Bullish Reversal Signals at Harmonic SupportCRD is showing multiple bullish signals suggesting a significant low may be forming.

Scenario 1 — Weekly low volume Spring Confirmation

If the weekly candle closes in its current position, it strengthens the case for a spring out of the Wyckoff range.

In this scenario, an entry on next week’s open is justified. with a clear invalidation under the spring.

The trade-off is that the major resistance cluster sits relatively close overhead, so the risk‑to‑reward isn’t ideal for short‑term traders.

However, for a longer‑term position, the structure supports the idea that this could be the beginning of a larger reversal. As Always, there are no guarantees and must adapt to the chart as it unfolds.

Scenario 2 — Throw-under Into S1 Pivot

Price may continue to pull back into the new yearly S1 pivot, creating a throw-under of the wedge structure.

A close back inside the range after this throw-under would significantly improve the risk‑to‑reward, as it would confirm a deeper spring and clear out remaining weak hands.

This scenario offers a cleaner entry and a more defined invalidation level.

*arrows are not time-based analysis just overall pathing

Wyckoffaccumulation

Gold needs a correction after the ATH!Greetings!

If you see me at the charts, it means a fresh dose of solid analysis is coming.

Today my focus is on XAUUSD.

Yesterday we updated the ATH at 4642. Congrats to all holders and bullish traders. 🔥

This move happened amid global uncertainty. Greenland, Cuba, Iran, Trump is actively talking about all of this after what happened in Venezuela.

Because of that, investors are rushing into safe-haven assets to protect capital from a potential crisis.

And gold is the #1 safe-haven asset of all time.

Now to the chart:

The local uptrend started with Wyckoff accumulation. After that, at the top of the channel, price went sideways and formed a Wyckoff distribution.

For those who don’t know:

Accumulation → potential reversal up

Distribution → potential reversal down

At the highs, smart money distributes, so I’m expecting the start of a correction (for now, local).

There are 2 key zones where we could potentially see a reversal.

Profits to everyone! 💰

Follow for more 🚀

Post‑Spring Retrace Into Key Zone — Eyes on $15.78APA is starting to look constructive here.

After the initial move out of the spring, price tagged a key 50% retracement measured from the ATH down to the spring low. We’re now seeing a controlled pullback into a meaningful area of interest.

Why the setup still holds

- The spring remains intact, which keeps the broader accumulation thesis valid.

- Volume on the spring was lighter than the Selling Climax, suggesting the market isn’t motivated to drive price back into deep supply.

- That typically reduces the probability of a full retest and instead favors a shallower pullback before continuation.

Upside structure

- First target sits near the range highs, where we’ll get the first real test of demand.

- A strong breakout from that zone opens the door to a minimum 200% pattern extension, projecting toward $15.78 with a strong possibility of much higher price due to the time of accumulation.

3-Year Breakout with LVN PrecisionSEEK has broken out of a multi-year range and is now testing the upper boundary to gauge buyer commitment. This is a critical zone. Price action here will reveal whether markup is ready to accelerate or pause for a reload.

Trade Scenario

Begin scaling in as price has reached the top of a Low Volume Node. This zone typically lacks price acceptance, so there is a strong chance of a brief dip before continuation. If price does pull back, monitor the buy zone for a second entry/scale in opportunity.

Risk management remains essential. Since a higher low has not yet formed, the stop loss should sit below the Last Point of Support. Once a new higher low is confirmed, the stop can be moved accordingly to lock in structure.

Targets

Initial target sits just below the all-time high

For extended upside, trail the stop loss using newly formed swing lows to capture continuation

The XRP chart is like from a textbook! Wyckoff tutorialWelcome! When finance professionals are watching, you can expect solid analytics and real education.

Today we’re going to break down Wyckoff market cycles using the XRP chart in real time.

