Walmart - Good PotentialCounting waves and assessing technical potential. Here’s what we see:

We are drawing a classic five-wave structure. The move started in November 2015.

November 2015 - April 2022 - Wave 1

June 2022 - February 2025 - Wave 3

April 2025 - present - Wave 5

The upside potential is estimated at 18 - 38 %.

Key targets:

136

156

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

Walmart

Walmart: New Impulse!After a period of indecision, Walmart's stock has recently gained new upward momentum. It's once again heading towards our red Short Target Zone ($127.46 - $134.37), where the green wave is expected to conclude. In the primary scenario, we anticipate a subsequent break of the support at $97.90 and a decline into our green long Target Zone between $80.90 and $69.60. Alternatively, the high of the green wave alt. might have already been set. A direct sell-off below the mentioned support would then lead the stock into our green Long Target Zone earlier (probability: 34%).

WMT – Breakout Holds as $110 Flips From Resistance to SupportFrom a technical perspective, the $110 level has completed a clear resistance-to-support flip. After the breakout, price pulled back and held above this zone, indicating that prior selling pressure has been absorbed and demand is now defending the level. The stock remains above a rising 20-day EMA, suggesting the structure is constructive rather than overstretched.

With this setup, $110 acts as the key bullish anchor. As long as price holds above this support, the market remains in a bullish consolidation phase, and recent pullbacks appear to be structural digestion rather than a signal of trend reversal.

Walmart. Current Growth Target.The previously proposed diagonal model is no longer valid, as the expected decline did not materialize.

The chart annotation has been adjusted in favor of developing a standard impulse wave, wave .

Target: 140.24, representing a +22.52% move from the current price.

📊

A potential entry will be signaled on a pullback within the next week or two. The structure for the subsequent advance is marked on the chart.

Note: the price during the correction should not break out of the channel boundaries.

Walmart Stays Strong, Ready for the Next LeapWalmart is proving once again why it remains one of the strongest companies in the world. Even as many retailers struggle, Walmart continues to grow, innovate, and win the confidence of investors.

Its stock is already up 22% this year, beating the S&P 500, and many signs show that the company could stay strong in 2026 as well.

◉ Why Walmart Is Winning

Walmart has become a perfect mix of traditional retail and modern technology.

Strong results:

● Revenue up 5.8% year over year

● Operating income up 8%

● EPS rising from $0.58 to $0.62

Market share growth:

Walmart gained more customers in grocery and general merchandise. Even higher-income shoppers have been spending more at Walmart.

E-commerce strength:

Online sales grew 27% as Walmart expands its online offerings and reaches customers beyond its stores.

Growing advertising business:

Walmart’s ad sales increased 53% in the latest quarter, turning it into a serious player in retail advertising.

◉ Technology Is Shaping Walmart’s Future

Walmart is investing heavily in technology to stay ahead:

● Partnering with OpenAI to let customers use ChatGPT for shopping and checkout

● Training developers to code faster with AI

● Automating supply chains and warehouses

● Buying Vizio to strengthen its advertising ecosystem

These changes are helping Walmart protect its low-price model while moving closer to becoming a tech-driven retailer.

◉ Leadership and Listing Changes

Two important updates were recently announced:

● CEO Doug McMillon is stepping down after ten years

● John Furner, head of Walmart U.S., will become the new CEO

Walmart also announced that it will move its stock listing from the New York Stock Exchange to the Nasdaq. This connects Walmart more closely with tech-focused indexes and funds.

◉ Dividend Stability

Walmart is a Dividend King, raising its dividend every year for more than 50 years. This adds strong stability for long-term investors.

◉ Technical Outlook

● From a technical point of view, the stock recently broke out of an ascending triangle pattern and touched a new all-time high.

● If this momentum continues, Walmart could see another strong rally in 2026.

◉ Final Thoughts

Walmart is winning today and building an even stronger position for the future. With solid financials, strong e-commerce growth, expanding advertising revenue, and steady leadership changes, the company is well-placed for 2026 and beyond.

