XAG/USD Bullish Structure Signals Upside Continuation!🔥 XAG/USD — SILVER vs U.S. DOLLAR

📊 Metals Market Opportunity Blueprint (Day / Swing Trade)

🧭 Market Bias

🟢 BULLISH PLAN CONFIRMED

Silver continues to show strength with bullish momentum supported by macro and metals-sector flows. Volatility expansion favors trend continuation traders.

🟢 Trade Execution Plan

📌 Entry:

✅ Buy at any price level

➡️ Suitable for scaling, cost-averaging, or momentum entries based on individual strategy.

🛑 Risk Management

🔻 Stop Loss: 73.000

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

This SL is not mandatory. Adjust according to your own risk management & position sizing.

Trading involves risk — manage capital wisely.

🎯 Profit Objective

🎯 Target: 80.000

📍 Strong resistance zone detected

📍 Overbought conditions possible near highs

📍 Potential correction & liquidity trap expected

🚨 Kindly secure profits near resistance levels.

⚠️ TP level is guidance only — adapt exits based on market behavior and your strategy.

🔗 Related Markets to Watch (Correlation Focus)

💵 U.S. Dollar Index (DXY)

📉 Weakening USD = Bullish for Silver

📈 Strong USD = Headwind for XAG/USD

🟡 XAU/USD (Gold vs USD)

Silver often follows Gold’s directional bias

Gold strength usually confirms Silver upside momentum

📈 US10Y Treasury Yields

Falling yields → Supports precious metals

Rising yields → Pressure on non-yielding assets like Silver

🛢️ WTI Crude Oil (USOIL)

Inflation expectations linked to energy prices

Rising oil can indirectly support Silver as an inflation hedge

🌍 Fundamental & Economic Factors to Watch

🏦 Federal Reserve Policy

Rate cut expectations → Positive for Silver

Dovish tone weakens USD, boosting metals

📊 U.S. Inflation Data (CPI / PCE)

Higher inflation → Silver demand as a hedge

Cooling inflation may slow momentum temporarily

🏭 Industrial Demand Outlook

Silver has strong use in solar panels, EVs, electronics

Global manufacturing recovery supports long-term demand

🌐 Geopolitical & Risk Sentiment

Market uncertainty → Safe-haven inflows into metals

Risk-off environments favor Silver accumulation

🧠 Trader’s Note

📌 This is a market opportunity blueprint, not financial advice.

📌 Trade responsibly, manage risk, and adapt to live market conditions.

Xagusdforecast

#SILVER(XAGUSD): Another Big Buy In Making, 2026 We Are Ready! **SMC|ICT Based Analysis On Silver (XAGUSD)**

Dear Traders,

We extend our best wishes for the upcoming New Year.

🔺Today, we will analyse Silver (XAGUSD). The month of December typically presents reduced market liquidity and volume due to numerous holidays. The market initiated with a positive liquidity gap at $83.50, subsequently experiencing a significant decline. The price descended to $70.44 and is currently trading at $71.51. This substantial sell-off indicates a high probability of further price depreciation. We anticipate the price to fall within the range of $68 to $66.

🔺Entering a position within our identified key levels may prove profitable, with take-profit targets established at the following key levels: the first at $75, the second at $78, and the swing key level at $85. These levels should be utilized as take-profit objectives. For stop-loss placement, we suggest setting it at $66, or at your discretion.

🔺We wish you a prosperous New Year and hope this year fulfils your aspirations. We sincerely appreciate your continued support throughout the years.

Team SetupsFX_

Silver: pause in motionAfter its recent rally, XAGUSD has shifted into a calmer phase. The wave structure points to the formation of a corrective movement, where upward impulses are followed by pullbacks, creating a balance between buyers and sellers.

The chart shows that the price is holding within the mid-range, while attempts at growth face resistance. Downward fluctuations do not yet appear to be a full-fledged reversal, but rather reflect the market’s desire to adjust previous impulses.

The fundamental backdrop remains mixed: interest in safe-haven assets supports silver, while expectations of dovish U.S. policy and fluctuations in commodity demand create conditions for a temporary pause in growth.

