XAUUSD — Strong Rally, Zero Permission Regime Invalid No TradeGold pushed aggressively higher today.

Momentum looks clean.

Breakouts look tempting.

Retail traders chase this move.

RegimeWorks does nothing.

Because price movement is not permission.

Top-down check:

• London session → CLOSED

• NY session → CLOSED

• 4H regime → INVALID

• Regime detail → Overextended

• Reversal permitted → NO

• Result → WAIT

When higher timeframe structure is stretched and sessions are closed, expectancy collapses.

This is exactly where most losses happen:

• chasing late trends

• trading outside liquidity

• forcing reversals into strength

Our system blocks all three automatically.

No setup = no trade.

Discipline is not about finding entries.

It’s about filtering bad environments.

Today gold moved.

We didn’t.

That’s correct behavior.

— RegimeWorks

Volatility

NQ Power Range Report with FIB Ext - 1/28/2026 SessionCME_MINI:NQH2026

- PR High: 26148.00

- PR Low: 26111.25

- NZ Spread: 82.5

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

10:30 | Crude Oil Inventories

14:00 | Fed Interest Rate Decision

- FOMC Statement

14:30 | FOMC Press Conference

25% AMP margins increase for expected FOMC volatility

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 359.39

- Volume: 27K

- Open Int: 260K

- Trend Grade: Long

- From BA ATH: -1.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

MU GEX - Potential Call Gamma Squeeze🔶 MU — Call Resistance at 400 Becomes the Decision Point 🔶

MU continued higher last week and tagged the 400 level , which now stands out as the largest call resistance on the board.

That level matters.

🔶 Structural Context 🔶

Price has reached a key call wall at 400 🟢

Momentum remains strong 🟢

Gamma dynamics are increasingly important here 🔵

In MU, the flow looks very similar to other momentum-driven tech names:

Retail positioned long calls

Dealers short calls , hedging via underlying buying

That creates a reflexive loop :

👉 strength forces dealers to buy more stock

👉 which can amplify upside if resistance breaks cleanly 🟢

🔶 Additional Context 🔶

Call pricing skew has expanded further 🟢

Calls are getting richer → sentiment remains bullish

Elevated skew also means expectations are crowded 🔵

🔶 What to Watch 🔶 💡

The 400 level is the inflection point .

Acceptance above 400 → opens the door for a call gamma squeeze 🟢

Rejection at 400 → likely leads to consolidation or pullback 🔴

As always, the tell is momentum + follow-through , not the level itself. MU is strong — but this is where structure decides whether the move accelerates or pauses.

SIEMENS - BB Expansion on the downsideCMP 2870

TF: Daily

The chart is breaking down from a consolidation after a BB Expansion. This move down will be quite strong as the consolidation was on for a pretty long period.

Feb 2850 Puts at 90 Rs on Radar

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

USD/JPY Plunges: Intervention & Market AnalysisA multi-domain dissection of the Japanese Yen’s sudden resurgence and its global impact.

The Macroeconomic Shift: Hawkish Signals

The Japanese Yen (JPY) staged a dramatic recovery this week, surging 3.6% against the US Dollar in just two sessions. The catalyst was the Bank of Japan’s (BoJ) January 2026 policy meeting. While the BoJ held interest rates at 0.75%, the accompanying report was decidedly hawkish. The central bank raised inflation forecasts for fiscal 2026 and 2027, signaling a commitment to policy normalization. This shift creates a critical divergence: as the US Federal Reserve stabilizes, Japan is tightening, narrowing the interest rate differential that historically suppressed the yen.

Management and Leadership: A Break from Consensus

A significant cultural shift is occurring within Japan’s monetary leadership. The BoJ’s decision featured a rare 8-1 vote split, with one board member dissenting in favor of an immediate hike to 1.0%. This deviation from traditional Japanese corporate consensus culture signals a new era of aggressive policy debate. Furthermore, Prime Minister Sanae Takaichi has staked her political capital on stabilizing the currency, warning of "bold action" against abnormal movements. This alignment between political will and central bank policy empowers the Ministry of Finance to act decisively.

Geopolitics and Geostrategy: The Global Risk Matrix

Currency markets are reacting to a heightened geostrategic risk profile. The recent US escalation regarding Greenland and associated tariff threats have injected volatility into the Atlantic alliance, driving capital toward safe-haven assets. This follows earlier instability involving US-Venezuela relations. In times of acute geopolitical stress, the yen historically competes with the US Dollar and Swiss Franc as a refuge. The current "triple threat" of trade wars, military posturing, and monetary tightening is accelerating yen repatriation.