Walmart (WMT) surged on expectations of robust consumer spending

The US indices have maintained their uptrend, supported by evidence of strong US consumer spending during Black Friday, which confirmed sustained consumer strength.

Adobe (ADBE) reported that consumers spent 11.9 bln USD online during Black Friday, marking a record high and a 9.1% increase YoY. The NRF survey results also indicated a record-high 186.9 mln people planned to shop from Thanksgiving through Cyber Monday.

Walmart (WMT) stock price surged, reflecting its 3Q earnings surprise and growing anticipation for increased year-end consumption. CFO Rainy commented that the early demand for the holiday season is very strong, with robust spending particularly notable among high-income customers.

WMT breached above the ascending channel's upper bound and broke to a new high. Diverging bullish EMAs indicate a potential uptrend extension.

If WMT closes above the channel's upper bound, the price could advance toward the new high and psychological resistance at 111.50.

Conversely, if WMT breaks below the channel's upper bound and the support at 109.00, the price may retreat to the subsequent support at 106.00.

Walmart Inc. Expands to Africa With First South Africa StoreWalmart Inc. (NYSE: NYSE:WMT ) has officially opened its first store in South Africa, marking a major step in the retailer’s long-term international expansion strategy. The launch took place in Roodepoort, west of Johannesburg, and signals Walmart’s ambition to deepen its presence in emerging markets while strengthening its global retail influence.

The opening drew overwhelming demand. Hundreds of shoppers lined up for hours, eager to access Walmart’s signature “Everyday Low Prices” and international items not widely available locally—such as Drew Barrymore designer appliances, Labubu dolls, and Dr Pepper beverages. Some customers targeted Black Friday tech deals, highlighting strong consumer interest from day one.

Walmart will compete directly with established local players, particularly Shoprite’s Sixty60 delivery service. The company is rolling out its own 60-minute delivery option to match South Africa’s rapid-commerce expectations. Executives emphasized that Walmart’s entry represents a commitment to long-term value, access, and affordability for South African consumers.

Beyond retail expansion, Walmart is prioritizing community impact. The new store created 80 jobs and partnered with 15 local SMEs to support regional supply chains. This combination of global variety and local empowerment strengthens Walmart’s positioning in a competitive market.

From an investment perspective, Walmart continues to outperform major benchmarks. Its 3-year return of 117.20% and 5-year return of 125.45% surpass the S&P 500 by a wide margin—reflecting consistent investor confidence in the retailer’s disciplined strategy and operational strength.

Technical Outlook

WMT recently bounced from the $100 support level after retracing from $109. Buyers defended the zone strongly, and price is now pushing back toward the $109 resistance. A decisive breakout above $109 opens the path toward new highs, supported by strong fundamentals and global expansion momentum. Failure to reclaim the level may lead to another retest of $100, but the broader structure remains bullish.

WALMART can correct to $85.00 if this level breaks.Exactly 5 months ago (June 12, see chart below), we gave a strong buy signal on Walmart (WMT) right at the bottom of its trend, which eventually hit our $110 Target and then got rejected:

This time we move to the larger 1W time-frame as our former Target was eventually a new All Time High (ATH) almost at the top of the 13-year Channel Up. The price is hanging tightly now on the 1W MA50 (blue trend-line), which is where the previous correction (Feb-March 2025) found Support and rebounded.

With the 1M RSI printing a formation that previous delivered two technical pull-backs of -23.74%, we expect the stock to start correcting again if it closes below the 1W MA50. All previous breaks below it, eventually led to a 1W MA100 (green trend-line) test.

If that takes place, we expect Walmart to hit at least $85.00 inside 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Walmart (NYSE: $WMT) Bulls Eye a Reversal Near Key SupportWalmart’s stock is showing early signs of a potential rebound after testing a crucial support zone near the $100 level. This area has acted as both resistance and support in the past, making it a critical price floor for buyers. The chart displays a well-defined ascending trendline that has held since early 2025, signaling a long-term bullish structure.

