY is currently approaching the support zone at $98. If this support holds strong and the price fails to break through $98, a rebound is possible. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Usdx

US Dollar RECAPDollar Index (DXY) — Range Heat Building

You’ve got a weekly bearish range, with a key high at 99.8 and price now trading into bearish distribution around 99.0.

The dollar’s been front and center this week — while Washington argues over funding, it’s been doing real damage across cross-asset charts.

Price has been printing higher lows all week, grinding inside this bearish range.

That’s your profit-taking zone, not an add-on zone.

Stay patient. Let the range speak.

US DOLLAR LIQUIDITY GAMES🇺🇸 US Dollar Range Politics – Liquidity Before Clarity

The dollar isn’t trending — it’s negotiating.

📊 Current Setup

U.S. Dollar Index (DXY): 98.322 → testing the value area high

Range Floor: 96.747 → the value area low

Structure: Bearish range, with liquidity being hunted before any true direction emerges.

🏛️ Macro Backdrop

Tariffs are reshaping global flows.

Fiscal gridlock + shutdown risk clouds investor confidence.

Inflation + Fed policy signals remain mixed.

Every headline feels like an amendment to a bill no one fully understands.

The result: the dollar drifts sideways in a liquidity-seeking phase. Traders should expect chop inside the box until a decisive catalyst (data, Fed action, or policy shift) provides clarity.

🌍 Cross Pair Impact

This stalemate spills into the majors:

EURUSD & GBPUSD → reflecting the same sideways ranges and fake-outs.

USDJPY → volatility compressed, waiting for dollar direction.

Crosses are trading in sympathy — liquidity hunts on both ends, with no clean trend until DXY escapes its range.

🧭 Takeaway: The dollar is boxed in by politics and policy. Patience rules here: trade the range, wait for the breakout.

US DOLLAR LIQUIDITY GAMES MAPThe U.S. Dollar is testing traders resolve.

Price action keeps pressing higher, and a daily close above 97.394 would confirm a classic “fractal low” — the kind of structural pivot that lures late buyers before the real move unfolds.

3 Key Insights

Macro Calendar – Stay alert:

Thu – Final Q2 GDP, Weekly Jobless Claims, Durable Goods Orders.

Fri – Core PCE Price Index, Personal Income & Spending, University of Michigan Sentiment (final).

These are the week’s steering currents for USD flows.

A daily close above 97.394 is the key trigger to confirm a fresh leg higher.

• EUR/USD short bias remains valid while DXY stays bid, but expect intraday volatility around data releases.

What Was Important for the US Dollar Index (DXY) This WeekWhat Was Important for the US Dollar Index (DXY) This Week

The long-awaited event — the Fed’s first rate cut of 2025 — has taken place. What is particularly important to note is the price action on the US Dollar Index (DXY) chart.

The value of the USD against a basket of other currencies made a two-step move, forming a pin-bar candle with a long lower shadow:

→ Arrow 1: When the Fed actually announced the easing, the dollar weakened as expected on this “dovish news.”

→ Arrow 2: But at the subsequent press conference, Fed Chair Jerome Powell delivered a series of “hawkish” remarks that shifted the market mood and drove the dollar higher. He stressed that this cut does not mark the beginning of “a series of continuous rate reductions,” and that further decisions will be taken “based on incoming economic data.”

Powell also stated plainly that the option of a more aggressive 50-basis-point cut had not gained sufficient support among FOMC members. Therefore, the “down-then-up” move highlights a sharp change in trader sentiment within a short timeframe, as expectations failed to materialise.

Technical Analysis of the DXY Chart

In our 9 September analysis, we confirmed the relevance of:

→ the descending channel (shown in red) defined by a sequence of lower highs and lower lows;

→ the intermediate QL and QH lines, which divide the channel into quarters.

Notably, at Wednesday’s low the price:

→ touched the QL line, underscoring its strength;

→ formed a clear Liquidity Grab pattern (in the terminology of the Smart Money Concept methodology).

From the perspective of Richard Wyckoff’s method, Wednesday’s low may be viewed as a Spring pattern, which preceded a Mark-Up phase of rising prices.

How Might Events Unfold Next?

Given the above, we could assume that the hawkish tone could serve as a longer-term factor for the DXY index. The 97.55 level appears to act as resistance, but it is possible that we may see an attempt to break through it, with the next target being the QH line.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Title: USDX 4H — expectations vs realityThe dollar index once again finds itself in a position where heroic posture doesn’t match reality. Price is capped at 97.85 right at the 0.382 Fibonacci level and every move higher quickly fades like a spark in the rain. If the breakout fails the road towards 97.24 and 96.90 seems far more realistic since the 0.618 retracement and demand zone are located there.

Moving averages are pressing from above, volumes don’t support the bulls and technically the setup favors weakness rather than strength.

