USOIL Analysis: Oil Testing Critical 63.85 Pivot Zone!Crude Oil (USOIL) Technical Analysis

Date: February 9, 2026

Pivot Point: 63.85

The price is currently hovering around the 63.85 level. This is the decisive zone for the next market move.

📉 Bearish Scenario (Main Outlook):

As long as the price remains below the 63.85 pivot point, the downward trend prevails:

First Target: A decline toward the support level at 62.40.

Second Target: Breaking below this level will drive the price further down to 61.40.

Bullish Scenario (Alternative Outlook):

If the price manages to break above the 63.85 pivot and stabilizes, the trend will flip to bullish:

First Resistance: The target will be 64.65.

Further Gains: A breakout above this resistance will push the price toward 65.20 and potentially reach 65.95.

Key Summary:

Below 63.85: Bearish momentum dominates.

Above 63.85: Bullish reversal confirmed.

Support & Resistance Levels:

Resistance: 64.65 | 65.20 | 65.95

Support: 62.40 | 61.40

Usoilshort

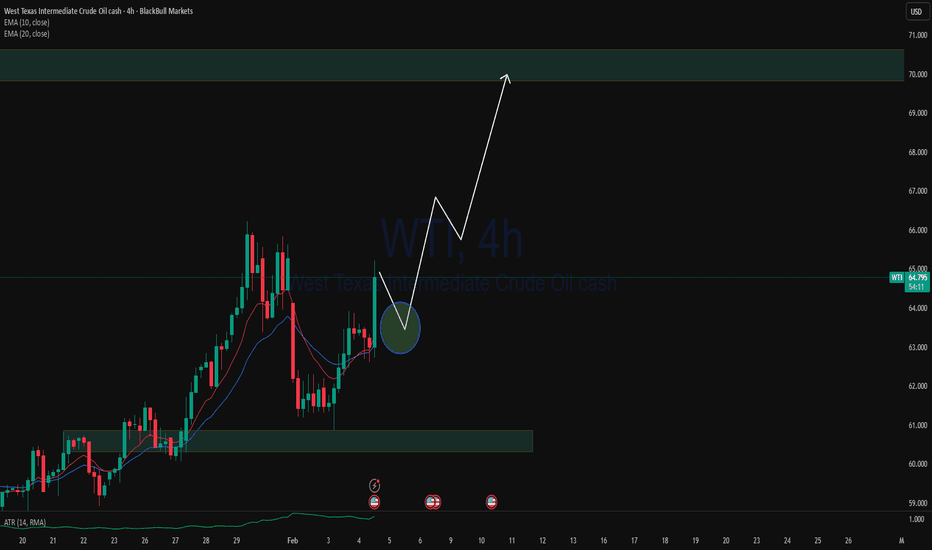

WTI Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USOIL Bearish Continuation Setup | Technical & Macro ViewUSOIL (WTI Crude) Bear Plays 🔥 | Oversupply + Economic Cues 📉 | Day/Swing Trade Tech + Fundamental Edge

🎯 Asset: USOIL (WTI Crude Oil) — Energies Market Trade Opportunity (Day/Swing)

📉 Bias: Bearish setup — continuation pressure confirmed

📍 Current Price Context: ~57.3 USD/bbl (WTI) with downside structural momentum below key dynamic resistance, trend shows continued bearish bias with decaying demand and oversupply pressure.

🧠 TRADE PLAN

🔻 Entry: Any favorable lower level entry within bear momentum zones — look for rejects at lower highs and trend continuation.

❌ Stop-Loss (SL): This is thief SL @ 57.50 Dear Ladies & Gentleman (Thief OG's) Adjust your SL based on your strategy & own risk,

⚠️ Note: Dear Ladies & Gentleman (Thief OG's) iam not recommended to set only my SL. its your own choice you can make money then take money at your own risk.

🎯 Target: Police force act as a strong support + oversold + trap + correction is there so kindly escape with profits OUR target @ 55.00

⚠️ Note: Dear Ladies & Gentleman (Thief OG's) iam not recommended to set only my TP. its your own choice you can make money then take money at your own risk.

🔁 RELATED PAIRS / WATCHLIST & CORRELATIONS

📌 BLACKBULL:BRENT — If Brent extends weakness, USOIL often accelerates downside.