As a result, XAGUSD is showing neutral movement with a corrective bias, where further development will depend on the market’s ability to stay within the current range and find new drivers.

XAG/USD - MonthlyOANDA:XAGUSD

Following up on the previous analysis (the link to which is provided below), the price of silver successfully reached the predetermined price target (or announced range) as anticipated.

Link

We now present a new, long-term analysis based on monthly chart data, spanning from 1980 to the present day.

Important Note: Due to the extended time horizon of this analysis, reaching the outlined price objectives may take several years. Therefore, this analysis is exclusively suitable for long-term investors in the silver market.

XAG/USD: Major Resistance Cleared, What Comes Next?🥈 XAG/USD — SILVER VS U.S. DOLLAR

Metals Market • Swing / Day Trade Opportunity Guide 🧭📈

⚙️ Market Outlook — Bullish Confirmation

Silver has broken through a major resistance zone, shifting momentum firmly into bullish territory.

This breakout signals the presence of strong buyers stepping in, making the market attractive for both short-term and swing-trade setups.

🎯 Trade Plan

📌 Entry:

Enter at any available level after the confirmed breakout retest.

Bullish continuation patterns are forming, giving us a clean pathway to the upside.

🛡️ Stop Loss — Thief Style SL @ 57.000

Dear Ladies & Gentlemen (Thief OG’s), secure your capital wisely.

Adjust SL according to your personal system, risk appetite, and style.

I do not recommend copying my SL blindly — your strategy = your rules.

🎯 Target — Profit With Precision @ 62.000

We have:

🧱 Strong resistance zone

🔥 Overbought conditions expected

🎭 Potential bull-trap areas above

So escape with profits once the market hits our zone.

Dear Ladies & Gentlemen (Thief OG’s), your TP is also your choice — manage your profits with discipline.

🔗 Correlated & Related Pairs to Watch ($ Versions Included)

Tracking these helps confirm momentum, spot divergences, and follow overall metals sentiment.

1️⃣ XAU/USD (Gold vs USD) — TVC:GOLD

Why watch?

Gold and Silver often move together due to safe-haven demand.

When Gold surges strongly while Silver lags, Silver usually follows.

If Gold rejects from resistance, Silver may also cool off.

Key Point:

Gold strength = higher probability continuation in Silver’s bullish wave.

2️⃣ XAU/XAG (Gold-to-Silver Ratio) — $GoldSilverRatio

Why watch?

A falling ratio means Silver is gaining strength faster than Gold.

A rising ratio signals Silver weakness.

Key Point:

A drop in the ratio supports our bullish Silver narrative.

3️⃣ DXY (US Dollar Index) — TVC:DXY

Why watch?

Silver is priced in USD.

When DXY drops, metals typically rise due to USD weakening.

Key Point:

If TVC:DXY shows bearish momentum → Silver bullish continuation is more confident.

4️⃣ XAG/EUR (Silver vs Euro) — OANDA:XAGEUR

Why watch?

Useful to understand Silver’s global demand, not just USD-denominated.

If Silver is bullish across currencies, then the trend is fundamentally strong.

Key Point:

Multi-currency strength confirms genuine Silver demand.

5️⃣ Copper Futures (HG) — CAPITALCOM:COPPER

Why watch?

Silver has partial industrial demand.

When copper rises, it signals industrial activity strength → bullish for Silver.

Key Point:

Copper strength = supportive macro backdrop for Silver.

🧠 Final Outlook

A clean breakout, supportive cross-metal correlations, and favorable USD weakness give Silver an attractive path toward 62.000.

Trade smart, protect your capital, lock in profits, and execute like true Thief OG’s. 🥷📊

Silver: corrective pause after growthSilver (XAGUSD) has entered a corrective phase after a confident rally. The chart shows that upward impulses have begun to lose strength, while the price is gradually shifting lower, forming a pullback structure.

The current dynamics suggest that the market is seeking balance after the previous rise. Corrective moves are becoming more pronounced, and consolidation near local resistance levels reflects buyer caution.

