XAG/USD - H1 – Wedge Breakout | Silver Bullish Reversal SetupSilver (XAG/USD) has formed a well-structured falling wedge on the H1 timeframe , a classic bullish reversal pattern. Price is now attempting a breakout from the upper trendline after strong reactions from the lower boundary. OANDA:XAGUSD

📊 Technical Overview

The falling wedge shows decreasing bearish momentum, often seen before a trend shift.

Multiple touches on both trendlines confirm the validity of the pattern.

Price reacted strongly from a key demand zone, indicating buyer interest at lower levels.

If the breakout holds, upside potential opens toward psychological levels and higher-timeframe resistance zones.

As long as price remains above the demand area, bullish continuation remains in focus.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

Xagusdlong

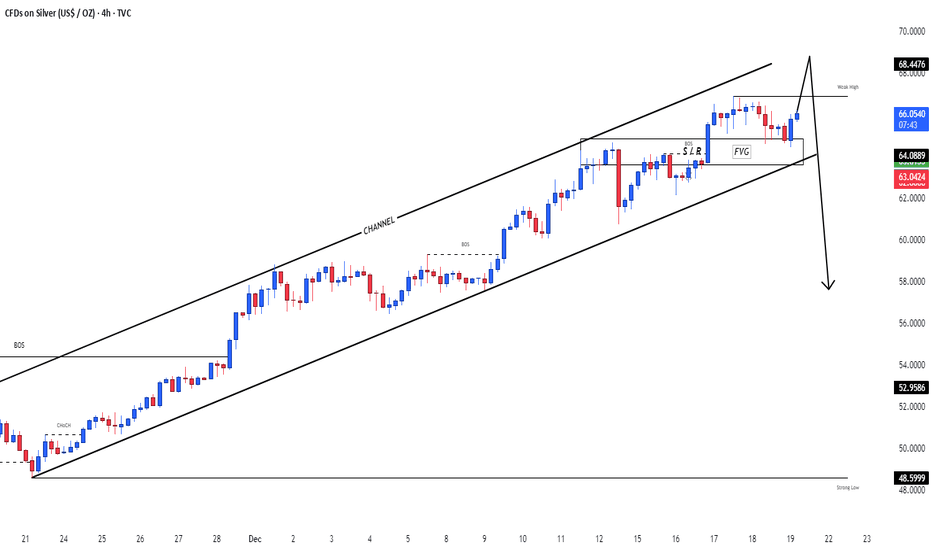

Silver — False Breakdown Signals Potential Bottom.In my previous Silver analysis, I mentioned that although price had found support around the 73 zone, it was clearly pressing into that level and a breakdown was possible.

That breakdown did happen.

Price pushed below support and dropped toward 64, but what followed is very interesting — and potentially informative for what comes next.

🔎 What the Market Told Us

After the dip to 64:

- price reversed quickly

- reclaimed the 73 support

- and confirmed the move as a false break

False breaks matter because they often trap sellers and shift momentum.

To add to this, the new week opened in the Asian session with a break above the falling trendline, further suggesting that bearish pressure may be fading.

📈 What This Could Mean

These developments increase the probability that a local bottom may be in place, opening the door for a potential leg higher toward:

🎯 90 zone

That becomes the logical upside objective if momentum builds.

📌 Key Zone for Bulls

The area bulls should monitor closely is:

👉 72.50–75.00

This is where buying interest may offer the best structure.

⚠️ VERY IMPORTANT NOTES

Silver is not a forgiving market right now.

1️⃣ Volatility Reality

If Gold is volatile these days, Silver’s volatility is extreme.

Daily swings are enormous...

2️⃣ Stop-Loss Logic

- A technically correct stop sits below 70.

- So a buy around 75 implies roughly a 7% risk.

- That makes this type of trade viable only with:

👉 very low leverage (max. 1:2)

Anything larger becomes gambling.

