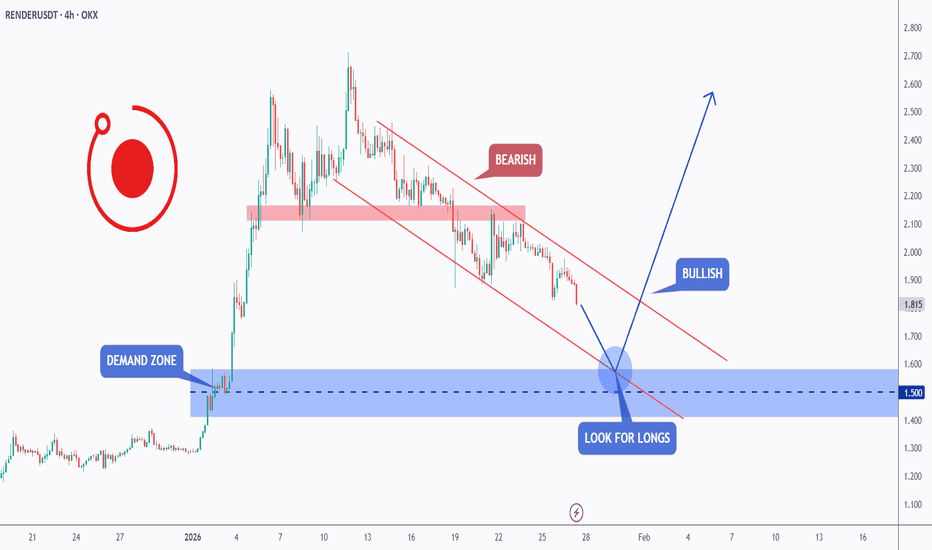

RENDER - Decision Zone ApproachingRENDER is slowly grinding lower and approaching a clear demand zone, an area where buyers have previously stepped in aggressively.

As long as price is holding inside this blue demand zone, the plan is simple:

👉 look for longs, patiently, with confirmation...

That said, context matters.

For the bulls to fully take control again, one thing is still missing:

a clean break above the red falling channel. Until that happens, any upside remains corrective rather than impulsive.

In short:

Demand zone = opportunity.

Channel break = confirmation.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Video

Wall Street Weekly Outlook – Week 46 2025 (Nov 10 – Nov 14)📊💥 Wall Street Weekly Outlook – Week 46 2025 💥📊

+ High Probability SMA/EMA Cross-Over Strategy! 💥

📅 November 10 – November 14, 2025

The new trading week is dominated by one crucial question:

Are we heading toward a larger year-end correction in equities, or does the market shift back into risk-on mode? 🚀📉📈

In this video, I break down the most important market drivers for the weeks ahead. 🎥📊

Lean back and get a structured overview of which levels matter now, how hedge funds are adjusting their exposures, and which setups look most attractive from a mean-reversion perspective. 🧠💼

💡 Bonus Lessons:

EMA/SMA cross-over strategy for equities, three key macro focus themes, and actionable mean-reversion setups. ⚡️

📘 Topics covered in this weekly outlook:

+ SMA/EMA Cross-Over Strategy 🧠💼

Best,

Meikel

Wall Street Weekly Outlook - Week 45 2025 [03.11.- 07.11.2025]Wall Street Weekly Outlook - Week 45 2025

📅 November 3 – November 7, 2025

Let’s kick off an exciting new trading week — and a brand-new trading month! 🚀

Seasonal factors often play a major role in November and December, and I’ll break them down for you in this week’s video. 🎥📈

Sit back, enjoy the overview, and dive into the world of banks, hedge funds, and institutional flows — with exclusive insights into how the pros are positioned right now. 🧠💼📊

💡 Bonus segments: Strategies, setups & market psychology — everything you need to know for the week ahead. ⚡️

📘 Topics covered in this week’s outlook:

🏛 Seasonality in the Nasdaq:

🥇 Seasonality in Gold:

... and many more charts & concepts in the video! 🎬📊

💬 I’m looking forward to your questions, comments, and an active discussion here on TradingView!

👋 Best,

Meikel

Getty Images | GETY | Long at $2.29Bull Thesis

Data is "knowledge" for AI.

Getty Images NYSE:GETY holds immense importance in the generative AI race due to its control over a vast, high-quality library of over 500 million licensed images and metadata.

