WAVES Technical Outlook

📊 Technical View – WAVES

Price is at an important horizontal support, showing a rebound attempt. The same zone is also supported by a rising trendline and aligns with the Fibonacci Golden Zone, creating a strong confluence area 🔁✨

🔹 Trade Idea

Entry: CMP 13.37

Stop Loss: 12.60 🛑

🎯 Upside Targets

14.30

14.85

15.38

16.00 (Breakout Zone) 🚀

The trend will maintain a bullish bias as long as the price holds above the support zone 📈.

A volume expansion breakout can accelerate upside momentum.

⚠️ Strict SL discipline is essential.

Waves

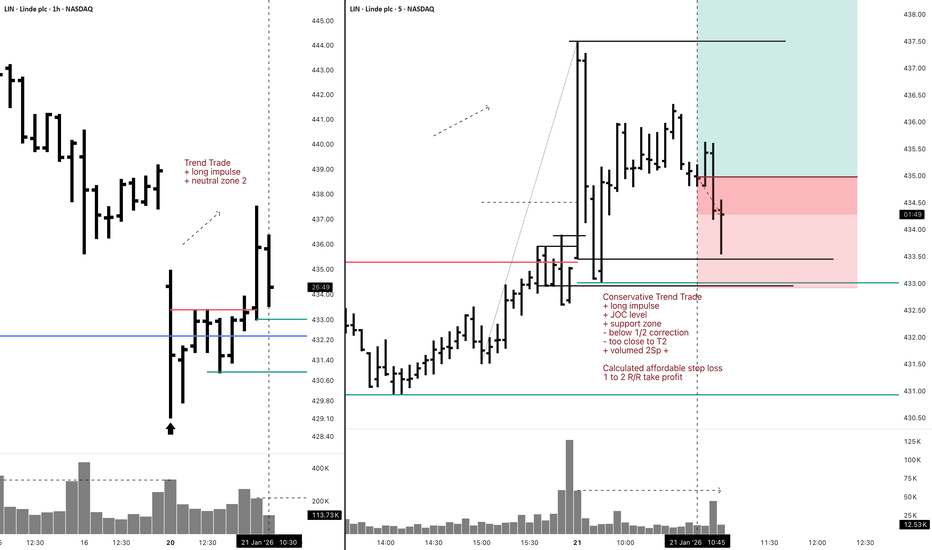

LIN 5M Long Conservative ConterTrend TradeConservative Trend Trade

+ long impulse

+ JOC level

+ support zone

- below 1/2 correction

- too close to T2

+ volumed 2Sp +

Calculated affordable stop loss

1 to 2 R/R take profit

1H Trend

"+ long impulse

+ neutral zone 2"

1D Trend

"+ long impulse

- SOS above JOC

+ support zone

- above 1/2 correction

- unvolumed manipulation bar"

1M Trend

"+ long balance

- below 1/2 correction

+ expanding ICE

+ biggest volume 2Sp+

- neutral zone 1"

1Y Trend

"+ long impulse

+ neutral zone 2

- far beyond rotation point

? exhaustion volume"