📌 OANDA:USDCAD — CAD tends to strengthen when oil drops, watch for confirmation.

📌 Energy Sector ETF ( AMEX:XLE ) — Weakness here often previews crude downside risk.

📌 NATGAS ( VANTAGE:NG ) — Not directly correlated but sentiment flow can affect broader energy trading appetite.

📌 Oil ETF ( AMEX:USO ) — Tracks broader oil sentiment and institutional positioning.

📌 TECHNICAL EDGE — KEY POINTS

📉 Descending channel dominance — confirmed lower highs & lower lows.

📊 Price respects dynamic resistance with weak bullish momentum.

⚠️ Breakdown of intermediate support can accelerate price toward lower demand zones.

🌍 FUNDAMENTAL & ECONOMIC FACTORS (CURRENT CONTEXT)

📉 Oversupply Pressure: Global crude supply continues to exceed demand, keeping price rallies capped and sellers in control.

📦 Inventory Dynamics: U.S. crude inventory changes show mixed signals, but structural supply remains elevated.

🌍 Geopolitical Watch: Ongoing geopolitical developments and production policy shifts remain volatility triggers.

📉 Demand Side Risk: Slower global growth expectations and industrial demand softness continue to weigh on crude.

📅 Economic Calendar Impact: U.S. labor data, inflation data, and central bank guidance can influence USD strength and risk sentiment, directly impacting oil prices.

🔔 KEY MARKET THEMES (LATEST)

🛢️ Oil prices remain pressured under supply-heavy outlook

📉 Sellers defending lower highs aggressively

⚠️ Volatility expected around macro data releases

0107 USOIL (WTI Crude Oil) Daily Timeframe Short Trading StrategHello traders,

Core Logic: Technical Breakdown + U.S. Firms’ Invasion of Venezuelan Oil Resources → Supply Surge Pressures Prices

1. Core Trading Logic

1. Technical Side: Support Break Unlocks Downside Room

The "Triple Test Support (55.33, marked as '1' on the chart)" is the key current support level. Once it’s effectively broken, the downside channel of the Fibonacci extension levels on the chart will be triggered;

2. Fundamental Side: Bearish Catalyst from U.S. Firms’ Invasion of Venezuelan Oil

If U.S. enterprises gain substantial access to Venezuela’s oil resources, it will directly boost global crude supply expectations — increased supply will fundamentally pressure oil prices, aligning with the U.S. need to lower domestic inflation via lower oil prices.

2. Trading Instrument & Timeframe

- Instrument: USOIL (WTI Crude Oil CFD)

- Timeframe: Daily chart

- Direction: Short (trend-following short position)

3. Entry Conditions (Technical + Fundamental Resonance)

1. Technical Break Confirmation: The daily closing price effectively breaks below 55.33 (the triple support level), accompanied by a large-bodied bearish candlestick or a breakaway engulfing pattern;

2. Indicator Alignment: RSI (14) breaks below 40 concurrently, confirming the continuation of weakness;

3. Event Catalyst: Enter the position on the back of substantive news (e.g., U.S. firms securing Venezuelan oil drilling/export rights).

4. Stop-Loss Strategy

Place the stop-loss above 57.0 (the recent daily rebound high + EMA5 resistance), keeping the single-trade stop-loss range around 1.7 points to avoid short-term rebound risks.

5. Take-Profit Targets (Aligned with Chart Markers)

1. 1st Target: The momentum-driven downside acceleration phase after the support break (the short-term swing following the invalidation of 55.33);

2. 2nd Target: 48.53 (the 1.27 Fibonacci extension level on the chart), close out positions gradually upon reaching this level.

6. Position Sizing & Risk Notes

- Position Sizing: Limit single-trade risk to ≤1.5% of account equity (e.g., ~0.3 standard lots for a $10,000 account);

- Note: If oil prices rebound and reclaim the 57.0 stop-loss level, close the position immediately — be wary of fundamental reversals (e.g., Venezuelan oil supply falling short of expectations).

GOOD LUCK!

LESS IS MORE!