By licensing content (e.g., via deals with Nvidia), NYSE:GETY monetizes its assets, promotes responsible AI, and challenges open-source models.

Standardized license deals will boost AI's commercial viability and prevent a "wild west" of IP theft, ultimately accelerating safe deployment in industries like advertising and media.

The merger with Shutterstock will only help NYSE:GETY be the ultimate leader in this licensed data space.

Bear Thesis

The "wild west" of IP theft continues for years and the company's debt / poor fundamentals build until and ultimate collapse or acquisition.

Action

The bull thesis makes the most sense given the amount of data NYSE:GETY has and the future of data licensing deals. Now, I would love the price to go lower to accumulate more shares (under $2 is not out of the question in the near-term). But, at $2.29, NYSE:GETY is in a personal buy zone, and a starter position was made. More shares will be gathered in the $1 range if the earnings and revenue growth projections continue to look promising beyond 2025: www.tradingview.com

Targets into 2028:

$3.07 (+34.1%)

$5.00 (+118.3%)

Wall Street Weekly Outlook - Week 44 2025 [27.10.- 31.10.2025]Wall Street Weekly Outlook – Week 44, 2025 📊💥

Let’s dive into another exciting trading week! 🚀

Rate decisions, month-end flows, and fresh quarterly earnings are setting the stage for strong market moves.

Sit back, enjoy the overview, and dive into the world of banks, hedge funds, and institutional flows — with exclusive insights into how the pros are positioning right now. 🧠💼📈

Extra Lessons: Strategies, setups, and market psychology — everything you need to know for the week ahead. ⚡️

**S&P500 Performance after FED rate cuts**

**Overview: The most important events of the week**

Have a great start to the trading week!

Meikel

Wall Street Weekly Outlook - Week 43 2025 [20.10.- 24.10.2025]Wall Street Weekly Outlook - Week 43 2025

Every week I release a Wall Street Weekly Outlook that highlights the key themes, market drivers, and risks that professional traders are watching.

+Extra lessons:

Any questions? Drop a comment or reach out directly.

Best,

Meikel

Wall Street Weekly Outlook - Week 42 2025Every week I release a Wall Street Weekly Outlook that highlights the key themes, market drivers, and risks that professional traders are watching.

This week promises to be particularly volatile.

With tensions escalating in the U.S.–China trade conflict, markets already began to show the first signs of risk-off sentiment late Friday. In this video, I’ll break down what this shift means for global markets and how investors can navigate the current environment.

+Extra lesson:

Any questions? Drop a comment or reach out directly.

-Meikel

Wall Street Weekly Outlook - Week 41 2025Every week I release a Wall Street Weekly Outlook that highlights the key themes, market drivers, and risks that professional traders are watching.

This week promises to be particularly important, with important fundamental developments... 📊 Stay ahead of the curve—watch the video now and get prepared like a Wall Street insider.

Any questions? Drop a comment or reach out directly.

-Meikel

EUR/GBP Outlook: Market Positioning Hints At Euro OutperformanceLooking at EUR/USD, GBP/USD charts and the relative positioning of futures traders on the euro and British pound, I outline why I think EUR/GBP could be headed for a breakout.

Matt Simpson, Market Analyst at City Index and Forex.com (part of StoneX)

DAX, FTSE Update: Bears Regain ControlMomentum has finally come my way, which has seen bears reclaim control of the DAX and FTSE 100. And I suspect they'll retain control for a while longer. Today I update my levels and outlook for both markets.

Matt Simpson, Market Analyst at City Index and Forex.com (part of StoneX).

USD/CAD, GBP/CAD, EUR/CAD: Canadian Dollar Bulls Regain FootingPrice action on several Canadian dollar charts suggests that we've entered a phase of strength from the bull camp. With Canadian CPI and a Bank of Canada meeting on tap, there is plenty of opportunity for volatility. Today I outline my bias for USD/CAD, GBP/CAD and EUR/CAD.

Matt Simpson, Market Analyst at City Index and Forex.com (part of StoneX)

Wall Street Weekly Outlook - Week 38 2025Every week I release a Wall Street Weekly Outlook that highlights the key themes, market drivers, and risks that professional traders are watching.

This week promises to be particularly important, with several events likely to move markets. 📊 Stay ahead of the curve—watch the video now and get prepared like a Wall Street insider.

