WIFUSDT: Bearish Continuation — Key Support Under ThreatPrice continues to move within a clear descending structure , respecting the long-term downtrend trendline . The marked blue zone represents a strong historical support, which has been holding price above a major downside area — essentially the last barrier before a deeper sell-off.

At the moment, this support is being tested again , and momentum remains bearish. A clean breakdown below this level would likely open the door for a strong continuation to the downside.

Bearish scenario:

Confirmed support break → acceleration lower

First target: 0.25 USD

Second target: 0.15 USD

If panic or high sell pressure enters the market, even lower levels are possible

As long as price stays below the descending trendline, the bias remains bearish . The blue zone is the key level to watch — once it fails, the market may enter a “free fall” phase.

Wifanalysis

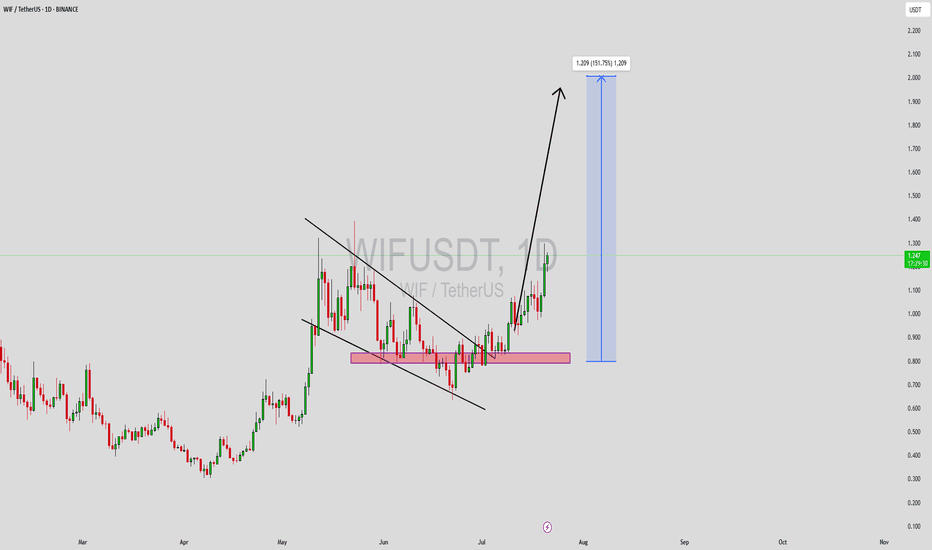

WIF - BULLISH OUTLOOK 🟩 CRYPTOCAP:WIF - Price analysis

I think we are going to see a bullish correction soon on the #alt market!📈

The Fed is expected to cut rates tomorrow, which could trigger a positive reaction across the market.📈

Here is why I am bullish:

✅ Double bottom on daily chart

✅ Bullish RSI divergence on daily

✅ Likely bullish accumulation structure (if support holds)

Current price remains stuck under the 0.410 resistance. If bulls manage to push above, we could see an explosive move toward 0.520 - $ 0.550 📈

What's your point of view? 🐕

WIF/USDT — Price Pressing Into a Make-or-Break Zone?DOGWIFHAT has entered one of the most decisive phases of its entire downtrend. After months of consistent lower-highs beneath the descending trendline, the market is now compressing into the Key Support Zone at 0.38–0.285 — an area that previously acted as a re-accumulation base and a major liquidity sweep level.

This is not just support.

This is the trend-defining battleground.

The descending trendline continues to reject every attempt to recover, creating a tight squeeze between seller pressure from above and buyer defense inside the zone.

This compression often leads to a high-volatility breakout in one direction.

If buyers hold this zone, a structural reversal is on the table with targets rising step-by-step toward:

0.55 → 0.695 → 0.80 → 1.16 → 1.44

If sellers break 0.285 with a clean 4D close, momentum may shift into a fresh markdown, opening downside levels toward:

0.23 → 0.15 → 0.10

The long downward wicks previously seen in this area show liquidity manipulation, confirming that smart money is active and this zone is being defended — or hunted.

The next major move will likely be decided here.

