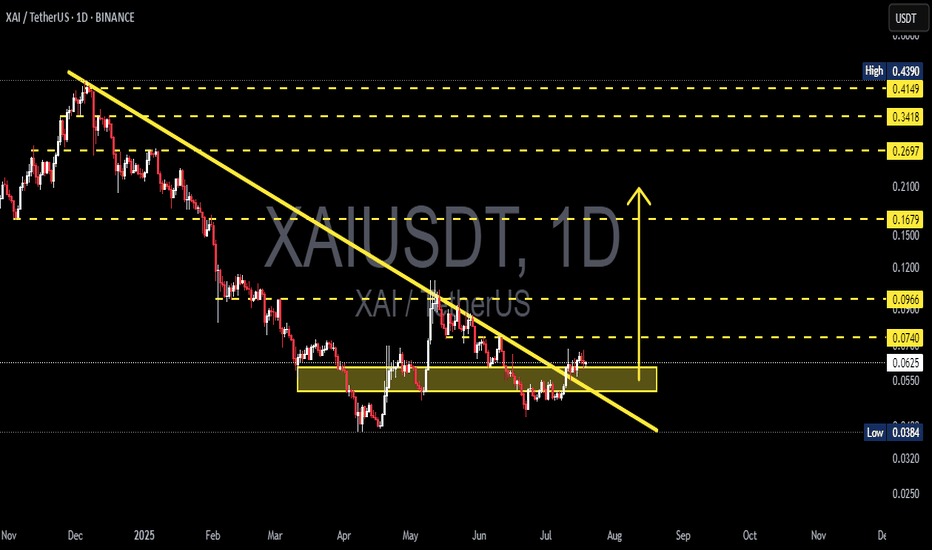

XAI/USDT (1D) — Critical Decision Zone at 0.038–0.043🔎 Overview

The daily chart of XAI/USDT shows a prolonged downtrend structure that has now reached a critical accumulation zone (0.0384–0.0428). This zone has acted as a strong support multiple times, creating a make-or-break situation:

1. If the zone holds → potential for a significant rebound toward higher resistance levels.

2. If the zone breaks down → bearish continuation with deeper downside targets.

---

📌 Key Technical Levels

Main Support (Accumulation Zone): 0.0384 – 0.0428

Resistance levels:

R1: 0.0509

R2: 0.0584

R3: 0.0667

R4: 0.0836

R5: 0.0964

R6: 0.1100

Current Price: ~0.0428

---

📈 Price Structure & Pattern

Long-term downtrend: Lower highs and lower lows clearly dominate since the beginning of the year.

Range support: The yellow highlighted zone has repeatedly acted as a strong defense area for buyers.

Potential Double Bottom: A bullish reversal pattern may form if price rejects this zone and breaks above key resistances.

Bearish risk: A breakdown below 0.0384 would invalidate the bullish setup and resume the primary downtrend.

---

🚀 Bullish Scenario

Confirmation: Daily close above 0.0509 with momentum.

Short-term target: 0.0584

Medium-term targets: 0.0667 – 0.0836

Extended targets (if momentum is strong): 0.0964 – 0.1100

✨ Bullish Narrative:

If buyers successfully defend this accumulation zone, XAI could be at the early stage of a major reversal. The first key breakout at 0.0509 will be crucial to validate a new upward trend.

---

⚠️ Bearish Scenario

Confirmation: Daily close below 0.0384

Initial target: 0.026 (measured move projection)

Extended target: 0.020 (psychological level)

🔥 Bearish Narrative:

A breakdown below the support zone signals buyer exhaustion, opening the door for sellers to extend the long-term downtrend and push price toward lower psychological levels.

---

📊 Strategy & Risk Management

Swing traders (conservative): Wait for confirmation above 0.0509 or below 0.0384 before committing to a larger position.

Aggressive entry: Consider buying within 0.0420–0.0400 with a tight stop below 0.038.

Conservative entry: Enter only after a confirmed breakout above 0.0509, ideally on a retest.

Golden rule: Risk management is essential. The potential reward is attractive, but so is the risk at this decision point.

---

📌 Conclusion

XAI/USDT is standing at a major crossroads:

Bullish case: If 0.038–0.043 holds → potential rebound toward 0.0509, 0.0584, and 0.0667+.

Bearish case: If 0.0384 breaks → downside extension with 0.026 as the next realistic target.

At the moment, the 0.038–0.043 range is the key decision zone. Traders should wait for clear confirmation while staying disciplined with risk management.

---

#XAI #XAIUSDT #CryptoAnalysis #SupportResistance #BullishScenario #BearishScenario #CryptoTrading #AltcoinAnalysis #TechnicalAnalysis

Xaiusdttrade

XAI/USDT — Descending Triangle: Ready for Takeoff or Breakdown?✨ Quick Summary:

The XAI/USDT chart is now at a critical decision point. For months, price has been consolidating inside the accumulation zone (0.0384 – 0.050), while being consistently pressured by a descending trendline from above. This structure forms a descending triangle, a pattern that often signals bearish continuation, but can also act as a powerful reversal base if a breakout occurs with strong volume.

Currently, price trades around 0.0504, right at the crossroads of major support and the seller’s pressure line. This means an explosive move — either a breakout or breakdown — is likely coming soon.

---

🔎 Chart Pattern & Price Structure

Support Zone (yellow box): 0.0384 – 0.050 → tested multiple times since April 2025, showing strong buyer defense.

Descending Trendline Resistance (yellow line): connecting lower highs since May, pressing price downward.

Pattern: Classic Descending Triangle → market is coiling tighter, awaiting a catalyst.

Market Psychology:

Buyers keep defending the same support.

Sellers consistently lower their asking prices.

This tug-of-war is reaching its breaking point.

---

🚀 Bullish Scenario (Breakout)

Key confirmation:

Daily close above the descending trendline.

Breakout and daily close above 0.0583 with significant volume.

Potential upside targets (layered resistances):

🎯 Target 1: 0.0583 (+15%)

🎯 Target 2: 0.0663 (+31%)

🎯 Target 3: 0.0715 (+42%)

🎯 Target 4: 0.0838 (+66%)

🎯 Target 5: 0.0973 (+93%)

🎯 Ambitious Target: 0.1094 (+117%)

Trading notes:

Strong breakouts often come with at least 2x average daily volume. The ideal setup is breakout → retest (turning resistance into support) → continuation. Conservative entries can wait for the retest confirmation above 0.0583.

---

⚠️ Bearish Scenario (Breakdown)

Key confirmation: daily close below 0.0384 with a full-bodied candle and high volume.

Downside risk:

Retest of the psychological support zone 0.033 – 0.030.

Breakdown here would likely extend the broader bearish trend, potentially setting new lows.

Trading notes:

A breakdown with volume often triggers panic selling. In this case, stop-losses for longs become crucial. Aggressive traders may consider shorts after a failed retest of broken support.

---

🔑 Extra Confirmation Factors

1. Volume: No volume = no trust in breakout/breakdown.

2. RSI / Momentum: Bullish divergence supports a breakout, bearish divergence confirms breakdown.

3. Market Sentiment: If BTC/ETH trend bullish, XAI’s breakout chances improve. A weak crypto market favors breakdown.

4. Fundamental Catalysts: Partnerships, project updates, or listings can flip the technical outlook.

---

📌 Conclusion

XAI/USDT is facing a make-or-break moment:

Bullish breakout could open a +40% to +100% rally.

Bearish breakdown could drag price back to the 0.030–0.033 zone.

For traders: this is the time to wait for confirmation. Entering too early in such a setup carries high risk. The best positions often come after the market chooses its direction.

---

#XAI #XAIUSDT #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #Altcoin #Breakout #SupportResistance #CryptoTrading

XAI/USDT — Accumulation at Key Zone & Potential Reversal?Summary

The daily chart shows XAI in a consolidation/accumulation phase within a key support zone (yellow box) after a prolonged downtrend. The long-term descending trendline (yellow) has recently been broken, signaling early signs that the downtrend may be losing momentum. However, confirmation is still needed (daily close and volume validation).

Key Levels (from the chart)

Major resistances: 0.0740, then 0.0966, 0.1679, 0.2697, (historical high ~0.4149–0.4390).

Current price: ~0.0551

Strong support/accumulation zone: around 0.043 – 0.056 (yellow box)

Breakdown low: ~0.0384

Potential moves from ~0.0551:

To 0.0740 ≈ +34.3%

To 0.0966 ≈ +75.3%

To 0.1679 ≈ +204.7%

Downside to 0.0384 ≈ -30.3%

Pattern Analysis (detailed & relevant)

Medium-term downtrend: price has been trending lower since the late 2024 peak, following a descending trendline. Recently, there was a breakout above this trendline, an early sign of trend weakening.

Accumulation zone (yellow box): price has tested and bounced from this area multiple times (April — Aug), indicating strong demand.

Possible double bottom/base formation: lows in early April and July/August at similar levels hint at a potential base-building phase. Needs confirmation with a breakout.

Key watch: A daily close above 0.0740 with strong volume would confirm bullish momentum. A breakdown below 0.0384 would confirm bearish continuation.

Bullish Scenario

1. Breakout confirmation — daily close above 0.0740 with strong volume → first target 0.0966, followed by 0.1679 and 0.2697.

2. Support retest & continuation — price may retest the accumulation box before bouncing, confirming the zone as a base for further gains.

3. Bullish signs: strong-bodied candles, successful retests, and increasing volume on breakout days.

Bearish Scenario

1. False breakout — price breaks the trendline but fails to surpass 0.0740, falling back into the range.

2. Accumulation breakdown — daily close below the yellow box (especially under 0.0384) → opens downside continuation risk.

3. Lower highs persist — continued inability to make higher highs keeps sellers in control.

Risk Management Checklist (Not financial advice)

Wait for daily close confirmation, not just intraday spikes.

Watch volume for breakout validation.

Conservative stop-loss: below the support box or 0.0384.

Take partial profits at key resistances (0.0740–0.0966), let the rest run if momentum continues.

Adjust position size according to risk per trade (e.g., 1–2% of capital).

#XAI #XAIUSDT #Crypto #TechnicalAnalysis #Breakout #SupportResistance #Accumulation #CryptoTrading

XAI/USDT Breakout from Long-Term Downtrend — Is a Major Trend?🔍 Complete Technical Analysis & Market Insight

After months of downward pressure, XAI/USDT is finally showing significant signs of life. The pair has successfully broken out of a long-standing descending trendline that has capped price action since November 2024 — potentially marking the beginning of a new bullish phase.

📐 1. Pattern & Technical Structure:

🔸 Descending Trendline Breakout:

Price has broken above the descending trendline, ending a multi-month bearish phase.

The breakout is supported by bullish candles and an uptick in volume, suggesting momentum shift in favor of the bulls.

🔸 Strong Accumulation Zone (Demand Area):

The area between $0.0550 – $0.0740 has acted as a solid accumulation/support zone.

Multiple rejections and consolidations around this zone suggest aggressive buyer interest.

🔸 Higher Low Formation & Potential Reversal Structure:

A series of higher lows is forming, indicating a potential bullish trend reversal.

The price structure hints at the possible development of a larger bullish pattern, such as an inverse head and shoulders or base formation.

📈 Bullish Scenario:

If the breakout holds and the price sustains above the key support:

Short-term target:

$0.0966 – initial resistance and psychological level.

Mid-term targets:

$0.1679 – strong historical resistance.

$0.2697 – a major reaction zone from previous breakdowns.

Long-term target if momentum continues:

$0.3418 – $0.4390

⚠️ Confirmation with volume and follow-through candles is crucial to validate a sustained bullish move.

📉 Bearish Scenario:

If the price fails to maintain above the breakout zone:

It may retest the accumulation zone between $0.0740 – $0.0624.

A breakdown below $0.0550 would invalidate the bullish thesis and could lead back to the previous low at $0.0384.

Breaching below $0.0384 could trigger a renewed bearish continuation.

📊 Market Sentiment & Context:

XAI is at a technically significant point. With selling pressure weakening and early bullish structures emerging, XAI could be positioning for a strong upside move — especially if broader market conditions improve.

However, given the speculative nature of the current breakout, risk management remains essential. False breakouts are not uncommon, especially in altcoins.

🧭 Strategic Summary:

Potential Buy Zone (on retest): $0.0624 – $0.0740

Stop Loss (conservative): Below $0.0550

Take Profit targets:

Short-Term: $0.0966

Mid-Term: $0.1679 – $0.2697

Long-Term: $0.3418 – $0.4390

Big breakouts often begin with subtle but critical structural shifts. XAI is showing early signs of such a shift — it could be the calm before a bullish storm, or just a trap. Either way, it deserves your close attention.

#XAIUSDT #XAI #AltcoinBreakout #CryptoBreakout #TrendReversal #CryptoAnalysis

#TechnicalAnalysis #SupportResistance #BullishBreakout

XAIUSDT Is a Breakout on the Horizon or a Pullback Imminent?Yello, Paradisers! Could #XAIUSDT be gearing up for a significant breakout, or is it poised for a pullback? Here's what we're seeing:

💎#XAI is displaying bullish potential after rebounding from the demand zone and forming a strong rejection candle. If the daily candle closes similarly, there is a real chance for the price to push toward the $0.228 supply zone. A successful breakout could lead to further upward movement, potentially crossing the resistance trendline and reaching the major resistance area we’re monitoring.

💎If XAI fails to hold above the demand zone and breaks down, a retest of the $0.18 - $0.166 area is likely. This zone has proven resilient in the past, often triggering rebounds and significant upward trends.

💎A daily close below the $0.166 major support would invalidate the bullish outlook, suggesting a potential deeper dip.

Stay disciplined and strategic, traders. Success in this market comes to those who trade with patience and precision.

MyCryptoParadise

iFeel the success🌴

#XAI Trendline Traders ( XAI going to breakout so soon)(((( Announcement for Trendline Traders ))))

*** #XAI going to breakout so soon***

#XAI

#XAIUSDT

#XAIUSD

BINANCE:XAIUSDT

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX ****

#bitcoin

#BTC

#BTCUSDT

XAIUSDT Chart Idea - Swing Long SetupXAIUSDT broke the falling wedge on daily TF in May and retested today on Friday 6/21. A little bullish BTC momentum can send this chart to the moon since it's a AI play as well. Taking a swing long for next few weeks from current price on the following confirmations.

Confirmations:

- Successfully retested the falling wedge breakout on daily TF

- Daily RSI is in oversold area

Swing Long Setup:

-- Entry: 0.5021

-- TP: 1.18 (0.618 Fib)

-- SL: 0.44