Wyckoff cycles are not just theory - they are an established concept that works in all markets. This is a model of price behavior based on the actions of large players ("smart money"). It shows how professionals accumulate positions, drive the market, and distribute assets, creating repeating phases of growth and decline.

Any market moves cyclically. Wyckoff identified two major cycles:

Bull market cycle (Accumulation → Markup → Distribution → Markdown)

Bear market cycle (the mirror reflection of the first)

Each cycle consists of four phases:

-Accumulation

-Markup (Growth)

-Distributio

-Markdown (Decline)

Phase 1. Accumulation

This is the phase when "smart money" buys the asset in large volumes while trying not to push the price too high. Conditions are created where regular market participants do not want to buy the asset, and may even sell it near market lows. Usually during this period there is bad news, lack of confidence, etc. Large players quietly buy up all this negativity.

Phase 2. Markup (Growth)

An impulsive upward movement begins - a trend that everyone notices when it is already too late. The crowd starts to wake up and enters the market at high prices.

Phase 3. Distribution

The price again enters a trading range, but now major participants sell their positions to retail traders who come in euphoric after the rise. Usually, the news is excellent here, everyone expects further growth, there is general euphoria, people load into the asset to the maximum while large players quietly unload their positions.

Phase 4. Markdown (Decline)

Professionals have sold everything they wanted, and now the market goes down almost without resistance. Retail - back to the factory.

The Wyckoff Trading MethodThe Wyckoff Trading Method

The Wyckoff Method is a classical approach to market analysis designed to help traders understand trend development, market cycles, and potential reversals. Despite being developed over a century ago, it remains highly relevant in modern financial markets and is widely used across stocks, forex, and cryptocurrencies.

What Is the Wyckoff Method?

The Wyckoff Method is a form of technical analysis created in the early 20th century by Richard D. Wyckoff, a pioneering trader and market analyst. The core idea behind this method is that price movements are governed by supply and demand, and that large institutional participants (often referred to as “composite operators”) leave identifiable footprints on the chart.

Wyckoff believed that by studying price, volume, and time, traders could anticipate future price behavior rather than react to it.

Core Principles of the Wyckoff Method

The Wyckoff methodology is built around several foundational concepts:

1. Supply and Demand

Price rises when demand exceeds supply and falls when supply exceeds demand. Observing how price responds to changes in volume helps traders identify who is in control of the market.

2. Market Structure and Phases

Markets move in recurring cycles, typically broken down into:

- Accumulation

- Markup

- Distribution

- Markdown

Recognizing these phases allows traders to align with institutional activity rather than trade against it.

3. Price and Volume Relationship

Volume acts as a confirmation tool. Strong price movement with weak volume often signals exhaustion, while strong volume supports trend continuation.

4. Liquidity and Institutional Behavior

The method emphasizes how large players accumulate or distribute positions over time, often through range-bound price action designed to absorb liquidity.

The Market Cycle

The Wyckoff Market Cycle

The Wyckoff methodology describes market behavior as a repeating four-phase cycle driven by supply and demand. These phases help traders understand where the market is in its process, rather than simply reacting to price movements.

Accumulation Phase

Accumulation typically appears as a range-bound market after a decline. During this phase, large institutional participants quietly build long positions while price remains relatively stable. To most traders, the market appears directionless, but in reality, buying is taking place without pushing price higher. The true intent of the market is concealed until accumulation is complete.

Markup Phase

Once sufficient long positions have been accumulated, institutions begin to drive price higher. This phase is characterized by a clear uptrend as increased demand attracts additional buyers. Breakouts from accumulation ranges often trigger momentum traders and breakout strategies, reinforcing the trend. Markups may include re-accumulation phases, where price pauses and consolidates before continuing higher.

Distribution Phase

Distribution occurs after an extended advance, when upward momentum begins to slow. During this phase, large players gradually offload long positions and build short exposure. Price often moves sideways in a range, giving the illusion of stability, while smart money exits positions. This phase prepares the market for the next directional move lower.