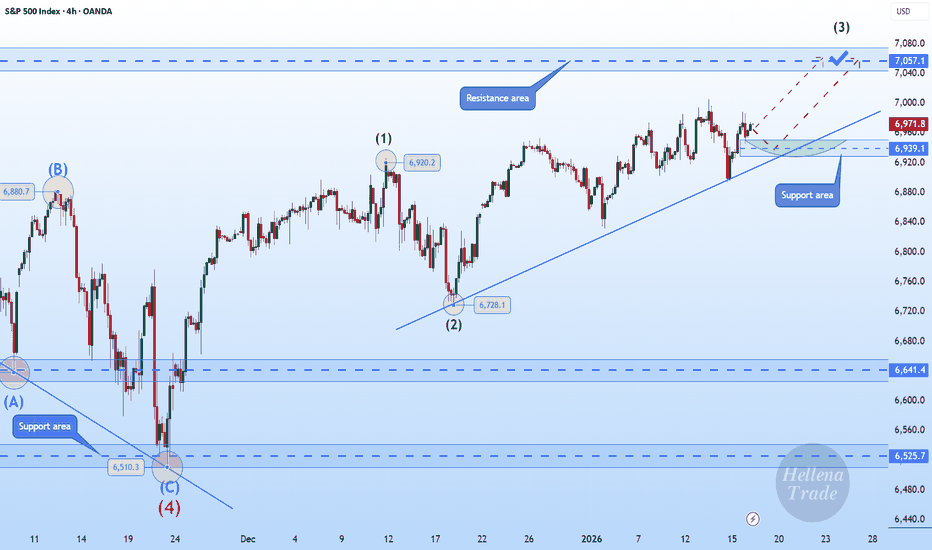

Hellena | SPX500 (4H): LONG to resistance area of 7050.Colleagues, the upward movement is not yet complete and remains a priority, but there is one caveat. The completion of the medium-term wave “1” (blue) is quite difficult to predict, as the junior wave ‘3’ may turn out to be wave “5”, since the structure resembles an initial diagonal. However, this does not negate the plan to continue the upward movement, even if there is a deep correction.

At the moment, I expect the resistance area of 7050 to be reached, as I would prefer to give a forecast for the nearest levels now.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

KHC Short 5M Aggressive Trend DayTradeAggressive Trend Trade

- long impulse

- unvolumed T1

+ resistance zone

+ biggest volume 2Ut+

+ weak test

+ first bearish bar closed entry

Calculated affordable virtual stop loss

Bought puts

1 to 2 R/R take profit

1H Trend

"+ short impulse

+ BUI level

+ resistance zone

+ 1/2 correction

- strong approach"

1D Trend

"+ short impulse

+ BUI test / T2 level

+ resistance zone

+ volumed 2Ut+"

1M Trend

"+ short impulse

= neutral zone 2"

1Y

Trend

no context

MDLZ Swing Long 1H Aggressive TradeAggressive Trade

- short impulse

+ exhaustion volume T1

+ support level

+ exhaustion volume 2Sp+

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

1D CounterTrend

"- short impulse

+ volumed TE/T1

+ support level

- below volume buildup

+ reverse volume weak approach

+ exhaustion volume Sp"

1M CounterTrend

"- short impulse

+ exhaustion volume TE/T1

+ support level

+ weak approach

+ exhaustion volume manipulation bar without result"

1Y Trend

"+ long impulse

+ 1/2 correction

- SOS above JOC level

+ support level

- ultravolumed manipulation bar"

AAPL Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ support level

+ volumed 2Sp+

? technical volume

Calculated affordable stop market

1 to 2 R/R take profit within 1D range

Monthly Trend

"+ long impulse

+ neutral zone 2

+ long volume distribution"

Yearly Trend

+ long impulse

+ neutral zone 2

- beyond rotation point

+ long volume distribution

TROW Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

Calculated affordable virtual stop limit

1 to 2 R/R take profit

- outside 1D

+ inside 1M

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

" '+ long impulse

+ T2 level

+ support zone

- deep correction

+ volumed interacting bar"

Long 1H Swing Conservative TradeConservative Trade

+ long balance

+ 1/2 correction

+ ICE level

+ supporting zone

+ biggest volume old spread Sp

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1H range

+ within 1D main and perforated ranges

Daily Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

? weak test"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

Long 1H Swing TROW Conservative TradeConservative Trade

+ long balance

+ 1/2 correction

+ ICE level

+ supporting zone

+ biggest volume old spread Sp

? weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1H range

+ within 1D main range

Daily Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

? weak test"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

Long 1D Investment TROW Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1D range

+ inside 1M range

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

Gold Is Not Done Yet — H1 Structure Is Rebuilding for a BreakoutHello everyone,

Intraday trading: Increase

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 4463 - 4466

💰 Take Profit(TP): 4460 - 4455

❎ Stoploss(SL): 4470

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4263 - 4266

💰 Take Profit(TP): 4269 - 4274

❎ Stoploss(SL): 4259

Note capital management to ensure account safety

On the H1 timeframe, the key focus right now is not the prior sell-off, but how gold is rebuilding structure after completing a full corrective cycle and reclaiming key dynamic levels. The chart clearly shows a transition from impulsive downside into controlled recovery and re-accumulation.

