Temporary Support vs Daily Bearish Structure.Prices are taking rejection from the 4H bearish Fair Value Gap. However, there was a sell break level below that the market has already broken, and this level will now act as a bullish PD array.

Additionally, there is an unfilled gap below the current price, which the market may move down to fill. Since price is already positioned at a daily bearish level, if the market provides strong selling confirmations at this area, it may drop from here and move lower to fill the gap below.

Viraltrade

Edgen / UsdtGATEIO:EDGENUSDT

### 🔍 What LayerEdge (EDGENU) is

* A **layer-2 scaling project** focused on **gaming + AI** use cases.

* Claims to provide **cheaper & faster transactions** for decentralized applications.

* Recently got listed on **Gate.io** which explains the early pump you see on the chart.

---

### 📊 Chart view (from your screenshot)

* First spike: **launch pump**, then a **sharp sell-off** (common for new listings).

* After the dump, price went into a **sideways accumulation**.

* Latest candles show a **second smaller breakout** attempt with higher lows forming.

---

### ✅ Good signs

* New listing on a known CEX (Gate.io).

* Positioned in a strong trend sector (AI + Gaming infra).

* Early-stage → volatility can create short-term trading opportunities.

### ⚠️ Risks

* Very **low liquidity**, meaning pumps and dumps are easy.

* No confirmed **major partnerships** yet.

* Mostly hype-driven until real adoption or ecosystem dApps go live.

---

👉 **In short (not financial advice):**

LayerEdge (EDGENU) is still highly speculative. Exchange listing + trending narrative = good for hype, but thin liquidity + lack of strong fundamentals = high risk.

“XAUUSD – Strong Retracement From New All-Time High (ATH) 3650“XAUUSD – Strong Retracement From New All-Time High (ATH) 3650 📉”

Gold (XAUUSD) reached the all-time high resistance / PRZ zone (3645–3680) and immediately showed rejection signs, confirming this level as a high-probability reversal point.

📊 Technical Breakdown

PRZ Rejection: The move above 3650 failed to sustain, indicating a liquidity grab and false breakout structure.

Momentum Exhaustion: A parabolic advance from 3330 support into ATH left behind multiple imbalances (FVGs) that now attract price back down.

Liquidity Dynamics: The rejection suggests buy-side liquidity has been taken, and the market may now seek sell-side liquidity below recent swing lows.

Market Structure: Intraday structure shows early signs of a bearish shift, with lower highs forming under 3635–3625.

🎯 Downside Targets

3585–3578 → First corrective level (38.2% retracement).

3565 → Key midpoint of the rally.

3545–3516 → Liquidity + 61.8–78.6% retracement cluster.

3480–3460 → Previous consolidation base.

3330–3320 → Major high-timeframe support demand zone.

⚠️ Invalidation

If buyers reclaim 3660–3680 with strong daily closes, the bearish retracement scenario will be invalidated, opening the path toward new ATH extensions.

📌 Conclusion:

Gold’s rejection at 3650 ATH PRZ is a significant technical signal. Current order flow suggests a retracement phase toward 3580–3515, with potential extension to 3330–3320 key support if selling pressure persists.

XAUUSD Critical Reversal Zone | XAUUSD Rejection or Breakout?XAUUSD Critical Reversal Zone | XAUUSD Rejection or Breakout?

Key Observations:

Resistance Zone (Strong Supply Area):

Price has shown multiple rejections around 3400–3440, confirming this region as a strong resistance.

A prior liquidity sweep ($$$) was observed above this zone, trapping buyers and triggering a sell-off.

Support Zone (Demand Area):

A solid base exists around 3260–3280, highlighted as strong support.

Price previously formed a higher low in this area, signaling that buyers are still defending.

Market Structure:

We observed a BOS (Break of Structure) earlier, followed by a fair value gap (FVG), which price later mitigated.

The current structure remains range-bound, with lower highs forming against a defended support.

Liquidity has been swept both above resistance and around key intraday lows.

Current Setup:

Price is trading within the entry zone (3360–3380).

A short trade setup is marked with a stop loss above 3380–3400 and a target around 3320–3300.

This reflects a risk-to-reward short opportunity favoring sellers if rejection holds.