Technology and High-Frequency Trading

The mechanics of the recent move suggest algorithmic involvement. Reports indicate the Federal Reserve conducted "rate checks" inquiries into bank position sizes at the London close on Friday. In the world of high-frequency trading (HFT), this acts as a digital signal flare. Algorithms interpret these checks as a precursor to physical intervention, triggering cascading sell orders on USD/JPY. This highlights the cyber-sensitivity of modern FX markets, where regulatory signaling can execute market corrections faster than actual capital deployment.

Industry Trends and Patent Analysis

The volatility in USD/JPY critically impacts Japan’s high-tech export sector. Companies like Sony and Toyota rely on stable exchange rates to fund long-term R&D and patent filings. A rapidly strengthening yen squeezes repatriated profits, potentially forcing a contraction in innovation budgets. Patent analysis suggests that Japanese firms maintain a "defensive moat" of intellectual property; however, maintaining this advantage requires consistent capital flow. If the yen appreciates too rapidly, it risks eroding the profit margins that fuel Japan’s science and technology leadership.

Economics and Commodity Correlation

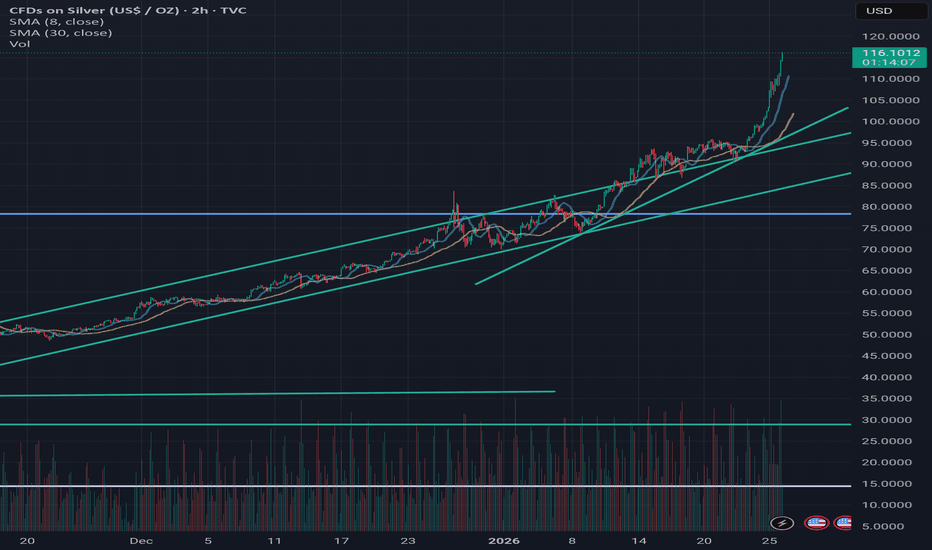

The currency shock has spilled over into commodity markets. Silver surged 6% to reach $110/oz, driven by the weaker dollar and the unwinding of the "carry trade." When the yen strengthens, global investors who borrowed cheaply in yen to buy assets like silver or stocks are forced to sell those assets to repay loans. This "unwind" creates a correlation where a stronger yen often leads to temporary liquidity shocks in other sectors, threatening the stability of equity markets like the Nikkei 225.

Future Outlook: The Intervention Cap

Goldman Sachs analysts argue that "intervention risk" now acts as a soft cap on USD/JPY upside. While the currency may technically warrant weakness based on fundamental fiscal risks, the threat of state action limits speculative shorting. Traders must now navigate a market where price discovery is driven not just by economics, but by the looming threat of coordinated government suppression.

NQ Power Range Report with FIB Ext - 1/27/2026 SessionCME_MINI:NQH2026

- PR High: 25897.00

- PR Low: 25838.50

- NZ Spread: 131.0

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

10:00 | CB Consumer Confidence

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 369.44

- Volume: 23K

- Open Int: 257K

- Trend Grade: Long

- From BA ATH: -2.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

IREN - Pressure Building Near Call ResistanceIREN is quietly building pressure.

For five consecutive sessions, price has been compressing in a tight range, holding above HVL , which already tells us the gamma environment remains supportive . 🟢

🔶 Key Structure 🔶

Price holding above HVL 🟢

Tight daily range → volatility compression 🔵

Major call resistance at 60 🟢

This setup matters because of who is positioned where .