Currently trading around $102, Walmart appears to be forming a higher low, which could serve as the base for a new bullish leg. This new leg may lead to a breakout toward $109 and possibly higher if volume confirms renewed buying pressure.

Fundamentally, Walmart continues to benefit from its dominant retail position and strategic investments in e-commerce and automation. The company’s ability to manage supply chains efficiently and maintain stable margins during inflationary periods has strengthened investor confidence. Additionally, its focus on expanding grocery delivery and membership programs has kept revenue growth steady even amid consumer spending shifts.

If the $100–$101 region continues to hold, technical traders may anticipate a bounce back toward the $108–$110 resistance zone. A clean break above that level could open the door for a move to new highs around $114. Conversely, a close below $98 would invalidate the bullish thesis and suggest further downside toward $94.

With strong fundamentals, consistent dividend growth, and a chart structure hinting at a technical reversal, Walmart’s setup appears attractive for medium- to long-term investors watching for confirmation of momentum.

Is Walmart Setting Up for a Bullish Momentum Shift?🛒 WMT: Walmart’s Wealth Heist Strategy 🚀 (Swing/Day Trade)

Asset: Walmart, Inc. (WMT)

Market: US Equities (not Forex, as WMT is a stock, not a currency pair! 😉)

Vibe: Bullish Breakout with a Thief Strategy twist! 🕵️♂️

📈 The Plan: Steal the Breakout! 💥

WMT is gearing up for a bullish breakout at $105.00!

🎯 For confirmation, we need a 4-hour candle close above the resistance level at $105.00 to lock in that buy signal. No sneaky moves before confirmation, or you’re gambling with your loot! 😎

🕵️♂️ Thief Strategy: Layered Limit Orders

This is where the Thief Strategy shines! 🌟 Instead of jumping in with one big order, we’re setting multiple buy limit orders to stack the deck in our favor:

$102.00

$103.00

$104.00

$105.00

$106.00

Pro Tip: Feel free to add more layers based on your risk appetite, but only place these limit orders after the breakout is confirmed (4H candle close above $105.00).

Setting layers blindly is like robbing a bank without a getaway car—risky business! 🚨

🛑 Stop Loss: Protect Your Stash

Set your stop loss at $101.00.

Note: Dear Thief OGs (Ladies & Gentlemen of the charts), this is my suggested SL, but it’s your heist, your rules! Adjust based on your risk tolerance. 💸

🎯 Take Profit: Cash Out Like a Pro

Our target is $112.00, where we expect strong resistance and potential overbought conditions. Watch out for a possible trap at this level—grab your profits and escape before the market pulls a fast one!

😈Note: This is my recommended TP, but you’re the boss of your trades. Take profits at your own discretion and keep the cash flowin’! 💰

🔗 Related Pairs to Watch (Correlations & Key Points)

Since WMT is a retail giant, its price action often correlates with consumer discretionary and retail sector stocks. Keep an eye on these related assets (all priced in USD):

NYSE:TGT (Target Corporation): Another retail titan. If WMT breaks out, TGT often follows the consumer spending vibe. 📊

NASDAQ:COST (Costco Wholesale): Big-box retail cousin. Strong correlation with WMT due to similar market dynamics. 🏬

AMEX:XRT (SPDR S&P Retail ETF): Tracks the broader retail sector. A bullish WMT could signal strength in XRT. 📈

Key Correlation Insight: WMT’s performance is tied to consumer confidence and economic data (e.g., retail sales, consumer price index). If these indicators are strong, expect WMT and related stocks to rally. Conversely, weak data could stall the breakout. Always check the economic calendar! 🗓️

📝 Final Notes for the Heist

Confirmation is King: Don’t set your layered limit orders until the 4H candle confirms the breakout above $105.00. Patience pays! ⏳

Risk Management: The Thief Strategy is slick, but don’t get greedy. Stick to your risk-reward ratio and protect your capital. 💼

Market Context: Watch for broader market sentiment (S&P 500, consumer sentiment reports) to support WMT’s bullish move. 🌍