Watching USD behavior every dip in gold silver euro and pound becomes a clear swing trading buy opportunity.

Fundamentally the dollar is also under pressure as markets expect a dovish Fed, Treasury yields stay weak and risk appetite drives capital into other assets. In the end the greenback looks more like a tired runner than a sprinter ready to race.

Potential bearish reversal?USDX is rising towards the resistance level which is an overlap resistance that is slghtly below the 50% Fibonacci retracement and the 127.2% Fibonacci extension and could revrse from this level to our take profit.

Entry: 98.62

Why we like it:

There is an overlap resistance level that is slightly below the 50% Fibonacci retracement and the 127.2% Fibonacci extension.

Stop loss: 99.40

Why we like it:

There is a pullback resistance level.

Take profit: 97.49

Why we like it:

There is a swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish drop?USDX is rising towards the resistance, which is a pullback resistance, and could drop from this level to our take-profit.

Entry: 97.89

Why we like it:

There is a pullback resistance.

Stop loss: 98.78

Why we like it:

There is a pullback resistance.

Take profit: 97.92

Why we like it:

There is a swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish reversal?US Dollar (USDX) has rejected off the resistance level which is a pullback resistance that aligns with the 23.6% Fibonacci retracement and could drop from this level to our take profit.

Entry: 98.40

Why we like it:

There is a pullback resistance that lines up with the 23.6% Fibonacci retracement.

Stop loss: 99.94

Why we like it:

There is a swing high resistance.

Take profit: 96.92

Why we like it:

There is a swing low support 61.8% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

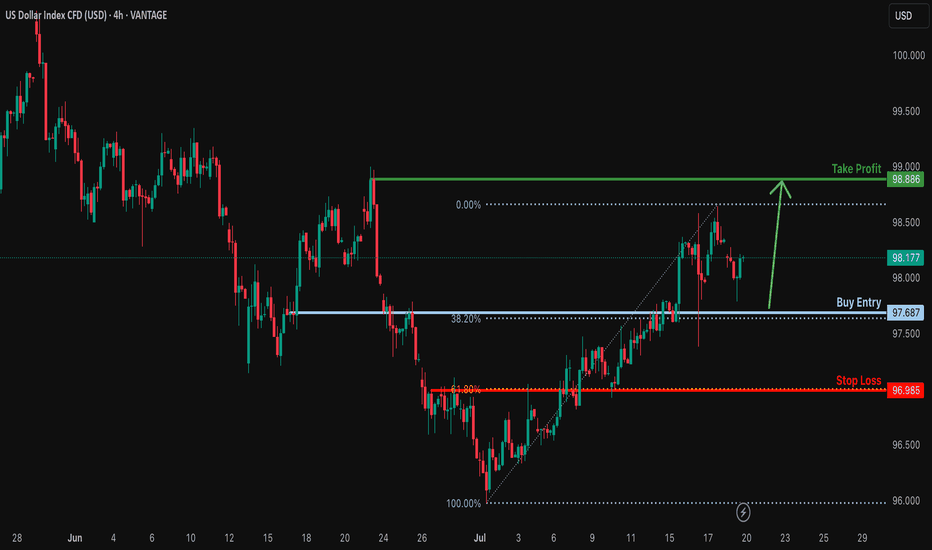

Bullish continuation for the Dollar?The price is falling towards the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 97.68

Why we like it:

There is a pullback support that aligns with the 38.6% Fibonacci retracement.

Stop loss: 96.98

Why we lik eit:

There is an overlap support that aligns with the 61.8% Fibonacci retracement.

Take profit: 98.88

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

DXYDXY price has come down to test the important support zone 96-95. If the price cannot break through the 95 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

USD Roadmap: Bullish Recovery or Structural Breakdown?TVC:DXY CAPITALCOM:DXY

🟢 Scenario A – Bullish Rebound (Red Arrow Up):

Price bounces from the lower channel and breaks toward:

107.348, 110.176, or even 111.901 resistance area.

If the dollar is supported by China buying USD, hawkish Fed, or geopolitical tensions, this scenario gains weight.

🔸 Resistance: Blue downward-sloping line (possible trendline resistance or lower high area)

🔸 Risk: Price could form a lower high and then reverse.

🔴 Scenario B – Bearish Breakdown (Red Arrow Down):

If the USD fails to break above resistance (around 107–112) and gets rejected…

Then we see a move back down, possibly breaking the long-term channel, aiming for the lower diagonal support zone or even sub-92.

🔸 This would signal a major shift in USD strength, possibly driven by:

Fed rate cuts

Global de-dollarization

China not supporting USD

Stronger EUR or CNY

DXYDXY price is near the support zone 98.74-97.87. If the price cannot break through the 97.87 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Dollar Bounce to 103 Incoming or Straight to 96?Will the Dollar Keep Tumbling, or Are We About to Bounce Back to 103 in May?

