WIFUSDT - Up first, then gravity does its jobAlright, hear me out before you ape in.

So far, I’ve lined up 4 trades that all follow the same classic crypto ritual:

👉 grab liquidity → fake everyone out → nuke the opposite direction.

Now, yes, we might get a market-wide pump this week…

or it could just be another episode of “Crypto: Market Manipulation – Season 47”. We’ll find out soon 🍿

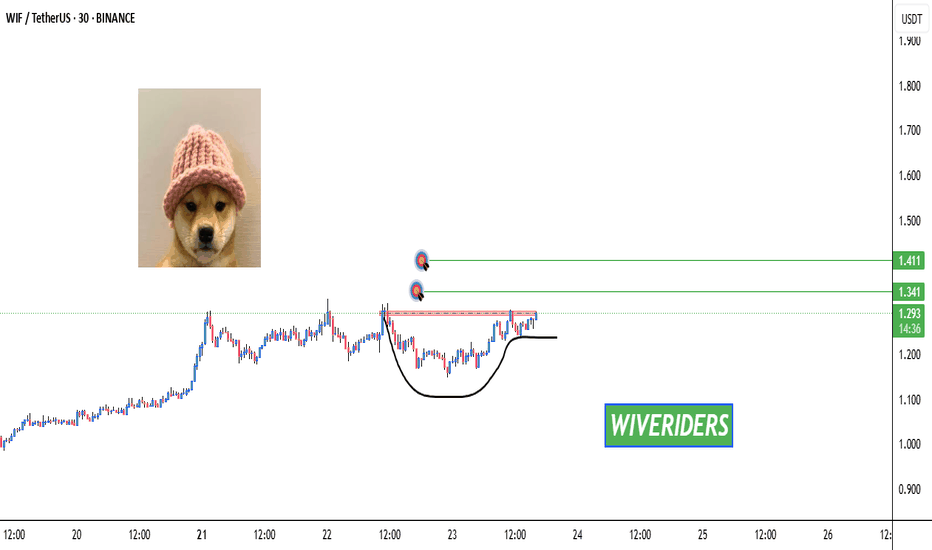

First on today’s menu: WIF 🐶

Here’s what’s cooking:

• There’s a HIGH above price that still hasn’t been taken (liquidity is screaming “come get me”)

• A Fair Value Gap (FVG) sitting there, patiently waiting to be filled

• And, just to make it more obvious, clean resistance above us

So yeah, a move up makes total sense before anything ugly happens.

Take Profit?

Depends on how far the pump wants to flex. But if you zoom out to the DAILY timeframe, you’ll notice something important:

👉 We can actually go much, much lower.

So the plan is simple:

• Short-term pump to clean highs & fill inefficiencies

• Then… down only, as tradition demands 🧨

This setup actually makes sense — which in crypto usually means “let’s see how it tries to ruin us”.

