Moody's: A 100-Year-Old Data Monopoly That Keeps Printing Cash

In a market full of exciting tech stories and overhyped disruptors, it's easy to overlook a quiet, durable compounder like Moody's MCO. But that would be a mistake. With its ironclad duopoly in credit ratings, a fast-growing analytics engine, and some of the highest returns on capital in public markets, Moody's is a business that quietly compounds behind the scenes and has done so for over a century.

There's still a compelling long-term case to be made for Moody's. It's not a value play. It's not misunderstood. But it is a machine built for cash generation, and one that may deserve a place in a long-term investor's portfolio even at a premium. Let's unpack the investment case.

1. The Ratings Backbone of Global Finance

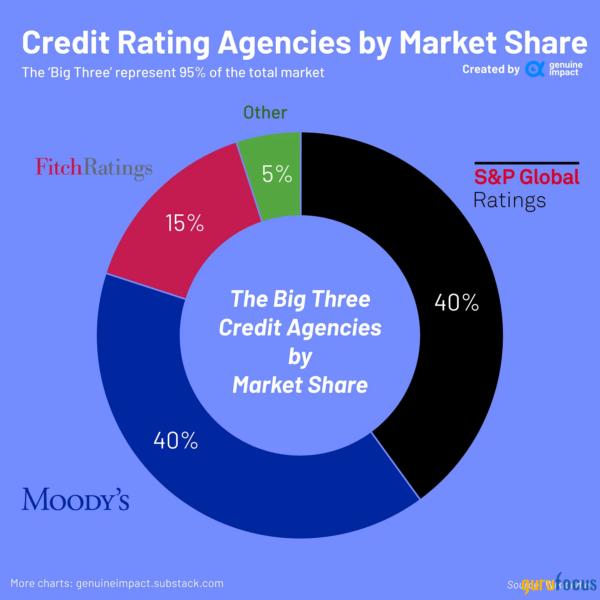

Moody's is best known as one of the world's two dominant credit rating agencies the other being S&P Global. Together, these two firms are responsible for rating over 80% of the world's public and private debt.

Whenever a company, government, or financial institution wants to issue bonds or take on large-scale debt, Moody's is often at the table, providing an assessment of credit risk that investors rely on. It's a system deeply embedded into capital markets. In fact, many regulatory regimes and investment mandates require Moody's ratings. That's not just brand power it's institutional infrastructure.

Moody's holds a full ownership of Korea Investors Service, the leading rating agency in South Korea, and a substantial presence in Japan through its wholly-owned subsidiary Moody's Japan K.K. In Europe, Moody's competes closely with S&P and Fitch, while its joint venture in China with Chengxin Credit Rating Group gives it a foothold in the world's second-largest bond market. This isn't just U.S. dominance it's global entrenchment. And given that roughly70% of international debt issuance is denominated in U.S. dollars, Moody's global ratings reach and influence carry even deeper weight across the global debt ecosystem

But Moody's isn't just a one-trick ratings agency anymore. Over the past decade, it has steadily built a second engine: Moody's Analytics. This business sells software, data, and tools to financial institutions think compliance modules, risk models, climate exposure analytics, KYC, and private credit insights. Around 96% of this revenue is recurring, with client retention in the mid-90s. In the first half of 2025, the analytics segment grew 9%, while the ratings business added another 4% on top.

That dual-engine structure one transactional, one recurring gives Moody's enviable resilience and leverage to market recoveries.

2. A Moat Measured in Trust and Regulation

Few businesses enjoy structural advantages as wide or defensible as Moody's. And those advantages have only expanded with time.

Start with the ratings side. The business isn't just built on brand recognition, although that certainly helps. It's wired into the system. Moody's holds Nationally Recognized Statistical Rating Organization (NRSRO) status, which means its ratings are recognized in regulatory frameworks across the U.S. and beyond.

Institutional investors including pension funds, insurers, and banks are often required by law or mandate to hold securities rated by an NRSRO. That designation is incredibly hard to achieve and acts as a regulatory moat that new entrants simply can't cross without years of audited credibility and compliance infrastructure.

Once an agency becomes accepted by both issuers and investors, its ratings become de facto standards. This is a winner-takes-most market. Issuers want ratings from agencies investors already trust. Investors want ratings regulators already accept. That mutual dependency creates a self-reinforcing loop one where the incumbents get stronger and new entrants are frozen out.

The switching costs are also enormous. Financial institutions build entire investment models, regulatory capital weightings, and compliance systems around the specific lettered ratings issued by Moody's. Switching to a new agency isn't just a preference shift it would require rewriting policies, recalibrating portfolios, and risking regulatory misalignment. For most of the market, Moody's isn't just a vendor. It's an institution.

Then there's the flywheel. Every new rating Moody's issue becomes a datapoint. Over the years, the company has built one of the world's deepest and most proprietary datasets on credit risk. That data powers both its ratings judgments and the analytics business creating a loop of learning and monetization. It's no coincidence that Moody's Analytics has emerged as one of the fastest-growing arms of the company.

And here's something that few investors are noticing: the global shift toward shorter?duration debt is quietly expanding Moody's revenue base. One 10?year bond requires just a single rating event one fee. But five 2?year bonds? That's five separate rating cycles five revenue inputs.

This trend is prominent in the U.S. Treasury market, where issuance is increasingly biased toward 15 year tenors, with short-term debt projected to account for up to 30% of issuance by 2027. Similar behavior is evident in corporate, municipal, and auto?ABS markets, where investors and issuers favor shorter maturities amid higher rate volatility.