Checking out the monthly charts, April finally delivered a close under that critical 100 level, breaking a floor that held firm for years:

Zooming into the weekly chart, we’ve retraced back to test the 100 level from below. It’s now acting as resistance—so, is another big drop coming?

Long term, my bias is clear: the dollar looks set to keep sliding lower after breaking the crucial 100 mark. But if we flip to the daily charts, we can clearly see signs of a short-term bounce brewing. It looks like price might want to squeeze back inside the range, aiming for that juicy sell zone around the 103 mark—the very origin of the leg down that initially broke 100:

This 103 area is a prime spot for short-term bulls, and an even better opportunity to start loading up on shorts for a move down towards the Monthly buy zone around 96.

Personally, I won’t trade USDX directly to the upside—I'll instead use this analysis to play setups on pairs like EURUSD and AUDUSD, as they're approaching key resistance areas right now.

My game plan: wait patiently for price to reach around 103, then start hunting for sell signals. But first, we’ll need a solid daily close back above 100, something I think we could see happen this week.

Don’t forget—we’ve got the Fed’s interest rate decision coming up, which might trigger some volatility. We could easily rally up to 103 ahead of the decision and then see a sell-off afterward. Of course, if the Fed throws us a curveball, the dollar might never get back above 100, and just continue dropping straight away.

Right now, the 100 level is crucial—so watch closely.

What’s your take? Drop your thoughts below! 😊

USDX,DXYUSDX price is near the important support zone 98.23-97.75. If the price cannot break through the 97.75 level, it is expected that in the short term there is a chance that the price will rebound.

**Very Risky Trade

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

DXY The Fake Dance- One of the most important barometers for global currencies and markets in the world.

- Most of the time DXY is a well used machine to supress markets (forex, stocks, cryptos, etc..)

- When they don't start the printing machine, DXY keeps is strength.

- When they start to print DXY starts to dip and markets boom up.

- it's really basic and based on "BRRR Machine".

- i had a hard time to decrypt this fake peace of resilience.

- actually there's none visible divergences on the 1M or 3M Timeframes.

- So i decided to push my analysis to 6M Timeframe and noticed few things :

- You can notice that from 2008 ( Post crises ), DXY was in a perma bullish trend.

- So now check MACD and will notice this fake move on January 2021 ( in graph the red ? )

- MACD was about to cross down, columns smaller and smaller, then a Pump from nowhere lol.

- i rarely saw that in my trading life on a 6M Timeframe.

- So to understand more this trend, i used ADX (Average Directional Index)

- ADX is used to determine when the price is trending strongly.

- In many cases, it is the ultimate trend indicator.

- So if you look well ADX columns, you will notice that a strong divergence is on the way.

- First check the Yellow Doted Line in July 2022 when DXY reached 115ish and look the size of the green columns.

- Now check today (red doted Line), and look again the ADX green columns is higher, but DXY diped to 105ish.

- So like always, i can be wrong, but i bet on a fast DXY dip soon or later.

- it's possible to fake pumps, but it's harder to fake traders.

Happy Tr4Ding !

Global Market Overview. Part 1: USDXThe Dollar Index is drifting at the key 99.5 mark. This strategic support level, which has held since early 2024, is on the verge of collapsing.

Let’s be clear: this isn’t just about the strength of the dollar. What’s at stake is the monetary sovereignty of the United States, caught between inflation, politics, and election-season hysteria.

And make no mistake — this has nothing to do with technical analysis. What we’re witnessing is a fundamental fire, and Donald Trump and his administration are fanning the flames.

Powell: “Rates remain unchanged.” But for how long?

Just days ago, Fed Chair Jerome Powell delivered what seemed to be a firm message:

“We are in a wait-and-see mode. Cutting rates prematurely could do harm.”

“If inflation accelerates, more difficult decisions may follow.”

On the surface — classic hawkish rhetoric. But in reality, this isn’t resolve.

It’s a delay tactic. Even Powell admits:

“The labor market is walking a fine line.”

“Economic growth weakened in Q1.”

“Business sentiment is deteriorating.”

“Tariff policy could lead to stagflation.”

“Political pressure is mounting by the week.”

The Fed says, “It’s too early to cut rates.”

But the market hears something entirely different: “We’re getting close.”

Trump applies pressure

Ahead of the elections, Trump declares:

“If we don’t cut rates now, we’ll lose to China, Europe, and our own markets.”

This isn’t just campaign rhetoric. It’s an open challenge to the Fed’s independence.

And history already tells us what happens when Trump applies pressure — 2019 rate cuts proved he can break through Powell’s defenses.

