GOLD Made A Reversal Pattern After Massive Movement , Ready ?Here is my 15Mins Chart On GOLD , After massive movement to downside finally the price created a reversal pattern , The price creating a very clear reversal pattern ( Inverted Head & Shoulders pattern ) and the price made a very good bullish price action now And the price confirmed the pattern by closing above the neckline. so we can enter a buy trade when the price go back to retest the broken neckline to can use a small stop loss , and we can targeting from 200 To 500 pips with a decent stop loss .

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4- Clear Reversal Pattern .

5- Pattern Confirmed .

Xauusdidea

Time To BUY Gold (xauusd) nowXAUUSD (GOLD) was recently in a short term downtrend but has now shown some clear bullish movements ahead. XAUUSD (Gold) has broken out of a downward trend and bounced off a powerful support zone. The price is very likely to head to the next strong resistance level which is marked as the take profit zone (green line). Time to buy gold XAUUSD.

Gold (XAUUSD) 30M – Support Bounce SetupHere’s a clean TradingView ANALYSIS you can post with this XAUUSD 30M chart 👇

(Professional + trader-style, matches your setup)

XAUUSD 30M – Descending Channel Support Bounce

Gold is trading inside a well-defined descending channel, respecting both upper and lower boundaries. Price recently tapped the lower channel support zone, where strong buying pressure appeared, forming a bullish reaction from support.

This bounce suggests a short-term bullish correction within the broader bearish channel.

Key Observations:

Price respected channel support and rejected lower levels

Bullish impulse from support confirms buyer presence

Entry aligned with structure + support confluence

Market targeting mid / upper channel liquidity

Trade Plan:

Entry: Around 4,570 area

Target: 4,710 – 4,720 (channel resistance / target point)

Stop Loss: Below 4,368 (support failure)

As long as price holds above the support level, bullish continuation toward the target remains valid. A break below support would invalidate this setup.

Gold Isn’t Pulling Back — It’s Distributing | Key Sell Zones

This is not a “guess the top” analysis.

This is continuation logic after a major bearish displacement.

Gold already dumped aggressively from 5597 → 4677.

That move alone tells you one thing clearly: buyers lost control.

🔍 Market Context (Higher Probability Bias):

Strong impulsive bearish move → trend shift confirmed

Pullbacks are corrective, not bullish

Smart money sells premium zones, not bottoms

🧠 Current Structure (M30):

Price reacting at a descending trendline

Double top forming at trendline → weakness confirmed

Bearish flow intact (lower highs, lower lows)

🎯 Sell Scenarios (Clear & Planned):

Primary Sell Zone:

Trendline + Double Top rejection

Secondary Sell Zone:

5050 round number

Previous BOS level

0.5 Fibonacci retracement of last bearish leg

→ Confluence zone, not coincidence

📉 Targets (Sequential Liquidity):

TP1: 4734 (recent support)

TP2: 4639

TP3: 4500

TP4: 4326 (major liquidity pool)

If 4734 breaks with acceptance, continuation is highly likely.

If price holds above sell zones — bias invalid, no trade.

No revenge trades.

No emotions.

Only structure, liquidity & patience.

⚠️ Note

Markets don’t reward predictions.

They reward prepared traders with multiple scenarios.