Let’s watch it play out 👀📉

Wif

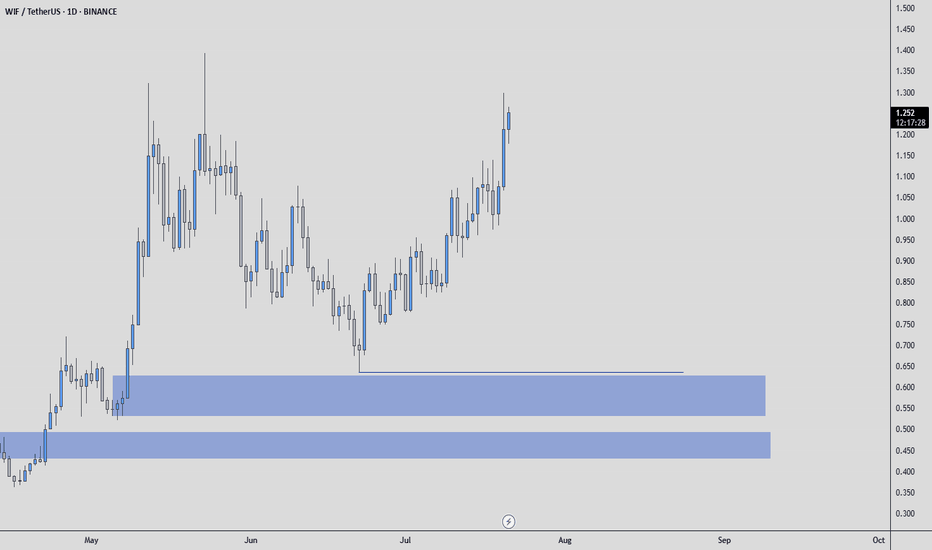

$WIF 1D Update: The pump is starting... SOL memes coming back? WIF is finally starting to show some strength on the daily. After a long period of basing and grinding near the lows, price is now pushing higher with an impulsive move rather than another weak bounce. That’s a meaningful change in character compared to what we’ve seen over the past few months.

This pump is coming after extended compression and seller exhaustion, which is typically where sharper relief moves can originate. The reclaim of the recent range highs suggests buyers are stepping in with more conviction, not just short covering.

That said, this is still early. One green candle doesn’t flip the higher timeframe trend by itself, but it does shift the short-term bias from purely defensive to cautiously constructive. If price can hold above this breakout area and avoid immediately retracing the move, it increases the odds that this is more than just a dead cat bounce.

Overall, WIF is looking better than it has in a while. I’m watching closely to see if this strength can build into follow-through and higher lows rather than fading back into the prior range.

1W WIF Chart: Potential bottom on WIF? I’m watching WIF cautiously on the weekly, but it’s now firmly on my radar for a potential bottoming process, along with other SOL ecosystem meme coins.

After a prolonged and aggressive downtrend from the highs, downside momentum has slowed materially. Price is no longer cascading lower and is instead compressing near the lows, which is often how these assets begin transitioning from distribution into early accumulation. This isn’t a reversal yet, but it is a change in behavior.

Structurally, WIF is spending time building value near the bottom of its range rather than bouncing and failing immediately. Volatility has contracted significantly compared to prior selloffs, and each push lower is attracting quicker responses from buyers, even if they’re still cautious.

I’m not assuming this is a bottom, but this is the zone where bottoms typically form if they’re going to form at all. The key for me will be time and confirmation: higher lows, reduced sell pressure, and eventually a reclaim of prior weekly resistance. Until then, patience is critical.

This same dynamic is starting to show up across several SOL meme names, which makes it worth monitoring as a group rather than in isolation. For now, this remains a watch-and-wait situation, with risk management front and center and no need to force exposure before the structure proves itself.

WIF/USDT at a Critical Line – Breakout or Another Sell-Off?On the 1D timeframe, WIF/USDT is still trading within a bearish market structure after a strong decline from previous highs. Price continues to form lower highs and lower lows, indicating sustained selling pressure. Currently, price is approaching a critical area near the main descending trendline.

---

Pattern & Technical Structure

The chart shows a clear Descending Trendline (Bearish Continuation Pattern):

The descending trendline acts as a dynamic resistance

Every bullish attempt has been rejected near this trendline

Volatility is decreasing, indicating price compression

This structure usually resolves with:

A bullish breakout if buyers manage to break the trendline

A bearish continuation if price gets rejected again

---

Key Levels

Resistance Zones:

0.370 → minor resistance / first reaction zone

0.440 → mid-term resistance & distribution area

0.540 → major resistance / bullish reversal confirmation

0.805 – 0.970 → strong supply zone (extended targets)

Support Zones:

0.327 → current daily support

0.280 → critical support level

0.240 – 0.205 → last demand zone (high-risk area)

---

Bullish Scenario

The bullish scenario becomes valid if:

Price breaks and closes above the descending trendline on a daily basis

A higher low forms after the breakout

Potential upside targets:

Initial target: 0.370

Next resistance: 0.440

Strong reversal confirmation: 0.540

With strong momentum, price may extend toward 0.805 – 0.970

Common strategy:

Buy on breakout or buy on trendline retest

Volume confirmation is highly recommended

---

Bearish Scenario

The bearish scenario remains dominant if:

Price fails to break the descending trendline

Strong rejection occurs at resistance

Downside potential:

Retest of 0.327

Breakdown opens the path toward 0.280

If support fails, price may continue to 0.240 – 0.205

This confirms ongoing bearish continuation.