In names like IREN, the flow is typically:

Retail long calls

Dealers short calls, hedging by buying the underlying

That dynamic means any sustained move toward — or through — the 60 call resistance can trigger a gamma-driven acceleration , as dealers are forced to add delta on strength rather than fade it.

🔶 Options Sentiment 🔶

Call pricing skew ~82% 🟢

Calls are significantly richer than puts

Options market sentiment is clearly bullish but it doesn't meean it will go up immediately.

🔶 Bottom Line 🔶

IREN is coiling above HVL with heavy call skew. If price engages the 60 level with momentum, the structure is set up for a call gamma squeeze , not a slow grind.

This is a classic “pressure first, expansion later” setup — worth keeping on the radar.

TE Connectivity(TEL) — Swing Trade Idea💰 TEL — Swing Trade Idea

🏢 Company Snapshot

• TE Connectivity designs and manufactures connectivity and sensor solutions across industrial, auto, and data infrastructure markets.

• Matters now due to sustained relative strength post-earnings and price holding a higher-timeframe uptrend despite recent market volatility.

📊 Fundamental Context (Trade-Relevant Only)

• Valuation: Fair vs peers; not stretched relative to industrial tech group.

• Balance Sheet: Moderate leverage with stable liquidity; no near-term balance sheet risk.

• Cash Flow: Consistent free cash flow generation supports trend continuation.

• Dividend: Neutral; not a catalyst but provides downside support.

Fundamental Read: Fundamentals support a trend continuation trade rather than a valuation-driven mean reversion.

🪙 Industry & Sector Backdrop

• Short-Term (1–4 weeks): Industrials showing selective leadership; capital goods holding up better than SPX.

• Medium-Term (1–6 months): TEL continues to outperform SPX on a relative basis.

• Macro Influence: Rates stabilizing; no immediate macro headwind to industrial capex.

Sector Bias: Bullish

📐 Technical Structure (Primary Driver)

• Trend: Price remains above rising 50-SMA and well above 200-SMA — primary uptrend intact.

• Momentum: RSI reset from overbought; currently neutral-to-slightly oversold on short-term oscillators, constructive for continuation.

• Pattern: High-level consolidation / shallow pullback after prior impulse leg.

• Volume: No heavy distribution; pullback volume lighter than prior advance.

Key Levels

• Support: 222.00 – 218.50

• Resistance: 235.50 – 240.00

🎯 Trade Plan (Execution-Focused)

• Entry: 222.00 – 224.00 (pullback into prior range support + 50-SMA confluence)

• Stop: 218.00 (loss of structure + failed higher low)

• Target: 235.50 (range high / measured move)

• Risk-to-Reward: ~2.3R

Alternate Scenario:

If price loses 218.00 on a closing basis, stand aside and reassess near 210–212 (next demand zone aligned with deeper trend support).

🧠 Swing Trader’s Bias

Price remains in a controlled uptrend above the 50-SMA with momentum resetting rather than breaking. Looking for a clean reaction at the 222–224 zone to target prior highs for a 2R+ continuation swing. A decisive break below 218 invalidates the setup.

USDJPY — No Trade Today | Regime Invalid = Capital PreservationToday is a textbook example of why permission > prediction.

My system didn’t place a single trade — by design.

Here’s what the regime framework detected:

• 4H trend bias → invalid (no directional edge)

• Volatility → expanding (unstable conditions)

• Both engines → BLOCKED

• Result → Flat

When volatility expands without structure, continuation and mean-reversion both degrade.

That’s the exact environment where most traders get chopped.

So instead of forcing setups…

The system does nothing.

No signal is a decision.

Flat is a position.

Capital preserved > random trades.

What would unlock trades?

For continuation (E1):

• 4H EMA alignment

• slope agreement

• volatility expansion with structure

For reversal (E3):

• contraction first

• then controlled extremes

Until then → no permission → no trade.

Most losses don’t come from bad entries.

They come from trading when there is no statistical edge.

Today the correct trade was discipline.

Regime first. Always.