👉 If this breakdown helped your bias — hit like

👉 Comment your thoughts about my analysis

👉 Follow for clean, no-noise Gold analysis

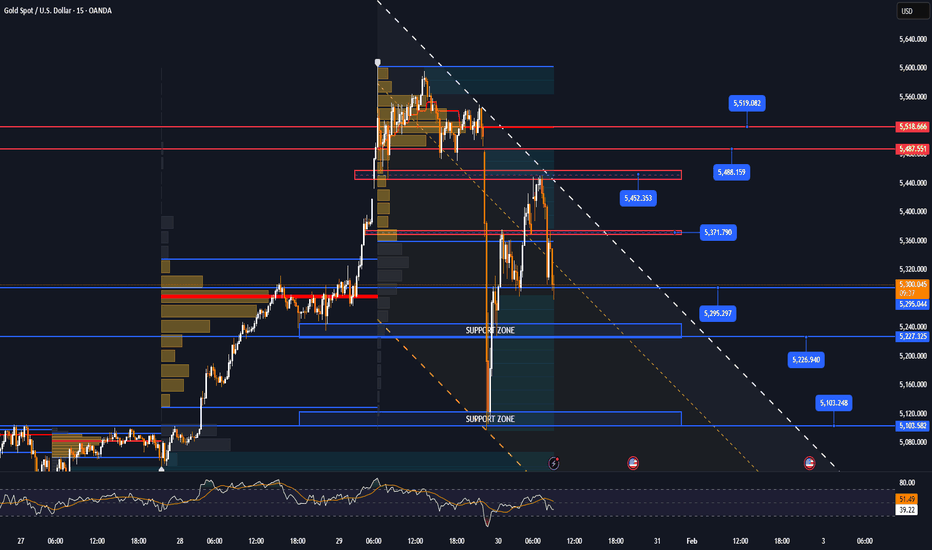

Gold are volatile with high risk levels, what should we do ?PERO – XAUUSD TRADING PLAN For This WEEK ( Feb 2 - Feb 6 / 2026 )

1️⃣Market Context

Gold is in a broader bullish structure after a strong impulsive rally, now undergoing a deep corrective phase.

The current selloff is liquidity-driven, designed to shake out late BUYs and premature SELLs—not a confirmed higher-timeframe reversal.

Environment: high volatility, elevated liquidity, fake breaks likely.

Rule: no FOMO, no wide stops.

2️⃣ Technical Breakdown (Multi-Timeframe)

Daily (D1)

Primary trend: Bullish (intact)

No confirmed daily lower-low → no swing SELL bias.

H4

Short-term structure broken → correction in progress

Expect range expansion and stop hunts before continuation.

H1 (key chart)

Price trades inside a descending corrective channel.

Momentum is fading (RSI ~ mid-30s) → downside pressure weakening.

➡️ BUY pullbacks at demand, SELL only as quick scalps at supply.

3️⃣ Key Levels

Resistance Zone

5,125 - 5,130

5,205 - 5,210

5,275 - 5,280

5,390 - 5,395

5,485 - 5,490

5,045 – 5,050

Support Zone (Primary BUY zones):

4,675 - 4,680

4,585 - 4,590 (deep pullback, highest RR)

⚠️ No trades in the middle of the range.

4️⃣ Trading Bias

Primary: BUY pullbacks in line with the higher-timeframe trend.

Secondary: SELL scalps only at supply with clear rejection.

If price doesn’t reach key levels → NO TRADE.

5️⃣ Execution Rules

🟢 BUY GOLD 4584 - 4586

↠ Stop Loss 4576

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

🔴 SELL GOLD 5390 - 5392

↠ Stop Loss 5400

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

6️⃣ Invalidation

Clean breakdown below 4,585 with strong momentum.

No reaction at demand zones.

➡️ Bias invalid → stay flat.

7️⃣ PERO Reminder

⚡️ Psychology, discipline, and capital management are the three pillars that turn analysis into consistent profitability. ⚡️

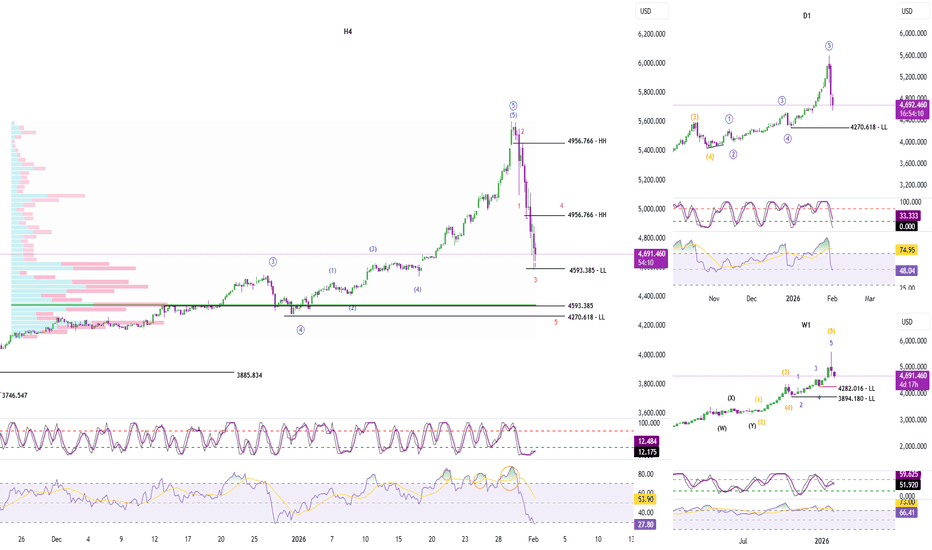

Elliott Wave Analysis XAUUSD – February 2, 2026

Momentum

Weekly momentum (W1)

Weekly momentum is showing early signs of a bearish reversal. We need to wait for this week’s candle to close to confirm the reversal.

If W1 momentum is confirmed to have turned down, the market will likely continue its bearish trend for at least several weeks ahead.

Daily momentum (D1)

Daily momentum is still declining and is approaching the oversold zone.

With this condition, there is a high probability that within the next 1–2 days, we will form a daily low, after which price may rebound or move sideways for at least a few days.

H4 momentum

H4 momentum remains compressed in the oversold area, with 13 consecutive H4 candles counted so far.

This suggests that price is likely near an H4 bottom, followed by a corrective rebound or sideways movement lasting at least several H4 candles.

Wave Structure

Weekly wave structure (W1)

As weekly momentum is attempting to reverse, we need to wait for this week’s candle close to confirm.

If price closes below 4282 (the previous bullish momentum reversal level), this would confirm the formation of a weekly top.

In that scenario, the W1 structure is likely forming a yellow (1)(2)(3)(4)(5) pattern, while the blue 12345 structure may also be complete.

If confirmed, the market is expected to enter a long-term corrective phase, lasting at least several weeks.

Daily wave structure (D1)

The current decline on D1 is steep and sharp, which strongly supports the view that blue wave 5 has already topped.

Based on current price behavior, there is a very high probability that the market is forming a 5-wave bearish structure.

With D1 momentum approaching oversold conditions, a momentum reversal is likely within the next 1–2 days.

Given that the decline appears to be a 5-wave structure, the next bullish phase after the D1 momentum turns up is most likely a 3-wave corrective move. We will continue to monitor for confirmation.

H4 wave structure

On the H4 chart, I am temporarily labeling a red 12345 structure.

The current price zone around 4593 aligns with a high-liquidity area on the Volume Profile, which also converges with the expected H4 momentum reversal.

Therefore, I expect this zone to act as the reversal area for red wave 4.

In this case, the 4956 level, corresponding to the 0.382 Fibonacci retracement of red wave 3, is projected as the target zone for the completion of red wave 4.

After wave 4 is completed, price is expected to decline again toward the 4270–4593 zone, completing the current 5-wave bearish sequence, before transitioning into a new bullish trend with at least a 3-wave structure.

Trading Plan

At this stage, newer traders may see strong impulsive moves like the current ones as trading opportunities.

However, from an experienced trader’s perspective, this is not an ideal environment to trade aggressively.

Volatility is extremely high, and the market can easily hunt stop losses before moving in the anticipated direction.

On the other hand, entering the market with incorrect positioning or without a stop loss often results in account damage.

👉 The priority right now is observation and patience, waiting for clearer structure and confirmed momentum signals rather than forcing trades during high-volatility conditions.