3️⃣ Risk-Reward Matters

From a pure risk-to-reward perspective, this trade only makes sense if you are targeting:

🎯 90 USD

Without that upside objective, the math simply doesn’t justify the exposure.

✅ Conclusion

Silver may be forming a bottom, but this is still a high-volatility environment.

Good opportunity? Possibly.

Easy trade? Definitely not.

Size small.

Respect volatility.

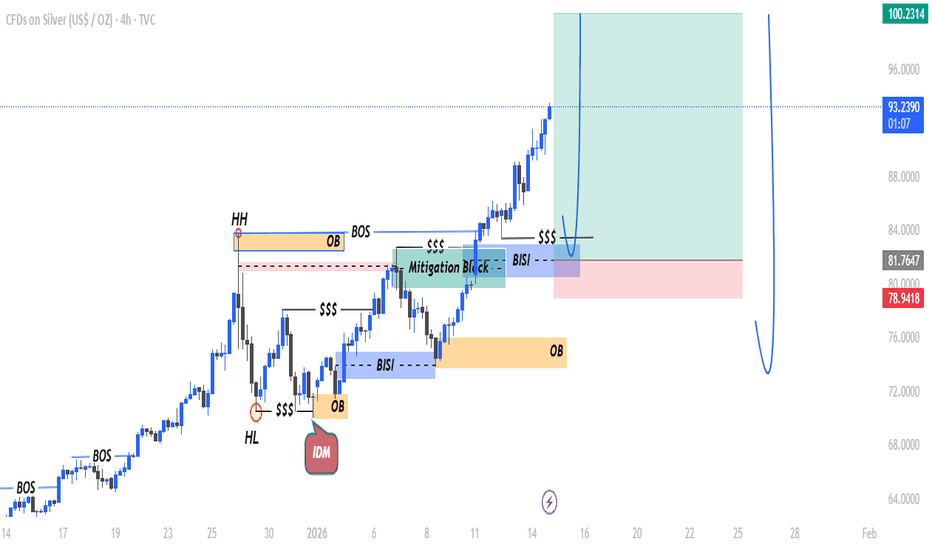

SILVER (XAGUSD) 4H — Smart Money Continuation Read Description.SILVER (XAGUSD) 4H

— Smart Money Continuation | BOS, Mitigation & Liquidity Roadmap

This Silver (XAGUSD) analysis is the result of deep structure reading, liquidity mapping and smart money execution logic — not random lines or assumptions.

From the left side of the chart, price respected multiple BOS (Break of Structure), confirming a strong bullish market condition. Each BOS was followed by continuation, showing that buyers were in full control and weak sellers were consistently removed from the market.

After forming a clear Higher Low (HL), price expanded aggressively and created a Higher High (HH).

This expansion left behind clean inefficiencies (BISI) and order blocks (OB) — areas where institutions executed large positions and price moved with intention.

Price then returned into the mitigation block, where previous imbalance and liquidity aligned perfectly.

This is not a coincidence — smart money often revisits these zones to rebalance inefficiency before continuing the primary trend.

The repeated SSS (Sell-Side Liquidity) markings show how liquidity was engineered and collected step by step.

Once sell-side liquidity was absorbed, price had no reason to stay low — resulting in strong continuation to the upside.

The roadmap on the chart highlights the logic clearly: • Liquidity is taken first

• Imbalance is revisited and mitigated

• Order blocks act as re-accumulation zones

• After rebalancing, price seeks higher external liquidity

This is not a signal and not financial advice.

It is a story of how price is delivered by smart money, written directly on the chart for those who know how to read it.

Markets don’t move randomly —

they move to fill orders, rebalance inefficiencies, and hunt liquidity.

🧠 Final Thought

If you stop chasing candles and start understanding why price pulls back,

you stop trading emotionally and start trading logically.

👉 Do you agree with this bullish continuation narrative on Silver, or do you see a different liquidity draw?

Drop your perspective in the comments and share this idea if it added value — let’s grow by learning together.

