CFDs Brokers Are to Adjust as CySEC Moves Away from Excel Reporting

The Cyprus Securities and Exchange Commission (CySEC) has issued two new circulars that impact Cyprus Investment Firms (CIFs), including those offering contracts for difference (CFDs) and retail trading services. The changes relate to the submission of prudential and statistical data.

Excel Option Ends for CIF Reports

In Circular C719, CySEC announced that from the reporting period ending 30 June 2025, CIFs must submit prudential reports under the Investment Firms Regulation exclusively in XBRL format via its dedicated portal. The Excel-based option, which had previously been available during the transition to the new system, will be discontinued after the reporting deadline of 11 August 2025.

This shift follows updates to the European Banking Authority’s (EBA) taxonomy, which require firms to use software capable of generating and validating compliant XBRL files. The reporting obligations cover areas such as own funds and capital requirements but do not affect how those figures are calculated. Templates related to remuneration and internal thresholds will continue to be accepted in Excel format.

Source: CySEC

You may find it interesting at FinanceMagnates.com: Forex Firms, Drug Money, and Cyprus: Mayor’s Allegations Spark CySEC Response.

Noncompliance Risks Penalties for CIFs

Separately, Circular C718 outlines requirements for the quarterly submission of statistical data via the Transaction Reporting System. All CIFs authorised by that date—including those not yet active—must submit Form QST-CIF by 4 August 2025.

The form includes operational and financial metrics relevant to CySEC’s supervisory efforts, such as the volume of binary options transactions and the handling of client funds.

Firms that fail to meet the reporting obligations risk administrative penalties under Cypriot law. CySEC has indicated it will not issue reminders for late or incomplete submissions.

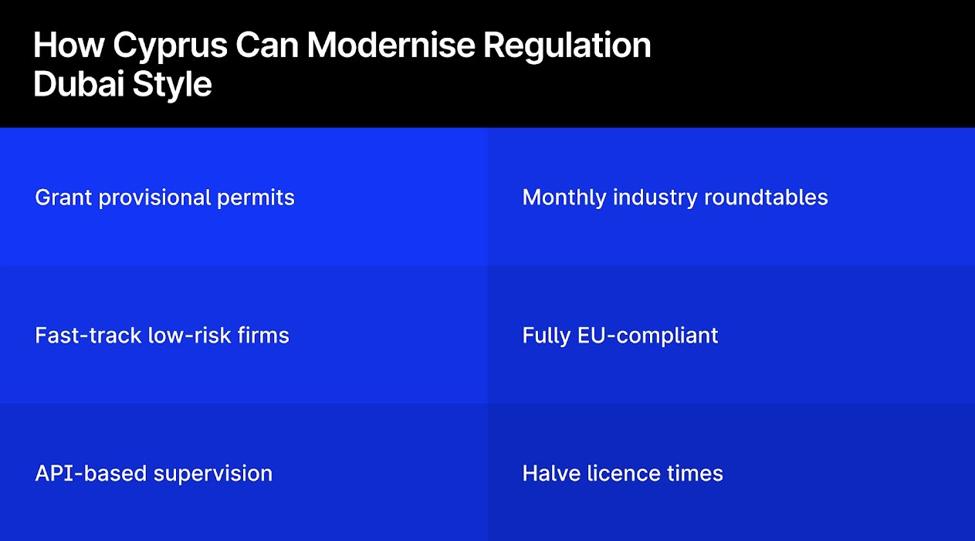

CySEC Could Adopt UAE Licensing Models

While Cyprus operates under the constraints of the EU regulatory framework, there are growing calls for more agile supervisory tools to enhance efficiency without compromising investor protection.

Industry observers point to models in the UAE—such as rolling-review sandboxes, risk-based licensing, and real-time supervisory data—as examples that could be adapted within CySEC’s existing remit.