Markdown Phase

The markdown is the declining phase that follows distribution. Selling pressure overwhelms demand, leading to a sustained downtrend. As price falls, traders are encouraged to enter short positions, further accelerating the move. Similar to markups, markdowns may include redistribution phases, where price consolidates before continuing lower.

Why the Wyckoff Model Works

Large financial institutions must execute trades of significant size, which requires liquidity. Liquidity is often found around stop losses, breakout levels, equal highs and lows, and key support or resistance zones. By intentionally pushing price into these areas, institutions can fill large orders efficiently without excessive slippage. This interaction between liquidity and market psychology forms the foundation of the Wyckoff model across all asset classes.

Core Principles of the Wyckoff Method

A key concept in Wyckoff theory is the Composite Man, a symbolic representation of institutional or “smart money” participants. Traders are encouraged to analyze price action as if a single, highly informed entity is controlling the market. The Composite Man accumulates or distributes positions strategically before allowing price to trend.

The Law of Supply and Demand explains that price rises when demand exceeds supply and falls when supply exceeds demand. The Law of Cause and Effect states that the size and duration of accumulation or distribution determine the magnitude of the subsequent price move, with higher-timeframe structures producing larger effects. The Law of Effort versus Result compares volume (effort) with price movement (result), highlighting potential trend continuation or exhaustion when these two factors diverge.

Wyckoff Schematics

Wyckoff schematics visually represent accumulation and distribution structures. Although these patterns may appear complex at first, they are mirror images of each other, with accumulation and distribution sharing identical phases and logic—only inverted. Studying these schematics helps traders recognize institutional behavior and align their trades with the dominant market process.

Type 1 Schematics

Accumulations

Phase A: Stopping the Downtrend

Phase A marks the transition from a markdown to the beginning of accumulation, where selling pressure starts to weaken.

- Preliminary Support (PS): After a prolonged decline, initial buying emerges and temporarily halts the downtrend. Volume increases as early demand appears, signaling that selling pressure is no longer dominant.

- Selling Climax (SC): Panic selling accelerates as long positions are stopped out and breakout traders enter short positions. At this point, the Composite Man absorbs this excess supply. The SC often leaves long lower wicks, reflecting strong buying interest.

- Automatic Rally (AR): Once selling pressure is exhausted, price rebounds quickly as shorts cover and new buyers step in. The high of the AR establishes the first resistance boundary of the accumulation range.

- Secondary Test (ST): Price revisits the SC area to test remaining supply. This test may form equal or slightly higher/lower lows, usually with reduced volume, confirming that selling pressure has diminished.

Phase B: Building the Cause

Phase B is where accumulation develops over time. The Composite Man continues to build long positions while price fluctuates within a range.

- Sign of Strength in Phase B (SOS(b)): In some cases, price rallies above the AR, creating a higher high within the range. This move suggests improving demand but still remains below preliminary resistance.

- Secondary Test in Phase B (ST(b)): A sharp decline follows, designed to trigger stop losses below prior lows and attract breakout sellers. This “liquidation” move provides the liquidity institutions need to continue accumulating, forming the underlying cause for the next trend.

Phase C: The Final Shakeout

Phase C is the critical phase that distinguishes accumulation from continuation lower.

- Spring: Price makes a final push below established support, sweeping remaining stop losses and trapping late sellers. This move briefly violates the range before quickly reversing.

- Test: After the Spring, price retests the area to confirm that supply has been fully absorbed. These tests typically form higher lows and occur on lower volume, signaling reduced selling interest.

Phase D: Transition to Markup

Phase D confirms that accumulation is complete and the market is ready to trend higher.

- Last Point of Support (LPS): Following the test and a rally, price pulls back shallowly, forming a higher low. This pullback reflects strong demand and is often the final opportunity before markup.

- Sign of Strength (SOS): Price breaks above the accumulation range with expanding volume, confirming bullish control. After this breakout, the market enters the markup phase, where the effect of prior accumulation is realized through sustained upward movement.