The fundamental backdrop also provides no clear support: interest in safe-haven assets remains, but dollar strength puts pressure on silver. As a result, the asset stays in a corrective zone, where the next direction will depend on the reaction to key levels.

Thus, XAGUSD is in a pullback phase, and the market’s next steps will determine whether the correction develops into a deeper decline or becomes preparation for a new impulse.

Silver Outlook Turning Stronger — Bullish Setup in Play!🥈 XAG/USD SILVER SURGE | Bullish Swing Trade Setup 📈

🎯 TRADE SUMMARY

Asset: XAG/USD (Silver vs US Dollar) | Metals Market 💰

Strategy: Swing Trade | Bias: BULLISH ⬆️

Risk/Reward: Professional Grade | Timeframe: Multi-Day Setup

📍 ENTRY STRATEGY - LAYERED APPROACH 🔄

Recommended Entry Zones (Multiple Buy Limit Orders)

1st Entry: $49.000 - Initial Position 20% 📌

2nd Entry: $49.500 - Add Position 30% 📌

3rd Entry: $50.000 - Final Entry 50% 📌

Strategy: Use limit orders at each level for better execution. Scale in progressively to optimize average entry price. This approach reduces risk and increases position efficiency.

🛑 STOP LOSS

Recommended SL Level: $48.000

⚠️ RISK DISCLAIMER: This is a suggested level based on technical structure. You must adjust your stop loss according to YOUR personal risk management, account size, and trading strategy. There is NO one-size-fits-all SL - ownership of risk is yours alone.

🎪 PROFIT TARGETS 🚀

Primary Target: $54.000

Confluence Factors:

Strong Resistance Zone Identified ✓

Overbought Condition Setup ✓

Potential Trap/Correction Reversal ✓

Bullish Breakout Extension ✓

⚠️ TP DISCLAIMER: This target is based on technical analysis. You control your profit-taking strategy. Consider taking partial profits at key resistance levels. Lock in gains at YOUR discretion - this is YOUR trading decision.

🔗 CORRELATED PAIRS TO MONITOR 📊

1️⃣ DXY (US Dollar Index) - INVERSE CORRELATION

Why: Silver prices move inversely to dollar strength

Watch For: If DXY weakens 📉, XAG typically strengthens 📈

Key Level: Monitor 103.50-105.00 zone

2️⃣ EURUSD - INDIRECT CORRELATION

Why: Euro strength correlates with silver strength (risk-on sentiment)

Watch For: EURUSD above 1.1000 supports silver bullish bias

Key Level: 1.0950-1.1050 range critical

3️⃣ GOLD/USD (XAU/USD) - POSITIVE CORRELATION

Why: Precious metals move together in risk-off/on scenarios

Watch For: Gold breaks above 2,700 = Silver momentum likely follows

Key Level: XAU/USD 2,650-2,750 zone

4️⃣ SPX500 (S&P 500) - RISK SENTIMENT

Why: Equities strength supports risk-on sentiment, bullish for silver

Watch For: SPX breaks 6,000+ supports precious metals outflow

Key Level: 5,850-6,050 pivot zone

5️⃣ COPPER/USD (HG) - INDUSTRIAL DEMAND

Why: Copper demand correlates with economic growth = Silver bullish signal

Watch For: HG above 4.30 = Risk-on sentiment confirmed

Key Level: 4.20-4.35 critical range

📈 KEY TECHNICAL POINTS

✅ Bullish Structure: Lower highs/lows pattern breaking

✅ Momentum: Building strength in watch zone

✅ Risk/Reward: Favorable 1:2+ setup

✅ Entry Precision: Multiple confirmation levels

✅ Exit Clarity: Clear profit target defined

⚡ QUICK TRADE CHECKLIST

Confirm DXY weakness before entry

Check Gold (XAU/USD) above 2,650

Verify EURUSD above 1.0950

Set all 3 limit orders at entry zones

Place SL at 48.000 (adjusted to YOUR risk)

Divide position into TP tranches

Monitor correlated pairs daily

🎓 TRADER'S NOTES

This analysis reflects current technical structure as of publication. Market conditions evolve. Adjust strategy based on:

Market news/data releases

Central bank decisions

Geopolitical events

Real-time price action

Remember: Past performance ≠ Future results. Trade with discipline. Manage risk first, profits follow.