After the breakdown from the rising channel, gold completed a five-wave bearish impulse into the 4,265–4,280 support zone, where selling pressure was finally absorbed. This marked a structural low, followed by a clean shift in behavior: price stopped expanding lower and began forming higher lows, signaling the end of the markdown phase.

From there, gold entered a corrective bullish sequence, respecting the short-term ascending support trendline. Price has now reclaimed EMA34 and is pressing into the EMA89, which currently aligns with the 4,380–4,400 resistance zone. This confluence makes the current area a decision zone, not a random pause.

Structurally, this move fits a classic ABC recovery:

(A) rebound from the lows

(B) higher-low pullback, holding above support

(C) current push into resistance and EMA confluence

Importantly, this advance has been orderly, not vertical. Pullbacks are shallow, momentum is controlled, and price is holding above prior reaction highs — all characteristics of strength rebuilding, not distribution.

Key levels to watch:

Immediate resistance: 4,380–4,400 (EMA89 + prior support turned resistance)

Bullish confirmation: Acceptance above 4,405–4,420 would open the door for a continuation move toward 4,515–4,520, as projected on the chart

Key support: 4,350–4,365 (trendline + EMA34 area)

Invalidation: A clean breakdown below 4,330 would weaken the bullish recovery structure

Until proven otherwise, gold is not in a bearish continuation phase. It is transitioning from correction into potential expansion, with the next directional clue coming from how price behaves at the current resistance cluster.

Wishing you all effective and disciplined trading.

AAPL 1H Long Swing Conservative TradeConservative Trade

+ long balance

+weak approach

+ 1/2 correction

+ SOS test / ICE level

+ support zone

+ biggest volume 2Sp=

Calculated affordable stop market

1 to 2 R/R take profit

1D Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ support level

+ volumed 2Sp+

? technical volume

+ weak test"

1M Trend

"+ long impulse

+ neutral zone 2

+ long volume distribution

+ before rotation point"

1Y Trend

"+ long impulse

+ neutral zone 2

- beyond rotation point

+ long volume distribution"

NZDUSD — Correction Invalidated, Execution From the A–B BreakerPrice is trading inside a higher-timeframe BC , where the first failure already occurred.

The base breaker formed when continuation buyers expected the uptrend to resume, but MSS invalidated that assumption , trapping early continuation attempts.

At that stage, there was no sequence yet — only uncertainty.

Only after that failure did a valid ABC structure develop.

Wave A proposed direction

Wave B formed as a correction, where buyers entered expecting B to hold

Wave C began at the end of B and structurally invalidated B , proving the correction was finished

The continuation breaker is defined as the entire zone between the end of A and the end of B , where correction buyers built exposure.

For execution, I drop to lower timeframes and isolate the last breaker inside the A–B zone before Wave C flipped the scenario .

That breaker represents the final correction belief — and therefore the highest-probability entry location .

Price is expected to return to this area to:

remove correction buyers

sweep inducement

rebalance risk

That liquidity is the fuel for Wave C continuation toward its target .

If price does not return to the A–B zone, there is no trade .

If correction is not structurally invalidated, there is no participation .

I don’t trade direction —

I trade when correction proves it’s finished .

“ I participate only after correction fails — not before, not without proof. ”

Not financial advice.

Gold (4H) — Supply is holding… for nowContext

On the left of the chart, Gold reached the higher-timeframe C target .