Distributions

Phase A: Stopping the Uptrend

Phase A marks the transition from an uptrend into distribution, where demand begins to weaken and supply quietly enters the market.

- Preliminary Supply (PSY): After a sustained advance, large operators start unloading positions, causing the first noticeable pause or pullback in price.

- Buying Climax (BC): Buying pressure reaches an extreme as late buyers enter aggressively, often accompanied by very high volume. This is where smart money sells into strength.

- Automatic Rally (AR): Once buying is exhausted, price pulls back sharply as demand fades. The AR typically forms below the BC and defines the first support boundary of the distribution range.

- Secondary Test (ST): Price revisits the BC area to test remaining demand, usually failing to make a new high. Volume is generally lower, indicating reduced buying interest and building liquidity for later phases.

Phase B: Building the Distribution

Phase B is where the Composite Man continues distributing positions while price fluctuates within a range.

- Sign of Weakness in Phase B (SOW(b)): A decline below the AR signals that supply is beginning to dominate. This move does not always appear, but when it does, it establishes a second support boundary.

- Upthrust (UT): Price briefly breaks above resistance to trigger buy stops and attract breakout buyers. This false breakout allows institutions to sell into increased demand and build short exposure.

Phase C: The Final Liquidity Grab

Phase C completes the distribution process by targeting remaining demand.

- Upthrust After Distribution (UTAD): Similar to a Spring in accumulation, UTAD is the final false breakout above resistance. It is designed to capture the last wave of liquidity before the true bearish move begins.

- Test: Price often revisits the UTAD area to confirm that demand has been fully absorbed. These tests typically occur on lower volume, signaling weakening bullish participation.

Phase D: Transition to Markdown

Phase D confirms that distribution is complete and bearish control is established.

- Last Point of Supply (LPSY): After price begins to decline, weak rallies attempt to test demand. These rallies are shallow and usually represent the final bullish reactions before the markdown.

- Sign of Weakness (SOW): Price breaks decisively below the range, confirming a bearish structure. Additional LPSYs may form, but this phase marks the final transition into the markdown.

Type 2 Schematics

Type 2 Wyckoff schematics contain the same structural components as Type 1, but without a Spring (in accumulation) or a UTAD (in distribution). In these cases, the market does not perform a final liquidity sweep before trending.

A Type 2 schematic can be identified by observing a direct transition into trend confirmation:

- In accumulation, price forms a Secondary Test (ST) and possibly an ST(b), then proceeds directly into a Sign of Strength (SOS) followed by markup.

- In distribution, price forms an ST or Upthrust (UT), then transitions directly into a Sign of Weakness (SOW) followed by markdown.

If markup or markdown begins without a Spring or UTAD, the structure should be classified as Type 2. Importantly, Type 2 schematics are traded using the same principles and execution logic as Type 1 structures.

The Five-Step Wyckoff Trading Strategy

Richard D. Wyckoff proposed a structured five-step approach to applying his methodology in real market conditions. This framework helps traders align with market structure and institutional intent.

1. Determine the Market Trend

Identify whether the broader market environment is bullish or bearish. Trading in alignment with the dominant trend increases probability.

2. Select a Suitable Market

Choose an asset or trading pair that clearly reflects the identified market trend and shows strong structural clarity.

3. Identify Accumulation or Distribution

Focus on assets that are currently forming a Wyckoff accumulation or distribution structure rather than those already trending.

4. Assess Readiness for a Move

Analyze the current Wyckoff phase and volume behavior. Events such as a Spring, UTAD, SOS, or SOW help confirm whether the market is prepared for markup or markdown.

5. Execute the Entry

Entries are commonly taken on Tests, Last Points of Support (LPS), or Last Points of Supply (LPSY), where risk can be controlled and structure is clear.

Does the Wyckoff Method Still Work?