Any questions? Drop a comment or reach out directly.

-Meikel

Vimeo | VMEO | Long at $3.87Vimeo NASDAQ:VMEO provides a cloud-based platform for video creation, hosting, and sharing - primarily serving businesses, creators, and enterprises for professional video content management. While NASDAQ:VMEO has a **lot** of competition, it is a rather "healthy" company:

Debt-free (a rarity out there...)

Maintained profitability over the last twelve months, with a healthy gross profit margin of 78%

Earnings are forecast to grow 34.76% per year

[*}Revenue growth rate through 2027 is projected at 5.36% (modest)

Adjusted EBITDA guidance raised to $35 million, up from $25-30 million

Upcoming product developments, including AI-powered features and new SKUs, are expected to drive further growth

Insider bought over $868,000 in shares in the last year at an average price of $5.04

Subscriber growth is a concern...

From a technical analysis perspective, the stock price is currently near the bottom of my historical simple moving average bands. This region is typically an area of consolidation. The two open price gaps below the current price on the daily chart (down to $3.38) will likely get closed in the near-term before a move up. I do believe this is a risky investment, though, given the competition and economic headwinds. I would not be surprised if the market flipped and took this down near or below $1... But, if one is going purely by what the company reports concerning fundamentals and general growth, this is an undervalued stock in the $3 range.

Thus, if the insider/company hype is true, NASDAQ:VMEO is in a personal buy zone at $3.87 - with near-term risk of the stock dropping to close the price gaps on the daily chart down to $3.38... or below.

Targets into 2028:

$5.00 (+29.2%)

$6.40 (+65.4%)

GBP/JPY, EUR/JPY Bulls Eye Breakout, USD/JPY RangingLooking at market positioning, I outline why I think futures traders are anticipating a stronger Japanese yen in the coming weeks. Though as you'll see on the daily charts, momentum is currently against yen bulls with USD/JPY lifting from its range lows and both EUR/JPY and GBP/JPY eyeing bullish breakouts.

Matt Simpson, Market Analyst at City Index and Forex.com

Gold Bulls Eye Breakout, But Caution May Be RequiredI'm seeing a lot of bullish calls for a gold breakout this week, and the contrarian within me suspects this could lead to disappointment over the near term. Even though my core bias is for gold to reach new highs eventually. Today I look at market exposure to gold futures from the commitment of traders report alongside key levels on gold's futures chart.

Matt Simpson, Market Analyst at Forex.com and City Index.

VIX Futures Positioning Sends Volatility Smoke SignalsIf real money exposure to the futures market is any guide, the VIX may be at or near a cycle low — implying that higher volatility could be on the horizon for Wall Street. Should a significant catalyst emerge, it could ripple through risk appetite across multiple asset classes.

Matt Simpson, Market Analyst at Forex.com and City Index.

Gold Technical Outlook Heading Into Powell's Jackson Hole SpeechIt is without a doubt that Jerome Powell's speech at the Jackson Hole symposium is THE event of the week, and possibly the biggest of the month and quarter. That brings the potential for safe-haven flows into gold as we veer towards this key event. I take a look at gold futures market exposure and key levels for gold futures.

Matt Simpson, Market Analyst and City Index and Forex.com

The Kiwi Plunges as the RBNZ Deliver a Dovish CutToday's 25b bp cut was expected, but the RBNZ have revised their forecasts and lowered their expected terminal rate. I take a look at the important points from the statement, how markets reacted, and why futures market positioning could point to further downside for the New Zealand Dollar.

Matt Simpson, Market Analyst at Forex.com and City Index

USD/JPY, CAD/JPY, CAD/JPY Technical OutlookSome interesting setups are forming on the daily charts of USD/JPY, CAD/JPY and CHF/JPY. Keep in mind that USD/JPY will be more sensitive to the incoming US inflation report, which leaves the potential for some divergences to form among the Japanese yen pairs. Overall, my bias is for them to move lower in due course.

Matt Simpson, Market Analyst and City Index and Forex.com

AUD/JPY bulls eye 99, 100The yen is broadly weaker, which is even allowing a weaker Australian dollar to rise. And with a decent bullish trend on the daily chart, I am now seeking dips within a recent consolidation range in anticipation of a move to 99 or even 100.

Matt Simpson, Market Analyst at City Index and Forex.com