USDJPY Technical Analysis – All eyes on the US CPI report

Fundamental Overview

The USD has been weak almost across the board since the NFP report as the softer than expected data triggered a quick dovish repricing and a change in stance for many Fed members.

The market pricing 58 bps of easing by year-end compared to just 35 bps before the NFP release. It’s highly likely that more benign data will see Fed Chair Powell opening the door for a cut in September at the Jackson Hole Symposium.

The focus now turned to the US CPI report due tomorrow. The recent Fedspeak suggests that a rate cut in September might be unavoidable, so we might need very hot inflation data to change their mind (and of course a good NFP report in September).

On the JPY side, the currency rallied strongly on the back of the soft NFP report and the dovish repricing for the Fed. For more JPY appreciation we will need weak US data to increase the dovish bets on the Fed or higher inflation figures for Japan to price in more rate hikes than currently expected. Other potential positive driver could be signs of more fiscal support as that will likely put upward pressure on inflation.

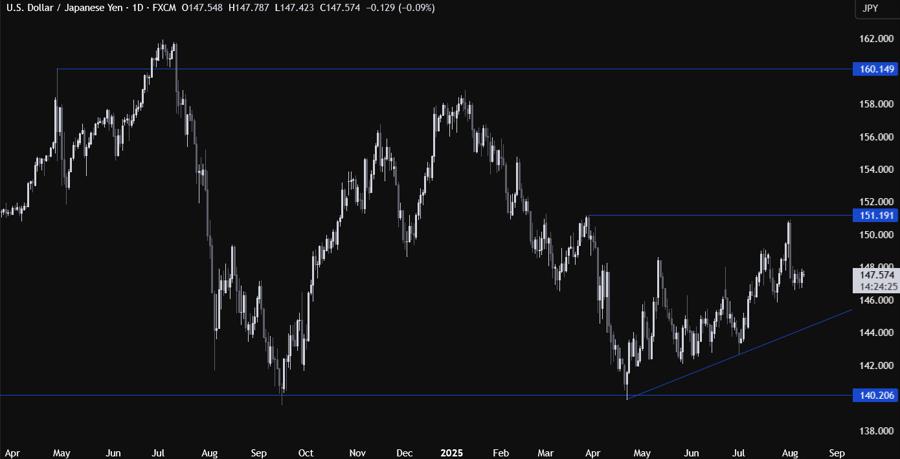

USDJPY Technical Analysis – Daily Timeframe

USDJPY Daily

On the daily chart, we can see that USDJPY got stuck in a consolidation ever since the NFP selloff. Traders are now waiting for the US CPI release before picking a direction. For the sellers, the target remains the major trendline around the 144.50 level. If the price gets there, we can expect the buyers to step in with a defined risk below the trendline to position for a rally back into the resistance.

USDJPY Technical Analysis – 4 hour Timeframe

USDJPY 4 hour

On the 4 hour chart, we can see more clearly the consolidation that started soon after the NFP-induced drop. The most recent swing high around the 148.00 handle should act as resistance. The buyers will want to see the price breaking higher to pile in for a rally back into the 151.00 handle. The sellers, on the other hand, will likely step in around the 148.00 level to extend the drop into the major trendline.

USDJPY Technical Analysis – 1 hour Timeframe

USDJPY 1 hour

On the 1 hour chart, there’s not much else we can add here as traders will likely continue to play the range until we get a breakout on either side. In any case, waiting for the CPI release would be a better idea from a risk management perspective. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we have the US CPI report. On Thursday, we get the US PPI and the US Jobless Claims figures. On Friday, we conclude the week with the US Retail Sales and the University of Michigan Consumer Sentiment report. Focus also on Fedspeak, especially after the US CPI data.

Watch the video below

This article was written by Giuseppe Dellamotta at investinglive.com.