EURUSD WATCHING 1.1380 Level.The euro currency continues to rally against the US dollar ahead of this evening's key interest rate decision from the US Federal Reserve. Technical analysis shows that gains above the 1.1380 resistance area could cause a strong upside rally towards the

1.1520 level. To the downside, a loss of the 1.1300 support level could cause traders to test back towards the 1.1240 level.

The EURUSD pair is only bearish while trading below the 1.1240 level, key support is found at the 1.1200 and 1.1150 levels.

The EURUSD pair is only bullish while trading above the 1.1240 level, key resistance is found at the 1.1380 and 1.1520 levels.

Do your own analysis ...

Dont Forget Moving StopLoss At Breakeven

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. You must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

Waiting

EURJPY Let It Come..!Do your own analysis ...

Dont Forget Moving StopLoss At Breakeven

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. You must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

ETHUSD pullback then break up.ETHUSD 8h also looks to be changing structure here, you can see the LL and LH marked and momentum on Macd d dying off, I think this could be some sort of abc before a bullish break out. Would not short as still on an uptrend, looking to see if a long order presents itself around bottom blue box area.

USDCHF - What to do now? - Market in a Retracement MoveHi Traders!

The market is in an overall Downtrend, but in a shortterm Longtrend.

As you can see it was falling since it was at the Top of 0.96400.

During this Bear Market the market respected a Trendline.

The Price fell until it reached the Support at 0.93800.

The distance is 160pips.

After that it broke the Trendline and is moving up.

So what to do now?

The market just broke out of the Trendline with high momentum.

It is in the Retracement move.

The question is, where the Retracement is going to end.

For that we can consider these things:

The 200MA and

the 61.8% of Fibonacci Retracement.

At this moment we can wait and see how the market reaches this Level.

If everything is normal and the market reach the Sell Area, we'll sell.

The TP would be at around the last low.

We recommend not to trade every move of the market.

Having no open positions is also a position!

Thanks and successful Trading :)!

Stay Away From TROUBLE And Win!! - 05/27/20 RECAPHi traders,

it's typically like a holiday for us traders when the market (SPY) moves strongly to one side as it did after Wednesday's open. But in current uncertain times (see my vid. "Indices Will Start Falling When...") you can never be sure of the genuity of such move. We saw exactly that yesterday. A V-shaped reversal and straight back up, ending the day positively!

This was why I stood away from the initial scrum and eventually found a profitable long opportunity later in the day.

Trades:

1) SIX - LONG @26.81, closed 1/2 earlier and raised SL. +1.30%

*In my ID trades, I risk 1% of the account per trade and go for 2% (2:1 RRR ). Sometimes I adapt a little bit as you can see in the trades' description.*

Total PnL for the day: +1.30%

Total PnL for the week: +0.60%

Good trades,

Tom | FINEIGHT

EURAUD PATIENTLY WAITING! EURAUD 1HOUR TF

So here is something I am waiting for to come back and test the retracement on the fib retracement! I am not going to be holding my breath here as this could still continue with the downtrend and not retrace!! or we could see a swing trade happen when it breaks out of my trendline retest the trendline on the 50% fib level and see it go for 1:12 RR

When will I take sells!

Retest Trendline

Bearish candle

exhaustion

-- Breaks trendline comes back in the trendline zone

- resistance holding it down with trendline!

O suporte será quebrado?A Bitcoin rompeu a resistência da Média Móvel de 200 dias contra o Real Brasileiro no gráfico de velas diárias, e agora está retornando para testar esse mesmo nível como suporte.

Nos próximos dias, vou estar observando se esse nível será rompido ou usado como suporte!

AVISO LEGAL: o conteúdo postado nessa página tem propósito informativo e não deve ser usado como conselho financeiro. Tome decisões de investimento baseadas no seu próprio julgamento.

Será que a MA 200 será usada de suporte?!Ontem, dia 03 de abril, o par BTC/BRL rompeu a média móvel de 200 dias, e hoje nós estamos presenciando o preço se matendo ACIMA da média!

Estou observando de perto para ver se o preço consegue manter essa posição, até porque NO PAR BTC/USD O MESMO NÃO ESTÁ ACONTECENDO!!

AVISO LEGAL: o coneúdo dos meus posts são direcionados para fins informativos e de entretenimento. Nada postado nesse perfil é conselho fineanceiro, portanto não deve ser entendido nem utilizado como conselho financeiro! Faça sua própria pesquisa e tome suas próprias decisões.

A relação entre as EMA de 9, 50 e 200 dias com ETH/USDC...Essa interação está realmente única...