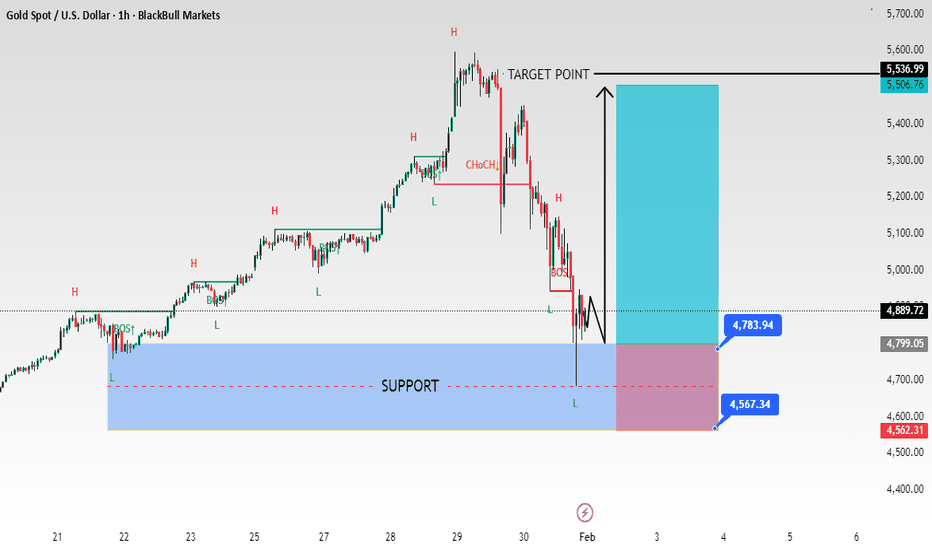

GOLD (XAUUSD) – Liquidity Sweep & Bullish Structure Shift. Market Structure Overview

Higher-timeframe bias:

Price previously broke structure to the downside (BOS ↓), confirming a short-term bearish trend.

Corrective phase:

After the impulsive drop, price moved into a descending channel (bearish correction).

Key shift:

Price broke out of the descending channel and formed a higher low (L) inside a marked support zone, suggesting trend exhaustion and a potential bullish reversal.

2. Support & Liquidity Behavior

Support Zone (blue box):

Strong reaction area where:

Sell-side liquidity was swept (fake breakout below support)

Price immediately reclaimed the zone → classic liquidity grab

This behavior often precedes impulsive moves in the opposite direction.

3. Current Price Action

Price is now:

Making higher highs and higher lows

Showing bullish momentum after the liquidity sweep

The impulsive leg upward suggests buyers are in control short-term.

4. Trade Idea Logic (Based on the Chart)

Bullish Scenario (Preferred while above support)

Bias: Bullish continuation

Entry area:

Pullbacks into the support zone (~4,586 – 4,483)

Invalidation:

Clean break and close below 4,483

Targets:

First reaction: recent high

Main target: ~4,937 – 4,950 (marked target point / prior liquidity & resistance)

📈 The projected move aligns with:

Channel breakout

Structure shift

Liquidity sweep → expansion phase

5. Bearish Scenario (If Conditions Fail)

If price:

Rejects strongly below 4,770

Or loses 4,483 support

Then expect:

Range continuation

Or retest of lower liquidity zones

6. Key Takeaway

This chart shows a textbook smart-money setup:

BOS ↓ → correction → liquidity grab → bullish expansion

As long as price respects the support zone, the upside target remains valid

Gold: Deep V wild swingGold saw a deep V wild swing trend: after hitting a new all-time high of $5594, it plummeted about $490 to a low of $5104 within 30 minutes, with an intraday maximum drop of over 5%. Then it oscillated and rebounded,forming an extreme volatility pattern of surge - crash - recovery overall.

Support Levels:

Primary Support: $5100-$5200 (intraday low + previous high-volume trading zone, the starting point for short-term rebounds)

Secondary Support: $5000 (round number level + psychological support; a break below may trigger a new round of selling)

Resistance Levels:

Primary Resistance: $5300-$5400 (concentrated trapped positions after the crash, key pressure for rebounds)

Secondary Resistance: $5500 (near the all-time high; a recapture will signal a return to a strong bullish trend)

Trading Strategy:

Adopt a wait-and-see stance as the primary approach. Wait for a firm break above $5300 or a clear break below $5000 before trading with the trend. Avoid chasing the rally or catching the falling knife.

Risk Warning:

Amid extreme volatility, reduce positions for leveraged trading and guard against black swan events.

monday Gold (XAUUSD) – Price Movement Around Key Support AreaGold price recently moved strongly downward and is now showing a reaction from a lower support area. The highlighted zone represents a previous price activity region where the market slowed down earlier. Current price behavior suggests a possible short-term upward movement if this area continues to hold.