Oil Traders Watch This Breakdown Level Carefully🔻 XTI/USD (WTI / USOIL) — Bearish Breakout Trade Blueprint

Energies Market | Day / Swing Trade Opportunity

📌 Asset Overview

XTI/USD – WTI Crude Oil vs U.S. Dollar

Market Type: Energy Commodity (CFD / Futures correlated)

Trading Style: Day Trade / Swing Trade

🧭 Trade Plan

🔴 Primary Bias: BEARISH BREAKOUT CONTINUATION

Price has completed a structure breakdown, confirming seller dominance after failed bullish recovery. Momentum favors downside continuation as liquidity shifts below key levels.

🎯 Entry Strategy

📍 Sell AFTER confirmed breakout below → 56.80

• You may enter at any price level after breakout confirmation

• Aggressive traders: enter on breakdown momentum

• Conservative traders: wait for a pullback retest below 56.80

Execution depends on your risk model & position sizing.

🛑 Stop Loss (Risk Control)

🚨 Protective SL: 58.00

⚠️ This is a reference level, not a mandatory rule.

Adjust your stop placement based on:

Timeframe

Volatility

Account risk parameters

🎯 Profit Objective

🎯 Primary TP Zone: 55.80

Why this zone matters:

• Strong historical support

• Oversold reaction area

• High probability of short-covering

• Correction + liquidity trap zone

⚠️ Partial profits are advised as price approaches this region.

🔎 Key Technical Drivers

✔️ Breakdown below key structure

✔️ Lower highs + lower lows

✔️ Momentum shift favoring sellers

✔️ Failed bullish continuation

✔️ Liquidity sweep completed above range

🌍 Related Markets to Watch (Correlation Map)

💵 USD-Linked Instruments

DXY (U.S. Dollar Index) → Strong USD often pressures oil prices

USD/CAD → Inverse correlation (CAD = oil-linked currency)

📉 Risk & Macro Assets

US10Y Treasury Yields → Rising yields = pressure on commodities

S&P 500 / US Indices → Risk-off sentiment weighs on energy demand

🛢️ Energy Complex

Brent Crude (UKOIL) → Confirms directional bias

Energy Sector Stocks → Weakness confirms oil downside momentum

📰 Fundamental & Economic Factors Supporting This Trade

⚖️ Macro Environment

• Demand concerns from global growth slowdown

• Stronger USD reducing commodity attractiveness

• Tight financial conditions limiting speculative inflows

🛢️ Oil-Specific Factors

• Inventory sensitivity remains elevated

• Market reacts sharply to supply-demand imbalance

• Volatility increases near key economic releases

📅 Upcoming Market Sensitivities

• U.S. inflation data

• Federal Reserve policy expectations

• Energy inventory updates

• Global growth & demand outlook commentary

Expect volatility spikes around high-impact macro releases.

⚠️ Risk Disclaimer

This analysis is not financial advice.

Stop loss and take profit levels are guidelines only.

Every trader must manage risk according to their own strategy.

👍 If this analysis adds value

• Drop a LIKE 👍

• Share your view in comments 💬

• Follow for consistent energy market breakdowns 📈

USOIL short trade setupIf price maintain below those Lower Highs, the dotted line, I can still see reasons to short USOIL.

-Price has been trending down creating LH's and LL's .

-I can see buyers presence only above that dotted line (!!!).

-I charted this on the 4H so this may take long to play out.

Patience.

XTI/USD Short Bias – Can Sellers Maintain Control?🛢️ WTI/USOIL BEARISH SWING TRADE - ENERGIES MARKET OPPORTUNITY 📊

⚡ TRADE SETUP: SHORT OPPORTUNITY

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📍 ASSET: XTI/USD (WTI Crude Oil) | ENERGIES

⏰ TIMEFRAME: Swing Trade (4H - Daily)

📈 BIAS: BEARISH ⬇️

💼 ENTRY STRATEGY - "LAYERING METHOD" 🎯

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Use Multiple Limit Order Layers for optimal entry execution:

✅ Layer 1: $60.00

✅ Layer 2: $59.00

✅ Layer 3: $58.00

💡 Why This Works:

Averages down your entry price

Reduces slippage risk

Allows gradual position building

Maximizes fill probability

🔧 CUSTOMIZABLE: Adjust layers based on YOUR risk management & capital allocation

🛑 STOP LOSS ⛔

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📌 Recommended SL Level: $61.00 (above supply zone)

⚠️ DISCLAIMER: This is a reference point only. Adjust YOUR stop loss based on:

Your risk tolerance

Account size

Trading strategy

Technical support/resistance

🚨 Risk Management First: Never risk more than 2-3% per trade

🎯 TAKE PROFIT TARGETS 💰

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Primary Target: $53.00 ⬇️

📊 Technical Confluence at $53.00:

✓ Strong support zone (oversold recovery area)

✓ Reversal trap potential

✓ High probability profit zone

💡 Profit-Taking Strategy:

Scale out 1/3 at $56.00 (quick gains lock)

Scale out 1/3 at $54.50 (momentum confirmed)

Scale out 1/3 at $53.00 (final target)

⚠️ DISCLAIMER: This is guidance only. Your profit targets should align with YOUR strategy, market conditions, and risk/reward ratio. Take profits at YOUR comfort level.

═══════════════════════════════════════════════════════════════

🔗 CORRELATED PAIRS TO WATCH 📡

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

1. USD/CAD (USDCAD) 📈 POSITIVE CORRELATION

• Current: ~1.4320

• Why: Canada is oil-exporting nation. Oil ⬇️ = CAD weakens

• Action: Watch USD strength - if USD rises, more pressure on oil

• Impact: ⭐⭐⭐⭐⭐ (5/5 Relevance)

2. S&P 500 (US500) 📊 INVERSE CORRELATION

• Current Level: ~6,800+

• Why: Rising energy costs = lower corporate margins = stock weakness

• Action: If stocks fall, risk-off → oil likely continues lower

• Impact: ⭐⭐⭐⭐ (4/5 Relevance)

3. US Dollar Index (USDZZ) 💵 STRONG NEGATIVE CORRELATION

• Why: Oil priced in USD. Strong dollar = cheaper oil for foreigners = lower demand

• Action: Monitor DXY strength - bullish USD = bearish oil

• Impact: ⭐⭐⭐⭐⭐ (5/5 Relevance)

4. Natural Gas (NATGAS/TradingView equivalent) ⚡ SECTOR CORRELATION

• Why: Both energy commodities, affected by demand

• Action: Watch as confirmation signal for energy sector weakness

• Impact: ⭐⭐⭐ (3/5 Relevance)

5. Russian Ruble (USDRUB) 🇷🇺 COMMODITY-LINKED CORRELATION

• Why: Russia major oil producer. Oil prices directly impact RUB

• Action: Weak ruble often signals oil pressure from supply concerns

• Impact: ⭐⭐⭐ (3/5 Relevance)

📋 TRADE CHECKLIST ✓

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

✅ Check USD strength confirmation

✅ Verify oversold condition on daily chart

✅ Confirm supply zone rejection above $61

✅ Monitor correlated pairs for confirmation

✅ Set alerts on each layer ($60, $59, $58)

✅ Define your max loss amount (2-3% rule)

✅ Plan exit strategy BEFORE entering

⚡ KEY POINTS SUMMARY 🔑

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Entry: Layered approach ($60→$59→$58)

🛑 Stop Loss: $61.00 (adjust to YOUR strategy)

💎 Target: $53.00 strong support

📊 Risk/Reward: Define YOUR ratio before entry

🔔 Confirmation: Watch USD, stocks, CAD correlation

USOIL Price Analysis & Bearish Trade Execution🛢️ Asset: WTI “USOIL” – Energies Market Trade Opportunity Guide (Day/Swing Trade)

📉 Plan: Bearish Plan Confirmed

Momentum is weakening, liquidity pockets are exposed at the lower ranges, and the structure favors downside continuation. Price remains vulnerable to deeper drawdowns as volatility compresses.

🎯 Entry:

ANY PRICE LEVEL ENTRY

(Execute based on your personal confirmation rules, premium/discount zones, or volatility triggers.)

🛡️ Stop Loss (Risk Guide):

This is the Thief SL @ 58.500 🛑

Dear Ladies & Gentlemen (Thief OG’s), kindly adjust your SL based on your own strategy, volatility preference, and personal risk model.

Note: I am not recommending that you use only my SL. You can make money and take money at your own risk.

💰 Target:

Strong support + oversold conditions + liquidity trap identified below, so kindly aim to escape with profits.

🎯 Our Target: 55.500

Note: Dear Ladies & Gentlemen (Thief OG’s), I am not recommending using only my TP. It is your own choice—you can make money and take money at your own risk.