Reparem como o preço usou a EMA de 9 dias como suporte, rompeu a EMA de 50 dias, sentiu resistência da EMA de 200 dias, depois usou a de 50 como suporte, e rompeu a de 50 novamente para usar a de 9 dias como suporte!

Vamos esperar algum tempo e ficarmos atentos para observar se a EMA de 9 dias irá ser rompida, o que seria uma indicaçã de baixa, ou se ela atuará como suporte para depois o preço romper as resistências das médias exponenciais de 50 e 200 dias.

Na minha opinião, existe uma boa probabilidade do preço movimentar-se um pouco dentro do canal, para depois ROMPER A EMA DE 9 DIAS E DESVALORIZAR!

AVISO LEGAL: o conteúdo postado nessa página não é conselho financeiro e não deve ser entendido como tel. O propósito dos posts é a INFORMAÇÃO. Invista e faça trocas de ativos baseado no seu próprio julgamento e risco!

O que será que as Bandas de Bollinger irão fazer a seguir?!No gráfico com velas de 4 horas, estou reparando uma indicação de baixa no MACD, ao passo que as Bandas de Bollinger estão se estreitando, e o preço está usando a Média Móvel (linha vermelha central das bandas azuis) como suporte!

Sempre que as Bandas de Bollinger se estreitam de forma convergente como está acontecendo, é sinal de que um movimento relativamente grande está prestes a acontecer!

Vou manter o olho aberto pra ver o que acontece nas próximas 12-24 horas, especialmente porque o MACD do gráfico com velas diárias está indicando força de alta!

Pra que direção vocês diriam que o movimento do preço tem mais probabilidade de seguir?

AVISO LEGAL: conteúdo com proósito de informação, e não deve ser considerado conselho financeiro.

TSLA (1D) Too Risky businessHi Traders, As you can see on chart, Tesla started Parabolic move Up. It usually DONT end´s good for long-term bulls. (Hodlers)

I expect that last few days are just liquidations of short-traders (mind the gaps :D ). So YES it can go higher.

In this moment I will NOT touch this stock even with a stick untill correction will happen.

Best would be if we reach area 290-270 USD. Then I am willing to buy. Another area for partial buy is Yellow tredline. Around 370 usd.

Trade safe.

Good luck ;)

Reversal? Waiting for BTC to show signs of a BULLISH REVERSAL.

Currently - Looks like we're at the decision point of a V Bottom.. Waiting for the break out of the GREEN BOX

If we break below this box, a potential double bottom reversal is in play, if we hold support on the 38.2% FIB RT.

Just being completely honest -BTC is not giving me ANY clear signs it wants to break out.. so, if the V Bottom confirms, I will enter a small trade -but other than that, just waiting for some development and an eye on VOLUME.

What are you all seeing?

Am I missing something?

Thanks for looking!

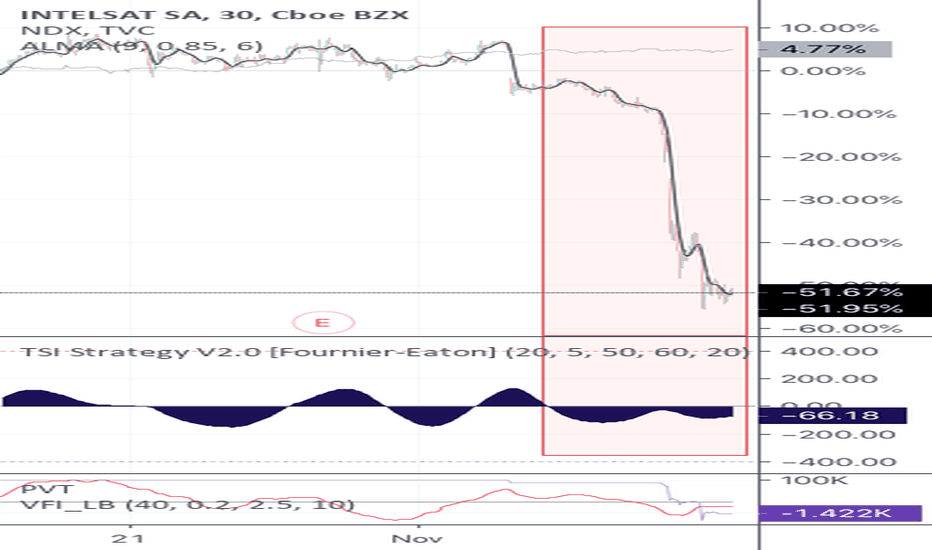

Almost time... but not yetTrend shift indicator (v2.0) histogram— along with other volume metrics —has this still weak. Wait for momentum and cross above 0 on TSI