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This Thief Style trading strategy is just for fun! Trade at your own risk and always do your own research. 😜

#Hashtags: #WMT #StockMarket #SwingTrading #DayTrading #ThiefStrategy #BullishBreakout #TechnicalAnalysis #TradingIdeas

PERFECT WALMART LONGNYSE:WMT has shown strength recently, and is now showing signs of an imminent breakout from its consolidation. The previous HTF break of structure at 104.76 is telling of upside potential. Couple this with its bullish consolidation within a downward channel over the last 3-4 weeks, where price has recently strongly rejected a HTF 0.5fib retracement and the daily 50ema.

Above you can see the major Bollinger band constriction on the daily chart, indicating a very large move in price is getting ready to take place. With the confluence of all these technicals I am willing to say the move will be up. I am targeting a 1.618 fib extension which aligns exactly with a price of 110.

The 4hr timeframe above shows rejection of 50ema and an inside pin, all bullish.

Coupled with the 1hr timeframe below showing a break of structure to the upside with a clean rejection of both 50 and 100 ema. We can enter long on the LTF.

Walmart: On Track for Further DeclinesWalmart shares have recently continued their planned sell-off, further extending magenta wave (C). Although the stock has traded in a narrow sideways range since last Wednesday, a further decline appears likely in the near term. The downward move is expected to bottom out at the low of green wave , within the corresponding Target Zone between $80.18 and $72.42. There is still a 39% chance of a short-term breakout above resistance at $105.68, which would mark a new corrective high.

WMT - Walmart turns southI attached the A-Handle of the fork to the GAP from November 2025, because a GAP is also a Pivot.

As we see, price reacts not bad at the Centerline.

Price failed to make a new high.

Then it broke the Centerline and retested it.

No we are trading in the midst of the old accummulation zone where Buyers hung out.

A nice bounce would be a good short opportunity.

Breaking the support zone also, but with lower Risk/Reward ratio.

Observing WMT for a potential short.

Walmart Earnings Play: Cheap Calls Into Earnings

## 🚀 Walmart Earnings Play: Cheap Calls Into Earnings (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.5% TTM (stagnant but stable)

* ⚖️ **Margins:** Thin → Profit Margin 2.7%, Operating Margin 4.3%

* 🏷️ **Analyst Sentiment:** Still *Strong Buy*, but guidance slippage = caution

* 🛡️ **Defensive Sector:** WMT benefits from consumer staples resilience

---

### 🔎 Options Flow Insight

* 📉 **Put Activity:** Heavy flow at \$97.00 strike = hedging/defensive tone

* ⚠️ **Put/Call Skew:** Bearish leaning, but IV rising ahead of earnings

* 📈 **Opportunity:** Leverage upside surprise with cheap calls

---

### 📉 Technical Setup

* 📊 Trading **below 20D & 50D MAs** (neutral → bearish drift)

* 🔑 **Key Levels:** Support \$97, Resistance \$105

* 💥 Volume spike: 2.48x avg (earnings speculation)

---

### 🎯 Trade Setup (Earnings Play)

* 🟢 **Direction:** CALL (Bullish Bias)

* 🎯 **Strike:** \$102.00

* 💵 **Entry Price:** \$0.04

* 📅 **Expiry:** Aug 22, 2025

* 📊 **Size:** 2 contracts

* 🕒 **Entry Timing:** Pre-earnings close

📌 **Profit Target:** \$0.08 (200% 🚀)

📌 **Stop Loss:** \$0.02 (50% risk cap)

📌 **Exit Rule:** Within 2 hours of earnings OR market open to avoid decay

---

🔥 Hashtags for Reach 🔥

\#WMTEarnings #OptionsTrading #EarningsPlay #TradingSetup #SP500 #OptionsFlow #StockMarket #DayTrading #SwingTrading

My 5% upside for WalmartMy 5% upside for Walmart.

There is a likely chance that WMT may push up from this psychological $100 zone. If this happens, we may see a 5% upside as shown on my chart with a risk-reward ratio of 1:2.1.