— RegimeWorks

FUSIONMARKETS:USDJPY

NQ Power Range Report with FIB Ext - 1/26/2026 SessionCME_MINI:NQH2026

- PR High: 25585.50

- PR Low: 25365.25

- NZ Spread: 492.50

Key scheduled economic events:

08:30 | Durable Goods Orders

High volatility week open, quickly filling ~190 point weekend gap down

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 366.94

- Volume: 50K

- Open Int: 256K

- Trend Grade: Long

- From BA ATH: -3.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Rostock24:BTC Sharply Loses Momentum After Updating Local HighsAt Rostock24, we analyze Bitcoin’s behavior across different timeframes daily and observe a recurring scenario: BTC confidently breaks a local high, rises 8–15% over several days, attracts media and community attention — then loses almost all the gained momentum within 1–5 days, falling into a 10–25% correction. Such episodes have become more frequent in 2025–2026 and spark heated debates: “the bulls gave up,” “this is already the top,” “the bears are back.”

In reality, sharp pullbacks after new highs are not a sign of market weakness — they are a perfectly natural and even healthy reaction. Let’s break down the main reasons why Bitcoin so often “runs out of steam” at new peaks.

Profit-Taking by Large Players

Large holders (whales, early miners, corporate treasuries, funds) take profits precisely at levels where price updates historical or local highs. For them, this is logical: the price has reached a target level where large sell orders were previously placed (take-profit), or a favorable risk/reward ratio has simply been achieved.

When several large orders execute simultaneously on spot or via OTC — price receives a strong downward impulse. Trading volume in these moments often does not increase, and may even decline — this is the classic sign of “selling into strength” without panic.

Rostock24 observes: after every significant breakout (e.g., above $95k, $105k, $115k in 2025–2026), noticeable outflows from large wallets occur within the first 24–72 hours.

Liquidation Cascades on Futures

More than 70–80% of Bitcoin trading volume occurs on perpetual futures with high leverage. After a strong rally, open interest reaches local peaks, and most new positions are longs opened on FOMO.

As soon as price reverses down 2–4% — a cascade of long liquidations begins → automated selling → price falls further → new wave of liquidations. When liquidations exceed $800 million – $1.5 billion in just a few hours, the correction accelerates exponentially.

Rostock24 emphasizes: the deepest intraday and daily pullbacks after highs are almost always accompanied by peaks in long-side liquidations.

Weakening Buying Pressure

At new highs, buying pressure naturally weakens:

FOMO retail has already entered,

conservative investors wait for a pullback to buy,

algorithms and market makers stop aggressively supporting the upside.

When aggressive buyers decrease and sellers (profit-takers + liquidations) become active — the balance of power shifts downward. This does not necessarily mean the end of the trend — it is simply the market “digesting” the move.

Market Expectations and Revaluation of Growth

After a strong upward impulse, the market often overestimates the speed and strength of the rally: “if we reached $120k so quickly, $150k is already tomorrow.” When price fails to meet inflated expectations in the coming days/weeks — disappointment sets in and profit-taking follows.

This is classic psychology: participants who entered at $100k–$110k want to see at least +30–50% within a month. If growth slows — many close positions to lock in the profit they already have.

Crowd Psychology After New Highs

Updating highs triggers euphoria: social networks, chats, streams fill with “to the moon,” “this is just the beginning.” But the peak of euphoria most often coincides with the local top. As soon as the first pullback appears — euphoria turns to fear: “that’s it, fake breakout,” “we’re trapped again.”

This mood swing amplifies selling: people who just entered at the highs begin to panic-sell, creating additional downward pressure.

Rostock24 notes: the Fear & Greed Index almost always reaches the “Extreme Greed” zone right before sharp corrections following breakouts.

Conclusion

Corrections after rallies are a natural part of the market, not a sign of its weakness. Bitcoin is not required to grow in a straight line. After every strong impulse, the market needs a breather: profit-taking, liquidations, reduced buying pressure, revaluation of expectations, and psychological reset — all these are normal mechanisms of a healthy market.

At Rostock24 we help clients not fear such corrections, but use them:

identify probable profit-taking and liquidation-cascade zones in advance,

filter entries considering open interest, funding rates, and order-book depth,

avoid buying at the peak of euphoria,

treat pullbacks as accumulation opportunities.

The market has not become worse — it has become more mature and complex. The ability to survive corrections without panic and buy on dips is what separates survivors from those who constantly lose to emotions.

Long Setup: Darphane Gold Certificate Targeting 110.24I am looking at the Daily chart for **DARPHANE ALTIN SERTIFIKASI (BIST:ALTIN)**. The asset has been in a sustained uptrend since October. Currently, the price is reacting to the Simple Moving Average (SMA), which is acting as a dynamic support level around **85.39**. We are seeing a bounce from this zone, with the price currently trading at **88.27**.