💡 LIKE if helpful | 📌 SAVE for reference | ✅ FOLLOW for updates

Technical Analysis | Swing Trading | Metals Market | XAG/USD Strategy

XAGUSD 4h

XAG started bullish movement, as we see there is a strong resistance area (red rectangle), price can react and drop from there or make a range and then start bullish to make an ATH again.

As we can see the beautiful reactions on Fibonacci levels with stronger buyers.

Price has touched the top resistance two times and made "Higher low" after second touch. (blue highlight dots)

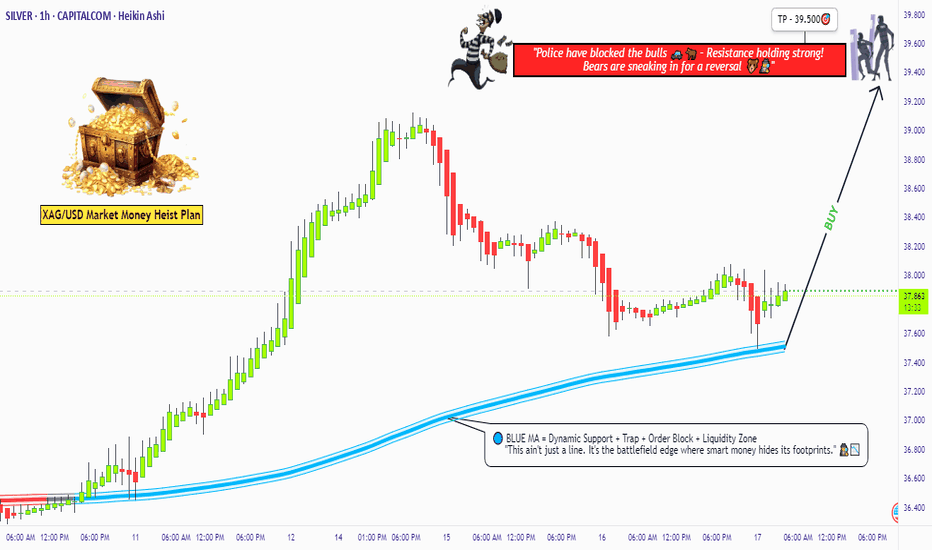

Market Insight: Silver’s Next Move Hinges on MA Breakout!🎯 XAG/USD: The Great Silver Heist - Bearish Breakout Setup! 💰

📊 ASSET OVERVIEW

Pair: XAG/USD (Silver vs U.S. Dollar)

Market: Precious Metals

Strategy Type: Swing/Day Trade

Bias: 🐻 BEARISH

🎭 THE HEIST PLAN (Trading Setup)

🔴 Entry Zone: The Breakout

Level: $49.50 (MA Breakout Zone)

Signal: Waiting for price to break below moving average support

Confirmation: Clean break with volume + momentum shift

🛑 Stop Loss: The Safety Vault

Level: $52.00

Purpose: Protection for potential pullback scenarios

Note: This SL accommodates a possible bounce before continuation down

⚠️ Risk Disclaimer: Fellow traders, this stop loss is MY risk tolerance. YOU decide your own risk parameters. Trade what YOU can afford to lose. Your money, your rules! 🎰

🎯 Target: The Escape Route

Primary Target: $47.00

Why This Level?