- Despite being developed nearly a century ago, the Wyckoff Method remains highly relevant in modern markets. Its core principles supply and demand, market structure, volume analysis, and liquidity behavior are universal and apply across forex, stocks, commodities, and cryptocurrencies.

- When combined with complementary tools such as support and resistance, indicators, or pattern analysis, Wyckoff can form the foundation of a robust and disciplined trading approach. Its enduring value lies in teaching traders how markets move, not just where price is going.

Educational Disclaimer

This material is provided for educational purposes only. It reflects a general interpretation of the Wyckoff methodology and should not be considered financial advice, investment recommendations, or an offer to trade. Traders should always conduct their own analysis and manage risk responsibly.

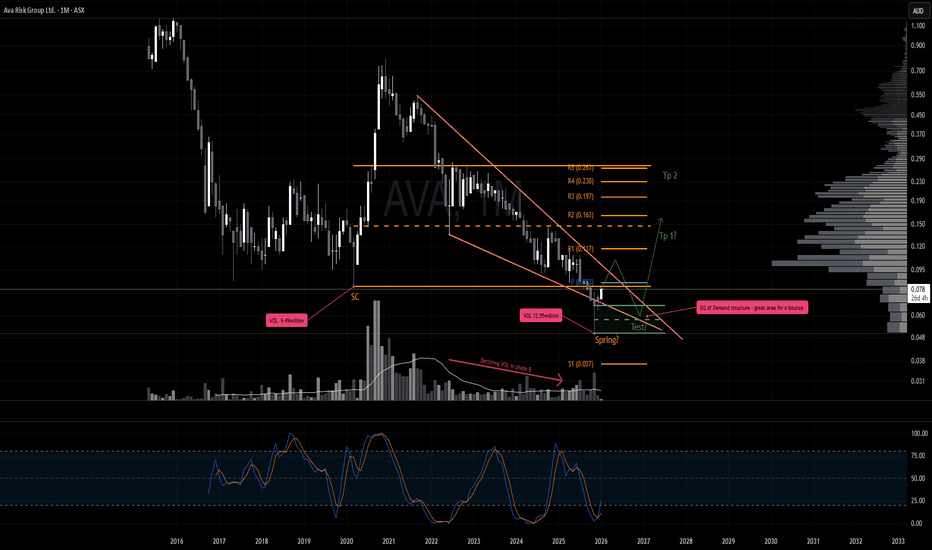

Deep Structure, Clean Risk, Big PotentialAVL is starting to look genuinely interesting here. Yes, it’s a small‑cap, highly speculative commodity play, but the structure developing on the chart is hard to ignore.

The current accumulation range shows multiple Phase B rallies, which deviates from the generic Wyckoff schematic most traders are familiar with. Those repeated bumps strongly suggest the Composite Operator was distributing into breakout enthusiasm, while retail money chased the early strength. Once that liquidity was absorbed, price unwound into a clean corrective leg.

That pullback from the May 23 high appears to have completed into the July 25 low, which is now acting as a potential Last Point of Support (LPS). LPS identification is rarely obvious in real time, but there are constructive signs here:

- the descending trendline has been broken

- demand is beginning to show up on the right side of the structure

- the reaction into the LPS held above the prior support shelf

From a technical perspective, this gives traders a valid long setup with risk defined beneath the LPS.

That said, there’s still a realistic scenario where price rejects this area and rotates lower toward the S1 yearly pivot, forming a deeper Spring. For that to unfold, we’d need to see a decisive move down followed by a monthly close back inside the range. If that happens, the following month’s open becomes the high‑probability entry and the risk‑to‑reward expands significantly.

This idea gains further weight when you look at the new yearly pivot structure. When price moves sideways between the yearly pivot and S1, it often tests the nearest pivot first. In this case, the yearly pivot, before driving into S1 and then launching back above the pivot zone. It’s a behaviour almost no one understands, yet AVL is following it cleanly, and it aligns perfectly with the potential Spring scenario.