📊 Trading Plan:

Short Bias:

Entry Zone: 3360–3380

Stop Loss: Above 3400

Target 1: 3320

Target 2: 3280 (major support)

Invalidation:

A clean breakout and close above 3400–3420 would invalidate the bearish setup, opening the way for retesting 3440 resistance.

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

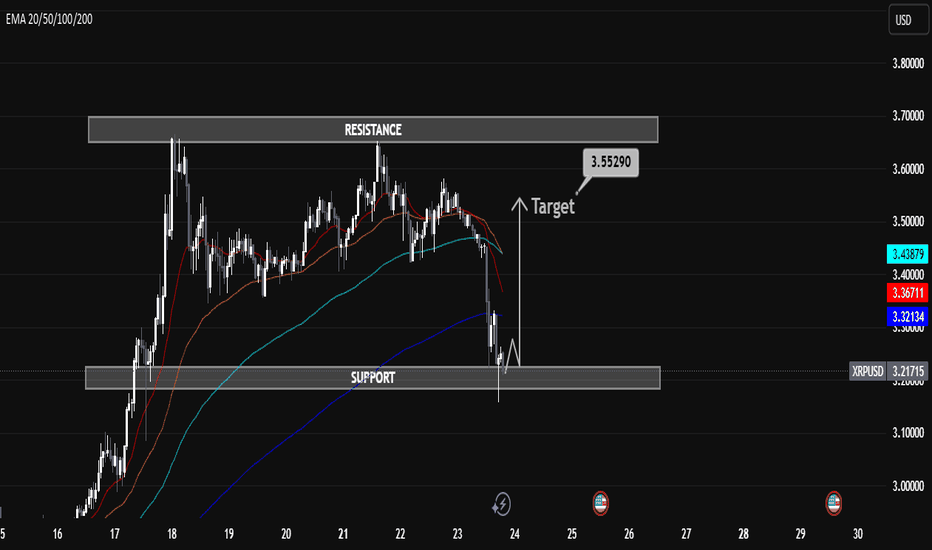

XRP/USD H1 Educational Market Analysis – Support-Based XRP/USD H1 Educational Market Analysis – Support-Based Long Opportunity

🔍 Structure Overview:

• Support Zone: $3.21 – $3.23

This level has acted as a strong liquidity pool and base for past bullish moves. Price has tapped into it, showing signs of potential demand returning.

• Resistance Zone: $3.65 – $3.70

Acts as a key supply zone, where previous bullish attempts failed. Targeting this area after a rebound is technically sound if structure confirms.

⸻

🔄 Price Action Insights (H1):

• Price broke down through EMAs (20/50/100/200), confirming short-term bearish pressure.

• A rejection wick from support hints at possible absorption of selling pressure.

• If price forms a higher low structure above $3.25 and reclaims EMAs, a potential bullish reversal may unfold.

⸻

🧠 Educational Note:

• H1 charts are ideal for intraday strategies, and this structure provides a clear example of:

• Support-resistance dynamics

• The use of EMAs as trend confirmation tools

• Reversal vs. continuation setups

⸻

🎯 Intraday Bullish Scenario:

• If price holds above $3.21 and breaks above the $3.40 (EMA cluster), bulls may push toward the $3.55290 target.

• This level aligns with the mid-range of the resistance zone, offering scalp-to-swing potential.

⸻

🚫 Bearish Risk:

• Failure to hold $3.21 could lead to a deeper correction toward $3.10 or even $3.00.

• Confirmation of bearish continuation would be a lower high rejection from EMAs without reclaiming them.

⸻

📌 Summary:

On the H1 chart, XRP is at a critical support. Watch for a clean bounce and break above EMAs for a move toward $3.55. However, losing $3.21 could attract further downside. Use price action confirmation before entries.

Daily Market Update.#ETHUSDI am providing a ethusd latest demand supply points where you can see and take Idia where market Will going and what will happened currently market trade at support if break this support we will see Down level to test market and give us trend change on these points.

Are You Understand My Daily Analysis If You Understand Then Thumbs Up In Comments!