If it, however, drops further to the trend line, I will buy more using DCA and aim for 7% TP.

Trade with care

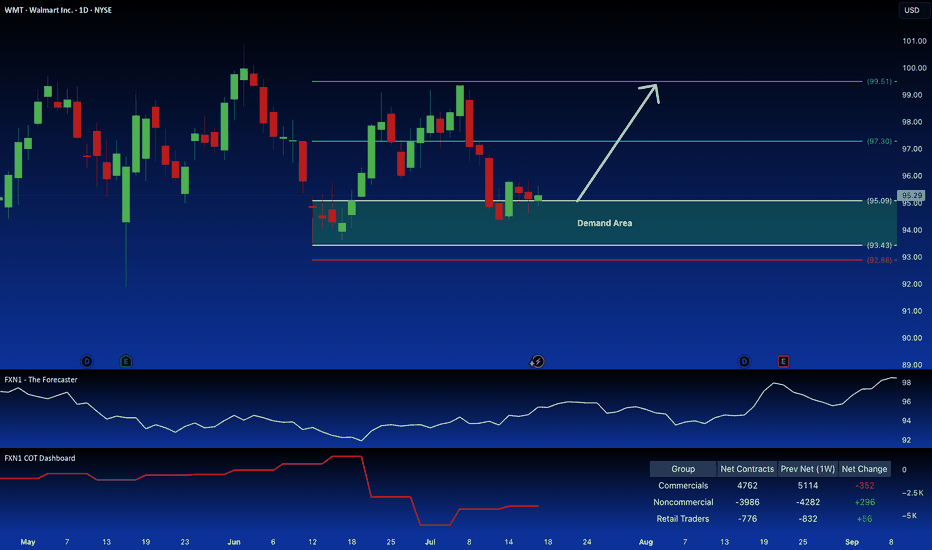

Walmart: Long Position Attractive on Demand ZoneWalmart Inc. presents a compelling long opportunity. The price action is reclaiming a key demand zone, suggesting a continuation of the current uptrend, a pattern reinforced by seasonal factors. Further bolstering the bullish case is the observed increase in large speculator positions.

✅ Please share your thoughts about WMT in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

WALMART testing its 1D MA50! Will it bounce?Walmart (WMT) hit yesterday its 1D MA50 (blue trend-line) for the first time since April 21. It appears that the rebound from the Trade War Low has turned sideways on a Double Top formation and the 1D MA50 is the first Support to be tested, with the 1D MA200 (orange trend-line) following.

This pattern resembles the August - September 2022 Bull Flag, which despite breaking below its 1D MA50, it resumed the uptrend shortly after and hit the 1.382 Fibonacci extension before the next 1D MA50 pull-back.

As a result, we expect the stock to reach $110.00 (Fib 1.382) by the end of the Summer.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WMT: Walmart stock under pressure from tariffs.

It seems that Trump's tariffs are not very favorable for Walmart’s long-term outlook.

However, from a technical perspective, the stock is currently in a good position, and its short-term EPS forecasts are improving day by day.

I don’t recommend buying Walmart for the long term, but there might be a good buying opportunity next week.

Walmart Head & Shoulders on Daily and Weekly chartWalmart (WMT) may be forming, or already has formed, a bearish Head & Shoulders pattern.

#WMT #Walmart #bearish #short #headandshoulders #retail #discountstore

Analysing the Spike in Volatility on the Walmart (WMT) ChartAnalysing the Spike in Volatility on the Walmart (WMT) Share Price Chart

On Thursday, the US retail giant reported its quarterly results — which turned out to be broadly better than expected. While total revenue was roughly in line with analysts’ forecasts, earnings per share came in higher at $0.61 versus the expected $0.57.

At the same time, Walmart CEO Doug McMillon stated on Thursday:

"We will do everything we can to keep our prices as low as possible. But given the scale of the tariffs, even at reduced levels, we won't be able to absorb all the pressure, considering the reality of tight retail margins."