That was a valid place for sellers to take control — and they didn’t.

Price absorbed selling pressure and kept moving.

Now we’re at a different level.

The red zone is the all-time-high supply.

Sellers are active here. Price is being held.

That part matters and shouldn’t be ignored.

What formed under supply

Instead of a dump, price built structure:

A clear base

Liquidity sweep

MSS

A fresh ABC sequence

B held.

B broke A.

That tells me buyers are still participating, even with supply overhead.

Expectation

I’m not expecting an immediate breakout.

What makes sense here is a pullback first.

A revisit into the continuation breaker , clearing inducement and resetting positioning.

If that zone holds and price flips back up, then a break of supply opens the path toward C .

If the structure fails, I step aside.

No forcing it.

Watching how price behaves — not guessing the outcome.

SmellyTaz — decoding chaos.

Not financial advice. Shared for educational purposes only.

AUDUSD — Counter-Trend ABC Breathing Inside a Bearish HTF WCLPrice is currently trading inside a fresh bearish higher-timeframe WCL , so any upside here is treated as corrective, not a trend flip.

Within that context, a clean bullish ABC has formed.

B held structurally, displacement followed, and the move left behind a breaker block + FVG , which defines my area of interest.

The idea is simple:

If price revisits this zone and respects it, the path of least resistance is a continuation of the correction toward the ABC C-target , before deeper HTF supply comes into play.

Invalidation is clear.

A break below B kills the sequence entirely.

This is a location-first setup —not a prediction, not a signal.

Always wait for confirmation and trade in alignment with higher-timeframe context.

Not financial advice.

GBPAUD — BC Entry Inside Weekly WCL, Invalidation Below BPrice is trading inside a Weekly WCL after a weekly bearish ABC sequence completed . At that point, momentum fades and location takes control .

Within this context, a bullish ABC formed, and price retraced into the BC / order-block zone .

Entry is mechanical, with invalidation below B , the sequence failure point.

Expectation is simple:

B holds → rotation higher toward the bullish ABC target

B breaks → idea invalidated

Note : when time allows, always wait for confirmation inside the level (sweep, displacement, CISD, etc.).

Structure over prediction.

— SmellyTaz

Disclaimer : This is not financial advice.

EURUSD — One Turnpoint, Two OutcomesThis Daily chart reduces the entire narrative to one decisive level .

We had a completed bearish ABC sequence , with price reaching its C target and establishing a fresh bearish WCL . As price entered that terminal zone, a new bullish ABC sequence began forming — a classic SK transition from momentum to location.

What matters now is not the past sequences, but the bullish WCL .

That bullish WCL is the turnpoint .

From an SK perspective, this level is binary:

If the bullish WCL is respected , price should rotate higher and retest the bullish ABC objective

If the bullish WCL fails , the bullish sequence is invalidated, and price should rotate lower to retest the bearish ABC objective

There is no prediction here and no bias without confirmation.

The market has compressed into a decision point where one level defines two paths .

Breaker structure still frames the area, but the WCL is doing the heavy lifting.

Everything else is context.

This is not about direction — it’s about who controls the turnpoint .

— SmellyTaz

Decoding chaos .

Disclaimer : This is not financial advice.

EURUSD: Wave Structure Education - Understanding Wave CountsEducational breakdown of wave structure counting using current EURUSD as a live example.

📚 WAVE STRUCTURE FUNDAMENTALS

Understanding wave counts is essential for identifying high-probability setups. Let's break down the key concepts using EURUSD's current structure.

🌊 WAVE 1 - The Foundation

Most Important Aspect: Wave 1 has two variations

Variation 1 - ABC Pattern:

Wave 1 forms as a corrective ABC structure before the main trend establishes.

Variation 2 - Straight Away:

Bearish: Higher High (HH) directly to Lower Low (LL)

Bullish: Lower Low (LL) directly to Higher High (HH)

Why This Matters:

Identifying which Wave 1 variation you're seeing helps you understand the strength and nature of the trend forming.