---

Conclusion

WIF/USDT is currently trading at a decision zone. A confirmed breakout above the descending trendline could signal the start of a trend reversal, while rejection would increase the probability of further downside. Waiting for confirmation is crucial in this structure.

#WIF #WIFUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoin #BearishTrend #Trendline #Breakout #PriceAction #CryptoTrading

FireHoseReel | WIF at Decision Point Will 0.317 Hold or Collapse🔥 Welcome To FireHoseReel !

Let’s dive into Dogwifhat (WIF) analysis.

⛳️ WIF Fundamental Overview

Dogwifhat (WIF) is a Solana-based meme coin focused on community-driven trading and speculation. Ranked #121 on CoinMarketCap, it has ~998.8M supply and strong daily volume fueled by hype.

👀 WIF 4H Overview

WIF is currently experiencing a strong bearish trend on higher timeframes. On the 4H timeframe, price is moving inside a large range (box) and is now attempting to break down below the lower boundary of that range.

📊 Volume Analysis

During upward pullbacks, trading volume tends to decrease, while selling volume expands during bearish continuation. If the box support breaks, an increase in sell volume is expected to confirm the breakdown.

✍️ WIF Trading Scenarios

🟢 Long Scenario:

A breakout above the descending curve trendline, followed by a reaction toward the $0.361 resistance, accompanied by a strong surge in buying volume, could initiate a bullish leg relative to the recent decline.

🔴 Short Scenario:

A breakdown below the box structure and loss of the $0.317 support, confirmed by increasing sell volume, could provide a solid short opportunity.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

WIFUSDT: Bearish Continuation — Key Support Under ThreatPrice continues to move within a clear descending structure , respecting the long-term downtrend trendline . The marked blue zone represents a strong historical support, which has been holding price above a major downside area — essentially the last barrier before a deeper sell-off.

At the moment, this support is being tested again , and momentum remains bearish. A clean breakdown below this level would likely open the door for a strong continuation to the downside.

Bearish scenario:

Confirmed support break → acceleration lower

First target: 0.25 USD

Second target: 0.15 USD

If panic or high sell pressure enters the market, even lower levels are possible

As long as price stays below the descending trendline, the bias remains bearish . The blue zone is the key level to watch — once it fails, the market may enter a “free fall” phase.

WIFUSDT — Possible Move Down? (Send It or Send Me Home)Alright, I’m hopping into this one a bit late — fashionably late, like every great crypto entry.

BUT the good news?

Because of that, we’re looking at a juicy R:R over 7:1.

Yes, SEVEN.

If this hits, I’m buying myself something nice. If it doesn’t… well, that’s what stop-losses are for. 😅

It’s definitely a riskier setup, but WIF is showing potential for another leg down in the coming days.

With an R:R like this, I’m willing to risk it — responsibly, of course… kind of.

Good luck, legends — may your trades print and your emotions stay unleveraged. 📉🔥🐕💚

WIF/USDT - Fresh meme coin. Trading setup in chanal. Popular fresh meme coin – Dogwifhat

📊 CoinMarketCap Rank: #102

🐦 Twitter (X) : 152K followers

💬 Telegram : 50K members

✅ Highly liquid meme coin – traded on many major exchanges, including Binance.

After the hype phase , the coin is now declining along with the overall crypto market —no exceptions. Essentially, it broke below multiple channel supports , and the price is now sitting at the support of the outer channel.

I also notice a non-textbook Head & Shoulders pattern, which suggests a potential -64% breakdown . The last squeeze happened around this level.