The trend structure remains bullish as long as the price holds above the SMA and the key horizontal support structure. The ATR (Average True Range) is sitting at **4.74**, indicating there is enough volatility to support a move toward the target.

I am projecting a continuation of the bullish momentum toward new highs.

Direction: Long

Target (Take Profit): 110.24 (Upper Green Zone).

Stop Loss: 69.33 (Lower Red Zone). This is placed conservatively below the major horizontal support line visible at **74.10** to allow breathing room for volatility.

* ****

If the price breaks below the 74.10 support and the SMA, this bullish thesis would be invalidated.

AVGO – Breakdown Below HVL🔶 AVGO – Breakdown Below HVL, Negative GEX Targets Gap Fill 🔶

AVGO has cleanly broken below the High Volatility Level (HVL) , which was previously holding around 330 . This breakdown marks a clear regime shift , pushing the market into a 🔴 negative GEX environment where downside sensitivity and volatility expansion tend to dominate.

With HVL lost , price action becomes more reactive, and moves are less likely to be absorbed smoothly.

🔶 Structural Context 🔶

From a structural perspective, AVGO is now moving into a gap-fill phase . The gap below price is in the process of being filled and is likely to act as a short-term downside magnet .

🔶 Current Options Structure 🔶

297.5 – primary put support 🔴

310 – overhead resistance zone, aligned with the 100-day moving average 🔵

As long as price remains below HVL and under the 100 SMA , rallies are more likely to be sold rather than sustained .

🔶 Volatility Dynamics 🔶

GEX profile is negative , favoring directional expansion rather than compression 🔴

Implied volatility has been rising steadily over the past 5 sessions , confirming growing demand for downside protection and positioning into volatility

In a negative GEX regime , downside moves tend to accelerate once support levels are tested , rather than grind slowly.

🔶 Key Levels to Watch 🔶

330 (HVL) – invalidation / regime flip level 🔵

311 (100 SMA) – overhead resistance 🔵

297.5 – put support / downside reference 🔴

As long as AVGO remains below HVL with a negative GEX profile , the path of least resistance remains lower , with volatility expected to stay elevated until the gap is fully resolved or structure changes.

NQ Power Range Report with FIB Ext - 1/23/2026 SessionCME_MINI:NQH2026

- PR High: 25629.25

- PR Low: 25575.50

- NZ Spread: 120.25

Key scheduled economic events:

09:45 | S&P Global Services PMI

- S&P Global Manufacturing PMI

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 358.84

- Volume: 24K

- Open Int: 256K

- Trend Grade: Long

- From BA ATH: -2.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

USDJPY — No Trade (Regime Invalid) | Permission FirstToday USDJPY produced multiple intraday moves that look tradable at first glance.

My system did nothing.

And that is the correct behavior.

RegimeWorks only trades when higher-timeframe structure grants permission.

Current state:

• 4H regime = invalid

• No expansion

• No clean directional bias

• Mean-reverting chop

• Edge = statistically weak

So every signal is blocked by design.

No overrides.

No discretion.

No “maybe this one works”.

If permission is absent → we stay flat.

Capital protection > trade frequency.

Most losses come from forcing trades in environments like this.

Today the best trade was: No trade.

—

RegimeWorks

Permission → Setup → Execution

Not prediction. Not signals.

NQ Power Range Report with FIB Ext - 1/22/2026 SessionCME_MINI:NQH2026

- PR High: 25569.25

- PR Low: 25523.25

- NZ Spread: 103.0

Key scheduled economic events:

08:30 | Initial Jobless Claims

- GDP

10:00 | Core PCE Price Index (MoM|YoY)

12:00 | Crude Oil Inventories

Weekend gap filled, immediate response

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 364.30

- Volume: 26K

- Open Int: 258K

- Trend Grade: Long

- From BA ATH: -3.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

XAUUSD — Regime Valid, NY Open, No Reversal Permission (Waiting)FUSIONMARKETS:XAUUSD

Context, not signals.

Gold is currently in a valid higher-timeframe regime, but despite NY being open, reversal conditions are NOT permitted at this time.