🌍 Related Pairs to Watch (Correlation Insights)

1️⃣ Brent Crude – “UKOIL”

Often moves in the same direction as WTI due to shared global demand/supply themes.

If UKOIL breaks structure first, USOIL usually follows shortly after.

2️⃣ Natural Gas – “NATGAS”

Not directly correlated but reacts to energy-sector sentiment.

A sharp move in NATGAS can shift commodity-flow risk appetite.

3️⃣ Canadian Dollar – “USD/CAD”

CAD strengthens when oil prices rise and weakens when oil drops.

For a bearish USOIL plan, watch for USD/CAD upward pressure.

4️⃣ S&P 500 Energy Sector – “XLE”

Tracks major oil companies.

Weakness in XLE often signals upcoming pressure on crude.

5️⃣ OPEC Headlines + API/EIA Reports

Sudden supply changes or inventory spikes can trigger fast volatility.

Keep monitoring these events closely during active trades.

✅ LIKE if you find this useful!

✅ FOLLOW for daily trade plans & market insights.

✅ COMMENT your entry or adjustments below!

#TradingView #USOIL #CrudeOil #SwingTrading #DayTrading #TradingIdeas #Forex #Commodities #Bearish #RiskManagement

Let’s grow together – trade smart, stay disciplined, and engage! 💼🔥

usoil : live tradeHello friends

Well, according to the channel we had, you can see that the sellers broke the specified support with strength and caused the price to fall.

Now, given that it has become clear to us that the power is in the hands of the sellers, we can re-enter the sell trade if the price rebounds or pullbacks in the specified area, of course with the necessary confirmations...

This analysis is purely technical and does not constitute a buy or sell recommendation, so please observe risk and capital management and avoid emotional movements.

*Trade safely with us*

USOIL:LIVE TRADEHello friends

you can see that we had a decline and the sellers were in power until the support was determined with Fibonacci, where buyers entered and were able to support the price.

Now, with Fibonacci, we have determined a resistance area for buyers that can move up to there, but considering the main trend, which is negative, the price increase is an opportunity for a sell trade.

Don't forget risk and capital management.

*Trade safely with us*

Weekly USOIL Trend SummaryOverall, USOIL oscillated at a low level with a slight upward trend during the period from November 24 to November 28, 2025. Despite minor fluctuations of gains and losses throughout the week, it hovered around $59 per barrel and failed to break free from the consecutive monthly decline trend that began this month. The specific trend is detailed in segments as follows:

1.Modest Gain at Week's Start with Synchronous Weakening Price Spread (November 24)

USOIL kicked off the week with a slight upturn. It closed at $58.89 per barrel that day, rising $0.91 or 1.57% compared with the previous week's closing price of $57.98 per barrel.

2.Oscillating Consolidation in Mid-Week, with Gains Constrained by Oversupply Expectations (November 25 - 26)

On November 25, oil prices traded sideways, hovering around $58.77 per barrel with a slight drop of approximately 0.91%.

On November 26, the market rebounded, and the growth rate of the relevant oil and gas index expanded to 0.87%. Oil prices followed suit with an upward movement. However, they failed to break through the earlier oscillating range overall. Meanwhile, potential incremental pressure on the supply side left the oil price rally lacking strong momentum.

3.Minor Fluctuations at Week's End Awaiting Policy Signals (November 27 - 28)

On November 27, oil prices pulled back slightly, and the corresponding oil and gas index edged down by 0.08%. After encountering resistance near $59 per barrel, oil prices retreated moderately. Market sentiment turned increasingly cautious as investors focused on the OPEC+ production policy meeting scheduled for Sunday.

On November 28, oil prices inched up again, and the oil and gas index rose by 0.67%, hitting a weekly closing high of 309.33 points.

Overall, although USOIL recorded a slight increase this week, it remained trapped in a low - range. Moreover, this month marks its fourth consecutive monthly decline, the longest losing streak since 2023. The main bearish factors weighing on oil prices include the expected lifting of sanctions on Russian oil driven by progress in the Ukraine peace talks and weak demand caused by the unexpected growth in U.S. crude oil inventories. Conversely, expectations of interest rate cuts by the Federal Reserve have provided some support for oil prices. Going forward, the production decisions of OPEC+ and changes in the geopolitical landscape will be the key factors determining the future trend of oil prices.