Currently, we are seeing consolidation with increased volume , along with high-wick price action in this zone.

I've marked potential downside support zones as well as upside resistance targets on the chart. Consider this in your trading strategy!

WIF/USDT – Accumulation Phase Before Potential RecoveryWIF continues to consolidate after an extended downtrend, currently trading around $0.53 within a well-defined range between $0.45 (support) and $0.85 (resistance).

The structure shows signs of base formation, with steady accumulation and reduced volatility — a setup that often precedes directional movement.

Support zone: $0.45 remains the key demand area where buyers are consistently stepping in.

Resistance zone: The main resistance to watch is near $0.85 — a breakout above could confirm trend reversal.

Volume behavior: Gradually increasing volume hints at potential momentum build-up for an upward move.

If market sentiment improves, WIF could attempt a return toward the $0.75–$0.85 zone, marking a mid-term recovery phase. For now, holding above $0.50 keeps the structure constructive for a bullish continuation.

WIF/USDT chart Update !!📊 WIF/USDT Update

WIF is holding strong within the key demand zone of $0.70–$0.75 and is showing signs of reaching lower levels.

Currently trading around $0.78, the price is forming a falling wedge – a potential bullish reversal setup.

A clear breakout above $0.85 could accelerate momentum in this direction:

🎯 Targets: $1.05 → $1.18 → $1.27+

As long as WIF remains above $0.70, the bullish trend remains intact.

🛑 A breakdown below that area would invalidate this setup.

Patience here could yield significant profits.

DYOR | NFA

WIF/USDT — The Apex Point: Awaiting a Major Breakout or Breakdow🔎 Overview

The DOGWIFHAT/USDT pair is currently consolidating at a critical junction on the 3-day timeframe (3D). The chart reveals a classic Descending Triangle — a technical pattern formed by consistent lower highs (selling pressure) converging with a strong horizontal support zone.

The essence of this pattern: price is being squeezed into a tighter range (the apex). The longer the compression, the stronger the potential explosive move — either upward or downward.

---

🟢 Bullish Scenario (Breakout Potential)

Trigger: A valid breakout requires a 3D candle close above the descending trendline and ideally a reclaim of 1.1499.

Catalyst: Strong breakout volume plus successful retest of former resistance turned into support.

Upside Targets:

1. 1.1499 → Initial breakout confirmation.

2. 1.3797 → First major upside target (+50% from current price).

3. 1.8132 → Next psychological level (+98% from current price).

4. If momentum sustains, 2.7430 → 4.2894 → 4.8722 could act as medium-term magnets.

👉 Note: As long as price holds above the golden Fibonacci pocket (0.7753–0.6707), bulls maintain a strong chance of reclaiming momentum.

---

🔴 Bearish Scenario (Breakdown Risk)

Trigger: Breakdown confirmed if the 3D candle closes below 0.6707 (Fib 0.618).

Confirmation: Failed attempt to reclaim 0.77 after breakdown.

Downside Targets:

1. 0.45 → Psychological support / liquidity area.

2. 0.2840 → Historical low.

3. Measured Move: Based on the triangle’s height (approx. 0.4792), a textbook target would be ~0.19 — though this requires heavy bearish momentum.

👉 Note: Losing the golden Fibonacci pocket would hand over full control to bears.

---

📌 Pattern & Key Significance

1. Descending Triangle → Statistically leans bearish, but strong reversals are common if broader market sentiment is bullish.

2. Fibonacci Golden Pocket (0.5–0.618: 0.7753–0.6707) → Strong confluence zone; potential accumulation area for bulls.

3. Apex Point → The closer price gets to the apex, the stronger the eventual breakout/breakdown move.

---

🧭 Trading Strategies

Bullish Traders (Breakout Players):

Enter on a confirmed 3D close above 1.1499, preferably after a retest. Target 1.38 and 1.81 with stop loss below 0.95–0.85.

Bearish Traders (Breakdown Players):

Short after a 3D close below 0.6707, with confirmation from failed retest. Targets 0.45 and 0.2840. Stop loss above 0.78.