🚧 Strong resistance zone acting as support (role reversal)

📈 Overbought conditions on lower timeframes

Potential bull trap zone - perfect profit extraction point

⚠️ Profit Disclaimer: This is MY target based on MY analysis. YOU make your own profit decisions. Lock gains when YOUR strategy says so. Always secure the bag at YOUR comfort level! 💼

🔍 TECHNICAL ANALYSIS BREAKDOWN

Key Factors:

Moving Average Breakdown - Price rejecting MA as new resistance

Market Structure - Lower highs forming on H4/D1 timeframes

Resistance Cluster - Multiple confluences at $52 area

Volume Profile - Decreasing buy pressure

What I'm Watching:

📉 Sustained close below $49.50

📊 Volume confirmation on breakdown

🕒 Time alignment with USD strength cycles

💱 RELATED PAIRS TO MONITOR (Correlation Watch)

Metals Family:

XAU/USD (Gold) - Moves in tandem with silver ~70% correlation

GC1! (Gold Futures) - Leading indicator for precious metals sentiment

HG1! (Copper Futures) - Industrial metals correlation

USD Strength Plays:

TVC:DXY (Dollar Index) - Inverse correlation with metals

FX:EURUSD - Risk-on/risk-off sentiment gauge

FX:USDJPY - Safe haven flow indicator

Key Point: When DXY 📈 = Precious metals 📉 typically. Watch Fed policy signals and real yields for directional bias!

🎪 THE "THIEF STYLE" STRATEGY PHILOSOPHY

This setup follows the "steal profits when the market sleeps" approach:

🎯 Identify overextended moves

⏰ Wait for breakout confirmation

💨 Execute with precision

🏃 Escape before the reversal

It's all about timing, patience, and taking what the market gives!

Conduct your own research (DYOR)

Use proper risk management

Never risk more than you can afford to lose

Consider consulting a licensed financial advisor

💼 No Guarantees: No trading outcome is guaranteed. Markets are unpredictable. Trade responsibly!

📢 ENGAGEMENT FOOTER

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

🏷️ HASHTAGS

#XAGUSD #Silver #PreciousMetals #BearishSetup #SwingTrading #DayTrading #ForexTrading #MetalsTrading #TechnicalAnalysis #BreakoutStrategy #SilverTrading #USD #DXY #ForexSignals #TradingIdeas #ChartAnalysis #PriceAction #RiskManagement #ForexCommunity #TradingView #MarketAnalysis

🎬 End of Analysis | Trade Safe, Trade Smart! 🎬

#XAGUSD(SILVER): Bears In Control Three Targets Swing SellSilver’s price dropped significantly yesterday, continuing a trend from last week’s Thursday when substantial trading commenced.

The data suggests an increase in bearish volume, indicating a potential selling opportunity. To identify a more precise entry zone, we should utilise smaller timeframes.

Once this is established, we can create a trading plan with strict risk management. Upon entry, we can select a suitable take-profit area based on our individual trading style and risk management preferences.

For further information, please like and comment on the ideas. Any questions comment down and we will happy to help.

Team Setupsfx

Silver Rally in Play – Prepare Layered Entries!🔥 Silver Heist: XAG/USD Day Trade Wealth Map 🤑💰

🎉 Ladies & Gentlemen, Welcome to the Thief’s Vault! 🚨 Get ready to swipe some shiny profits with this XAG/USD (Silver vs. US Dollar) bullish breakout plan! Our Metal Market Wealth Strategy Map is locked and loaded for a day trade adventure. Let’s dive into the heist with a polished, professional, yet sneaky fun vibe! 😎

📈 The Setup: Bullish Bandits on the Move! 🐂

🔍 Market Context: Silver (XAG/USD) is flashing bullish vibes 📡 with a confirmed Least Squares Moving Average (LSMA) pullback. The price has swept liquidity at the dynamic moving average support, giving bull traders the upper hand. 💪

🚀 Why It’s Hot: The bulls are charging as the price respects the dynamic support, signaling strength and a potential breakout. The market’s screaming, “Time to stack those silver bars!” 🪙

🏦 The Heist Plan: Thief-Style Layered Entries 🎯

🛡️ Entry Strategy: We’re using the infamous Thief Layering Strategy! 🕵️♂️ Place multiple buy limit orders to catch the price at key levels. Suggested entry layers:

$42.50

$43.00

$43.50

💡 Pro Tip: Feel free to add more layers based on your risk appetite! Stack those orders like a master thief. 😏