This statement may have raised concerns among market participants about the company’s future earnings, contributing to Friday’s drop in the share price to $92.

It also drew the attention of the US President. On Saturday, Donald Trump said that Walmart (WMT) should “swallow the tariffs” instead of blaming them and raising prices.

In response, Walmart reiterated that it will keep prices as low as possible for as long as it can — which has always been the company’s approach.

Technical Analysis of the WMT Stock Price Chart

Looking at the broader market context, we can see that price fluctuations formed a narrowing triangle in late April — a sign that buyers and sellers had reached some agreement around a fair value of approximately $95.50.

In early May, sentiment shifted in favour of the bulls, with this level acting as support (marked by an arrow).

The earnings release triggered a spike in volatility — the ATR indicator is now at a one-month high. The Walmart stock price extremes seen at the end of last week suggest two key levels, roughly equidistant from the $95.50 axis:

→ resistance around $99 (reinforced by the psychological level of $100);

→ support around $92.

Given the above, it is reasonable to suggest that once the market has digested the news, price movements may calm down again. In that case, we may well see another narrowing triangle form on the WMT chart — slightly above the previous one.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Quantum's Walmart (WMT) Trading Guide 4/28/25WMT’s weekly outlook balances its defensive resilience against macroeconomic headwinds, with a comprehensive synthesis of technical, market, and strategic factors guiding its trajectory for weekly options contracts. The FAME framework underscores WMT’s long-term bullish potential, driven by robust fundamentals (+5% revenue, $0.58 EPS, 21% e-commerce growth) and adaptability (AI, Walmart+), positioning it as a resilient player in a risk-off regime. However, elevated yields (10-year 4.255%, 20-year 4.738%, 30-year 4.721%) and a stable DXY at 99.58 amplify tariff pressures and margin concerns, capping upside and reinforcing a cautious stance. A tactical long bias is favored for weekly contracts, targeting a bounce from $94.36 to $96.47–$98.50, with a short stance viable below $88.50 if support fails.

Technical implications highlight bullish momentum on daily (RSI ~40, Stochastic ~28) and weekly (RSI ~44, Stochastic ~32) timeframes, with oversold conditions signaling a rebound potential for weekly contracts if $94.36 holds. Monthly neutral momentum (RSI ~50) suggests consolidation, requiring a breakout above $96.47 to confirm bullish strength. This supports a short-term bounce but advises monitoring for sustained moves.

Market influence implications reflect a risk-off environment, with high yields and a stable DXY increasing import costs, particularly amid tariff uncertainty from WMT’s upcoming Trump meeting. The VIX at 24.84 amplifies volatility, favoring WMT’s defensive appeal but heightening risks. WMT’s Q3 FY25 strength and e-commerce growth provide stability, supporting resilience near $94.36.

OFD summary and implications reveal bearish pressure from Vanna (-$0.04), Charm (-$0.02), and DEX (-$0.06), driven by put-heavy flow and hedging demand tied to tariff fears. However, GEX (+$0.08) at the $95 strike pins price, stabilizing volatility and supporting a neutral-to-bullish bounce for weekly contracts if $94.36 holds, aligning with oversold technicals.

Edge insights bolster the case for a bounce, with institutional buying at $94–$95 signaling accumulation, defensive retail sector strength outperforming cyclicals, and low short interest (1.4%) offering squeeze potential above $96.47. These factors enhance confidence in a tactical long bias for weekly contracts, provided support holds.

Strategic outlook implications emphasize consolidation near $95.09, with $94.36 as a critical pivot. A break below risks $88.50, driven by tariff fears and bearish options flow, while a move above $96.47 targets $98.50, fueled by oversold signals and institutional support. The VIX at 24.84 and put-heavy options flow underscore volatility, but WMT’s defensive positioning mitigates downside, favoring a bounce in a risk-off regime.