Swing Traders (Risk-Reward Optimizers):

Consider speculative longs at 0.77–0.67 with tight SL below 0.62, aiming for potential breakout to 1.15+.

---

📊 Key Levels

Critical Support Zone: 0.7753 – 0.6707 (Fibonacci confluence).

Major Resistances: 1.1499 → 1.3797 → 1.8132 → 2.7430 → 4.2894 → 4.8722.

Historical Low: 0.2840.

Pattern: Descending Triangle → approaching resolution.

---

🚀 Conclusion

DOGWIFHAT is at a major crossroads. This descending triangle could serve as a springboard into the next altcoin rally or a trapdoor toward new lows.

The golden Fibonacci pocket (0.77–0.67) is the key battleground. If it holds, bulls have a real shot at reclaiming higher levels. If it breaks, bears will likely dominate the structure.

---

#DOGWIFHAT #WIFI #Crypto #Altcoin #ChartAnalysis #TechnicalAnalysis #DescendingTriangle #SupportResistance #Fibonacci #Breakout #Breakdown

#WIF/USDT Forming Descending Channel#WIF

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.890, representing a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.893

First target: 0.897

Second target: 0.900

Third target: 0.905

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

WIFUSDT — Critical Demand Zone: Bounce or Breakdown?Currently, WIFUSDT is trading around 0.7605 and retesting the major demand zone (~0.62 – 0.78) — a level that previously acted as strong resistance before flipping into support.

The price action here will determine the medium-term direction:

Either a bullish reversal fueled by accumulation,

Or a bearish continuation if this zone fails.

---

🔎 Market Structure & Pattern

1. Macro Trend:

From late 2024 to early 2025, WIF faced a strong downtrend.

A sharp rebound in March–May 2025 pushed the market into a consolidation range.

Since then, the chart has been forming lower highs, showing persistent selling pressure.

2. Critical Flip Zone (0.62 – 0.78):

Previously acted as heavy resistance.

Flipped into support after a breakout in May.

Now being retested as a decisive level.

3. Potential Reversal Formation:

Holding this zone may form a double bottom / base pattern → bullish setup.

Losing this zone could trigger a continuation breakdown toward new lows.

---

🟢 Bullish Scenario

Confirmation: Daily close above 0.75–0.78 with a strong bullish candle.

Upside targets:

1.0251 → nearest resistance.

1.2008 → major consolidation area.

1.8468 – 2.1772 → mid-term resistance levels.

Ideal setup: Retest & bounce with rising volume, forming a higher low.

---

🔴 Bearish Scenario

Confirmation: Daily close below 0.62 with strong follow-through.

Downside targets:

0.50 → psychological level & minor demand.

0.3040 → major low from the chart.

Ideal setup: Breakdown → retest of yellow zone as resistance → rejection → continuation downtrend.

---

⚖️ Key Notes

The yellow zone (0.62 – 0.78) is the decision zone for WIF.

Breakout or breakdown here will likely trigger strong momentum.

Aggressive traders: may enter inside the zone with a tight SL below 0.62.

Conservative traders: wait for a daily close confirmation with volume.

Always use risk management — WIF is highly volatile.

---

✍️ Conclusion

WIFUSDT is at a strategic turning point:

Holding above support could trigger a bullish reversal toward 1.02 → 1.20.

Losing this zone could open the door to deeper downside toward 0.40 – 0.30.

The next daily close will be crucial for validating direction.

#wifusdt #dogwifhat #cryptoanalysis #altcoins #supportresistance #demandzone #bullishscenario #bearishscenario #cryptotraders #priceaction #technicalanalysis

WIF Breakout Watch – Testing Key Resistance! 🚨 WIF Breakout Watch – Testing Key Resistance! 🔴⏳

WIF is testing the red resistance zone right now.

📊 If a breakout confirms, the next move could target:

🎯 First Target → Green line level

A confirmed breakout here could trigger strong bullish continuation.

WIFUSDT to bounce from weekly support around 0.60#WIF #WIFUSD #WIFUSDT SEED_WANDERIN_JIMZIP900:WIF

On WIFUSDT, I see two possibilities for the upcoming price action.

The price has tapped into daily support DS1 and it is currently bouncing from there.

The first path suggests that this is the start of the reversal and upward journey continuation. But I am not very inclined to that possibility.

The second path suggests that the price will go down further to weekly support zone WS1 after the current bounce from DS1 is exhausted.

I am more inclined on the second path. This will allow a bounce with enough strength to make the price move beyond the current highs. And that bounce from weekly support WS1 will be a real breakout and allowing the price to move beyond 1.5 and so on.

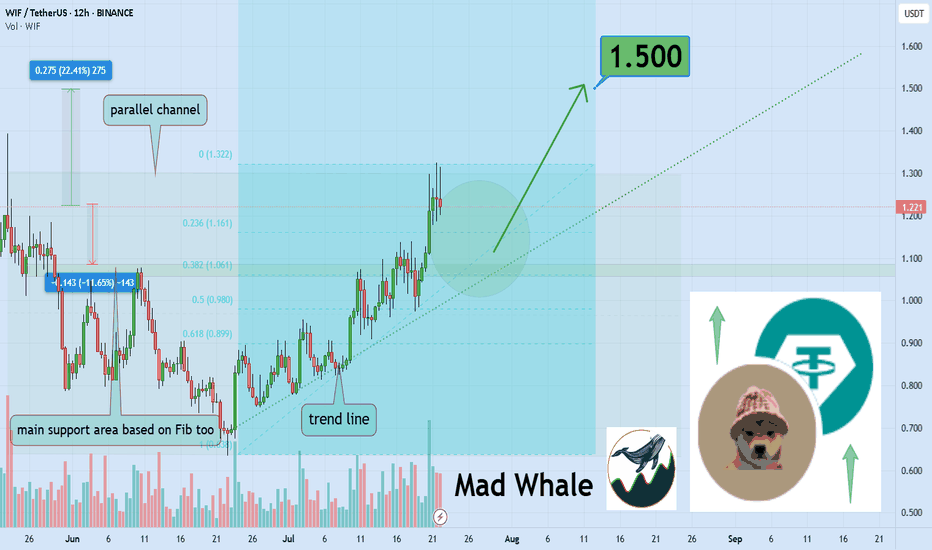

Dogwifhat Poised For 22% Growth Toward $1.50Hello✌

Let’s analyze Dogwifhat’s upcoming price potential 📈.

📈 BINANCE:WIFUSDT is currently sitting near a strong daily support and trendline. At the same time, the Fibonacci Level support lines up closely with this key level. This convergence suggests a potential upside of about 22%, aiming for a target price of $1.50. 🔥

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

They're lying! WIF will explode to 28.8$ ✅ Golden Pocket Extension: $28.80 aligns with the 1.618–1.65 fib extension (golden pocket zone) from the last major impulse.

✅ Measured Move: Breakout from the prior downward consolidation projects to ~$28.80 when using the height of the range added to the breakout point.

✅ Confluence = High Probability: Both fib extension and measured move target the same zone, increasing confidence.

✅ Momentum + Meme Rotation: If broader meme coin rotation continues, WIF has narrative + volatility fuel.

Memecoin with potential for purchase.Hello friends🙌

Considering the decline we had in the weekly timeframe, you can now see that with the good growth we had, it gives us a good signal to buy, of course in a stepwise manner and with capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸

WIFUSDT: Mid-Term AnalysisI know the prices I want are very cheap.

But I believe this market can give me those prices if I’m patient.

Until then, I’m watching calmly. If price comes to my levels, I will look for:

✅ Footprint absorption

✅ CDV support

✅ Structure reclaim for confirmation

If it aligns, I’ll take the trade with clear risk. If not, I’ll keep waiting.

No rush. The right price, or no trade.