📝 Entry Note: You can enter at any price level within the bullish zone, but layering gives you the edge to scale in like a pro. 📊

🛑 Stop Loss: Protect the Loot! 🔒

🛑 Thief SL: Set your stop loss at $41.50 to keep your capital safe from market traps. 🕳️

📣 Note: Dear Thief OG’s (Ladies & Gentlemen), this SL is my suggestion, but it’s your heist, your rules! Adjust based on your risk tolerance and make those profits yours. 💸

🎯 Take Profit: Cash Out Like a Boss! 💼

🎯 Target: We’re aiming for $46.00, where strong resistance, overbought conditions, and potential traps await. 🪤 Lock in profits before the market pulls a fast one!

📣 Note: Dear Thief OG’s, this TP is my call, but you’re the master of your vault! Take profits at your discretion and secure the bag. 🤑

🔗 Related Pairs to Watch 👀

🔎 #XAUUSD (Gold vs. US Dollar): Gold and silver often move in tandem due to their precious metal correlation. A bullish XAU/USD could reinforce our XAG/USD setup. 🪙

🔎 USD Index (#DXY): A weaker US dollar typically boosts precious metals. Watch for DXY weakness to confirm bullish momentum in XAG/USD. 📉

🔎 #AUDUSD: The Aussie dollar has a positive correlation with silver due to Australia’s commodity-driven economy. A rising AUD/USD could signal strength in XAG/USD. 🇦🇺

🔑 Key Points & Correlations

🔔 Liquidity Sweep: The recent pullback to the LSMA support cleared out weak hands, setting the stage for a bullish surge. 🚀

🔗 Correlation Insight: Silver’s price action often mirrors gold (XAU/USD) due to their shared safe-haven status. A declining DXY or rising AUD/USD can amplify this setup’s potential. 📊

⚖️ Risk Management: Use the layered entry strategy to spread risk and maximize reward. Always respect your stop loss to avoid getting caught in a market trap! 🕵️♂️

⚠️ Disclaimer

This is a Thief-Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and I’m not a financial advisor. Always do your own research and trade at your own risk. 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#️⃣ #XAGUSD #Silver #DayTrading #ThiefStrategy #Bullish #TradingView #SilverTrading #DayTrade #ThiefTrader #LSMA #ForexStrategy #MetalMarket #TradingIdeas #LayeredEntries #BullishSetup #TradingView

#SILVER: Will Price Momentum Take The Silver To $60?Metals is on the verge of reaching another record high after touching the $54 price point. It is highly probable that it will reach $60 or beyond. Currently, a smaller timeframe is suitable for minor corrections. Once a confirmation is obtained, a trade with strict risk management can be executed.

Best wishes and safe trading.

Team Setupsfx

XAGUSD(SILVER):To $60 the silver is new gold, most undervaluedSilver has shown remarkable bullish behaviour and momentum, in contrast to gold’s recent decline. Despite recent news, silver remains bullish and unaffected by these developments. We anticipate that silver will reach a record high by the end of the year, potentially reaching $60.

There are compelling reasons why we believe silver will be more valuable in the coming years, if not months. Firstly, the current price of silver at 36.04 makes it the most cost-effective investment option compared to gold. This presents an attractive opportunity for retail traders, as gold may not be suitable for everyone due to its nature and price.

Silver’s price has increased from 28.47 to 36.25, indicating its potential to reach $60 in the near future. We strongly recommend conducting your own analysis before making any trading or investment decisions. Please note that this analysis is solely our opinion and does not guarantee the price or future prospects of silver.

We appreciate your positive feedback and comments, which encourage us to provide further analysis. Your continuous support over the years means a lot to us.

We wish you a pleasant weekend.

Best regards,

Team Setupsfx

SILVER (XAGUSD): Strong For Weeks! Continue To Buy! It!In this Weekly Market Forecast, we will analyze the XAGUSD (SILVER) for the week of Sept. 22 - 26th.

Silver has been strong for weeks. The industries continue strong demand from solar, electric vehicles and electronics. That, combined with supply constraints, continues to lend support to silver.

