Yenpairs

The Yen Conundrum / USDJPY/ Carry trade / Educational Where to start. This is mainly for the traders who partook in a short position is USDJPY during the week of the the USD rate cut and the JPY rate hike.

I am here to try to answer the question the obvious question.

Quick back round on me. Trading for 7+ years. 3+ years profitable.

I am going to try to keep this simple.

Why did USD/JPY go up on BOJ rate hike?

USD RATE CUT/ 3.50%

USD INFLATION/ 3%

REAL USD INTEREST RATE 0.5%

Now very important, USD inflation was 3%, the interest rate has been and is still above the inflation rate.

JPY RATE HIKE/ +0.75%

JPY INFLATION/ 3%

REAL JPY INTEREST RATE NEGATIVE 2.25%.

They could hike a little more but prefer not too because chances of causing a fiscal crisis is high.

There is no confidence here in what they are doing, interest rates still favor the dollar enough to earn, Why would it strengthen

The elephant in the room, Structure of flow

Okay for starters, The carry trade. Sell yen buy other things and collect that gooey interest in-between.

Lets go bigger. Your in charge of a Japanese pension fund, You have billions to invest. Nothing is safe in your country, Nothing has any kind of real yield. They invest abroad.

Imports/exports

Exporters Love it, They import mostly energy and food.

Every time they buy energy... you guessed it, they sell yen/ buy dollar to pay for their energy.

Could it fall, Could it revert? Could the carry trade unwind?

Yes, But for now the macro flows are against you.

Any thing anyone wants to add is the comment section below is welcomed!

Happy trading and happy new year!

Is CAD/JPY Signaling Continuation or a Bull Trap?🍁💴 CAD/JPY: BULLISH BREAKOUT SETUP | Day/Swing Trade

📊 MARKET OVERVIEW

Asset: CAD/JPY (Canadian Dollar vs Japanese Yen)

Current Price: 114.00 JPY

Market Status: ⚡ Consolidating near resistance with bullish momentum

🎯 TRADE PLAN

Direction: 📈 BULLISH

Entry Strategy:

✅ ANY PRICE LEVEL after confirmed breakout above 114.400

Wait for candle close above resistance

Volume confirmation preferred

Look for retest of broken level

Stop Loss: 🛡️ 113.700

⚠️ CRITICAL DISCLAIMER: This is MY stop loss based on MY risk tolerance. Dear Traders & Investors - YOU must adjust YOUR stop loss based on YOUR strategy, YOUR risk management, and YOUR account size. Trade at YOUR OWN RISK.

Target: 🎯 115.500

💡 Multiple resistance factors at target:

Historical resistance zone

Overbought territory potential

Profit-taking area

Correction zone likely

⚠️ TAKE PROFIT DISCLAIMER: This is MY target. Dear Traders & Investors - YOU should set YOUR take profit based on YOUR analysis and YOUR risk-reward preference. Scale out profits as YOU see fit. YOUR money, YOUR choice, YOUR responsibility.

💵 CORRELATED PAIRS TO WATCH

USD Pairs:

USD/CAD @ 1.3738 - Inverse correlation (USD strength impacts CAD)

USD/JPY @ 161.84 - Direct impact on JPY side

Commodity Currency Pairs:

AUD/CAD @ 0.9132 - Similar commodity correlation

NZD/CAD @ 0.7994 - Risk-on/off sentiment indicator

Cross Pairs:

EUR/JPY @ 183.35 - JPY strength indicator

GBP/JPY @ 209.67 - Yen risk appetite gauge

Correlation Note: These pairs move in tandem due to USD strength, commodity prices, and risk sentiment. Monitor for confluence.