XAGUSD ANALYSISThis is one of the strongest moves for the entire history on XAGUSD. Actually, we could see that the growth of the last few weeks has happened because of high short squeeze, people kept shorting this asset, and additionallu most retail felt FOMO.

The reason why XAGUSD was so strong compared to other instruments and kept growing without any corrections is the DXY index which is in a bearish trend and updates new low levels. Everyone understands that Trump is adherent of cheap dollar, right? He is going to place a new chairman at the FED system. It's obvious that a new guy will cut interest rates as quick as possible. In other words, Trump wants to have cheap dollar to borrow more money to cover the USA national debt. This was one of his big promises in the election campaign. So investors started reallocating their capital into more defensive assets like XAUUSD and XAGUSD. The recent correction is a normal situation because there were too many overleveraged traders and the market wanted to punish them for high risks... :)))

I'd already started buying XAGUSD in the spot portfolio, if you have a brokerage account, allocating 10-15% of your deposit in this instrument would be a good investment. The support zone at $70 looks pretty strong, as the price has reacted to this level multiple times since December. So I don’t think it’s likely to break below this zone. It’s essential to keep an eye on price action to see whether bulls will defend this support.. The goal is $130 and higher... That's my own opinion, and if you have any arguments, I'd love to hear them below...

XAGUSD - A QUICK BUY SET UP - 29-01-2026XAGUSD -G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

XAGUSD -still kinda on the "move" and continue up...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

Silver XAG/USD - Breakout + Retest Signals Upside Continuation📝 Description🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD is forming a well-defined Triangle Breakout pattern on the M30 timeframe.

After a strong bullish move, price consolidated with lower highs and higher lows, compressing volatility — a classic sign of an upcoming expansion.

Price has now broken above the triangle resistance and is showing a healthy breakout & retest, supported by EMA and holding above the structure.

This favors a bullish continuation scenario.

📍 Support & Resistance

🟨 Support Zone: 104.70 – 106.00

🟢 1st Resistance: 123.90

🟢 2nd Resistance: 130.00 – 130.20

⚠️ Disclaimer

This analysis is for educational purposes only.

Commodities are volatile — always use proper risk management and position sizing.

💬 Support the Idea👍 Like if you’re bullish on Silver

💬 Comment: Clean breakout or fake move?🔁 Share with traders watching XAG/USD

#XAGUSD #Silver #CommodityTrading #TriangleBreakout #PriceAction #TechnicalAnalysis #TradingView #Kabhi_TA_Trading

Silver Strength (XAG/USD) – Safe-Haven Demand Fuels Upside📝 Description 🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD continues to show strong bullish structure on the H1 timeframe.

Price has respected a well-defined demand zone with multiple retests and rejections, confirming strong buyer interest. Silver is trading above EMA and Ichimoku cloud support, signaling trend continuation rather than exhaustion.

The broader backdrop supports metals as safe-haven assets, keeping the upside bias intact.

📍 Support & Resistance

🟡 Key Demand / Support Zone: 85.00 – 87.00

🟢 1st Resistance: 98.00

🟢 2nd Resistance / Extension Target: 101.00

Trend strength remains valid above demand with higher-high structure intact

🌍 Fundamental Context

1.Rising geopolitical tensions and trade-related uncertainty

2.Investors rotating into safe-haven assets like Silver

3.Risk-off sentiment continues to support precious metals

#XAGUSD #Silver #PreciousMetals #SafeHaven #ForexTrading #TechnicalAnalysis #PriceAction #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Markets are volatile — always manage risk properly and use a stop-loss.

💬 Support the Idea 👍 Like if you’re bullish on Silver

💬 Comment: Breakout continuation or pullback first? 🔁 Share with traders watching metals

#SILVER(XAGUSD): Another Big Buy In Making, 2026 We Are Ready! **SMC|ICT Based Analysis On Silver (XAGUSD)**

Dear Traders,

We extend our best wishes for the upcoming New Year.

🔺Today, we will analyse Silver (XAGUSD). The month of December typically presents reduced market liquidity and volume due to numerous holidays. The market initiated with a positive liquidity gap at $83.50, subsequently experiencing a significant decline. The price descended to $70.44 and is currently trading at $71.51. This substantial sell-off indicates a high probability of further price depreciation. We anticipate the price to fall within the range of $68 to $66.

🔺Entering a position within our identified key levels may prove profitable, with take-profit targets established at the following key levels: the first at $75, the second at $78, and the swing key level at $85. These levels should be utilized as take-profit objectives. For stop-loss placement, we suggest setting it at $66, or at your discretion.

🔺We wish you a prosperous New Year and hope this year fulfils your aspirations. We sincerely appreciate your continued support throughout the years.

Team SetupsFX_

Strong Bullish Structure Developing in Silver🚀 XAG/USD (SILVER) Swing Blueprint | Bullish Structure Intact | Key Levels Mapped! ⚔️

🎯 Metals Market Opportunity: Silver (XAG/USD) Swing Trade Setup

📈 Direction: Bullish | Swing Trade

🏷 Asset: XAG/USD - Silver vs. U.S. Dollar

⚖️ Core Thesis: Silver is building a potential swing bullish structure, aiming for a significant resistance zone. This plan outlines the key framework.

📊 Trade Plan (Blueprint)

✅ Entry Zone: Consider entries on pullbacks or strength confirmation. (Any price level entry - discipline is key).

🛑 Stop Loss (Risk Management):

"This is thief SL @ 54" 💎

Dear Traders (The OG Crew), 👊

This is my protective level. YOU MUST adjust your SL based on YOUR OWN risk tolerance & strategy. I do not recommend using only my level. Manage your capital wisely.

🎯 Target Zone: @ 62 Area.

This aligns with a strong historical resistance + potential overbought/trap zone. 🪤 The strategy is to "escape with profits" as price approaches.

Note: This is my target. Take profits based on your own analysis and risk-reward goals.

🔍 Related Pairs & Market Correlations (Must-Watch) 🔗

Monitoring these pairs provides context for Silver's move:

🦅 TVC:DXY (U.S. Dollar Index):

Key Point: INVERSE correlation. A weaker TVC:DXY typically boosts commodities priced in USD, like Silver. Watch for DXY breakdowns for added Silver bullish confirmation.

🟡 XAU/USD (Gold):

Key Point: STRONG positive correlation. Gold is the leader. A strong, bullish Gold market often drags Silver higher (and vice-versa). Silver's moves can be more volatile ("Gold on steroids").

📈 US 10-Year Treasury Yields / TVC:TNX :

Key Point: General inverse relationship. Rising real yields can pressure non-yielding metals. Watch for yield pullbacks that may relieve pressure on Silver.

⛽️ Crude Oil ( BLACKBULL:WTI / ICMARKETS:XBRUSD ):

Key Point: Inflation/Commodity Sentiment Gauge. Rising oil can signal broader commodity strength and inflation fears, which can benefit Silver as a real asset.

📊 Copper ( CAPITALCOM:COPPER ) & AMEX:GDX (Gold Miners ETF):

Key Point: Industrial / Risk Sentiment. Copper confirms industrial demand outlook. AMEX:GDX strength confirms bullish precious metals sector momentum.

💎 Final Notes

This is a blueprint, not financial advice.

You are the captain of your own capital. 🧭

Always use proper position sizing.

Markets are dynamic—always monitor for structure breaks.

Let's get this bread... responsibly! 🥖

✅ Like & Follow if you find this detailed blueprint valuable! It helps the idea reach more traders. 💡

#SILVER #XAGUSD #TradingSetup #SwingTrading #Commodities #PreciousMetals #Forex #TradingView #DXY #GOLD #XAUUSD #Analysis

Silver - This metal is blowing up now!💣Silver ( OANDA:XAGUSD ) is rallying even higher:

🔎Analysis summary:

Just a couple of months ago, we witnessed another bullish break and retest on Silver. It was quite obvious that Silver will rally accordingly and just recently, we experienced another +150% rally. However, looking at the higher timeframe, Silver is still not done.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

XAG/USD › Bullish Price Structure & Trade Planning📈 TITLE — SILVER SWING BREAKOUT 📊 XAG/USD “SILVER vs USD” 🥈

Market Blueprint | Bullish Thief Strategy | Layered Entries + Macro Signals

📝 DESCRIPTION

🔔 Asset: XAG/USD – Silver vs U.S. Dollar (Metals)

💡 Trade Bias: Bullish (Day / Swing)

🚀 Plan Summary:

Silver remains in a structural uptrend and is trading at elevated levels with strong industrial and safe-haven demand. Macro drivers include dovish Fed expectations, persistent supply deficits, and robust demand from solar, EV & tech sectors — all bullish fundamentals supporting higher prices.

📌 Entry Strategy (Thief Layering)

Thief layering strategy — place multiple buy limits to scale into strength with risk control:

🎯 Layer Buy Zones (example):

• 🟩 76.000

• 🟩 78.000

• 🟩 80.000

(You can increase/add layers based on volatility & personal risk tolerance.)

📌 Why layering?

This technique helps build position as price retests structural supports while capturing volatility swings.

🔥 Stop-Loss (Risk Control)

🛑 Thief Stop-Loss @ 74.000

👉 Adjust SL based on your risk profile — trade safe, manage risk first.

🎯 Target / Profit Zones

🏁 Target Area: ~87.000

Key resistance zone near overbought levels & potential reversal/top trap region — take partial profits. Let price action confirm continuation.

Targets are guidelines — manage according to your risk/reward.

📊 Correlated Pairs to Watch

Watch correlations with:

• XAU/USD (Gold) — safe-haven behavior often aligns with silver trends.

• USD Index (DXY) — stronger USD can cap metals; weaker USD fuels bullion upside.

• Copper / Base Metals — industrial demand context.

Correlation signals give context on trend strength vs macro flows.

📈 Macro & Fundamental Drivers (Latest)

Bullish Fundamentals:

🔹 Silver has seen a historic rally and recently touched near record highs, driven by supply constraints + industrial demand.

🔹 Structural supply deficits and growing tech/green energy demand support higher price floors.

🔹 Market pricing still reflects expectations of Fed rate cuts in 2026, pushing yield-less assets higher.

Risk / Volatility Factors:

⚠ Index rebalancing and technical selling could add short-term pressure.

⚠ Silver historically more volatile than gold → wider swings possible.

📅 Economic & News Catalysts

Keep an eye on these reports with London time relevance:

📌 US Federal Reserve rate decisions & press releases

📌 US CPI & employment (NFP) data

📌 ISM Manufacturing + global PMIs

📌 China industrial output & export policies

These data points shape USD direction, interest-rate expectations, and commodity flows.

💬 Risk Reminder (Thief OGs)

Dear traders, sizing SL/TP is YOUR decision — trade your plan. Profits are earned when disciplined. Live setups change — adapt.

📌 This is a guideline plan based on current structure, not financial advice.

XAG/USD Bullish Structure Signals Upside Continuation!🔥 XAG/USD — SILVER vs U.S. DOLLAR

📊 Metals Market Opportunity Blueprint (Day / Swing Trade)

🧭 Market Bias

🟢 BULLISH PLAN CONFIRMED

Silver continues to show strength with bullish momentum supported by macro and metals-sector flows. Volatility expansion favors trend continuation traders.

🟢 Trade Execution Plan

📌 Entry:

✅ Buy at any price level

➡️ Suitable for scaling, cost-averaging, or momentum entries based on individual strategy.

