Why XRP Is Going Down? XRP Price Drops 5% as Bitcoin and Ethereum Retreat Amid Heavy Crypto Profit-Taking

XRP, the third-largest cryptocurrency by market cap, tumbled 5% on Monday, 18 August 2025, sliding to $2.94 and breaking below the key psychological mark of $3 for the first time in nearly two weeks. The pullback reflects a wider downturn in crypto markets, with major tokens like Bitcoin (BTC) and Ethereum (ETH) also shedding value as traders lock in profits after recent rallies.

In this article, drawing on my years of experience as a cryptocurrency analyst and trader, I explain why the price of XRP is falling today, provide a technical analysis of the XRP/USDT chart, and present the latest XRP price forecasts for the coming years.

Why XRP Price Is Going Down Today? Profit-Taking Drives the Slide

Data from leading exchanges shows that XRP price began the day trading just above $3, but selling pressure intensified during the early morning Asian and European trading hours. The steep decline tracked similar moves in peer coins, with Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) posting daily drops between 4% and 6%. Bitcoin slipped to $115,000, marking an 11-day low amid nearly $500 million in liquidations across the crypto sector.

Market analysts point to profit-taking as the primary factor weighing on XRP. After a sharp run-up in July and early August, nearly 94% of XRP holders sat on gains, an overheated setup that historically has triggered corrections as traders rush to capture profits. The latest sell-off comes on the heels of a record $12.4 billion in daily XRP trading volume last week, following Ripple's resolution of its lengthy legal battle with the SEC.

XRP price is falling today. Source: CoinMarketCap

Technical signals have flipped bearish. Increased trading volumes below $3, a fall in net longs, and rising short interest point to further downside risk. Analysts highlight $2.85 as a critical support level, with a major demand wall around $2.81 where 1.7 billion XRP were previously accumulated. If the slide accelerates, the next support may be found near $2.70.

Macro and Market Correlations Shape Moves

The weekend’s quiet U.S. trading session left cryptocurrency prices vulnerable to volatility as Asian and European markets opened. Broader macro uncertainty, ranging from a potential Federal Reserve rate cut in September to unresolved geopolitical tension between the U.S., Russia, and Ukraine, has driven traders to lighten positions.

Crypto’s close links with equities proved significant, with many investors awaiting retail earnings reports from companies like Walmart, Lowe’s, and Target. Comments from BTSE’s Jeff Mei reflected the mood: “Markets didn't see much movement over the weekend, so we'd expect cryptocurrencies to trade in line with stocks when the US market opens later today.”

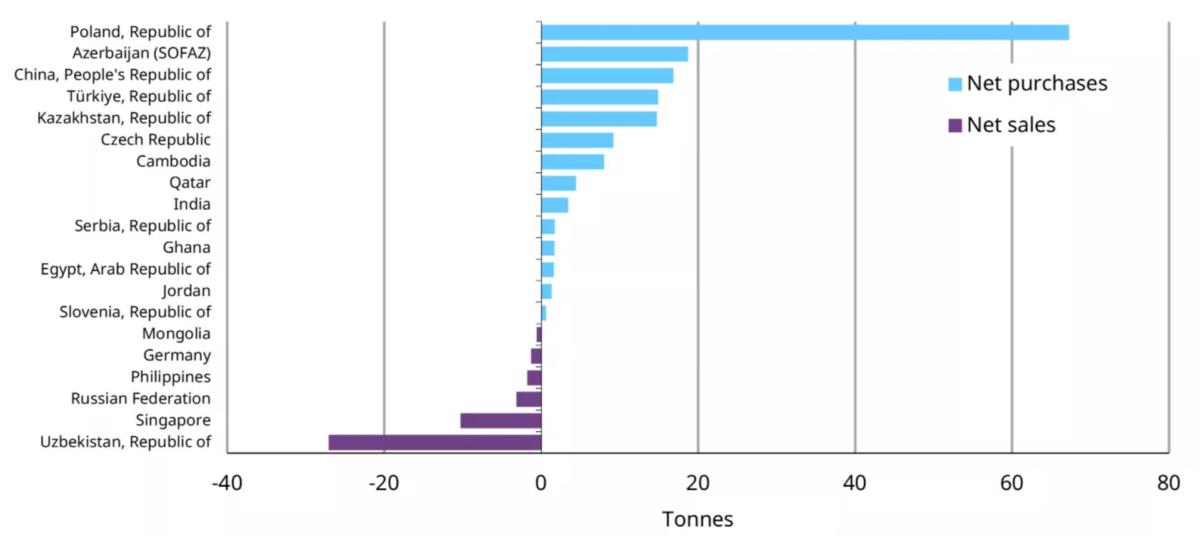

At the same time, Bitcoin’s narrative as “digital gold” faces fresh scrutiny. Central banks have ramped up gold buying to hedge against macro shocks, driving bullion to record highs, while Bitcoin and other cryptocurrencies remain tethered to risk-on sentiment. This divergence has led some traders to rotate out of digital assets and into gold as geopolitical risks intensify.

Source: Gold.org

Routine Token Releases and Institutional Positioning Influencing Sentiment

XRP’s correction has been compounded by Ripple’s routine monthly release of 1 billion tokens from escrow, a practice that sometimes injects selling fears, even as Ripple executives clarify its regularity. On-chain data shows some large holders rebalancing portfolios and reducing exposure at recent highs.

Derivatives data paints a mixed picture. Open interest is cooling off as longs bail, but some “whale” addresses have added thousands of tokens in recent days, betting on support holding firm in the mid-$2 range.