There’s still plenty to play out, but whether the LPS holds or we get the deeper Spring, the chart is offering some attractive upside targets. These are large TPs, not guarantees — simply the major resistance zones that stand out on the chart.

In short:

LPS may already be in → early long with tight risk.

Spring still possible → deeper test into S1 before the real markup.

Pivot structure supports both paths, with the Spring offering the cleaner confirmation.

Either way, AVL is entering a part of the cycle where the chart finally matters again.

*Please note arrows are not time based just overall price path expected

EURUSD analyticsAfter the downward movement on the chart, there was an upward wave. It began with the formation of an order block at the bottom. Then we saw a return to the order-block zone with a strong bullish candle.

In addition to this, I also see potential Wyckoff accumulation here, which can also reverse the price.

I expect a move toward the upper order block during this week.

Relief Rally Inbound? JOE is shaping up for a potential reversal.

After the aggressive October 10 sell‑off, price responded with a clean Automatic Rally (AR) before rolling over into a controlled pullback. This latest dip appears to be sweeping the October 10 lows, and the December 19 bullish engulfing candle is the first meaningful sign of demand stepping back in.

Crucially, price closed back inside the prior range, which keeps the structure constructive. While heavier volume on the reversal would’ve added confidence, the low‑volume nature of the sweep actually supports a spring narrative — supply has been drying up for weeks, and there’s been no evidence of aggressive selling pressure. That’s exactly what you want to see heading into a potential Wyckoff spring.

Trade Scenario

Initial TP would be just below the range EQ which lines up with the yearly pivot and 50% of the range retracement. From here, if the price can close, hold and form higher lows above this level, would strongly suggest that a bottom is in. The next meaningful upside target sits around $0.1296, where prior resistance and structural alignment converge.

Market Context

A surprising number of alts are printing similar spring‑like structures right now:

• Washed‑out lows

• Diminishing volume

• Reclaims back into range

• Early signs of demand returning

Reversal Incoming AVA is shaping up as one to watch.

The November low may have formed a high‑volume spring with a brief throw‑under of the wedge structure. It’s a constructive signal, but confirmation is still lacking. Price has yet to break back into the range and close convincingly.

For the bullish scenario, the key level is the new yearly pivot at $0.083.

Importance of this zone: it’s the first approach into the yearly pivot, it aligns with range‑low resistance, and it intersects the downward resistance trendline. A clean, impulsive break on increased volume and close above this cluster would signal real strength.

If that breakout occurs, the next expectation is a pullback to retest the spring, especially given the spring printed higher volume than the selling climax, making it a logical demand check.

Scenario 2

Since price is in high-risk zone a strong rejection here could result in a much deeper pullback. First zone of interest would be the yearly 1 pivot

AUC Pulling Into Key AOI

AUC setup is shaping up well. After the initial breakout on expanding volume, price has pulled back ~30% and now retesting the top of the prior range. That’s a healthy retrace, and structurally, the chart still leans bullish.

Entry

You could begin scaling in here, but the more compelling support zone sits closer to ~$0.56. Notably, October closed with heavy volume and a bearish engulfing candle so ideally, we want to see this pullback continue on declining volume with overlapping candles. That would signal absorption rather than distribution.

Take Profit (TP)

• First TP sits around the EQ of the monthly supply structure (already marked).

• Beyond that, there’s minimal overhead resistance, so you can trail stops using higher swing lows as they form.

Stop Loss (SL)

• Since we haven’t seen a new swing low (LPS) yet, the $0.220 LPS remains the logical invalidation point.

• Once a monthly higher low confirms, you can tighten the stop accordingly.

• Until then, risk management is key especially for a small cap stock

Structure Holds as LPS Reload LoomsCMW is shaping up well with a clean structural setup. Price action suggests we may be in the process of forming another Last Point of Support or Backup.