Bullish FVGs, bullish BOSs, and OLHC candles point to higher prices.

No reason to short this market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAG/USD Technical + Macro Analysis ¦ Bullish Layer Strategy⚡ XAG/USD Silver Swing & Scalping Trade | Thief Layer Strategy

🛠️ Trade Plan (Bullish Pending Order)

Entry (Breakout Trigger): $41.400 ⚡

Layered Entries (Thief Strategy):

$41.000

$41.200

$41.400

(You can increase/reduce limit layers based on your own plan — confirm after breakout. Set TradingView alarms for alerts.)

Stop Loss (Thief SL): $40.600 (after breakout confirmation)

⚠️ Adjust your SL according to your own risk tolerance.

Target (Exit Zone): $42.200 🎯

Resistance + overbought + trap zone = take profit opportunity.

💡 Thief Strategy = Using multiple buy limit orders (layering style entries) to scale into position at breakout confirmation levels.

🔎 Why This Plan (Thief Style)

✅ Technical breakout aligned with resistance test.

✅ Fundamentals & sentiment confirm upside bias.

✅ Layering entries reduce risk & capture volatility.

✅ Plan respects upcoming macro events → CPI & Fed.

📊 XAG/USD Real-Time Data

Daily Change: +0.56% (▲ +0.23)

Day’s Range: $40.54 – $41.34

52-Week Range: $27.70 – $41.49

Year-to-Date Performance: +42.32% 🚀

😰😊 Fear & Greed Index

Stock Market Sentiment: Greed (53/100) 📈

Crypto Sentiment: Neutral (0/100)

Drivers:

Weak US labor data → boosting Fed rate cut expectations.

S&P 500 above 125-day MA → bullish momentum.

Low VIX → reduced fear.

📉📈 Trader Sentiment Outlook

Retail Traders:

Bullish (Long): 60% 😊

Bearish (Short): 40% 😰

Institutional Outlook:

Technical Bias: Strong Buy ✅

🌍📉 Fundamental & Macro Drivers

Fed Rate Cut Probability (Sep 2025): 100% ✅

US Dollar Weakness → supports precious metals.

Upcoming Events:

📅 Sep 11: CPI Report (volatility risk).

📅 Sep 16–17: Fed Meeting (critical rate decision).

Industrial Demand: Electronics + solar keeping silver in steady demand.

🐂🐻 Overall Market Outlook

Bias: Bullish (Long) 🐂

Score: 75/100 (Strong upside potential).

Why Bullish?

Technical indicators = Strong Buy signals.

Fed dovish stance → USD weakness.

Geopolitical risks → safe-haven demand.

Risks: Hot CPI data → possible USD rebound.

💎 Key Takeaways

Silver is up +42% YTD → momentum intact.

Breakout levels align with Thief Layer Strategy.

Fed meeting (Sep 16–17) = major catalyst.

CPI data (Sep 11) = short-term volatility watch.

🔗 Related Pairs to Watch

OANDA:XAUUSD (Gold)

TVC:DXY (US Dollar Index)

AMEX:SLV (Silver ETF)

COMEX:GC1! (Gold Futures)

COMEX:SI1! (Silver Futures)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Silver #XAGUSD #ThiefTrader #SwingTrade #Scalping #Commodities #Breakout #LayerStrategy #Fed #CPI #Metals

Silver XAGUSD Overextended With Range-Bound Price Action🥈 XAGUSD (Silver) is overextended in my view 📈. Price has recently pushed into new highs 🔼 and is now moving sideways in a range 📊—often a sign that larger entities 💼 may be working their orders.

⚖️ This could be a form of distribution, as silver has moved into a zone of thin liquidity 🌊. To facilitate bigger positions, institutions may need to generate liquidity by keeping price sideways ⏸️ before the next move.

📉 My current bias is for a retracement back into equilibrium ⚖️ and towards an unresolved bullish imbalance 🔍 that remains below.

