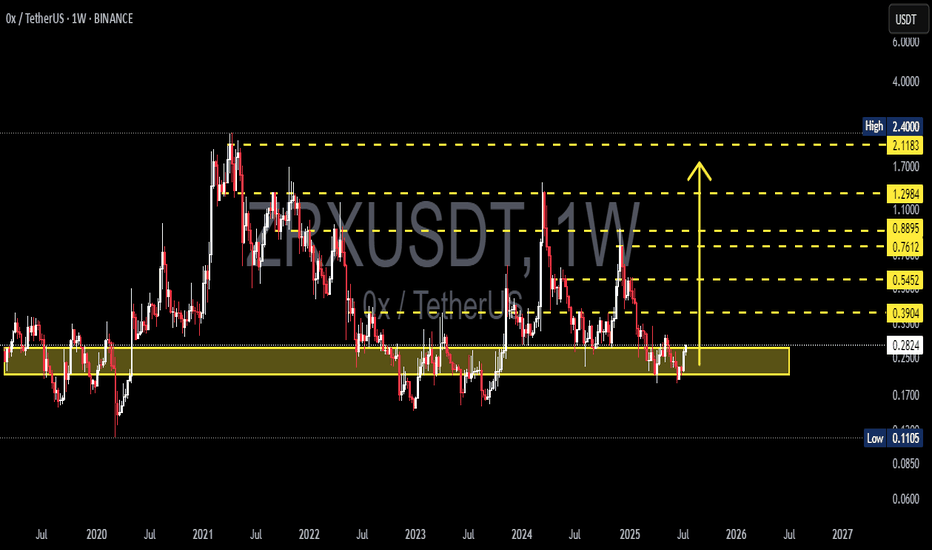

ZRXUSDT Weekly Analysis – Major Reversal Brewing from Multi-Year🔍 Technical Overview:

ZRX (0x Protocol) is currently showing strong signs of a long-term accumulation phase, with price once again revisiting a critical historical demand zone between $0.25 and $0.30. This area has acted as solid support multiple times since 2019, and the current structure suggests a potential macro-level reversal is underway.

Key technical highlights include:

Strong Historical Demand Zone: The yellow box highlights a multi-tested area of support where major rallies have originated.

Double Bottom Formation: A potential double bottom pattern is forming, indicating a reversal setup.

Volatility Compression: Price action has tightened into a sideways range, often a precursor to a breakout.

Well-defined Fibonacci Resistance Levels: Layered resistance targets give a clear path for bullish continuation once breakout is confirmed.

🟢 Bullish Scenario:

If ZRX holds above the $0.28 level and successfully breaks out above $0.39, it could trigger a powerful rally toward higher key resistance zones.

🎯 Bullish Target Zones:

✅ $0.5452 – First major resistance

✅ $0.7612 – Previous breakout level

✅ $0.8895 – Horizontal supply zone

✅ $1.1000 – Psychological round number

✅ $1.2984 – Pre-2022 breakdown area

✅ $2.1183 – $2.4000 – Ultimate high and previous cycle top

A clean breakout from current levels could yield multiple 100% gains, with a favorable reward-to-risk ratio for mid- to long-term swing traders.

🔴 Bearish Scenario:

Failure to hold the $0.25–$0.28 support zone would invalidate the bullish structure and may result in a drop toward the historical low of $0.1105.

Weekly candle close below $0.25 would be a strong bearish signal.

This would suggest prolonged downside or range-bound movement.

🧠 Strategic Notes:

This setup favors patient swing traders and investors looking for reversal plays in oversold altcoins.

Accumulating within the current demand zone, with a breakout confirmation above $0.39, presents a compelling strategy.

Consider using laddered entries and a stop-loss below the demand zone for optimal risk control.

⚠️ Risk Management:

ZRX is a low-cap altcoin, and while the upside potential is substantial, volatility remains high. Always apply strict risk management and position sizing to protect capital.

📌 Summary:

ZRX is offering one of the cleanest reversal setups in the altcoin market. With a historically strong demand base, clear resistance levels, and a favorable reward/risk structure, this chart is worth watching closely in the coming weeks.

#ZRXUSDT #CryptoReversal #AltcoinSetup #TechnicalAnalysis #AccumulationZone #BreakoutTrade #DoubleBottom #SwingTradeSetup #CryptoChart

Zrxusdtrading

ZRXUSD: Rally still not over. Buy for a blowoff top.ZRXUSD is incredibly overbought on the 1W timeframe (RSI = 89.293, MACD = 0.117, ADX = 50.025) but that doesn't call for a pullback yet, at least not to the 1D MA50. The reason is that this is the final phase of the Bull Cycle rally that makes a Top inside the R1 Zone and the Sine Wave activity grasps that very accurately. We remain bullish on ZRX, targeting the bottom of the R1 Zone (TP = 2.0000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##