Trade Scenario

If price continues to pull back, monitor the highlighted zones for a potential entry. Since we do not yet have a confirmed higher low, the initial stop loss should be placed at the $0.330 low.

Risk management is critical here—avoid overexposure until structure confirms. If a higher low forms as outlined on the chart, the stop can be adjusted to that level.

That said, we are also working with a Gann fourth time breakout. This means price may not pull back immediately. If it breaks above the local high at $0.50, traders can look to the daily timeframe for a clean continuation setup toward the $0.57 zone.

As always, keep it simple and let structure lead. Risk management is the foundation—protect capital first, then let the trade work.

Confirming Chart Patterns With VolumeIn the chart above, one can clearly recognize the Wyckoff Market Cycle pattern. The pattern's legitimacy can be confirmed by volume. The volume is represented in the lower portion of the chart.

Low to average volume candles are blue. Average volume is indicated by light blue candles. Yellow candles represent higher than average volume. Orange is high volume. And red represents extremely high volume.

You will see each phase of the Wyckoff Market Cycle pattern confirmed by this volume on our current Bitcoin chart.

First, the market enters the accumulation phase. Market volume is fairly high, as seen in the accumulation quadrant in the lower left on the chart. However, it is important to note that there is an equal distribution of high-volume selling days as there are high-volume buying days. Thus, price tends to trend sideways within the channel until the true buying power comes into action.

Next, the buyers step in and take the price higher. This is generally indicated by a high-volume day when the price breaks above the accumulation channel. When buyers step in, most of the yellow and orange volume candles are, in fact, buyers in the markup phase. You can verify this is true by lining these higher-than-average volume candles up with the green price candles on the Bitcoin chart. This indicates the markup phase has begun and is underway.

Then, we come to the distribution phase on our chart. Notice the volume in that 3rd quadrant, the distribution quadrant. It is mostly average volume. Institutional sellers are attempting to carefully exit quietly. But you can also see that near the end of the distribution phase, sellers are starting to step in, tipping their hats and indicating that the distribution phase is about to end.

Finally, sellers take back full control, dropping us from the distribution channel altogether. High volume selling confirms this move and the pattern. The final quadrant in the bottom right proves that mostly sellers have control, as the majority of higher volume candles (yellow, orange, and red) are credited to the sellers.

Our Wyckoff Market Cycle pattern is now confirmed, and further selling can be expected until volume is once again taken back by the buyers. One will need to see clearly that high-volume candles are in line with green price candles. In this chart, that is not yet the case. Thus, more selling should be expected until it is clearly evident that buyer command control once again.

Hope you found this brief educational write-up informative and helpful, as volume can often be utilized in many uncertain pattern formations to find pattern legitimacy and confirmation.

✌️Stew

Rally Inbound?CORE looks poised for a potential rally. After the sharp October 10 sell-off, price staged an Automatic Rally (AR) before pulling back, now potentially sweeping the October 10 lows. The December 1 candle managed to close back within the prior range on what appears to be capitulative volume a constructive sign.

The immediate focus is the monthly pivot. A decisive close above this level, followed by a sequence of higher lows, would strongly suggest that the bottom is in place. From there, the next key resistance sits around $0.26.

One step at a time: first reclaim the pivot, then build structure above it.

Phase E incomming?AFG is shaping up with a structure that demands attention. Since August 25, price has retraced a clean 25% into the first key area of interest, with subsequent support zones clearly defined on the chart.

The ideal scenario is for price to hold above the purple box. Should it pierce that zone, any entry would need to be backed by a compelling signal for example, a bullish doji or hammer candle accompanied by a spike in volume. For now, price remains well above that level, so the focus is on taking it step by step.

For those employing a DCA approach, risk management is paramount. The invalidation level is set at the LPS low, which serves as the hard stop. This choice reflects the nature of small caps: price can wick through key zones and trigger stops, so anchoring risk to the LPS provides a more robust safeguard.