What the framework is saying

HTF Regime: ✅ Valid

London Session: ❌ Closed

NY Session: ✅ Open

Reversal Permission: ❌ No

Outcome: Waiting

This means:

Trend structure is still intact

No confirmed regime weakness

No stretched conditions aligned with a sweep/rejection model

In other words: there is no permission to fade this move yet.

Why no trade here

Reversal engines in RegimeWorks only activate when:

Trend continuation weakens

Price is not stretched

Session context supports liquidity-driven reversals

None of those conditions are fully met right now.

Key takeaway

Not trading is a decision.

If the regime has not broken, there is nothing to “anticipate.”

Patience here protects capital and keeps the system aligned with its rules.

RegimeWorks philosophy:

Entries are temporary opinions. Regime is permanent law.

SPX – GEX 6800 Put Support Holds🔶 SPX – 6800 Put Support Holds, Pricing Skew Mean-Reversion 🔶

On the daily chart, SPX found clean support at the 6800 put level , tied to the Jan 23 expiration . That level absorbed yesterday’s downside pressure, and price has been rotating higher since the bounce. 🟢

🔶 Options Structure 🔶

From an options structure perspective, the range is now clearly defined:

6800 acts as the primary put support 🔴

6915 marks the next call resistance on the weekly expiration 🟢

One of the most important signals comes from the Options Oscillator . Yesterday, put pricing skew reached a historically extreme level , indicating significant put overpricing relative to calls. Since then, we’ve seen a sharp mean-reversion in skew, suggesting that downside hedging pressure is easing.

That said, caution is still warranted . SPX remains below the High Volatility Level (HVL) , a regime where price action tends to be faster and more reactive, with elevated volatility. 🔵

If 6800 continues to hold , the next key test is the HVL zone around 6895 . A reclaim above HVL would shift the regime toward more controlled price behavior and opens the path toward 6915 call resistance as the next upside reference. 🟢

🔶 Key Levels to Watch 🔶

6800 – put support / downside anchor 🔴

6895 (HVL) – regime pivot 🔵

6915 – next call resistance (weekly) 🟢

As long as price holds above 6800 , the structure favors continued upside rotation , but sustained strength likely requires a reclaim above HVL . Failure to hold 6800 would quickly reintroduce downside volatility .

NQ Power Range Report with FIB Ext - 1/21/2026 SessionCME_MINI:NQH2026

- PR High: 25175.25

- PR Low: 25103.50

- NZ Spread: 160.5

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 349.33

- Volume: 39K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -4.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

SPX – GEX Back to Positive🔶 SPX – HVL Reclaim & GEX Shift 🔶

SPX briefly traded below the High Volatility Level (HVL) yesterday, entering a 🔴 negative GEX regime , which increased downside sensitivity and intraday volatility. However, that breakdown failed to follow through.

Price has since reclaimed the HVL , and based on the 01/16 GEX profile , SPX is now back in 🟢 positive GEX territory , signaling a structural shift away from downside acceleration and back toward dealer-supported price behavior.

On the daily chart, this reclaim occurred directly off the rising trendline , which has defined the broader uptrend. The successful defense of this trend support suggests that the move below HVL was a temporary liquidity sweep rather than a regime change.

With HVL reclaimed and GEX flipping positive again, 🟢 upside flows regain control , and price becomes more responsive to call-side positioning rather than put hedging pressure.

🔶 Options Structure – Upside Reference 🔶

From an options structure perspective, the next major upside reference is the 7000 level , which represents:

a key call resistance zone

the dominant upside magnet in the current positive GEX environment

a natural extension target following the trendline bounce

🔶 Key Structure to Monitor 🔶

HVL – reclaimed, now acting as regime pivot 🟢

Rising trendline – trend integrity confirmed 🟢

Positive GEX (01/16) – supportive dealer positioning 🟢

7000 – primary upside target / call resistance 🟢

As long as SPX holds above HVL and the rising trendline , downside volatility should remain contained, and 🟢 rotation toward 7000 remains the higher-probability path. Failure to hold HVL would be the clearest signal that 🔴 negative GEX dynamics are reasserting.

NQ Power Range Report with FIB Ext - 1/20/2026 SessionCME_MINI:NQH2026

- PR High: 25405.00

- PR Low: 25367.25

- NZ Spread: 84.25

No key scheduled economic events

High volume open following holiday weekend

- Weekend gap down ~1.0% remains open

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 356.37

- Volume: 201K

- Open Int: 269K

- Trend Grade: Long

- From BA ATH: -3.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone