Short HD; you can do it, I can help.A couple of indicators are showing divergence for the past week or so, as HD has melted up choppily. It needs some relief and is being sustained by erstwhile investors scrambling for a safe investment in a volatile bond market when the banks can't be counted on to manage their risk. I'd suspect that this could continue a little bit, but within the next week or so as the market changes again this should take a pounding.

Note the marked divergences and the weakness of the indicators after we passed the shaded area. Today might well be the double top we need to leg it down.

The way I see it, the weak technical picture hides an interesting scenario; bond yields calm, money flows back into more conditional investments like tech (this will keep happening to a lesser extent everytime yields 'decline' and consolidate) and away from HD. Bond yields increase and the market panics. Bond yields stay the same and people go back to their riskier bets. In all scenarios HD and other builder, stocks decline in the interum. Perhaps they'll pickup before earnings but they need price discovery now.

XHB

WHR: Extreme Bearish DivergenceWhirlpool showing extreme bearish divergence in multiple mid-term timeframes on multiple indicators. Semiconductors used in Microwaves and Appliances are infamously unavailable, and this is sure to affect whirlpool's outlooks despite favorable macroeconomic conditions and stock rotation. The entire sector related to homebuilders is due for a drawback, and despite a p/e of <13 I think WHR will feel it worse.

Why RKT not rocketing higher?Bull Case:

Technically:

1. AO divergence

2. Stoch oversold

3. Vol spike

4. Consolidation / Accumulation between 20-21

Fundamentally:

5. Forward P/E 11

6. 60% institutional ownership (croweded?)

Last Earnings results:

-Closed origination volume up 122% year-over-year to a record $89.0 billion

-Increased GAAP net income 506% year-over-year to $3.0 billion

-Announces $1 billion share repurchase authorization

-“Rocket Companies assisted more clients in the third quarter of 2020 than any quarter in our 35-year history,” said CEO Jay Farner.

Bear Case:

I cant find any. You tell me.

Housing is hot now

IPOs are hot too

Why isn't RKT much higher?

rising channel on daily, bullish homebuilder sectorThe homebuilder sector etf was up .75% on friday, despite rest of market being red. BZH has rising channel on daily, resistance would be $14.44 in this channel. Over 4000 $14 calls sitting in OI for 10/16. Fibonacci .618 is $15.4. Everything is dependant on Trumps health. Happy trading

$LEN Bullish Descending Megaphone$LEN Bullish Descending Megaphone

$LEN has formed a beautiful descending broadening wedge or descending megaphone into its earnings report Monday after close. This pattern retested previous highs and bounced, showing support on a perfect retest of $71.30. First target is previous highs around $79.50 which I am looking for Monday into Earnings. I am looking to stay long LEN & homebuilders in general through earnings but will take some profits at first target.