In summary, WMT’s weekly outlook hinges on defending $94.36, with oversold technicals, GEX pinning, and institutional buying supporting a bounce to $96.47–$98.50 for weekly contracts. Tariff risks, high yields, and DXY stability maintain a risk-off backdrop, capping upside and requiring vigilance for a break below support, which could shift bias to bearish. This balanced approach leverages WMT’s defensive strengths while navigating weekly volatility, aligning with Buffett’s preference for resilient businesses with tactical opportunities.

Walmart (WMT) shares reach highest level since early MarchWalmart (WMT) shares reach highest level since early March

As shown on the chart of Walmart (WMT) shares, trading closed yesterday above the $94 mark – a level not seen since the beginning of March. This means that since the start of 2025, Walmart’s share price has risen by approximately 5.5%.

This positive trend stands in stark contrast to the S&P 500 index (US SPX 500 mini on FXOpen), which has declined by more than 8% over the same period.

Why are Walmart (WMT) shares outperforming the index?

Apparently, from the market’s point of view, this is due to the fact that Walmart’s supermarkets are a source of essential goods for Americans, giving the company an advantage in a scenario where the US economy may slide into recession.

According to Mizuho Bank analyst David Bellinger, Walmart is a sensible choice for investors trying to stay afloat in a volatile market. He forecasts that WMT’s share price could rise to $105 – around 15% higher than its current level.

Bellinger notes that Walmart continues to attract price-conscious shoppers and has made significant progress in e-commerce, helping the company remain resilient even amid the prospect of economic slowdown.

Technical analysis of Walmart (WMT) shares

The chart shows that the share price is moving within a long-term upward trend. The black dashed line, which had acted as support for many months, has been broken:

- This suggests that the line may now act as a median.

- Allowed us to widen the channel and find its lower boundary, which is expected to offer support.

Indeed, the lower boundary of the expanded channel provided support in the first half of April, with particular attention drawn to the large bullish candlestick on 9 April (marked with an arrow). According to the NYSE, over 46 million shares were traded on that day – more than twice the average volume. This highlights the strength of demand.

It is possible that WMT shares may continue to outperform the index going forward, forming fluctuations while:

- receiving support from the psychological $90 level (previously a resistance point);

- gradually approaching the median of the aforementioned channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Walmart Holds Strong and Ends the Week Up More Than 15%Shares of retail giant Walmart have risen more than 15% over the past five trading sessions, despite growing tensions over reciprocal tariffs between China and the United States. The bullish bias has remained intact, primarily because the company stated this week that it is prepared for scenarios with tariffs of up to 125% on Chinese imports and is currently negotiating with suppliers to secure better pricing in the coming weeks. This has helped preserve investor confidence and positioned Walmart as one of the few stocks that has withstood the volatility of the renewed trade war.

Building Bullish Momentum

This week’s price action showed a sustained upward bias, suggesting the beginning of a new short-term bullish trend. However, Walmart's stock still faces resistance from a key Fibonacci retracement level, which it must overcome to confirm a strong buying momentum and possibly maintain a bullish trend in the coming weeks.

MACD Indicator

The MACD currently favors the bulls, as the histogram has expanded significantly, reinforcing the upward momentum above the zero line in the short term. As long as no divergence emerges between price action and the MACD, there’s little room for meaningful selling corrections in the immediate sessions.

ADX Indicator

The ADX line is beginning to show some indecision, as it gradually descends toward the neutral 20 level, just as the price approaches key resistance zones. If this downward trend continues, the market could shift into a more neutral phase. However, for now, the indicator still supports the idea that the recent upward moves reflect a solid directional bias.

Key Levels to Watch:

$95: Likely the most important nearby resistance, aligning with the 61.8% Fibonacci retracement level. A decisive move above this area could open the door to a stronger bullish phase.

$104: A long-term resistance, representing the recent highs reached in the past few months. A return to this level could revive the broader bullish trend that had been dominant in the past months.

$85: A key support level, aligned with the 200-period moving average. If price retraces back to this level, it could reactivate the bearish bias seen in previous weeks.

By Julian Pineda, CFA – Market Analyst