📈 EXTENSION WAVES - The Power Moves

Bearish Extension Pattern:

The sequence for bearish extensions:

Lower High (LH)

Higher Low (HL)

Lower High (LH)

Lower Low (LL)

Bullish Extension Pattern:

The sequence for bullish extensions:

Higher Low (HL)

Lower High (LH)

Higher Low (HL)

Higher High (HH)

Key Principle:

Extensions follow a specific pattern. Recognizing these sequences allows you to anticipate the completion point and trade accordingly.

💼 CURRENT EURUSD WAVE COUNT

Position: Bearish Wave 2 Extension (3 of 5)

What This Means:

We're in Wave 2 of the larger structure

Wave 2 is extending (showing the extension pattern)

Currently at position 3 within the 5-wave extension sequence

More downside expected to complete the extension

Trading Application:

Understanding we're in position 3 of 5 tells us:

Two more wave points to complete (4 and 5)

Wave 4 will be a pullback (selling opportunity)

Wave 5 will be the final leg down in this extension

🎓 Educational Takeaways:

1. Wave 1 Sets The Stage:

Always identify which Wave 1 variation you're seeing. ABC or Straight Away? This determines your initial bias.

2. Extensions Follow Patterns:

Both bullish and bearish extensions have specific sequences. Learn to recognize them.

3. Count = Roadmap:

When you know where you are in the wave count (like "3 of 5"), you know what's coming next.

4. Practice Required:

Wave counting takes time to master. Watch price action create these patterns repeatedly until recognition becomes second nature.

Summary:

Wave 1 has two variations: ABC or Straight Away (HH→LL / LL→HH)

Extensions follow patterns: Specific sequences for bullish/bearish

Current EURUSD: Bearish Wave 2 Extension, position 3 of 5

Next: Expect Wave 4 pullback, then Wave 5 completion

👍 Boost if you found this educational

👤 Follow for more wave structure lessons

💬 Questions? Drop them in comments

Hellena | GBP/USD (4H): LONG to resistance area of 1.34683.Colleagues, the upward movement is actively developing, and I see a medium-term upward impulse (12345) developing in the higher wave “1” (red).

At this stage, I see:

1) the possibility of a correction in wave “4” in the area of 1.32440, then reaching the resistance area of 1.34683.

2) the extension of wave “3” directly to the area of 1.34683. Such scenarios often occur in impulses.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

XAU/USD Elliott Wave Analysis: Potential Bearish Reversal OANDA:XAUUSD PEPPERSTONE:XAUUSD ICMARKETS:XAUUSD

The chart suggests that Gold Spot/U.S. Dollar (XAU/USD) has completed a major correction pattern and is now on the verge of a significant downward move.

Major Correction (A) ➡️ (B):

The price action from the major peak appears to be forming a complex correction, with the current phase completing the major (B) wave.

The sharp drop to the low around November 1st is labeled as a major (A) wave.

The subsequent rally is labeled as the major (B) wave, which is currently subdividing.

Subdivision of Wave (B): The corrective rally (B) is showing signs of completion as a smaller ABC pattern:

o Wave A (of B): A strong 5-wave impulse (labeled 1-2-3-4-5) completed in mid-November.

o Wave B (of B): A correction followed this high.

o Wave C (of B): The current rally is the final leg, Wave C (of B), aiming for the final target.

• Critical Reversal Target for (B) Wave: The chart anticipates the completion of the final Wave C (of B) at a specific price point, coinciding with a key Fibonacci level and trendline resistance:

61.80% Fibonacci Retracement at $4,313.88

This $4,313 zone is the high-probability reversal point before the major downside move begins.

📈 Technical Levels and Trendlines

Major Resistance (The Reversal Zone):

Upper Red Trendline: This descending trendline connects the initial peak with the top of the internal Wave (B), serving as strong dynamic resistance.