What the charts are saying

The Dollar Index (USDX) is locked in a persistent downward channel.

The 103.0 support zone has been broken

The 101.17 level remains the final significant support

99.5 is already being tested as a potential sell-off trigger

Below that — only air until 98.0 and 97.5

The technical setup confirms a fundamental truth:

The market no longer believes in the dollar’s strength.

What if the Fed actually cuts rates?

If the Fed moves to cut, USDX will break below 99 and enter a systemic phase of weakening.

Capital will flow into gold (as if it hasn’t already gone far enough), oil, crypto, and high-yield emerging markets.

The United States will lose its competitive edge in monetary policy,

and the dollar will slowly cease to function as the global anchor it once was.

Powell can talk tough all he wants. The market is no longer listening.

The Dollar Index isn’t dropping because rates are already cut — it’s falling because everyone knows it’s just a matter of time.

U.S. monetary policy has lost the initiative, and market expectations have taken over.

Today, the Fed rate is no longer a tool of control. It’s a signal of approaching capitulation.

The question is no longer “Can we hold 99.5?”

The real question is: “What happens after it breaks?”

Manipulation or strategy? Black swans on a leash

Powell’s rate policy, DXY charts, inflation forecasts — all of it loses clarity when the dominant market force is no longer economics, but politics.

We live in an era where markets break not from bad data, but from tweets, briefings, and backroom deals — moves that only reveal themselves in the charts after the fact.

That’s what makes the current cycle the most toxic in the last 15 years.

Markets aren’t just volatile — they’ve become irrational.

Trade war: scalpel in a surgeon’s hand or a bat in a brawler’s grip?

Tariffs aren’t new.

But in Trump’s hands, they’ve evolved — from macroeconomic tools to blunt political weapons.

He uses them as battering rams — to force concessions, corner opponents, and set up ideal conditions for insider gains.

The market reacts exactly as you’d expect:

Tariffs announced — indexes fall

Panic ensues — capital flees into dollars and gold

Within 48 hours — videos surface of Trump and his allies joking about the “hundreds of billions” they made during the crash

This isn’t conspiracy.

It’s already triggered official investigations, but everyone knows: the odds of accountability are near zero.

And that’s the biggest risk for fundamental analysis today:

It’s powerless against narratives crafted behind closed doors.

So who’s really running the market?

Trump is deliberately deflating the bubble. Loudly. Dramatically. On camera.

But the goal isn’t destruction. It’s control.

And while Powell fears making a mistake, Trump fears only one thing — losing control of the narrative.

The market is no longer a field for rational actors.

It has become a battlefield, where officials already understand:

You can control more than just money through the market — you can shape public consciousness.

How not to lose your footing in this chaos?

We’ll break it down in the next part of the Global Market Overview. Stay tuned.

Bearish reversal?USDX is rising towards the resistance level which is a pullback resistance that aligns with the 78.6% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 103.43

Why we like it:

There is a pullback resistance level that aligns with the 78.6% Fibonacci retracement.

Stop loss: 104.13

Why we like it:

There is a pullback resistance level.

Take profit: 102.30

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

DXY (Dollar Index) and Pamp/Dump BTC. Markets Cycles.USA Dollar Index + Bitcoin Pamp/Dump Cycles. Logarithm. Time frame 1 week. Minima and maxima of bitcoin secondary trends are shown. Everything is detailed and shown, including what everyone always wants to know. Cyclicality. Accuracy.

This is what it looks like on a line chart to illustrate simple things.

USDX, DXYUSDX price is approaching the support zone of 106.45-105.36. If the price fails to break through the main support zone of 105.36, it is expected that there is a chance that the price will rebound. On the contrary, if the price can break through the level of 105.36, it will have a negative impact on the dollar.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

#USDX 4HUSDX (4H Timeframe) Analysis

Market Structure:

The price is forming a flag pattern, which is generally considered a continuation signal. This indicates that the market is in a consolidation phase after a strong move, and a breakout could lead to further bullish momentum.

Forecast:

A buy opportunity may arise if the price breaks above the upper trendline of the flag pattern, confirming bullish strength.

Key Levels to Watch:

- Entry Zone: A buy position can be considered after a breakout above the flag pattern with strong volume.

- Risk Management:

- Stop Loss: Placed below the recent low to manage risk.

- Take Profit: Target the next key resistance levels based on previous price action.

Market Sentiment:

The flag pattern suggests that the market is pausing before continuing its upward move. Waiting for a confirmed breakout will help align with the prevailing trend and avoid false signals.

The weekly chart that indicates the $ will rally all of 2025

The weekly chart will tell us how things will probably playout in the months ahead.

The double bottom has much further to run.

In the immediate time-zone on a daily the dollar price is at the bottom of a triangle that it wants to have some more room.

I expect the dollar will continue its climb this week.