Kenvue at the Cross-Road

Kenvue Inc. (NYSE: KVUE), spun out from Johnson & Johnson in 2023, is at a crossroads. As the world's largest pure-play consumer health company, Kenvue boasts a portfolio of iconic brands like Tylenol, Listerine, Aveeno, Band-Aid and Neutrogenalegacy assets that once defined J&J's consumer division. These are some of the best brands in the Consumer Packaged Goods sector.

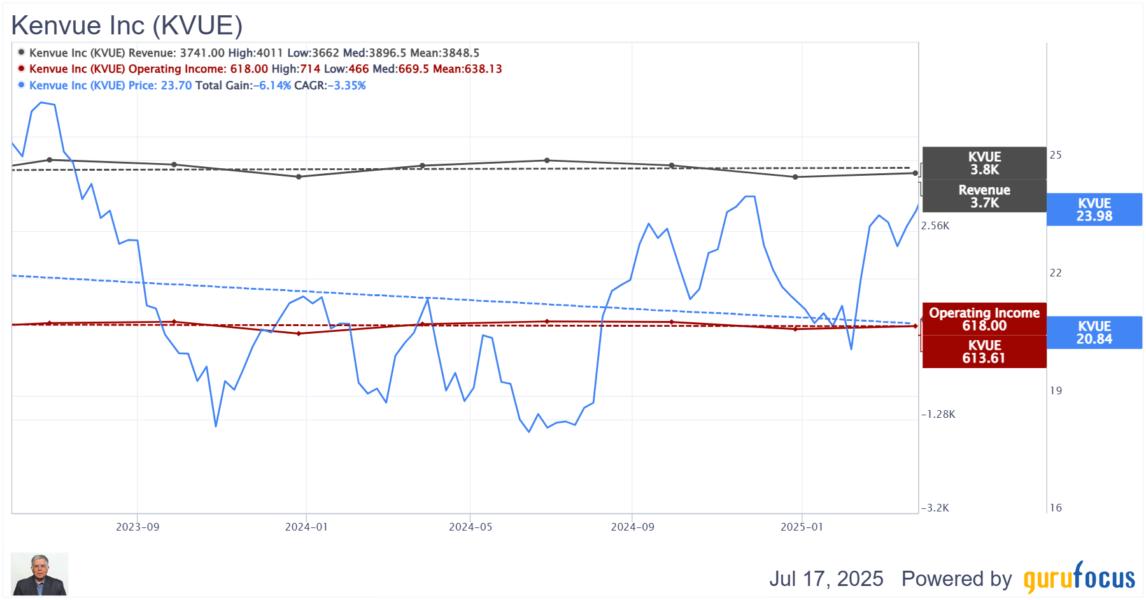

Yet, since its debut as an independent company, Kenvue's stock has underperformed, its revenue has stalled, and operating income has edged downward over two years. This lackluster performance has drawn sharp scrutiny from activist investors and set the stage for a dramatic leadership and strategic overhaul.

Starboard Value, led by its CEO Jeffrey Smith has been appointed director on the Board together with two more directors backed by Starboard. In addition Third Point (led by Daniel Loeb (Trades, Portfolio) (Trades, Portfolio) ), TOMS Capital and Van Eck Associates have bought stock. They are demanding change and seeking to unlock value from Kenvue stock.

The Catalyst for change: Sluggish Performance and Activist Pressure

Kenvue's post-spinoff journey has been rocky. After its May 2023 IPO, the stock dipped more than 5%, lagging far behind the S&P 500's rally over the same period. Although shares have rebounded somewhat in the past year, the broader financial picture remains uninspiring: revenue growth has flattened and operating income has declined, most recently highlighted by a 4% drop in net sales for Q2 2025well below analyst expectations.

This tepid performance has not gone unnoticed. Activist investors have intensified pressure on management to deliver better results or explore structural changes. The board's response has been swift: a comprehensive strategic review is underway, with all optionsincluding portfolio simplification, operational restructuring, and even a full or partial sale of the companyon the table.

KVUE Data by GuruFocus

Major Competitors of Kenvue

The table below presents the major competitors of Kenvue, alongside their areas of focus and key brands or product lines.

| Competitor | Category/Focus | Key Brands/Product Lines Competing with Kenvue |

| Sanofi | Consumer Health (OTC, Allergy, Digestive) | Allegra, Zantac, Dulcolax, Nasacort |

| Bayer | OTC Medications, Nutritional Supplements | Aspirin, Aleve, Alka-Seltzer, One A Day |

| Church & Dwight | Personal Care, Household Products | Arm & Hammer, OxiClean, Batiste, Nair, Trojan |

| Colgate-Palmolive | Oral Care, Personal Hygiene, Skincare | Colgate, Sensodyne, Palmolive, Speed Stick, Softsoap |

| Edgewell | Personal Care (Sun, Shaving, Feminine) | Schick, Wilkinson Sword, Banana Boat, Hawaiian Tropic |

| Perrigo | Private-label/Store Brand OTC & Infant | Store-brand pain relievers, cold medicines, infant formula |

| The Honest Company | Eco-friendly Personal & Household Care | Diapers, baby care, wellness, cleaning products |

| Seventh Generation | Sustainable Home & Personal Care | Cleaning, baby care, personal hygiene products |

| Haleon | Consumer Health (OTC, Wellness) | Advil, Sensodyne, Panadol, Centrum, Aquafresh |

| Unilever | Global Consumer Goods (Personal Care) | Dove, Vaseline, Lifebuoy, Pukka Herbs |

| Procter & Gamble | Consumer Health & Hygiene | Vicks, Metamucil, Old Spice, Crest, Oral-B |

| Reckitt Benckiser | Consumer Health, Household, Hygiene | Mucinex, Durex, Lysol, Dettol |

One of the above players could be interested in part or the whole of Kenvue. Assets like Kenvue rarely come to the market. Pass the popcorn and let the games begin!

Valuation

Here are some key metrics comparing Kenvue with its main competitors. Most Kenvue metrics are within the ballpark of the competitive set. Kenvue does not look particularly undervalued. So any acquisition would be mostly for strategic reasons.

| Company | Ticker | Current Price | Market Cap ($M) | PS Ratio | Price-to-Opera ting-Cash-Flow | PE Ratio without NRI | EV-to-EBITDA | EBITDA Margin % | Operating Margin % | 5-Year EBITDA Growth Rate (Per Share) | 5-Year EPS without NRI Growth Rate |

| Kenvue Inc | KVUE | 22.09 | 42,420.41 | 2.76 | 22.30 | 20.09 | 20 | 16.33 | 16.94 | -5 | 0.60 |

| Haleon PLC | HLN | 9.56 | 42,966.46 | 2.94 | 14.23 | 24.15 | 18.15 | 20.51 | 19.64 | 14.70 | -71.60 |

| Church & Dwight Co Inc | CHD | 96.52 | 23,770.69 | 3.92 | 22.04 | 28.39 | 22.86 | 17.96 | 19.02 | 0.70 | 5.80 |

| Colgate-Palmolive Co | CL | 86.97 | 70,482.24 | 3.57 | 17.73 | 23.89 | 16.15 | 24.17 | 21.85 | 3.20 | 3.80 |

| Procter & Gamble Co | PG | 155.70 | 365,045.20 | 4.56 | 20.66 | 22.90 | 16.72 | 27.78 | 23.81 | 15.70 | 6.90 |

| Unilever PLC | LSE:ULVR | 44.40 | 146,680.55 | 2.19 | 14.01 | 17.78 | 13.29 | 19.36 | 18.52 | 2.80 | 1.90 |

| Reckitt Benckiser Group PLC | LSE:RKT | 50.12 | 45,859.39 | 2.48 | 13.08 | 14.36 | 14.18 | 20.88 | 24.31 | 1.60 | 0.40 |

Leadership in Flux: Mongon Out, Perry In

The most visible sign of this upheaval is the abrupt departure of Thibaut Mongon, Kenvue's inaugural CEO and a 20-year J&J veteran who steered the company through its separation. Mongon has also stepped down from the board, marking a clear break from the past. In his place, the board has appointed Kirk Perry, a current director with three decades of experience in consumer goods and technology, as interim CEO while a search for a permanent leader continues.

Perry's mandate is unambiguous: work with the board and management team to stabilize operations, sharpen the company's strategic focus, and position Kenvue for a potential turnaroundor a sale. Analysts suggest Perry's appointment, given his background in business transformation, increases the likelihood of portfolio divestitures or other major strategic moves, perhaps even the sale of the entire company.

The Road Ahead: Strategic Review and Portfolio Optimization

The board's strategic review is not merely cosmetic. It is a recognition that Kenvue must adapt to a rapidly evolving consumer health landscape, where digital health, personalized medicine, and sustainability are reshaping consumer expectations and competitive dynamics. The review will assess whether Kenvue's current brand portfolio and operating model are optimal, and explore ways to streamline the business, improve execution, and accelerate profitable growth.

Industry observers see the leadership change and strategic review as a proactive, if necessary, response to mounting challenges. With activist investors now firmly embedded in the boardroom, and the company's performance under a microscope, Kenvue's next steps could determine whether it remains independent or becomes a target for acquisitioneither whole or in parts.

Broader Implications: Governance and Performance Under Scrutiny

Kenvue's situation reflects a familiar pattern in corporate governance: when performance falters and activist pressure mounts, boards often initiate strategic reviews that can lead to CEO changes and, sometimes, radical restructuring. In Kenvue's case, the strategic review is both a mechanism for change and a direct response to underlying financial underperformance.

For now, all eyes are on interim CEO Kirk Perry and the board as they navigate this pivotal period. The outcome will not only shape Kenvue's future but also serve as a case study in how legacy consumer health brands adaptor strugglein an era of heightened expectations and relentless competition.