📰 FUNDAMENTAL FACTORS

🇨🇦 Canada (CAD Bullish Drivers):

Bank of Canada Status:

Policy rate: 2.25% (held December 10, 2025)

Cut cycle paused after signal rates "about right"

Q3 GDP growth: +2.6% (beat expectations)

Unemployment fell to 6.5% in November

CPI inflation: 2.2% (near 2% target)

Economic Outlook:

✅ Strong Q3 growth surprise

✅ Labor market improving

✅ Inflation under control

⚠️ Trade uncertainty with US tariffs

Crude Oil Link:

WTI @ $58.56/barrel (up 6 consecutive sessions)

Geopolitical tensions supporting prices

CAD highly correlated with oil prices

Canada is major energy exporter to Asia

🇯🇵 Japan (JPY Bearish Pressures):

Bank of Japan Recent Action:

Rate hike: 0.75% (December 19, 2025)

Highest rate since September 1995

Hawkish stance but REAL rates still deeply negative

More hikes signaled ahead

Economic Challenges:

❌ CPI inflation: 2.9% (above 2% target for 44 months)

❌ Real wages declining 10 months straight

❌ Yen weakness (154-157 vs USD)

❌ Despite rate hikes, yen remains under pressure

✅ Wage growth momentum expected 2026

Key Factor: Even at 0.75%, with 2.9% inflation, Japan's REAL interest rate is -2.15% (deeply negative), keeping yen structurally weak.

🔍 KEY ECONOMIC EVENTS AHEAD

Upcoming Dates:

January 28, 2026: Bank of Canada next rate decision

Q1 2026: BoJ expected to continue rate hikes toward 1.0-1.25%

Weekly: Canadian employment data

Weekly: Japanese inflation data

Critical Catalysts:

🛢️ Crude oil price movements

📊 Canadian GDP data

💹 BoJ policy statements

🌐 US-Canada trade developments

💴 Yen intervention risk (if weakness accelerates)

⚖️ INTEREST RATE DIFFERENTIAL

Canada: 2.25% | Japan: 0.75%

Differential: +1.50% favoring CAD

This positive carry makes CAD/JPY attractive for:

Swing traders capturing rate differential

Carry trade positioning

Medium-term bullish bias

🚨 RISK FACTORS

Bearish Risks:

⚠️ BoJ intervention if yen weakens too rapidly

⚠️ Crude oil price collapse

⚠️ US tariff escalation hitting Canadian economy

⚠️ Global risk-off sentiment strengthening JPY

Bullish Confirmations:

✅ Sustained oil price strength

✅ Canadian data beats expectations

✅ BoC maintains "higher for longer" stance

✅ Risk-on market environment

📈 TECHNICAL SETUP SUMMARY

Trend: Bullish channel respected

Support: 113.450 weekly zone

Resistance: 114.400 (breakout level)

Target: 115.500 (profit zone)

Market Structure: Higher lows intact

⚡ FINAL WORD

Dear Traders & OG's 👑

This is MY analysis based on current market data. YOU are responsible for YOUR trades. Always:

Size YOUR positions appropriately

Use YOUR stop losses

Take YOUR profits when satisfied

Manage YOUR risk

NOT FINANCIAL ADVICE. Trade at YOUR OWN RISK.

📊 May the markets be in your favor! 🚀

USD/JPY: The Yen Regains Strength At present, USD/JPY has posted a streak of three consecutive bearish sessions, recording a short-term decline of more than 1.3%, as a consistent selling bias has begun to dominate year-end price action. For now, selling pressure has remained firm, as markets are increasingly pricing in expectations that the Bank of Japan could continue with a series of interest rate hikes heading into 2026. This outlook has helped keep Japanese bond yields at attractive levels, supporting steady demand for the yen in the short term. As long as confidence around higher rates in Japan during the first part of 2026 remains in place, selling pressure in USD/JPY is likely to continue shaping price movements over the coming trading sessions.

The Aggressive Trend Begins to Weaken

Since the early days of October, USD/JPY had managed to sustain an aggressive bullish trend. However, recent price action has started to reflect growing weakness, in line with the yen’s short-term strengthening. This has prevented the trendline from posting new highs consistently, highlighting an emerging neutral tone in price behavior. If this dynamic persists, it could place the prevailing bullish trendline—still the most relevant technical structure on the chart—at risk. Should buying pressure fail to hold, price action could give way to a short-term consolidation range, marked by persistent indecision.