⚠️ This is for educational purposes only, not financial advice 📚

XAG/USD Market Robbery Plan – Entry, SL, and Escape Route💎 XAG/USD Silver vs U.S Dollar Heist Plan (Swing/Scalping Trade) 💰🚀

🌟Hello Money Makers, Robbers & Thief OG’s🌟

The vault is open… and this time it’s SILVER (XAG/USD)! ⚡

Based on our 🔥Thief Trading Style🔥, here’s the robbery blueprint:

📈 Entry (The Break-In):

The thief doesn’t wait at the door… we layer in quietly. Place multiple buy limit orders at:

(39.900)

(39.700)

(39.500)

(Feel free to add more layers if you want to expand the robbery bag 🏦).

Any pullback = our silent entry.

🛑 Stop Loss (Thief Escape Route):

This is Thief SL @38.700.

But remember, dear Ladies & Gentleman (Thief OG’s), adjust SL according to your own risk appetite & position size.

🎯 Target (The Police Barricade 🚓):

Police waiting heavy at 42.000 – so don’t get caught!

Our escape van target is set @ 41.000 💰.

Grab the loot and vanish before the chase starts! 🏃♂️💨

💎 Thief Notes:

Silver shines but can trap greedy robbers. Always layer in wisely, manage risk, and respect the Thief Code.

⚠️ Trading Alert:

Beware of sudden news explosions 📢 – they trigger alarms in the market vault! Use trailing SL if the loot gets heavy.

🔥💵 Support our robbery squad 💥Hit the Boost Button💥 to fuel the getaway car 🚘💨.

Every like = more strength for our crew. Stay sharp, stay stealthy, and keep robbing the market with Thief Trader Style! 🏆🥷💰

#SilverHeist #XAGUSD #ForexThief #SwingTrade #ScalpingPlan #LayeringStrategy #ThiefTrader #MarketRobbery #BullishSilver #SmartTrading

"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

"XAG/USD: BULL FLAG FORMING? LAST CHANCE TO JUMP IN!"🔥 XAG/USD "SILVER RAID" – Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

Based on the 🚨Thief Trading Style🚨 (a ruthless mix of technicals + fundamentals), we’re plotting a day/swing trade heist on XAG/USD (Silver). Our mission? Loot bullish gains before hitting the police barricade (resistance zone). Stay sharp—this is a high-risk, high-reward escape plan with overbought signals and bearish traps lurking!

📜 THE HEIST BLUEPRINT

🎯 Entry (Bullish Swipe):

"Vault is OPEN!" – Long at any price, but for smarter thieves:

Buy limit orders near swing lows/highs (15m-30m TF).

DCA/Layering strategy: Spread entries like a pro bandit.

🛑 Stop Loss (Escape Route):

Nearest swing low/high (1H candle body/wick) → 36.700 (adjust based on risk & lot size).

Risk management is key! Don’t get caught by the market cops.

🏴☠️ Take Profit (Escape Before Handcuffs!):

First Target: 38.500 (or bail earlier if momentum fades).

Scalpers: Only play LONG! Use trailing SL to lock profits.

💡 WHY THIS HEIST? (Market Drivers)

Bullish momentum in Silver (XAG/USD) fueled by:

Macro trends (COT report, sentiment shifts).

Intermarket moves (Gold correlation, USD weakness).

Potential breakout from consolidation.

⚠️ News Risk: Major releases can trigger volatility—avoid new trades during high-impact events!

🚨 THIEF'S PRO TIPS

✅ Trailing SL = Your getaway car.

✅ Small accounts? Ride the swing traders’ coattails.

✅ Big wallets? Go full-throttle.

✅ Boost this idea 💥 to strengthen our robbery squad!

📌 DISCLAIMER (Stay Out of Jail!)

Not financial advice! DYOR, manage risk, and adapt to market changes.

Silver is volatile—trade smart, not greedy.

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🕵️♂️

🔗 Want the Full Intel?

Check the fundamentals, COT reports, and intermarket analysis for deeper clues! (Klick the 🔗🔗).

💬 Drop a comment if you’re joining the heist! 👇