Upper marked levels may act as resistance where price could pause or react again. Market direction will depend on how price responds around these highlighted zones. This chart view is shared only for market observation and learning purposes.

monday update Gold (XAUUSD) – Short-Term Price Reaction Near KeGold price recently showed a strong downward move and is now reacting from a lower area. The marked zone highlights a previous price reaction level where buyers and sellers were active before. Current structure suggests the market may attempt a short-term recovery if price holds above this area.

If price moves higher, nearby resistance zones could act as reaction points. Overall movement will depend on how price behaves around these highlighted levels. This view is shared for learning and chart observation purposes only.

Gold Extreme Volatility: Key Levels & Short-Term Trading StrategGold continued to see extreme volatility today, trading in a pattern of gap-down drop to lows - range-bound consolidation at the bottom - weak rebound. Market sentiment is the dominant driver, rendering traditional technical signals partially ineffective.

Key Support Levels:

Primary Support: $4500-$4600, a confluence of the intraday low and round number level, serving as a critical anchor for a short-term oversold rebound. Holding this range will sustain the oscillatory recovery trend.

Secondary Support: $4390, the intraday absolute low. A decisive break below this level may trigger a new round of panic selling and open up further downside potential.

Key Resistance Levels:

Primary Resistance: $4700-$4750, a cluster of the round number level and short-term trapped positions, acting as the primary resistance for any rebound. A decisive break above this level is needed to ease bearish market sentiment.

Secondary Resistance: $4880, the intraday high. Recapturing this level would likely strengthen the rebound momentum; otherwise, gold will remain in a weak oscillatory pattern.

In the short term, gold is likely to trade in a wide range of $4500-$4800, with the core focus on digesting previous selling pressure and repairing oversold indicators. Market sentiment remains the dominant factor during this period, and traditional technical analysis signals have limited reference value.

Trading Strategy

Sell 4700 - 4710

SL 4720

TP 4650 - 4630 - 4610

XAUUSD/GOLD DAY SELL PROJECTION 02.02.26Today we are going to analyze XAUUSD – Gold Day Sell Projection for 2nd February 2026.

This analysis is purely based on price action, market structure, and smart money behavior.

📊 MARKET STRUCTURE OVERVIEW

Gold was moving inside a strong bullish channel for a long period.

However, at the upper channel resistance, price faced heavy rejection.

This rejection clearly indicates buyer exhaustion and profit booking from institutional traders.

🔴 REJECTION & SELL CONFIRMATION

You can see a strong bearish impulsive candle breaking down from the top.

This is not a random move — this is smart money distribution.

Once price breaks the channel support, the market structure shifts from bullish to corrective bearish.

This confirms our sell-side bias.

📉 SELL ENTRY PLAN

Our plan is very simple and disciplined:

We wait for a pullback towards the previous support turned resistance

This area acts as a sell zone

We do NOT chase the market

This is sell on retracement, not emotional trading.

🛑 STOP LOSS LOGIC

Stop loss is placed above the supply zone.

Why?

Because if price moves above that zone again,

the sell idea becomes invalid.

Always protect capital —

survival is more important than profit.

🎯 TARGET PROJECTION

Price is expected to:

Make a small pullback

Create a lower high

Continue towards the next major demand and liquidity zone

This target is based on:

Previous demand

Liquidity grab

Institutional price imbalance

What scenarios could unfold for gold prices on February 2, 2026?📈 1️⃣ Trendline

The long-term trend was previously BULLISH, supported by a clearly rising trendline.

Price has now broken below the ascending trendline, indicating that the bullish structure is weakening.

The former trendline is now acting as dynamic resistance when price pulls back for a retest.

➡️ Current outlook: corrective decline after losing the main trendline

🟥 2️⃣ Resistance Zones

Nearest resistance: 4,835

Former breakout area → now acting as resistance

Aligns with the recent strong price rejection zone

Major resistance: 5,000 – 5,103

Previous accumulation zone before the sharp drop

Near the medium-term EMA + broken trendline

If price retraces to this area → selling pressure is expected to be high

➡️ Pullbacks into these zones are more likely to be selling opportunities, not bullish reversals.