Indicators

At the moment, both the RSI and the MACD are oscillating close to their respective neutral levels of 50 and 0. This suggests that indecision is building both in the average momentum of the past 14 sessions and in short-term moving average strength. If this behavior continues across both indicators, it could reinforce a more pronounced neutral phase, favoring the development of a short-term sideways range in USD/JPY price action.

Key Levels to Watch:

158.89 – Key resistance: This level corresponds to the 2025 highs and stands out as the most relevant bullish barrier to monitor. Bullish moves that manage to break above this zone could revive a stronger buying bias and open the door to an extension of the aggressive uptrend.

157.48 – Nearby barrier: A level aligned with recent highs that could act as a short-term equilibrium point. Price action holding around this area may amplify market indecision and support the formation of a more defined sideways range.

154.51 – Major support: This level aligns with the 50-period simple moving average. Bearish moves that break below this zone could put the aggressive bullish trendline at risk and open the door to a dominant bearish bias toward the close of 2025 for USD/JPY.

Written by Julian Pineda, CFA, CMT – Market Analyst

AUDJPY Eyes a Rally Above 100.00 as Japan Likely Holds RatesHey Realistic Traders!

Falling Wedge Breakout & Looser Fiscal Policies, Could OANDA:AUDJPY exceed 100.000 level?

Current Market Sentiment

The yen slipped to a one-week low on Tuesday after hardline conservative Sanae Takaichi was elected as Japan’s new prime minister. Her expected push for looser fiscal policies and the potential for greater uncertainty over interest rates have added pressure on the currency. Therefore, we anticipate further yen weakness ahead.

Now, Let’s dive into the technical analysis to see what the chart is really telling us.

Technical Analysis

AUDJPY has moved above the EMA200 again and the bullish candlestick remains above the EMA200 level, indicating bullish trend. While the MACD golden cross added confirmation to the bullish bias. Together, these factors strengthen the case for continuation of the prevailing trend.

In this scenario, the first upside target lies at 100.774 , a level that coincides with historical resistance and where a short-term correction could take place. Should bullish momentum persist, AUDJPY has the potential to extend higher toward 102.098.

This bullish outlook will remain valid as long as price stays above 96.254. A move below that level would invalidate the setup and return the outlook to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on AUDJPY.

GBP JPY - Wave D forming?Daily chart image shows my thought pattern and an opportunity I am waiting for price to revert to.

I'm referring to the Daily price chart and key counts are in line with Wave counting and supply and demand curve trading levels based on fair value gap intervals of weekly trading sessions plotted to a daily chart at intervals of 60.

Current wave -

Wave A: The first correction test (200+) - where a rejection into the impulse high - to form a weekly supply.

- Wave B: Deep testing of the lows into 184 territory, but keeps the rising channel weekly in tact.

- Wave C: Technical rebound exactly to the higher wick on the max top of the supply and settled in the marked zone - of a large volume of sell orders.

- Now to Wave D formation: 190? or below 189*? showing the weekly trend down to where the wav could end?

Master Key for zones

Red = Three Month

Blue = Monthly

Purple = weekly

Pink = Consolidative box example (Daily)

Orange = Daily

Risk Warning

Trading leveraged products such as Forex, commodities and CFDs, carries with it a high level of risk and so may not be suitable for every investor. Prior to trading the foreign exchange, commodity or CFD market, consider your investment objectives, level of experience and risk appetite. You should never risk more than you can afford to lose. If you fail to understand or are uncertain of the risks involved, please seek independent advice and remember to conduct due diligence as criteria varies to suit the individual.

Below are some of the take aways from the video - please listen again incase any detail is missed.

Do you enjoy the setups?

Professional analyst with 8+ years experience in the capital markets

Focus on technical output not fundamentals

Focus on investing for long term positional moves

Provide updates where necessary - with new updated ideas tracking the progress.

If you like the idea, please leave a like or comment.

To all the followers, thank you for your continued support.

Thanks,

LVPA MMXXIV

Political chaos in Japan collides with key chart setupsThe yen’s momentum reversed sharply on Friday, perhaps getting ahead of the weekend’s news. Japan’s Prime Minister Shigeru Ishiba announced his resignation following growing pressure within his party to accept responsibility for a historic loss of power in this year's election.

As the new trading week begins, the outlook for the yen remains fragile. Unless volatility in Japanese government bonds subsides, USD/JPY, EUR/JPY, and GBP/JPY potentially all look tilted to the upside.

This week’s domestic calendar will also draw attention, with final Q2 GDP, August producer inflation, machine tool orders, Reuters Tankan results, and key manufacturing sentiment surveys all in focus.

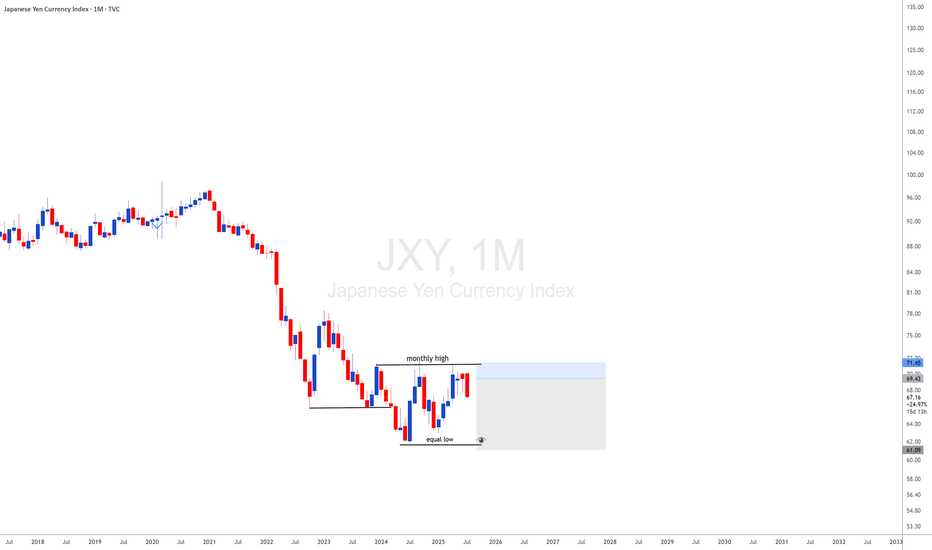

JXY with JXY looking monthly downside and DXY looing upside i will be looking for 35 years breakout of usdjpy meanning uj is a long therm upside

How to View the Assets in Japan

It should be noted that many of the assets the government owns are not marketable, or, if so, their

price can sharply drop in the case of fiscal crisis. Therefore, the financial situation should be assessed

first by gross debt.

In addition, the assets earmarked with the liabilities (such as pension reserves and FILP loans) are

not directly related to fiscal consolidation because they are not included in “Bonds outstanding of

central and local governments”, which is the benchmark of fiscal consolidation target

"(NZD/JPY) Kiwi-Yen Bandit Trade: Steal 200+ Pips This Week!"🚨 NZD/JPY Bank Heist: Loot the Kiwi-Yen Rally Before the Cops Arrive!

🌟Hola! Kia ora! Konnichiwa! Hello, thieves! 🌟

Attention all market bandits & profit pirates! 🏴☠️💰

Your favorite 🔥Thief Trading Crew🔥 is back with another high-stakes forex robbery—this time targeting the NZD/JPY "Kiwi vs Yen" vault!

🔓 The Master Plan:

Long entry = Our golden key to the bank.

Target: The high-risk Yellow ATR line (where traps lurk, but so do MASSIVE profits!).

Danger zone: Overbought signals, bearish ambushes, fakeouts—but we steal smarter!

📈 Entry Point:

"Vault doors cracked open—swipe those bullish gains NOW!"

👉 Pro thief move: Set buy limits near 15-30min swing lows/highs for sneaky pullback entries.

🛑 Stop Loss (Escape Route):

Thief SL: Hide below the 4H moving average (85.800).

Adjust based on your risk appetite & loot size.

🎯 Take Profit: 88.500 (Time to vanish with the cash!)

⚡ Scalpers’ Corner:

Only scalp LONG—no bearish bets!

Big stacks? Raid the market now.

Small budget? Join swing traders & execute the heist slow & steady.

Trailing SL = Your getaway driver. 🚗💨

💡 Why NZD/JPY?

Bullish momentum fueled by:

Fundamentals (COT data, macro trends)

Market sentiment & intermarket flows (Full analysis in bi0 linkks! 🔗👉👉👉)

⚠️ Heist Alert! News = Police sirens! 📢🚨

Avoid new trades during high-impact news.

Trailing stops = Your invisibility cloak.

💖 Support the Crew!

SMASH THAT BOOST BUTTON! 💥

Help us dominate the charts & loot daily with the Thief Trading Style! 💰🔥

Next heist coming soon… Stay sharp, thieves! 😎🔪

"CHF/JPY Bullish Trap? We’re Stealing Profits Anyway!"🔥 Swiss-Yen Bank Heist: Bullish Loot Grab! (CHF/JPY Master Plan) 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting a bullish heist on the CHF/JPY "Swiss-Yen" Forex Bank. Follow the strategy on the chart—long entry is our golden ticket! Target? The high-risk Red Zone—where police traps, overbought signals, and bearish robbers lurk. But we’re sneaky thieves… and we always get the loot! 🏆💸

📈 Entry: "The vault is wide open!" Swipe bullish gains at any price—the heist is LIVE!

Pro Tip: Place buy limit orders within 15-30 min (swing lows/highs).

🛑 Stop Loss:

Thief-style SL at recent 4H swing low (174.100) (Day/scalping trade)

Adjust based on your risk, lot size, and multiple orders.

🎯 Target: 177.200 (Time to cash out!)

🧲 Scalpers: Eyes here! 👀

Only scalp LONG.

Big money? Charge in! Small budget? Join swing traders and execute the robbery.

Trailing SL = Your money’s bodyguard. 💰

Why CHF/JPY?

Bullish momentum fueled by:

Fundamentals (COT reports, macro trends)

Sentiment + Intermarket analysis (Check our bioo for deep dives! 🔗👉👉👉)

⚠️ Trading Alert: News = Chaos! 📰🗞️🚫

Avoid new trades during major news.

Trailing stops = Profit protector.

💖 Support the Heist!

Smash the Boost Button! 💥

Strengthen our robbery squad. Steal profits daily with the Thief Trading Style! 🏆💪🚀

Stay tuned—another heist drops soon! 🤑🐱👤🤩

STEAL THIS TRADE! GBP/JPY Long Setup(Thief Trader’s Secret Plan)💰 Thief Trader’s GBP/JPY Heist Alert – Stealthy Long Setup Loading!

🌍 Greetings, Profit Raiders!

Hola, Konnichiwa, Ni Hao, Privyet, Hallo, Bonjour!

📢 Attention Market Bandits & Chart Pirates—the GBP/JPY Beast is ripe for plunder! Time to execute the next Thief Trader Masterplan.

🎯 Entry Zone – Loot the Dip!

Current price = Open vault. Fire longs now or snipe pullbacks (15M/30M charts recent swing low level).

Pro Thief Move: Stack buy limits near swing lows/highs. Chart alerts = your secret weapon. 🔫

🛑 Stop Loss – Guard the Treasure!

Swing Thieves: Hide SL below 4H swing low (~190.000).

Day Raiders: Adjust SL to your risk size & order count. No free rides!

🎯 Profit Target – Escape with the Gold!

Take the 200.000 bag or exit early if momentum fades.

🔪 Scalpers vs. Swingers – Choose Your Weapon!

Scalpers (Quick Strikes): Longs only. No distractions.

Swing Traders (Patient Hunters): Trail stops & lock in gains.

🌪️ Market Pulse – Bullish Winds Blowing!

Price battling MA Resistance? No panic. Bulls still rule thanks to:

Fundamentals + Macro Trends

COT Data + Sentiment Shift

Quant Scores & Intermarket Alignments

(Check Linkss for the full heist blueprint.)

⚠️ News Trap Warning!

Upcoming high-impact events? Freeze trades or tighten stops. Trailing SL = your escape route.

🚨 Join the Thief Trading Crew!

Like 👍 or Boost 🚀 this idea to fuel our next raid.

Thief Trader Tactics = Daily Market Domination. Your support keeps the heists alive! 💰❤️

🤑 Stay Locked In – The Next Big Score is Coming…

Timing is everything. Watch the charts. Strike hard. Exit smarter.

I continue to sell JPY pairs (go long the yen)I've been long the JPY since the beginning of 2025. I recently closed an incredible OANDA:NZDJPY short position, which was very rewarding. Currently, I'm short CADJPY, CHFJPY, EURJPY, and GBPJPY.

My bullish bias for the yen continues. The yen index recently closed above a key horizontal level, signalling that there could be more upside.

Buy the Yen!If you've been following my content, you'll know I've been long the yen since the start of 2025. My short AUDJPY, CADJPY, EURJPY, NOKJPY, and NZDJPY positions are starting to pay off!

The yen index ( TVC:JXY ) recently closed above a key horizontal resistance at 66.00. This may signal the JPY may continue to strengthen and test the weekly range resistance at 71.00.

OANDA:AUDJPY

OANDA:CADJPY

OANDA:EURJPY

OANDA:GBPJPY

OANDA:NZDJPY

OANDA:USDJPY

EURJPY I Potential retracement and more downside Welcome back! Let me know your thoughts in the comments!

** EURJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

EURJPY Pattern FormationThis price has been forming a rising flag for the past few years (according to monthly and weekly timeframes) and I do except that the price will continue with the bearish momentum to complete pattern.

An analysis will follow using a shorter time frame to know the entry position.

Fundamental Market Analysis for November 22, 2024 USDJPYHigher market sentiment and rising US bond yields are limiting the rise of the low-yielding yen.

The US Dollar is holding near its highest level in the last year and is providing support to the USD/JPY pair.

The Japanese Yen (JPY) attracted buying for the second day in a row following the release of slightly better-than-expected Japanese consumer inflation data. This came amid statements released on Thursday by Bank of Japan Governor Kazuo Ueda, which kept expectations of an interest rate hike in December. In addition, Japanese Prime Minister Shigeru Ishiba's 39 trillion yen economic stimulus package boosts the Yen and puts some pressure on the USD/JPY pair.

Nevertheless, the prevailing risk-on and higher US Treasury yields keep traders from aggressive bullish bets on the low-yielding Yen. Investors remain concerned that U.S. President Donald Trump's policies could lead to renewed inflation and force the Federal Reserve (Fed) to slowly cut interest rates. This has been a key factor in the recent rise in US bond yields, which has kept the US Dollar (USD) near yearly highs and provided support to the USD/JPY pair.

Trade recommendation: Watch the level of 154.00, trading mainly with Buy orders.

AUDJPY LoongEver since this price touched its LL at 93.5, it has been filling the imbalance created by then the volatile bearish momentum.

So far, it has filled two of the three imbalances created, and I anticipate that the next bullish momentum will be to fill before it resumes with the bearish momentum.

Entry at 101.5, target at 102.9 and SL at 100.8

Yen VS Dollar; Trade with cautionGlobal financial markets are bracing for a possible Fed rate cut. Accordingly, forex markets have priced in the anticipated rate cut. September CPI data indicated US inflation is on course towards 2%; seems like the prevailing interest rates are working.

Blackrock thinks the Fed will be cautious with a 25-bps rate cut as opposed to a 50-bps rate cut. There is also the remote possibility that the Fed will be cautious and maintain the rates. Ostensibly, it seems the markets have aggressively priced in a rate cut that has seen the dollar weaken against major currencies.

Looking at cross Yen pairs, bearish momentum is dominant in Q3 OF 2024. However, we have seen price imbalance and price inefficiency across all Yen pairs that must be corrected. For this imbalance to be corrected, we require the US Dollar to rise. All factors held constant, retaining rates or cutting rates lesser than expected will spook the markets and we could see the dollar strengthen against the Yen and other major global currencies.

Turning to the US Dollar index, we see a potential for further weakening before the index rises targeting 105 to 110 price levels.