$XHB on the whole looks decent

Component $DHI looks good

$TOL broke out & looks fantastic

BTO $LEN 9/18 $80c

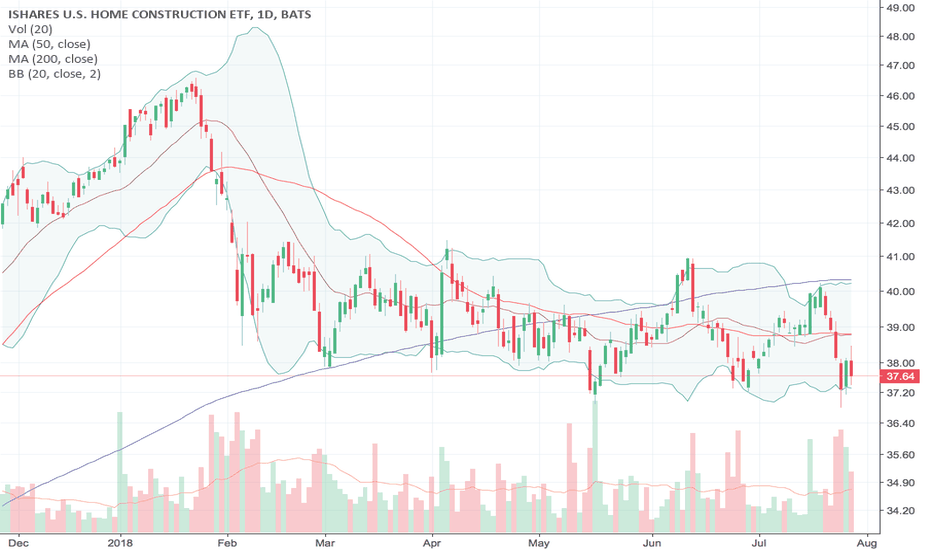

ITB channel breakoutHomebuilders have been behaving well in a channel since the market low of march 23rd.

Tuesday after memorial day was the first break out of the channel, and today's participation continues to give the sector a more positive view.

Next tested resistance which is all time highs around $49.5

Next strong support is the 200sma (red line)

RSI is taking us to overbought level (relative bear)

OBV trending higer (bull)

We are seeing some sort of rotation to more cyclical sectors. I am checking out for IYT, IYF, XLI.

WARNING: Why US Real Estate Bubble Is About to Implode!Dear Friends

You know how D4rkEnergY is here to help you! That's his mission - he is here to make everyone happy. He will warn you about buying your dream home

now. Here is why!

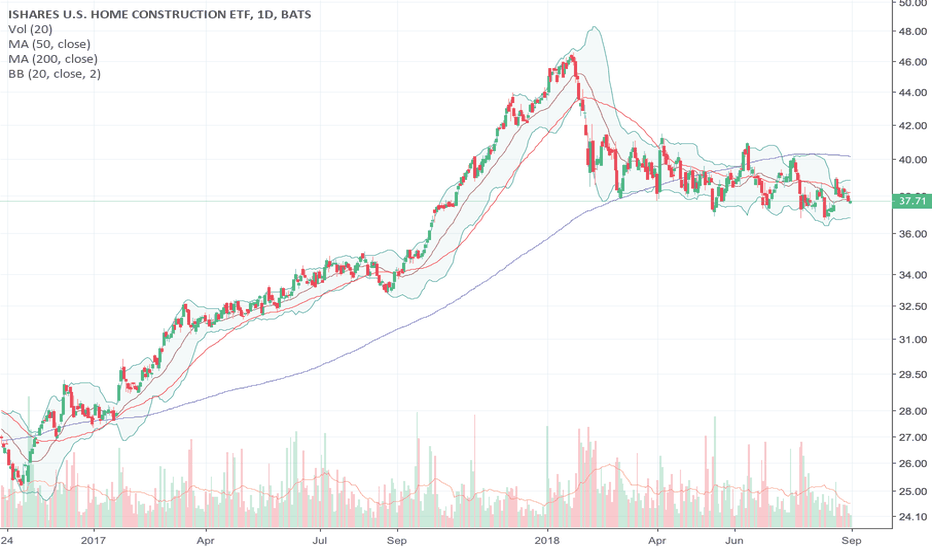

XHB index, the Homebuilder Index, is where we want to look if we want to get an idea about the real estate market in US. It's a really good leading indicator, and are composed of sectors like: homebuilding, construction supply, home improvement, electrical components and home furnishing etc.

It predicted the market crash in 2007-2008 - notice how the index already crashed in 2006 before the real crash happened. Also notice how 2018 has been a huge bloodbath. This could very well be a sign of an coming crash, IF we continue down.

And down we will go - most likely. We already survived one Head and Shoulder pattern due to help from the EMA50. But we are now below this critical area, and the EMA now working against us as resistance.

So here is D4rkEnergYs advice to you:

Don't buy a house now - wait a year or 2 and you can get your dream home on sale!

D4 Loves You <3

Please leave a LIKE! Thanks in advance

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp