ZM - Zoom in on this one...Growing Revenue, chart stabilising...Is NASDAQ:ZM looking to make a serious move to the upside?

Our systems have identified a point of potential interest & volatility in ZM.

If price can hold above $78.21 ... Significant Bullish potential may be unlocked.

If however price falls below $78.21 ... Significant Bearish risk may come into play.

As things sit now, it seems momentum may have turned to the upside for ZM, but will it hold? Let's find out...

We're inspired to bring you the latest developments across worldwide markets, helping you look in the right place, at the right time.

Explore our profile for further updates, and we look forward to being of service along your trading & investing journey!

Disclaimer: Please note all information contained within this post and all other Bullfinder-official Tradingview content is strictly for informational purposes only and is not intended to be investment advice. Past performance is not in any way indicative of future performance. Please DYOR & Consult your licensed financial advisors before acting on any information contained within this post, or any other Bullfinder-official TV content.

ZOOM

ZOOMing back to $160 $ZMZoom is already a solidly profitable, mid teens P/E on forward earnings and very strong gross margins versus large SaaS and tech peers.

Recent quarters have shown revenue growth reaccelerating from a low base.

Management has repositioned the company as a unified communications and AI centric platform

(ZOOM workplace, Phone, contact center, AI companion) broadening it's TAM beyond meetings and supporting upsell to existing enterprise customers.

Zoom has a strong balance sheet and robust free cash flow, which limits downside and offers buyback optionality.

#CupandHandle

ZM | Price Will ZOOM Higher | LONGZoom Communications, Inc. engages in the provision of a communications and collaboration platform. It operates through the following geographical segments: Americas, Asia Pacific, and Europe, Middle East, and Africa. The company was founded by Eric S. Yuan in 2011 and is headquartered in San Jose, CA.

ZOOM : go LONG

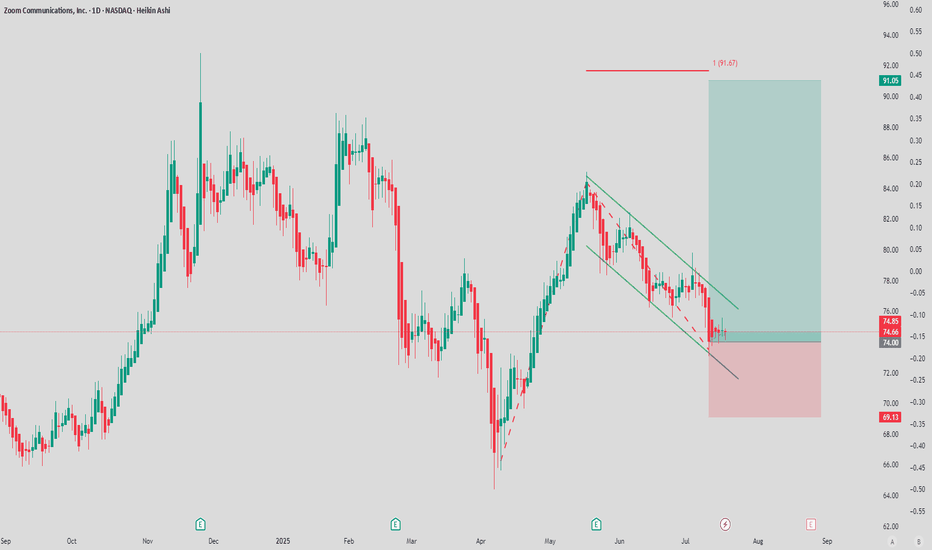

1. Technical Analysis (Based on the Heikin Ashi Chart)

The Heikin Ashi chart is used to smooth out price fluctuations, making it easier to identify market trends.

* Strong Bullish Reversal Signal:

* Following a period of consolidation or slight correction (late September to mid-October), the chart shows a series of consecutive green Heikin Ashi candles, signaling a shift from a sideways/downward trend to an uptrend.

* The appearance of long-bodied green candles with little or no lower wick, particularly in late October and early November, is a powerful indicator that buying pressure is dominating.

* Breakout Above Resistance/Accumulation Zone:

* The stock price has broken out above the horizontal support/resistance line marked at approximately $82.66. This area was likely a zone of accumulation or prior resistance. Breaking this level with strong green candles suggests investor consensus and the potential for continued upward momentum.

* Potential Price Target:

* Based on the trade setup shown on the chart, the potential target price is set at $122.38. This represents a significant potential return relative to the current price ($87.23), indicating an attractive risk/reward ratio if the stop-loss is placed logically below the broken support level.

* Current Entry Point:

* The current price of $87.23 is right after the confirmation of the bullish signal (post-breakout of $82.66), which could represent an optimal entry point to ride this new uptrend.

2. Fundamental Analysis

While Zoom faces intense post-pandemic competition, the following fundamental factors still support a buy thesis:

* Revenue and Earnings Beat Expectations:

* Zoom has raised its revenue outlook for the full fiscal year 2025 (projecting $4.61 billion - $4.62 billion) and reported adjusted Earnings Per Share (EPS) higher than previous forecasts, indicating the company's ability to grow and manage costs effectively.

* Consistently beating analysts' estimates in recent earnings reports (e.g., Q4 revenue of $1.15 billion) builds positive confidence in the business's capabilities.

* Sustainable "Hybrid Work" Trend:

* Although the pandemic is over, the hybrid work model (combining remote and in-office work) has become a long-term trend. Demand for professional, user-friendly video conferencing solutions like Zoom Phone, Zoom Rooms, and Zoom Video Webinar remains strong and steady.

* Product Diversification and Acquisition Strategy:

* Zoom is actively expanding into other enterprise services like Zoom Phone and Zoom Rooms to reduce reliance on the core video meeting application and seek more sustainable revenue streams from larger customers (Enterprises).

* The integration of Artificial Intelligence (AI) into its services is also a key focus, promising to enhance user experience and create new competitive advantages.

* The company has engaged in a Share Buyback plan, which is generally viewed positively, as it reduces the number of outstanding shares and can support the stock price.

* Strong Financial Position:

* The company maintains a large Free Cash Flow and holds a significant amount of cash on its balance sheet, providing flexibility to invest in growth, pursue acquisitions, or navigate economic uncertainties.

Zoom $78 Calls: Huge Earnings Upside Potential!

## 🚀 Zoom Earnings Play: Cheap Calls Before the Bell (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.9% TTM – stagnant post-COVID growth

* ⚖️ **Margins:** Gross 75.9%, Profit 22.3% → Strong efficiency

* 📈 **Historical Beat Rate:** 100% over last 8 quarters

* 🖥️ **Sector:** Tech / SaaS – AI and cloud trends impact growth sentiment

* 🧭 **Analyst Consensus:** Buy, with upside potential

---

### 🔎 Options Flow Insight

* 📉 **Put Activity:** OTM puts (\$66-\$67) highlight cautious institutional sentiment

* ⚖️ **Put/Call Skew:** Slightly bearish, hedging activity present

* 💡 **Opportunity:** Take advantage of earnings momentum with \$78 calls

---

### 📉 Technical Setup

* 📊 **Current Price:** \$72.16 → below 50D (\$75.09) & 200D (\$78.61) MA

* 🔑 **Support:** \$71.00

* 🔑 **Resistance:** \$75–\$78

* 💥 Volume: Slightly below average, indicates muted momentum

---

### 🎯 Trade Setup (Earnings Play)

* 🟢 **Direction:** CALL (Bullish Bias)

* 🎯 **Strike:** \$78.00

* 💵 **Entry Price:** \$0.98

* 📅 **Expiry:** Aug 22, 2025

* 📊 **Size:** 1 contract

* 🕒 **Entry Timing:** Pre-earnings close

📌 **Profit Target:** \$2.94 (200% 🚀)

📌 **Stop Loss:** \$0.49 (50% of premium)

📌 **Exit Rule:** Within 2 hours post-earnings to avoid theta decay

---

🔥 Hashtags for Reach 🔥

\#ZoomEarnings #ZMOptions #EarningsPlay #TechStocks #OptionsTrading #TradingSetup #DayTrading #SwingTrading #WallStreet

Possible Long ZMThe price is at a turning point:

In the short term, the key is to see if it can break the 61.8% Fibonacci resistance (USD 72.29) and confirm with volume.

Downside risk remains as long as it does not break above the descending trendline.

Aggressive traders could look for entries on a confirmed breakout, while conservative profiles would wait for a close above USD 74.7 to reduce risk.

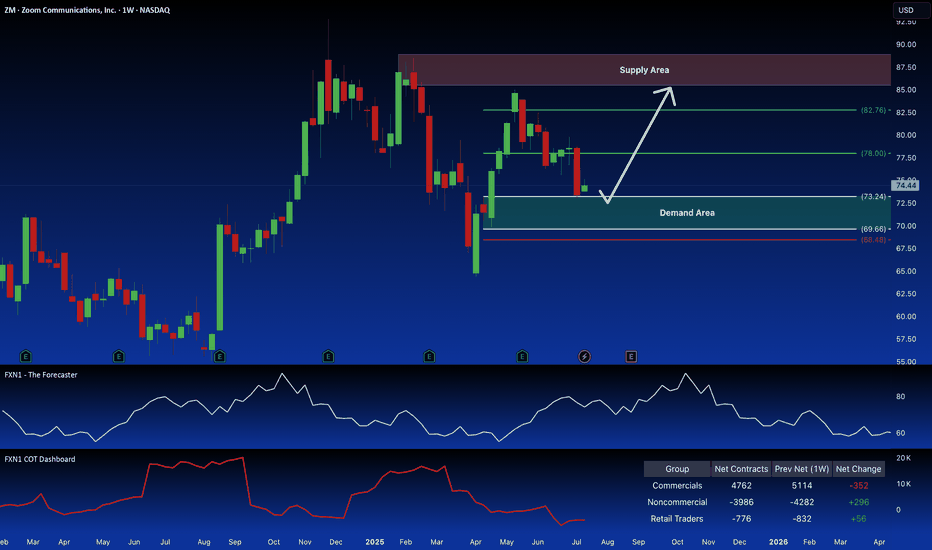

Zoom (ZM): Potential Long Setup at Demand ZoneZoom Video Communications (ZM) recently experienced a rejection at a key demand zone on its weekly chart. Non-commercial traders have increased their long positions, and forecasts suggest a potential upward trend. I'm considering a long trade setup based on a retest of that demand zone. What are your thoughts?

✅ Please share your thoughts about ZOOM in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

ZM Zoom Video Communications Potential BreakoutIf you haven`t bought ZM at the end of the giant falling wedge:

Now Zoom Video Communications (ZM) is currently showing a bullish pennant pattern, which is often a precursor to an upward breakout.

With the stock approaching the $72 level, a breakout could lead to a swift move higher, given the strong technical setup.

For speculative traders, buying the $72 strike price calls expiring this Friday at a $0.12 premium offers an appealing risk-reward ratio.

If ZM breaks above the resistance, these calls could rapidly gain value.

🔀 Bang Bang. Zoom Hit The Ground. Bang Bang. Bears Shot It DownZoom company's video-conferencing service became so ubiquitous during the Covid-19 pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

Zoom shares VIE:ZOOM rose seven-fold in 2020 as sales surged after millions of workers were stuck at home because of COVID-19 restrictions. By 2021, though, revenue growth slowed, and the stock plunged. The company has shed at least $100 billion in market value since then.

Meanwhile over the past two years, the stock has stagnated because Zoom's video-conferencing service is needed less as businesses continue pushing staff back to the office.

Zoom, one of the main enablers and beneficiaries of remote work, in August 2023 has asked its employees to head back to the office. The company announced that employees living within 50 miles of a Zoom office must work there at least two days a week.

"We believe that a structured hybrid approach – meaning employees that live near an office need to be onsite two days a week to interact with their teams – is most effective for Zoom," a spokesperson said in a statement. "As a company, we are in a better position to use our own technologies, continue to innovate, and support our global customers."

As pandemic Covid-19 is over, many other companies have announced return-to-office mandates, but Zoom's change of heart is surprising given the role its technology plays in remote work. The company's video-conferencing service became so ubiquitous during the pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

People are back to Travelling. The annual graph for NYSE:RPM , Revenue Passenger Miles for U.S. Air Carrier Domestic and International, Scheduled Passenger Flights.

Meanwhile, there're some important things to say.

Warren Buffett's 99-year-old business partner, Charlie Munger, was surprisingly embraced Zoom during the pandemic. Eric Yuan, the founder and CEO of the video-conferencing platform, celebrated the veteran investor's endorsement of his product on an earnings in 2021.

"I have fallen in love with Zoom," Munger, the vice-chairman of Berkshire Hathaway, said in a CNBC interview filmed at Berkshire's annual shareholder meeting in May, 2021.

"Zoom is here to stay. It just adds so much convenience."

• Munger added that he struck a deal in Australia using the communications tool. He trumpeted its prospects at Daily Journal's annual meeting in February, 2021 as well.

• When the pandemic is over, I don't think we're going back to just the way things were," the newspaper publisher's chairman said.

• We're going to do a lot less travel and a lot more Zooming.

Charlie loves Zoom and uses it frequently for business and to keep in touch with his family, as it's difficult for him to travel.

His business advice was to build a better product or offer a better solution, that it's all about competition, and that successful people are those with the acumen to understand life better than everyone else. He said it's up to you to work harder and better than the next person.

Charlie also said investments are better than money in the bank, and it's important to go to the office to work in person.

The main graph says, Zoom equities just hit the major all history ground support near $59 per share.

Zoom's Surges 2.47% Early Thursday on Q2 Earnings ReportZoom Video Communications, Inc. (NASDAQ: NASDAQ:ZM ) showcased its ability to navigate the post-pandemic landscape with a solid Q2 earnings report, leading to a 2.47% surge in Thursday’s premarket trading. Despite facing headwinds from decelerating growth, the company outperformed Wall Street expectations, offering a glimmer of hope for investors.

Key Financial Highlights

For the quarter ended July 31, Zoom (NASDAQ: NASDAQ:ZM ) reported adjusted earnings of $1.39 per share, a 4% increase from the previous year, and above analyst projections of $1.21 per share. Revenue rose 2% to $1.162 billion, also surpassing estimates of $1.149 billion. However, this marked the tenth consecutive quarter of slowing sales growth, reflecting the company’s ongoing transition from the explosive demand driven by the COVID-19 pandemic to a more stabilized market environment.

The enterprise segment, a key area of focus for Zoom (NASDAQ: NASDAQ:ZM ), saw revenue rise 3.5% to $683 million, beating expectations of $675 million. This growth is particularly encouraging as Zoom continues to evolve into a comprehensive communications platform, catering to business needs beyond its core video conferencing service.

Future Outlook: Revenue Re-Acceleration on the Horizon?

Zoom’s guidance for the October quarter has further bolstered investor confidence. The company expects revenue between $1.16 billion and $1.165 billion, slightly above analyst estimates of $1.157 billion. This outlook, along with an upward revision of its full-year revenue and profit forecasts, suggests that Zoom’s expanded product suite is gaining traction with enterprise customers.

Despite these positive developments, Zoom’s stock remains under pressure, having dropped nearly 18% before the earnings report and 16% year-to-date. The market has been concerned about the company’s ability to maintain growth, particularly as competition intensifies from giants like Microsoft and its Teams platform.

Strategic Shifts and Leadership Changes

Zoom’s efforts to diversify its offerings are evident in its recent moves. The company is expanding its business tools to include phone systems, contact centers, and AI-powered assistants. Additionally, the launch of a single-use webinar service capable of hosting up to 1 million attendees signals Zoom’s commitment to innovation and adaptability.

However, the announcement of CFO Kelly Steckelberg’s departure at the end of the fiscal quarter has added an element of uncertainty. While Zoom clarified that Steckelberg’s exit is not due to any internal disagreements, the search for a successor will be closely watched by investors.

Navigating the Post-Pandemic World

Zoom’s success during the pandemic was unprecedented, but the company now faces the challenge of maintaining relevance in a world that is gradually returning to in-person interactions. The ongoing decline in consumer and small business customers has been a point of concern, with sales in this segment remaining flat year-over-year. However, the company reported its lowest ever churn rate, indicating some stability in this crucial market.

CEO Eric Yuan emphasized the resilience of Zoom’s business, particularly among smaller customers, and highlighted the platform’s role in hosting significant political events, including those supporting Vice President Kamala Harris. This demonstrates Zoom’s continued importance in various sectors, even as it navigates a more competitive and less predictable environment.

Conclusion

Zoom’s Q2 earnings report may have provided a short-term boost to its stock, but the road ahead remains challenging. The company’s ability to reaccelerate growth, especially in its enterprise segment, will be critical in determining its long-term success. As Zoom continues to innovate and expand its product offerings, investors will be watching closely to see if the company can sustain its momentum in a post-pandemic world.

With the market’s focus on the bottom line and the looming leadership transition, Zoom’s next moves will be pivotal in shaping its future trajectory.

ZOOM: $66 | From Video to an Ai Assistant somehowwe all know zoom DOMINATED during the the COVID Breakout

yet when the Vaccine was rolled out by WHO and Fauci it discounted quickly to rollback to where it came from

Google Meeting is killing it Microsoft meeting is getting a piece of the pie

the ai angle in zoom iQ may take a while for ENTERPRISE players to digest

to put it simply its a business to business model

that reminds me of Business INtelligence of Msoft or

EXECUTIVE DASHBOARD appls back in 2005ish

it's a different flavor of BARD or HER that Robot Assistant movie

needs a great PACKAGER to roll this out

if this pans out.. this can be YUUUUGE!

ZOOM iQ = a glorified Executive Assistant that summarizes meetings.

ZOOM 70 % rally comingZOOM remains bearish.

Last week we had both bearish engulfing weekly and monthly close.

We expect the downtrend to continue and retest lows from 2019.

After that if we get bullish divergences, it may be the time to accumulate zoom stock.

If we break below previous all time lows, new lows may be coming as the price will enter the discovery mode to the downside therefore it´s important to set up the stop loss.

Entry, target and stop loss are shown in the chart.

Zoom (ZM): Zoom Bottoming Out? Major Accumulation Signs!A stock we previously considered "dead" and seemingly on its last legs is Zoom. Despite its current low standing, it warrants another look.

Zoom is currently trading around its lowest level ever, approximately $58 to $59. This is a stark contrast to its all-time high of $588, marking a significant sell-off following the end of the COVID-19 pandemic. Stocks like Zoom are challenging to evaluate due to the massive fluctuations in value.

Historically, Zoom has tested and held the $250 level seven times, but now, for the first time, it’s been in a prolonged sideways movement. This could indicate an accumulation phase, often seen when stocks are at their lowest, suggesting that Zoom might be finding a bottom.

Moreover, there's a trendline within this accumulation phase that has been touched three times, reinforcing the possibility that Zoom is stabilizing. This trendline might act as a support level, potentially leading to a period of growth or at least stability.

Zooming in further, we notice that during this accumulation phase, there are four notable touchpoints on the trendline. While two points dip slightly lower, this is not overly concerning given the overall price action. The trading volume within this phase is visible and consistent, with price movements often oscillating around the Point of Control (POC) at $67. Prices fluctuate above and below this level but tend to return to the POC, indicating strong trading interest at this price point.

Currently, Zoom has the potential to rise towards $72, which corresponds to the High Volume Node Edge. This movement could involve a retest of both the trendline and the POC. A successful retest and subsequent breakout from these levels could provide the necessary momentum to break out of the accumulation phase, potentially opening the door for significant upward movement.

In summary, while Zoom has faced a dramatic decline, the current price movement and trendline support could indicate a phase of accumulation, suggesting that it might not be entirely out of the game yet. While this scenario is intriguing, it is also fraught with risk. Therefore, we are opting to remain on the sidelines for now, monitoring the situation closely.

ZM: Zoom is zooming into a black hole of disasterThere is almost noting bullish about ZM. After the huge selloff for months it's been a bear flag consolidation for weeks. With general market weakness intensifying, ZM has no chance here. Most likely in lower double digits to single digit in the next year or so. We might see a bounce first due to RSI oversold conditions, but wouldn't expect much. It will be a pump and dump scheme for investors to get out. They have no use case left as Microsoft and Apple have cornered the market for video conference. I hope google or some other big tech buy them out and put them out of their misery. I don't own or hold any stocks, so I have no skin in the game, but this is just sad to watch. I like the product better than teams or face time. But market doesn't like it and that's what counts.

ZM Zoom Video Communications Options Ahead of Earnings If you haven`t sold ZM before the previous earnings:

Then analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 61usd strike price in the money Calls with

an expiration date of 2024-3-1,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

🚀🚀🚀 Bitcoin is unstoppable! 🚀🚀🚀

We are witnessing history, fellow zoomers. Bitcoin will smash through 70k and it's not stopping there. This is the future of money, and we are the pioneers. 💯💯💯

Don't listen to the boomers and the fudders. They are scared of change and innovation. They don't understand the power of decentralization and cryptography. They are stuck in the past, while we are building the future. 🙌🙌🙌

Bitcoin is more than just a currency. It's a movement. It's a revolution. It's a way of life. We are not here for the short term gains. We are here for the long term vision. We are here to change the world. 🌎🌎🌎

So zoom in, zoom out, and zoom on. The moon is not the limit. The sky is not the limit. There is no limit. Bitcoin is infinite. Bitcoin is eternal. Bitcoin is everything. 🔥🔥🔥