🟩 3️⃣ Support Zone

Main support: 4,590

The most recent swing low after the strong decline

Area where buying interest previously appeared

If this level breaks:

Price may extend into a deeper bearish leg

Short-term downtrend would be more strongly confirmed

📌 Trade Setups

SELL GOLD: 5,000 – 5,002

Stop Loss: 5,015

Take Profit: 200 – 500 – Open

SELL GOLD: 5,105 – 5,107

Stop Loss: 5,117

Take Profit: 200 – 500 – Open

XAU/USD - Possible Scenario🐂 Bullish Scenario

Demand: 4,700–4,780

Needed liquidity: sweep below 4,700 (~4,680)

Trigger: bullish CHOCH + reclaim 4,980

Stop: 4,650

Targets: 4,980 → 5,120 → 5,380–5,420

🐻 Bearish Scenario

Bias flips bearish below: 5,120 (CHOCH)

Continuation BOS: ~4,970

Supply: 5,320–5,400

Bearish continuation: acceptance below 4,700 / 4,650

XAUUSD 1H – From Bullish Expansion to Bearish RepricingHigher-Timeframe Context

The market was in a clear bullish trend (series of HH & HL).

Price topped near 5,55x–5,56x and then showed distribution.

After the top, structure shifted from bullish to bearish.

2. Market Structure Breakdown

You can see a CHoCH (Change of Character) after the peak:

First sign that buyers lost control.

Followed by a BOS (Break of Structure) to the downside:

Confirms bearish market structure on the 1H.

This means rallies should now be viewed as pullbacks, not trend continuation.

3. Key Zones Identified Correctly

🔵 Support Zone (Blue Area)

Major demand / support around:

4,80x → 4,56x

Price swept liquidity below the lows and reacted strongly, indicating:

Buyers are still active here

Possible short-term relief bounce

🔴 Risk Zone (Red Area)

Below 4,56x

If price closes strongly below this zone:

Support fails

Opens path to 4,45x–4,40x next

4 Upside Targets (If Bounce Continues)

If price holds above support and pushes higher:

4,89x → first reaction / minor resistance

5,05x–5,10x → imbalance + structure resistance

5,50x–5,53x → major target / previous high (your marked target)

⚠️ Price must reclaim 4,90x+ with structure for this scenario to remain valid.

6. Bearish Continuation Scenario

More probable unless structure flips:

Price retraces into 4,88x–4,95x

Fails to break structure

Continues lower toward:

4,56x

Then 4,45x if support breaks

7. Summary Bias

Short-term: Bounce from support (corrective)

Mid-term: Bearish until a bullish BOS appears

Key Decision Area: 4,88x–4,95x

Invalidation: Strong 1H close above structure resistance

XAU/USD: Bearish Breakdown and Liquidity Grab StrategyGold (XAU/USD) has entered a decisive bearish phase on the 15-minute timeframe. After an aggressive rally that reached extreme premium levels, the market has finally shifted its structure, breaking below major intermediate support levels. This current setup is focused on a "Break and Retest" sequence as sellers aim for deeper liquidity pools.

Technical Analysis:

Structural Breakdown: The price has decisively lost the 5,100 psychological support level. This breach confirms a "Change of Character" (ChoCh) from a bullish expansion to a bearish correction.

Resistance Defense: The previous support at 5,100 is now expected to act as a significant supply barrier. Sellers are likely to defend this area aggressively during any minor relief bounces.

Projected Downside Path: According to the current forecast (black lines), the market is expected to consolidate or slightly retrace to test the broken support before accelerating toward the downside.

Key Targets:

Primary Objective: 5,000 – A major psychological milestone where the first significant buy-side liquidity is concentrated.

Major Target: 4,950 – This aligns with the bottom of the current demand zone and represents a strong institutional area for potential re-accumulation.

Risk Management: The bearish thesis remains intact as long as the price maintains its position below the 5,200 resistance peak.

Conclusion: The momentum has shifted in favor of the sellers. The most effective strategy here is to look for bearish confirmation near the 5,100 retest zone before targeting the $5,000 and $4,950 levels.

XAU/USD: Structural Breakdown and Retest StrategyGold (XAU/USD) is currently undergoing a significant bearish correction on the 15-minute timeframe. After an aggressive bullish run that reached peak levels near 5,600, the market has broken its immediate upward momentum and is now navigating through a series of structural retests.

Technical Observations:

Major Breakdown: The price has decisively fallen from the upper premium zones and has just breached a critical intermediate support level near 5,100. This move indicates a shift in control from buyers to sellers.

Forecasted Trajectory: As shown by the black forecast path, we are expecting a "Break and Retest" sequence. The market is likely to bounce slightly to re-validate the 5,100 area (previous support turned resistance) before continuing its descent.

Key Targets:

Primary Objective: 5,000 – A major psychological level where initial buy-side liquidity is expected to rest.

Secondary Objective: 4,950 – The bottom of the current demand zone, which marks a significant institutional area for potential re-accumulation.

Risk Parameters: This bearish outlook remains valid as long as the price holds below the 5,200 resistance level. A sustained move back above this zone would invalidate the current downward expansion.

Trading Logic: The current bias is "Sell on Strength." Traders should look for bearish exhaustion—such as rejection wicks—during the anticipated pullback to 5,100 before targeting the deeper liquidity pools at the 5,000 and 4,950 levels.

Elliott Wave Analysis XAUUSD – January 30, 2025

1. Momentum

Weekly timeframe (W1)

Weekly momentum is currently rising. With this condition, the market is likely to continue moving higher or remain sideways for at least the next 1–2 weeks.

Daily timeframe (D1)

Daily momentum is currently declining. This suggests that over the next 1–2 days, price may continue to fall or move sideways until D1 momentum reaches the oversold zone.

H4 timeframe

H4 momentum is compressed and overlapping in the oversold area. This indicates that the current bearish or sideways phase may continue, however, the probability of a bullish reversal on H4 is relatively high.

2. Wave Structure

Weekly Wave Structure (W1)

On the weekly chart, the five-wave structure (1–2–3–4–5) in blue is still forming.

Yesterday, price experienced a strong decline. However, to confirm that blue wave 5 has completed, price needs to produce a bearish close below the 4282 level.

At the moment, since W1 momentum remains bullish, this decline is more likely a corrective move within blue wave 5, rather than a completed top.

Daily Wave Structure (D1)

Daily momentum is declining, therefore price may continue to move lower or sideways for another 1–2 days until D1 momentum reaches oversold conditions.

Within the context of blue wave 5, price is likely forming yellow wave 4, which belongs to the internal 1–2–3–4–5 yellow structure of blue wave 5.

Once yellow wave 4 is completed, price is expected to resume its advance to form yellow wave 5, thereby completing blue wave 5.

From the RSI perspective, the previous rally reached extremely overbought conditions. This suggests that buying pressure remains strong enough to support at least one more push to a new high, potentially accompanied by bearish divergence at the top. This further supports the scenario that yellow wave 5 will form, and that the market is currently in yellow wave 4.

H4 Wave Structure

The current decline has already reached the 0.382 Fibonacci retracement of yellow wave 3.

From a momentum standpoint, D1 momentum is still declining, so in the near term, another 1–2 days of decline or sideways movement remain possible. Meanwhile, H4 momentum is compressed in the oversold zone, indicating a high probability of a bullish reversal on H4.

Therefore, the most likely scenario is continued sideways movement on H4, or a minor continuation lower before a bullish reaction develops.

RSI from the prior bullish leg remains in a strongly overbought condition, reinforcing the idea that the current decline is corrective in nature, and that the market may still form a new high afterward.

3. Trading Plan

Swing setups:

At this stage, there are no attractive swing positions, as the market is currently in the late phase of an extended wave, where price behavior becomes difficult to predict.

Additionally, today is Friday and also the monthly candle close, which significantly increases volatility risk. The appropriate approach is to remain patient and observe, waiting for D1 momentum to reach the oversold zone, at which point higher-probability swing setups can be considered.

"How does the extreme volatility of gold manifest itself?"📈 1️⃣ Trendline / Main Trend

The overall trend remains BULLISH as price continues to hold above the long-term ascending trendline (the lower diagonal support).

The market structure is still forming long-term Higher Lows, with no signs of a major trend breakdown.

The recent sharp decline appears to be a shakeout rather than a reversal, since price has not closed below the main trendline.

➡️ Trend Conclusion: The medium-term uptrend remains valid, and the current move is a corrective phase.

🟥 2️⃣ Resistance

🔹 5,316 – 5,320

Former breakout zone → now acting as near-term resistance.

Price may react when pulling back to retest this area.

🔹 5,438 – 5,450

Strong resistance (previous top + prior supply zone) + GAP.

A clear break and strong candle close above this zone would confirm bullish continuation.

➡️ At the moment, rallies into these zones may face short-term selling pressure.

🟩 3️⃣ Support

🔹 5,090 – 5,100

Key support zone aligned with the ascending trendline.

This area is crucial for maintaining the bullish market structure.

A strong bounce here would help preserve the medium-term uptrend.

🔹 If 5,090 is broken

Price may enter a deeper corrective phase.

The short-term bullish structure would then be invalidated.

🔻 Trade Setups

SELL GOLD: 5,316 – 5,318

Stop Loss: 5,330

Take Profit: 200 – 400 pips – Open

SELL GOLD: 5,438 – 5,440

Stop Loss: 5,452

Take Profit: 200 – 400 pips – Open

🟢 BUY Setup

BUY GOLD: 5,098 – 5,100

Stop Loss: 5,086

Take Profit: 200 – 400 pips – Open

The uptrend is complete. Forum adjustments are now underway.1️⃣ Market Context

Gold remains in a confirmed higher-timeframe uptrend, but price is currently in a short-term corrective / distribution phase following a strong impulsive rally.

Momentum has clearly slowed, and the market is transitioning from expansion to range–pullback behavior. There is no major high-impact macro catalyst driving strong directional flows at this moment, meaning technical levels and liquidity reactions are in control.

👉 Context Summary:

HTF bias: Bullish

Intraday condition: Correction / consolidation

2️⃣ Technical Breakdown

Market Structure

After a sharp sell-off from the highs, price found strong demand and produced a technical rebound.

On M15, structure shows lower highs, indicating the current move is a corrective pullback, not a fresh impulsive leg.

Buyers are active at demand zones, but upside continuation requires a clean break above key intraday resistance.

Trend & Momentum

Price remains below the descending trendline, which continues to cap bullish attempts.

Each approach into the trendline has triggered selling pressure.

RSI has recovered toward the 50–53 zone, confirming neutral momentum, not overbought conditions.

3️⃣ Key Levels

Resistance (Supply Zones)

5,370 – 5,375

Intraday supply + trendline confluence. Strong reaction area.

5,445 – 5,455

Higher supply zone. Only valid for shorts on clear rejection.

5,485 – 5,520

Major distribution zone. No long entries at this level.

Support (Demand Zones)

5,295 – 5,300

Intraday support. First level for potential bullish reaction.

5,225 – 5,235

Stronger demand zone. High-probability buy area if swept.

5,103 – 5,120

Major demand base. Only relevant if panic selling occurs.

4️⃣ Trading Bias

Primary Bias: Buy the pullback

Secondary Bias: Short-term counter-trend sells at resistance (scalp only)

The dominant trend remains bullish, but entries must be selective and based on price reaction, not anticipation.

5️⃣ Trade Execution Plan

🟢 BUY GOLD 5239 - 5237

↠ Stop Loss 5234

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

🔴 SELL GOLD 5488 - 5486

↠ Stop Loss 5491

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

6️⃣ Risk & Discipline Rules

⚡️ Psychology, discipline, and capital management are the three pillars that turn analysis into consistent profitability. ⚡️

📌 Daily Summary

Gold is in a corrective phase within a broader bullish trend. The plan is to buy dips at demand zones with tight risk and sell only short-term reactions at resistance. Discipline and execution quality will determine performance today.