Key Price Target: The $4,313.88 level is the projected apex of the rally.

Understood. Here is the full analysis and titles for your post, presented in English, as requested.

📉 XAU/USD Elliott Wave Analysis: Potential Bearish Reversal from $4,313

🌊 Wave Count Interpretation (Elliott Wave)

The chart suggests that Gold Spot/U.S. Dollar (XAU/USD) has completed a major correction pattern and is now on the verge of a significant downward move.

Major Correction (A) ➡️ (B): The price action from the major peak appears to be forming a complex correction, with the current phase completing the major (B) wave.

The sharp drop to the low around November 1st is labeled as a major (A) wave.

The subsequent rally is labeled as the major (B) wave, which is currently subdividing.

Subdivision of Wave (B): The corrective rally (B) is showing signs of completion as a smaller ABC pattern:

Wave A (of B): A strong 5-wave impulse (labeled 1-2-3-4-5) completed in mid-November.

Wave B (of B): A correction followed this high.

Wave C (of B): The current rally is the final leg, Wave C (of B), aiming for the final target.

Critical Reversal Target for (B) Wave: The chart anticipates the completion of the final Wave C (of B) at a specific price point, coinciding with a key Fibonacci level and trendline resistance:

61.80% Fibonacci Retracement at $4,313.88

This $4,313 zone is the high-probability reversal point before the major downside move begins.

📈 Technical Levels and Trendlines

Major Resistance (The Reversal Zone):

Upper Red Trendline: This descending trendline connects the initial peak with the top of the internal Wave (B), serving as strong dynamic resistance.

Key Price Target: The $4,313.88 level is the projected apex of the rally.

Major Support (The Target Zone):

Lower Green Trendline: This ascending trendline connects the key lows and represents the potential final target for the upcoming decline.

Target Price Zone: The final target for the major (C) wave is indicated near the $3,826.25 level.

🎯 Trading Strategy Implication

Imminent Move: The price is completing the final internal wave towards the $4,313.88 reversal zone.

Short Entry: The ideal short-entry zone is near the $4,313.88 level, with a tight stop-loss placed just above the upper red trendline to manage risk.

Profit Target: The anticipated sharp decline, labeled as the massive (C) wave, targets the lower green trendline around $3,826.25, offering a substantial risk/reward opportunity.

Disclaimer:

This analysis is for educational purposes only and is based on Elliott Wave Theory and technical indicators. It is not financial advice. Trading foreign exchange, cryptocurrencies, and commodity futures involves significant risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Always do your own research

EURUSD Shot Position1) Short-Term Price Action (1H Chart)

EUR/USD FX:EURUSD has strongly broken out of its channel on the 1-hour timeframe and is now trading within the extended channel toward the gap zone.

2) Gap Zone & Key Levels

The gap zone aligns with the 50% level of the larger 4-hour channel.

This zone presents a high potential for price to reverse downward.

3) Reversal & Resistance Zones

The main reversal area could be the resistance zone, especially where it coincides with a strong supply zone.

Both the resistance and supply zones are key levels for potential selling opportunities.

4) Demand Zone & Short-Term Reaction

If price declines, it is likely to reach at least the demand zone, which may trigger a short-term bullish reaction.

5) Risk Disclaimer

This analysis reflects my personal view.

Always trade based on your own strategy and trading system, and strictly follow risk and money management rules.

I’d be happy if you follow me to catch all my market analyses and live stock trades in real time.

Gold - Counting the WavesThe gold chart is highly technical, and its structure can be broken down into both smaller and larger wave formations.

Since late October 2022, gold has completed a classic five-wave advance.

Looking ahead, this is not the full extent of the long-term move — gold still has room to grow.

However, before that, the market needs to correct the upward structure that has already been formed.

First, we need to correct the fifth wave. This process has already begun, and price should dip once more below the 3,900 level.

After that, the entire five-wave structure will also require a broader correction

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---