🛑 Risk Management

🔻 Stop Loss: 73.000

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

This SL is not mandatory. Adjust according to your own risk management & position sizing.

Trading involves risk — manage capital wisely.

🎯 Profit Objective

🎯 Target: 80.000

📍 Strong resistance zone detected

📍 Overbought conditions possible near highs

📍 Potential correction & liquidity trap expected

🚨 Kindly secure profits near resistance levels.

⚠️ TP level is guidance only — adapt exits based on market behavior and your strategy.

🔗 Related Markets to Watch (Correlation Focus)

💵 U.S. Dollar Index (DXY)

📉 Weakening USD = Bullish for Silver

📈 Strong USD = Headwind for XAG/USD

🟡 XAU/USD (Gold vs USD)

Silver often follows Gold’s directional bias

Gold strength usually confirms Silver upside momentum

📈 US10Y Treasury Yields

Falling yields → Supports precious metals

Rising yields → Pressure on non-yielding assets like Silver

🛢️ WTI Crude Oil (USOIL)

Inflation expectations linked to energy prices

Rising oil can indirectly support Silver as an inflation hedge

🌍 Fundamental & Economic Factors to Watch

🏦 Federal Reserve Policy

Rate cut expectations → Positive for Silver

Dovish tone weakens USD, boosting metals

📊 U.S. Inflation Data (CPI / PCE)

Higher inflation → Silver demand as a hedge

Cooling inflation may slow momentum temporarily

🏭 Industrial Demand Outlook

Silver has strong use in solar panels, EVs, electronics

Global manufacturing recovery supports long-term demand

🌐 Geopolitical & Risk Sentiment

Market uncertainty → Safe-haven inflows into metals

Risk-off environments favor Silver accumulation

🧠 Trader’s Note

📌 This is a market opportunity blueprint, not financial advice.

📌 Trade responsibly, manage risk, and adapt to live market conditions.

XAGUSD: Silver Awaits a New WaveXAGUSD: Silver Awaits a New Wave

XAGUSD Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that silver is currently forming an interesting structure, where the global picture and local movements are beginning to coalesce into a single scenario.

Chart D1: The global dynamics show the completion of an extended corrective formation. Silver is gradually breaking out of its sideways range, forming the basis for the next impulse. The wave structure indicates that the market is preparing for a phase change and may transition to a more directional movement.

Chart H4: The local pattern confirms the formation of key entry points. Here, the first signs of an impulse are visible, which could be the beginning of a larger wave. The internal structure appears to be the end of a correction and preparation for a move in the direction of the trend.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement may be accompanied by increased seller activity and a gradual shift in priority to the downside.

Alternative Scenario

If the price holds above local peaks and forms a stable upward impulse structure, the priority will shift to continued growth. In this case, the correction will be considered incomplete, and silver could stage an additional rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with tight stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Conclusion

Silver is at the transition point between a correction and a new impulse. The wave structure on D1 and H4 provides clear guidelines for action: watch for confirmation of the scenario and act with discipline.

Silver Breakout Confirmed or False Move Ahead?💎 PROFESSIONAL SILVER BLUEPRINT: XAG/USD BREAKOUT STRATEGY 💎

Day & Swing Trade Opportunity | Metals Market Analysis

🎯 TRADE SETUP SUMMARY

Asset: XAG/USD (Silver vs US Dollar)

Bias: Bullish Breakout

Timeframe: 4H & Daily Charts

Strategy Type: Momentum Breakout with Risk Management

📊 ENTRY & EXECUTION PLAN

⚡ ENTRY CONDITIONS (MUST HAVE ALL):

Price Breakout above 66.900 with 4H candle close

Volume Confirmation – Higher than average volume on breakout

Momentum Alignment – RSI above 50 (but not overbought >70 on entry)

🎯 PRIMARY TARGET: 69.000

Why this level? Previous major resistance turned support

Multiple confluence:

Fibonacci 61.8% extension from recent swing

Psychological round number

Overbought zone on weekly chart

🛡️ RISK MANAGEMENT PROTOCOL

Stop Loss: 65.500 (1.4% risk from entry)

Alternative SL options for different risk profiles:

Aggressive: 66.200 (1.05% risk)

Moderate: 65.500 (2.1% risk)

Conservative: 64.900 (3.0% risk)

🔍 MARKET CONTEXT & RATIONALE

📈 TECHNICAL CONFLUENCE:

Pattern Recognition: Ascending triangle breakout on 4H

Moving Averages: Price above 50 & 200 EMA on daily

Momentum: MACD histogram turning positive on daily

Volume Profile: High volume node at 66.50 supports bullish bias

🎭 MARKET PSYCHOLOGY:

"Police Barricade" at 69.000: Institutional resistance zone where profit-taking intensifies

Overbought Trap Risk: RSI likely to hit 75+ at target – smart money exits early

Retail Sentiment: Currently neutral – room for bullish momentum

🌐 CORRELATION MATRIX – RELATED ASSETS

1️⃣ PRIMARY CORRELATION: XAU/USD (Gold)

Correlation Coefficient: +0.85 (Strong Positive)

Key Insight: Silver often amplifies gold moves (2-3x volatility)

Watch For: Gold breaking $2,350 = Accelerated silver rally

Divergence Alert: If gold rises but silver lags → Caution needed

2️⃣ USD INFLUENCE: DXY (US Dollar Index)

Relationship: Inverse (-0.70 correlation)

Critical Levels: DXY below 104.50 = Bullish for silver

Data to Monitor: Fed statements, CPI data, employment reports

3️⃣ CURRENCY PAIRS WITH HIGH CORRELATION:

EUR/USD (+0.65) – Euro strength often mirrors silver strength

AUD/USD (+0.60) – Australia = major silver producer

USD/JPY (-0.55) – Risk sentiment indicator

4️⃣ COMMODITY & EQUITY CORRELATIONS:

Copper (+0.75) – Industrial demand proxy

S&P 500 (+0.50) – Risk-on environment supportive

US Treasury Yields (-0.60) – Real yields critical for non-yielding metals

⚖️ FUNDAMENTAL BACKDROP

🦅 MACRO DRIVERS SUPPORTING SILVER:

Monetary Policy: Dovish Fed pivot expectations

Industrial Demand: Green energy transition (solar panels, EVs)

Geopolitical: Safe-haven flows during uncertainty

Inflation Hedge: Persistent inflation concerns

⚠️ RISK FACTORS MONITORING:

USD Strength Surprise

Rate Hike Resurgence

Economic Slowdown impacting industrial demand

ETF Outflows (SLV holdings)

📋 TRADE MANAGEMENT PROTOCOL

A-SCALE EXECUTION (RECOMMENDED):

Position Size: 1-2% account risk per trade

Scale-In: 50% at breakout, 50% on retest of 66.900 as support

Scale-Out: 50% at 68.200, 50% at 69.000

Trailing Stop: Move to breakeven at 67.800

B-SCALE ADJUSTMENTS FOR MARKET CONDITIONS:

High Volatility: Reduce position size by 30%

Low Volume Breakout: Wait for confirmation candle

News Event Day: Consider entering after news settles

📊 CONFLUENCE CHECKLIST – BEFORE ENTERING

✅ Price > 66.900 (4H close)

✅ Volume > 20-day average

✅ DXY < 104.80

✅ XAU/USD trending upward

✅ No major economic news in next 4 hours

✅ Risk defined (max 2% of account)

"Are you trading silver this week? Bullish or bearish?"

"What's your silver target for Q2?"

"Which correlation do you find most reliable: gold or DXY?"

✨ LIKE if this adds value! FOLLOW for systematic trade blueprints! ✨

💬 COMMENT your silver outlook or trade adjustments below!

🔄 SHARE to help fellow traders navigate volatile markets!