---

🟢 Bullish Scenario

Price holds the 0.38–0.285 zone

Break + 4D close above the descending trendline

Successful retest → bullish reversal confirmed

Upside targets: 0.55 → 0.695 → 0.80 → 1.16 → 1.44

---

🔴 Bearish Scenario

4D close below 0.285

Support flips into resistance

Downside continuation targets: 0.23 → 0.15 → 0.10

#DOGWIFHAT #WIF #CryptoAnalysis #SupportZone #Breakout #CryptoTrend #PriceAction #AltcoinAnalysis

WIF/USDT — The Apex Point: Awaiting a Major Breakout or Breakdow🔎 Overview

The DOGWIFHAT/USDT pair is currently consolidating at a critical junction on the 3-day timeframe (3D). The chart reveals a classic Descending Triangle — a technical pattern formed by consistent lower highs (selling pressure) converging with a strong horizontal support zone.

The essence of this pattern: price is being squeezed into a tighter range (the apex). The longer the compression, the stronger the potential explosive move — either upward or downward.

---

🟢 Bullish Scenario (Breakout Potential)

Trigger: A valid breakout requires a 3D candle close above the descending trendline and ideally a reclaim of 1.1499.

Catalyst: Strong breakout volume plus successful retest of former resistance turned into support.

Upside Targets:

1. 1.1499 → Initial breakout confirmation.

2. 1.3797 → First major upside target (+50% from current price).

3. 1.8132 → Next psychological level (+98% from current price).

4. If momentum sustains, 2.7430 → 4.2894 → 4.8722 could act as medium-term magnets.

👉 Note: As long as price holds above the golden Fibonacci pocket (0.7753–0.6707), bulls maintain a strong chance of reclaiming momentum.

---

🔴 Bearish Scenario (Breakdown Risk)

Trigger: Breakdown confirmed if the 3D candle closes below 0.6707 (Fib 0.618).

Confirmation: Failed attempt to reclaim 0.77 after breakdown.

Downside Targets:

1. 0.45 → Psychological support / liquidity area.

2. 0.2840 → Historical low.

3. Measured Move: Based on the triangle’s height (approx. 0.4792), a textbook target would be ~0.19 — though this requires heavy bearish momentum.

👉 Note: Losing the golden Fibonacci pocket would hand over full control to bears.

---

📌 Pattern & Key Significance

1. Descending Triangle → Statistically leans bearish, but strong reversals are common if broader market sentiment is bullish.

2. Fibonacci Golden Pocket (0.5–0.618: 0.7753–0.6707) → Strong confluence zone; potential accumulation area for bulls.

3. Apex Point → The closer price gets to the apex, the stronger the eventual breakout/breakdown move.

---

🧭 Trading Strategies

Bullish Traders (Breakout Players):

Enter on a confirmed 3D close above 1.1499, preferably after a retest. Target 1.38 and 1.81 with stop loss below 0.95–0.85.

Bearish Traders (Breakdown Players):

Short after a 3D close below 0.6707, with confirmation from failed retest. Targets 0.45 and 0.2840. Stop loss above 0.78.

Swing Traders (Risk-Reward Optimizers):

Consider speculative longs at 0.77–0.67 with tight SL below 0.62, aiming for potential breakout to 1.15+.

---

📊 Key Levels

Critical Support Zone: 0.7753 – 0.6707 (Fibonacci confluence).

Major Resistances: 1.1499 → 1.3797 → 1.8132 → 2.7430 → 4.2894 → 4.8722.

Historical Low: 0.2840.

Pattern: Descending Triangle → approaching resolution.

---

🚀 Conclusion

DOGWIFHAT is at a major crossroads. This descending triangle could serve as a springboard into the next altcoin rally or a trapdoor toward new lows.

The golden Fibonacci pocket (0.77–0.67) is the key battleground. If it holds, bulls have a real shot at reclaiming higher levels. If it breaks, bears will likely dominate the structure.