You may also like: Why Bitcoin Price Is Surging Today? Bulls Target $140K BTC as Crypto Rally Accelerates

XRP Technical Analysis Suggests $5 Bullish Target

Despite the current market stagnation, my technical analysis suggests that XRP is holding significant support, and the structure of the daily chart may lead to strong gains of several dozen percent toward new all-time highs, as shown in the chart below. Monday’s declines in XRP stopped at a key confluence of supports: the 50-day exponential moving average (50 EMA), which has already acted as support three times since July, preventing deeper depreciation, and the horizontal level around $2.94, defined by local peaks from March of this year.

At the same time, additional support is provided by the rising trendline, which forms part of a bullish pennant pattern originating from the late-June lows. If XRP manages to break out of the current setup to the upside, the measured target based on the length of the pennant’s mast falls just below the round level of $5. To get there, however, XRP must first overcome two key horizontal resistances: around $3.31, the highs from January, and $3.65, this year’s peak.

XRP technical analysis and potential move to $5. Source: Tradingview.com

How do other analysts and major financial institutions view the situation, and do their perspectives and forecasts align with my technical analysis?

What’s Next? XRP Price Prediction

Standard Chartered, a major multinational bank, is one of the most visible names in digital asset price forecasting. The bank currently projects that XRP could reach $5.50 by the end of 2025, $8.00 in 2026, and up to $12.50 by 2028. Their bullish stance draws on recent regulatory clarity, anticipated inflows from a potential spot ETF in the United States, and Ripple’s efforts to expand cross-border payments.

Popular independent analysts provide price targets for XRP ranging from $3.12–$4.45 by the end of August 2025, up through $5.00–$8.00 by year-end. Some see even loftier targets, like $10 or higher, should broader crypto markets rally and the tokenization trend accelerate.

Machine learning platforms, technical pattern watchers, and digital asset forecasting models generally suggest more conservative scenarios, projecting XRP between $3.12 and $5.53 for 2025, depending on regulatory events and adoption trends.

XRP Price Prediction Table 2025, 2026, 2027, 2028

Source / Analyst | Price Target | Date / Timeframe | Notes |

Standard Chartered Bank | $5.50 | End of 2025 | Major bank forecast |

Standard Chartered Bank | $8.00 | End of 2026 | Medium-term target |

Standard Chartered Bank | $12.50 | End of 2028 | Long-term forecast |

XPMarket / Mr. Xoom | $6.00 – $8.00 | August 2025 | Analyst projection, bullish |

TradingView ML Models | $3.12 | August 31, 2025 | Machine learning prediction |

Finance Magnates Technical Analysis | $3.12 – $5.53 | 2025 | Conservative / Fibonacci extension |

Changelly | $3.02 – $3.16 | August 2025 | Crypto analyst forecast |

GOV Capital | $4.78 | One year | Bullish model forecast |

Peter Brandt (Analyst) | $4.47 | Coming months | Technical pattern analysis |

Tony Severino | $13.00 | 40 days | Very bullish scenario |

Founderof X DAO (Fencer) | $5.20 – $6.50 | Next 3-6 months | Short-term bullish |

CoinCodex | $2.96 – $3.49 | September 2025 | Month-by-month forecast |

Economic Times (Models) | $3.12 – $4.45 | August 2025 | Short-term model consensus |

Finder Panel | $1.05 | End of 2025 | Conservative panel consensus |

EGRAG Crypto (Analyst) | $5.50 | 2025 | Fibonacci pattern analysis |

Most forecasts cite regulatory clarity after Ripple’s SEC case, potential ETF approval, and growth in institutional adoption as the main drivers for higher XRP prices. Technical models identify key support levels above $3 and look for decisive bullish breaks above $3.60 and $4.00 to trigger fast upside. Extremely bullish cases envision new all-time highs in the $6–$8 range or more if the entire crypto market surges.

Conversely, more conservative models highlight choppy sentiment, lack of major catalysts, and the risk of profit-taking, suggesting XRP could trade sideways near its current range in the coming months.

Some long-term holders see the current dip as a buying opportunity. But with regulatory headlines, technical signals and macro uncertainty all swirling, many investors are content to wait for clearer direction before deploying new capital.

XRP News FAQ

Why Is XRP Falling Down?

XRP is dropping mostly due to heavy profit-taking by traders after its recent rally. As prices soared in July and early August, a large number of holders chose to lock in gains, causing selling pressure. The correction has been amplified by wider uncertainty in the cryptocurrency markets, with Bitcoin and other major coins also moving lower. Additional factors such as regular token releases and cautious investor sentiment around global macro events are contributing to the slide.

Is XRP Going To Go Up Again?

XRP could bounce back if broader crypto sentiment improves or new positive catalysts appear, such as regulatory progress or strong institutional inflows. Technical analysis points to key support just below $3, which could stabilize the price in the short term. If crypto markets regain momentum or XRP clears new resistance levels, the asset may attempt another run higher. However, further selling or wider market volatility could keep prices subdued.

Is XRP Worth Holding?

Whether XRP is worth holding depends on your investment outlook and risk tolerance. Many analysts highlight its unique position in payments technology and ongoing partnerships as long-term strengths. However, price swings are common, with sentiment often driven by news, technical levels, and broader crypto trends. Some investors view the current dip as an entry point, while others prefer to wait for clearer signs of recovery.

Will XRP Reach $5 by End of 2025?

Forecasts for XRP are split. Major banks like Standard Chartered see a path to $5.50 by the end of 2025, citing regulatory clarity and potential ETF flows. Several analysts and technical models also set targets above $5 if institutional interest expands and market conditions improve. On the other hand, some models forecast lower outcomes, especially if macro headwinds persist or investor interest wanes. XRP reaching $5 is possible, but not guaranteed—investors should track unfolding news and weigh up risks.