Once a clear monthly higher swing low is established, the stop can be adjusted and trailed beneath each new monthly swing low. The initial target sits just below the local August high. If price achieves a clean breakout above those highs, stops can be trailed further to capture the bulk of the move.

High R/R Opportunity from Key ZonesPrice has recently rallied into a key supply zone, so a reaction or rejection from this level is expected. While the projected path favors continuation, it's crucial to monitor the $0.320 support area. If we see a strong weekly bullish hammer-style candle with a solid close into this zone, that would trigger a long entry.

If price fails to hold $0.320, attention shifts to the $0.290–$0.270 range, which should act as a deeper support zone. From either level, the upside target remains $0.430, offering a compelling risk-to-reward profile for a staggered entry strategy.

3-Year Range Breakout in MotionXYZ is shaping up for a potential breakout after nearly three years of range-bound accumulation and it looks like it wants to push through relatively soon. Granted there is a key supply structure just above (marked), which should be respected, but given the duration of the base, a clean push through wouldn’t be surprising.

We’re watching for how price reacts in this zone:

A clean breakout could trigger a swift move toward higher levels.

A rejection would likely lead to a rebuild phase before another attempt.

Either way, the structure remains bullish.

Trade Scenario

Entry: Current price

Stop Loss: Below the LPS, with room for potential wicks

Take Profit:

TP1: Near the equilibrium of the supply zone (first reaction zone)

TP2: Near the all-time high

TP3: Trail stop below each new swing low to capture extended move

AMC Accumulation I believe NYSE:AMC has been in a large accumulation starting around April 24'. The most recent break below the range on decreasing volume leads me to believe we are in Phase C. In order for this to be a Spring, we need to see strong volume come into the upside to break back into the range and a test of Supply. A break above Supply would be a Sign of Strength. (SOS) While many scream fundamentals, I choose to trade the chart. With that said, a strong Q4 could flip net profit positive. (HUGE) I see deep value in AMC if they can pull off profitability in Q4. This is just my opinion and what I see on the chart. I am focused on the Wyckoff events and phases. As far as timing, I wish I could remove the dates below the chart. This is my thesis.

Originally posted on Nov. 19th. Had to remove due to educational link to external source explaining what accumulations and distributions are.

Sideways Risk Until Breakout ClearsHDN is showing some promise here, but the reaction at this level is critical. Price has pulled back to the top of the range and bounced, yet there’s still no clear signal that the pullback has fully run its course. Extra caution is warranted, especially since price dipped below the macro 50% level, a key area that often defines broader trend strength.

Given these conditions, the prudent play is to stay conservative and wait for confirmation. A clean break and close above $1.415, ideally accompanied by rising volume and wider candle spreads, would signal genuine strength. While this approach may mean giving up a portion of the early gains, it ensures you’re buying into momentum rather than risk. Without that confirmation, price could easily slip back into the range and churn sideways for longer.

If the above plays out, TP 1 would be just below the EQ of supply structure and LVN zone as marked. From here, there isn't much resistance until ATH. For SL trail with higher weekly swing lows to capture the move.

17-Year Reaccumulation Unfolding—Bullish Structure in Play*re uploaded chart as was deleted - nothing changed even after all the negative around BHP over the past week

BHP is setting up a generational move. After ~17 years of reaccumulation, price has carved out an uprise structure.

Currently, price is holding above the breakout zone, showing strong signs of absorption. Declining volume paired with heavy candle overlap suggests sellers are being absorbed and demand is quietly stepping in.

Scenario

• Entry: Begin layering now. Structure supports accumulation, and price is retesting demand.

• Stop-Loss: Anchor below the Last Point of Supply (LPS). Once monthly swing lows form, SL can be raised to protect gains.

Targets

• TP1: ~$80 the minimal range projection based on a clean 100% extension. Fast and achievable.

• Extended target: Price could easily push well beyond the range target. Trail SL using monthly swing lows to capture the full move.