---

#DOGWIFHAT #WIFI #Crypto #Altcoin #ChartAnalysis #TechnicalAnalysis #DescendingTriangle #SupportResistance #Fibonacci #Breakout #Breakdown

#WIF/USDT Forming Descending Channel#WIF

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.890, representing a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.893

First target: 0.897

Second target: 0.900

Third target: 0.905

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

WIF/USDT Technical UpdateBINANCE:WIFUSDT has successfully broken out of the falling wedge 📉➡️📈 and has already completed a clean retest of the breakout zone ✅.

Currently price action is forming a potential ABC corrective wave structure (Elliott Wave count), with:

🅰️ Wave (A) aiming toward the 0.84–0.85 resistance zone

🅱️ Wave (B) likely testing support around the breakout area (~0.80)

🅾️ Wave (C) targeting the major resistance zone at 0.93–0.94

Key confluences:

✨ Bullish market structure shift after wedge breakout

✨ Support-turned-resistance flip successfully tested

✨ Momentum favors the upside if BTC continues bullish momentum 🟢

📌 Watch out for BTC’s move — if BTC pumps, WIF has a high probability to continue rallying toward 0.93–0.94 🎯

⚠️ Invalid below 0.78 support zone

WIFUSDT — Critical Demand Zone: Bounce or Breakdown?Currently, WIFUSDT is trading around 0.7605 and retesting the major demand zone (~0.62 – 0.78) — a level that previously acted as strong resistance before flipping into support.

The price action here will determine the medium-term direction:

Either a bullish reversal fueled by accumulation,

Or a bearish continuation if this zone fails.

---

🔎 Market Structure & Pattern

1. Macro Trend:

From late 2024 to early 2025, WIF faced a strong downtrend.

A sharp rebound in March–May 2025 pushed the market into a consolidation range.

Since then, the chart has been forming lower highs, showing persistent selling pressure.

2. Critical Flip Zone (0.62 – 0.78):

Previously acted as heavy resistance.

Flipped into support after a breakout in May.

Now being retested as a decisive level.

3. Potential Reversal Formation:

Holding this zone may form a double bottom / base pattern → bullish setup.

Losing this zone could trigger a continuation breakdown toward new lows.

---

🟢 Bullish Scenario

Confirmation: Daily close above 0.75–0.78 with a strong bullish candle.

Upside targets:

1.0251 → nearest resistance.

1.2008 → major consolidation area.

1.8468 – 2.1772 → mid-term resistance levels.

Ideal setup: Retest & bounce with rising volume, forming a higher low.

---

🔴 Bearish Scenario

Confirmation: Daily close below 0.62 with strong follow-through.

Downside targets:

0.50 → psychological level & minor demand.

0.3040 → major low from the chart.

Ideal setup: Breakdown → retest of yellow zone as resistance → rejection → continuation downtrend.

---

⚖️ Key Notes

The yellow zone (0.62 – 0.78) is the decision zone for WIF.

Breakout or breakdown here will likely trigger strong momentum.

Aggressive traders: may enter inside the zone with a tight SL below 0.62.

Conservative traders: wait for a daily close confirmation with volume.

Always use risk management — WIF is highly volatile.

---

✍️ Conclusion

WIFUSDT is at a strategic turning point:

Holding above support could trigger a bullish reversal toward 1.02 → 1.20.

Losing this zone could open the door to deeper downside toward 0.40 – 0.30.

The next daily close will be crucial for validating direction.

#wifusdt #dogwifhat #cryptoanalysis #altcoins #supportresistance #demandzone #bullishscenario #bearishscenario #cryptotraders #priceaction #technicalanalysis

Memecoin with potential for purchase.Hello friends🙌

Considering the decline we had in the weekly timeframe, you can now see that with the good growth we had, it gives us a good signal to buy, of course in a stepwise manner and with capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

WIFUSDT Forming Descending ChannelWIFUSDT is currently trading within a descending channel pattern, a structure often considered bullish when found in a broader uptrend. This pattern indicates a period of healthy correction and consolidation, which often precedes a breakout move to the upside. With good trading volume and growing interest from the crypto community, WIF may be preparing for a strong reversal. The technical setup suggests a potential gain of 140% to 150%+ upon a confirmed breakout above the upper boundary of the channel.