USOIL : Don't be fooledHello friends

Well, you see that we have a descending channel that has hit the ceiling twice and the ceiling three times.

Well, in the third encounter with the bottom or support, you see that the buyers provided good support for the price and pushed it up and broke our medium-term ceiling. Now, if the breakdown is confirmed, the price will go to the ceiling of the channel and from there, a price correction can be expected.

The specified range is very important for a sell trade. Why?

Because there are many orders here, if the price reaches this area, it will inevitably correct. And there is another reason that we have, and the most important reason is that our trend is down and we should not open a trade against the trend.

This analysis is technically reviewed and is not a recommendation to buy or sell.

Avoid emotional behavior and observe capital management.

*Trade safely with us*

USOIL : Full analysisHello friends

Well, you see that we have a descending channel in which the price is moving, and considering that the price reached the ceiling of the channel, we had a Sharpe decline, and now it seems that the sellers want to break the channel, and the first support identified could be the buyers' stronghold, where we need to see if they support the price or not.

If they support, there is a significant resistance in their way. This area is full of sell orders and can naturally correct the price. In this regard, breaking this resistance is very important and vital for price growth.

Now what if the buyers cannot support the price in the support area and the price falls further?

Well, we need to find areas again for a sell trade because if the descending channel is broken, the fall will be heavier and it is better to move with the trend.

This analysis is purely technical and is not a buy or sell recommendation.

*Trade safely with us*

USOIL : LIVE TRADE

Hello friends

Well, considering the downtrend and the power of the sellers, we should also follow the trend and go to the side of the one who has the power.

Given the price drop, if the price pullbacks, we can see the price drop again.

This post is not a buy or sell offer and is only reviewed from a technical perspective.

Observe risk and capital management and avoid emotional movements.

*Trade safely with us*

USOIL trades with a weak oscillatory biasUSOIL is exhibiting a weak oscillatory downward trend today. Despite a slight rebound yesterday, affected by bearish news and technical pressure, the intraday upside momentum remains insufficient, with bearish momentum gradually emerging. Overall, it shows a sluggish pattern of a quick pullback after the rebound.

For the upside, focus on the short-term resistance zone of $59.5 - $60.5 per barrel, among which $59.5 per barrel can be regarded as a key watershed. On the downside, closely monitor the support range of $57.0 - $57.5 per barrel. If this zone is effectively broken down, the price may further decline to around $56 per barrel.

Sell 59 - 59.7

SL 60.1

TP 57.5 - 57 - 56.5

Crude oil: Weak ConsolidationToday, crude oil is trading with a weak oscillatory bias, fluctuating narrowly within the 57 - 58 per barrel range. The softened geopolitical risks have set the tone for the subdued market sentiment, while the technical landscape remains dominated by bears.

Key Levels:

Support Zones:Immediate support is concentrated around 57.0 – 57.4 per barrel, with notable buying interest emerging near 57.6. A breakdown below this zone could pave the way for a test of 56.0 per barrel, potentially extending to the vicinity of the annual low around the same level.

Resistance Levels:Near-term resistance lies around 58.75 per barrel, where some trading strategies suggest initiating short positions. Further resistance is seen at the 59.0 – 60.0 per barrel range; only a decisive breakout above this interval can alleviate the short-term bearish momentum. For a full trend reversal, a breach of the long-term key resistance at 61.44 per barrel is required.

USOIL : LIVE TRADEHello friends

Given the price growth, you can see that buyers have repeatedly tried to break the resistance but were unsuccessful and the weakness of the trend is quite clear.

Now we can trade with capital and risk management and account management.

This is not a buy or sell offer.

*Trade safely with us*

USOIL: Consolidation First, Breakout Next After crude oil plummeted last week to a low near 58.1, it rebounded on Friday and closed around 59.5, basically confirming a consolidating trend.

For this week, crude oil is expected to first trade in a low-range consolidation before assessing the potential for a unilateral move. Focus on the 58 level as support below and 62 as resistance above; trade within this range using a "buy low and sell high" strategy.

Go long around the 58.2 level.

Go short around the 61.8 level.

If the price breaks out of this range, then look for a unilateral trend to follow.