NASDAQ100US100 has been ranging since last week, I would like to see it drop before it rallies to new highs, though it is simple for nas100 to reach our SL because our entry is exposed and in sync with 97% of retail traders who sold simply because resistance zone, we are part of liquidity into this trade and market algo price machine is mostly likely to take us out.Use low lots and proper risk management. Lets Download Success

NASDAQ100US100 has been ranging since last week, I would like to see it drop before it rallies to new highs, though it is simple for nas100 to reach our SL because our entry is exposed and in sync with 97% of retail traders who sold simply because resistance zone, we are part of liquidity into this trade and market algo price machine is mostly likely to take us out.Use low lots and proper risk management. Lets Download Success

$SIRI to go to $6.50 after breaking the $5 lvl of resistanceSiri to rise to the $5-$6.50 gap. It's clear as day on the chart.. with the 50 day moving average crossing the 200 day in an uptrend.

Invest smart, invest hard.

Boost my post if you like this idea 💡

Also follow and subscribe for more uproars. Let's spread the word together.

Roaring Puppy 🐶 out.

NASDAQ:SIRI

GAMESTOP SOARING from $25 to $111 - $168 range.GME just got $1 BILLION dollars in funding. Price expected to rise past all short squeezes in the $120 - $168 price range. This stock just went from a simple meme to opposing sides on institutional traders that even Kramer is beginning to call it a good investment (not that his opinion matters at this point with the amount he flip-flops with retail investors money)

Invest smart, invest hard. This one's to the moon.

Boost my post if you like this idea 💡

Also follow and subscribe for more uproars. Let's spread the word together.

Roaring Puppy 🐶 out.

[FSRN] FISKER TO SATURNS MOON - FROM 6 CENTS TO $1.50 - $2.00There is a major short squeeze about to be crippled at $1.50 - $2.00 range after announcements that Fisker raised $3.5 million last month to stay afloat from private investors.

The TESLA engineering genius Henrik Fisker is back with a vengeance.. Legendary car-designer Henrik Fisker is one of those deeply imaginative thinkers. An automotive pioneer and tech innovator. Trust this is the most underrated stock in the market right now.

Potential to make $100,000 from each $1000 invested.

You're welcome, Roaring Puppy out.. OTC:FSRN

Follow for more uproars...

Reference:

Fisker Raises Additional Capital From Existing Investor; Funding Is $3.456 Million; Potential to Increase to $7.5 Million

Fisker also Adds Three New U.S. Dealer Partners, in California and New Jersey; Waives $2,438 D&H Fee in U.S. on MY2023 Extremes and Ultras

USDJPY: BUY COMPLETE ✅Yeah now looks at me used to buy a opportunity I already confirm in fast analysis now look at my present target it that's cold baby price action is not with I am from get part 6 years I learned lots of things by my mistake no back support and no or got fathers and no teachers will teach me I learnt by mistake mistake mistake and also learning from mistakes and I also better I will mistake mistake fail fail and fail then you better something then you I can't feel and then you better little more that's how that's how you will be grow you first night bro s lost now it's my turn,

📈 Get Your Crypto Coin Analyzed by Our Experts! 📈Hey Crypto Enthusiasts,

Ever wondered how your favorite crypto project stacks up in the charts? Now's your chance to find out!

👇 Comment Below with Your Coin of Choice! 👇

We're inviting you to comment with the crypto coin or project you're most interested in. Our team of experts will perform a technical analysis on 1-2 coins per day based on your suggestions.

⏳ Please Be Patient:

Due to expected high demand, we'll be tackling 1-2 coins daily. So if your coin isn't picked immediately, don't worry! We'll get to as many as we can.

🔍 What You'll Get:

Detailed technical analysis

Key support and resistance levels

Potential entry and exit points

So go ahead, drop your coin in the comments and let's dive into the charts together!

Happy Trading! 🚀

TrendlinesSXP500 has been trading in a bearish trendline for approximately full year now. We are currently witnessing the price touch at the trendline once more again, this may result into another bear movement in the coming days. If any movement gets against us, losses will be accepted when any candle breaks and close above the trendline. Wish you all the best. Let's Download Success.

Support & ResistanceNZDJPY has reached the previous turning zone, could this mean the zone can resist the price from passing through? Price action will tell it all. I'll be happy to see the price prints a catalyst right there on our resistance. All the best. Remember to use proper risk managements. Let's Download Success.