Dogwifhat (WIF) has garnered significant attention due to its strong meme coin narrative within the Solana ecosystem. As meme tokens continue to attract retail attention, WIF has remained one of the more resilient and talked-about assets in its category. This strong community support, combined with current technical indicators, adds confidence to the bullish case.

The descending channel has allowed price to compress and reset RSI levels, setting the stage for a possible explosive move. If price breaks out with volume, this could mark the beginning of a new bullish wave. Traders should watch for a breakout candle with strong follow-through above recent resistance zones as a key confirmation point.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Price explosion is coming?Read carefullyhello friends👋

We have come to analyze a popular Kuwaiti meme that you have asked to analyze a lot.

🌟Well, according to the drop we had, it can be seen that the buyers came in and formed a good upward wave, and after that, Femt entered a channel, which can be said to be a flag pattern...🧐

Now, according to the formed channel, we can enter into a purchase transaction with capital and risk management in case of a valid failure of the channel.

🔥Follow us for more signals on Bolran.🔥

*Trade safely with us*

WIFUSDT Forming Classic Wedge WIFUSDT has recently formed a classic wedge pattern, a powerful technical indicator often associated with upcoming breakouts. Wedge patterns, especially those with tightening price action and consistent volume, suggest a coiled market preparing for a strong directional move. In the case of WIFUSDT, this wedge structure is showing all the right characteristics for a bullish breakout, supported by growing trading volume and increasing investor interest.

The price structure within the wedge is narrowing, indicating a possible compression before expansion. This typically precedes a sharp breakout, and current market behavior around WIFUSDT suggests bulls are positioning themselves for a significant upside move. Technical projections show a strong potential for gains ranging between 140% to 150%+, especially if the breakout is accompanied by momentum confirmation on higher timeframes.

What adds to the bullish thesis is the noticeable uptick in trading volume, which confirms that accumulation might already be underway. When volume supports a pattern breakout, it often adds strength and sustainability to the move. With market sentiment slowly shifting and capital rotating into altcoins, WIFUSDT stands out as a high-potential candidate in the current environment.

WIFUSDT is quickly becoming a favorite among breakout traders and short-term investors looking to ride explosive setups. If the wedge breaks to the upside as expected, it could mark the beginning of a strong rally phase. Traders may want to monitor closely for entry signals as the breakout unfolds.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

They brought it down for the fill — now it's time to see who’s rBINANCE:WIFUSDT just reacted perfectly off the 0.618 golden zone at 0.827 with bullish intent. The STB 1D and FVG 1D combo formed a high-probability demand zone that Smart Money won't ignore lightly.

Here’s the bullish roadmap:

Entry: 0.788 (bottom wick through 0.618 fib)

Structure: Clear higher low with mitigation of FVG 1D

Volume: Climax candle into key levels — classic absorption

Targets:

TP1: 0.921 (mid-level fib and consolidation ceiling)

TP2: 1.015 - 1.132 (FVG to OB 1D imbalance fill)

TP3: 1.321 (full expansion target — optimal trade entry delivery)

Moonshot: 1.393 if bulls dominate past OB retest

Invalidation: Daily close below 0.692 (STB 1D)

Price doesn’t just reverse — it transfers power. This is that shift.

For more plays just like this — all based in structure and timing — check the profile for setups that speak precision, not prediction.

This wasn’t a bounce. It was a reclaim.BINANCE:WIFUSDT.P hit the daily OB at 0.8330 and snapped back — not with hope, but with intent.

Smart Money didn’t panic on the drop. It positioned.

Here’s the structure:

Price tapped a clean D OB, aligned perfectly with 0.618 fib — the algorithm’s comfort zone

The bounce reclaimed 1.00 fast, and the market is now flirting with internal liquidity near 1.0178 and 1.1339

Above, the real draw sits at 1.3965 — a void yet to be filled

Below, we still have W OB liquidity near 0.7260 if this rotation fails

This move doesn’t need hype. It needs follow-through. If we consolidate above 0.9299 and break into 1.0178 clean, the next phase unlocks — straight into the 1.13–1.32 range.

Execution plan:

Bias remains bullish above 0.92

Pullbacks into 0.89–0.83 are still valid long zones as long as 0.7260 doesn’t get breached

Target 1.1339 first — then 1.3965 as the higher timeframe liquidity magnet

This setup isn’t emotional. It’s engineered. You don’t need to guess when price is built to deliver.

More trades like this — real levels, real invalidations — are in the profile description.

A 35% fall in WIF from its current price levels is possibleWIF has just broken below the 200 EMA on the H4 timeframe and reacted to an imbalance area.

From here, it’s possible for a pullback to form in an ABC pattern with low volume on the upward move, potentially testing the resistance zone where the 200 EMA may also act as resistance.

Looking at the BTC chart, there’s still room for further downside, which supports our thesis.

Using the RSI across the M15 and H1 timeframes to identify overbought areas with divergence could serve as the entry trigger.

Let’s see what this week brings!

#WIF/USDT#WIF

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.650

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.671

First target 0.716

Second target 0.751

Third target 0.800

WIF (SPOT)BINANCE:WIFUSDT

WIF / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

WIF Preparing to storm 0.79 ready to grow by 50%The WIFUSDT coin has been at the bottom for a long time, having accumulated a decent amount of short-term liquidity. Apparently, it is ready to grow by 50%. This is more of an intuition than a clear trading idea, but if you want, you can enter an amount that you don't mind losing. The target is 0.79

Do you think we'll take off? 🚀

WIF/USDTHello friends

According to the market cycle, the price decline is ongoing and is expected to continue.

Now the only important support is the green area, which the price reaches there and we will see what reaction we get from the buyers.

Will they support the price or will the decline continue...

If you want to be with us in this alt season, send us a message.

*Trade safely with us*

WIF /USDT Long SL -14.12%WIF/USDT Long Setup ( Retake )

Reason:

Breakout and Confirmation done in Internal Structure.

Strong Bullish bullish momentum with high Volume.

All technical Parameters suggesting a strong Bullish Wave.

After Successfully breakout from wedge, we can Expect a 40% bullish wave.

Pro Tips:

After Target 2, Move Stoploss to breakeven

HODL

Best Regards,

The Panda

BINANCE:WIFUSDT

MEXC:WIFUSDT

BINANCE:WIFUSDT.P

KUCOIN:WIFUSDT

BITGET:WIFUSDT.P

BINGX:WIFUSDT.P

$WIFUSDT: Third and Final Entry – Aiming for 4.8!Entries below 1.3 are welcomed. This is my third and final entry at these levels.

Aiming for a move towards 4.8, as we're currently in a ranging scenario.

Accumulating at range lows and watching for a breakout at the range highs if the mid-level is reclaimed. Above $3, $4.8 is an easy target.

Planning to accumulate through the end of January and into mid-February.

BINANCE:WIFUSDT still alive, in my opinion.

WIF/USDT: A Breakout is Brewing – Are You Ready? Yello Paradisers! Have you been tracking #WIFUSDT lately? If not, you're at risk of missing what could be a massive move will it skyrocket or collapse? Let’s break it all down.

💎#WIFUSDT has just broken out of a falling wedge pattern, a classic bullish indicator that often signals a trend reversal. Following this breakout, the price retested the key support at $1.707 and held its ground, showing clear strength from buyers. This zone, extending as low as $1.432, has been a crucial demand area that has repeatedly proven itself over the past few weeks.

💎If the price stays above this key support, we could witness a strong push toward $2.93, a minor resistance level that must be cleared to fuel sustained bullish momentum. A clean break above $2.942 would open the doors for WIF to target its major resistance zone between $4.63 and $4.80. Historically, this level has been a significant ceiling, but if breached, it could trigger an explosive rally.

💎 On the flip side, if the price fails to hold the $1.432 demand zone, it could result in a bearish breakdown, potentially dragging the price below $1.00.

💎#WIFUSD is at a critical crossroads. Bulls need to reclaim higher levels, while bears are closely watching for any signs of weakness to exploit. As Paradisers, this is a time for patience and discipline. Don’t rush into a position wait for clear confirmations of a breakout or breakdown before making any moves.

Stay focused, play it smart, and remember, Paradisers: the market rewards those who are disciplined and prepared!

MyCryptoParadise

iFeel the success🌴