Starting in 2022, institutional bond holders insurance portfolios, pension balance sheets, and fixed income mutual funds began to shorten aggregate durations, reducing exposure to long-term risk and boosting demand for short-term issuance that needs to be regularly re?rated. As long-duration issuance declines and is replaced with more frequent short-term maturities, the addressable market for rating cycles expands not just in total dollars, but in repeat interactions. That's a structural tailwind for Moody's.

Moody's is the strongest player in a market that barely lets new players in. It controls ~40% of the global credit ratings market by value outstanding tied with S&P Global at the top. Fitch trails far behind with just ~15%. That number likely overstates Moody's share of bond issuance, as smaller agencies handle more frequent but lower-value deals. Still, when it comes to institutional-grade credit the market that matters Moody's dominates.

That's not just dominance it's an entrenched oligopoly. And the moat isn't built on pricing or tech alone. It's trust, reputation, and regulation the kind of barriers that take decades to build and a crisis to even shake. In a business where institutions are required to use the ratings, and where switching isn't just costly but often impossible, Moody's doesn't just compete it compounds.

There's also a structural reason Moody's moat remains intact: the system needs two giants, but not three. Most institutional-grade bond offerings require ratings from at least two agencies. That's by design to reduce dependence on a single opinion and give investors a backstop. But few want more than two ratings, because each adds cost and complexity. This creates a market equilibrium where S&P and Moody's dominate and Fitch acts as the spare tire for issuers that don't want to use one of the top two.

This isn't accidental. It's a natural duopoly with just enough room for a third player to offer optionality but not enough demand for a fourth. That means even well-funded competitors can't get enough traction to threaten the incumbents. Moody's doesn't just have staying power. It has a seat baked into the financial system's architecture.

3. Capital Allocation That Respects the Compounding Engine

CEO Rob Fauber took the reins in 2021, having spent around two decades inside the company. His approach has been steady and methodical: build on Moody's core strengths, expand analytics, and return capital when it makes sense.

Moody's hasn't made splashy acquisitions. Instead, it has focused on bolt-on deals that deepen its competitive moat. The $2 billion acquisition of RMS, a leader in catastrophe and insurance modeling, was a smart move that expanded Moody's relevance in climate and insurance risk two areas seeing explosive demand. Similarly, the acquisition of Bureau van Dijk strengthened its private company database, now crucial as capital shifts from public to private markets.

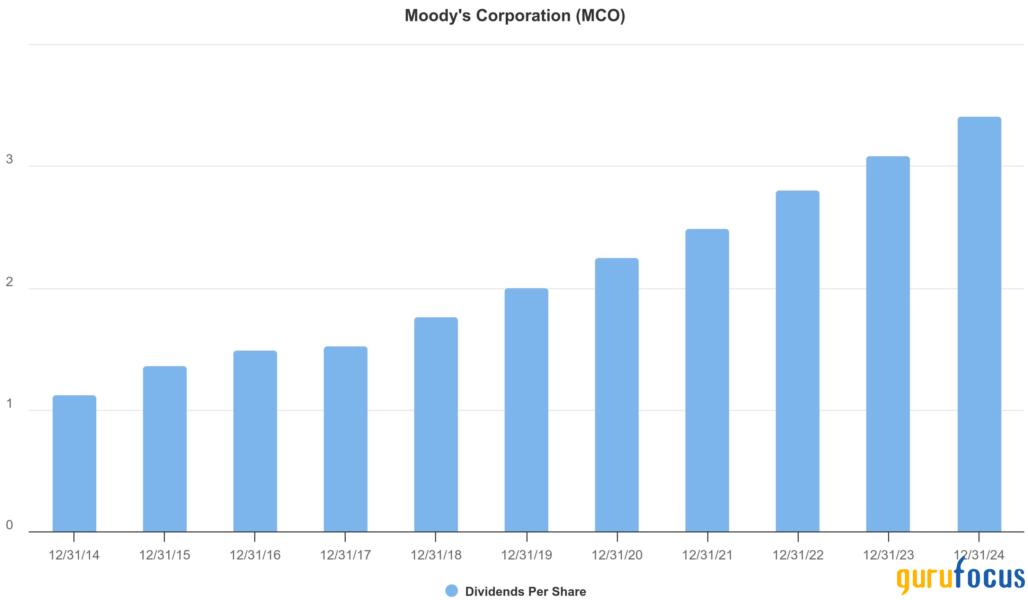

Buybacks have been consistent and thoughtful. Moody's has reduced its share count by about 14% over the past decade, repurchasing stock when prices made sense and using cash flow instead of debt. Meanwhile, dividends have grown at a double-digit pace, from $1.12 in 2014 to $3.34 per share in 2024, with plenty of room to rise further.

What stands out in all this is restraint. Moody's has the capacity to spend, but it doesn't chase headlines. It operates like an owner and allocates like one too.

4. High Margin, Cash Generative Business

In a letter to shareholders, Warren Buffett (Trades, Portfolio) once called Moody's a dream business. A look at the numbers makes it clear why.

Start with profitability. Moody's posted a 42% operating margin in 2024 a number that would make even software giants blush. Net margin came in just 39%. These are elite figures, made possible by a capital-light model that doesn't require warehouses, factories, or high customer acquisition costs.

Free cash flow was $2.52 billion in 2024, with a conversion rate over 100% of net income. That's a pattern, not an anomaly. Moody's consistently turns earnings into cash and doesn't need to reinvest much to grow. Capital expenditures were just 4.5% of revenue last year.

Then there's return on capital. Moody's generated ~20% ROIC in the trailing twelve months, with a five-year average close to 18%. These aren't just good returns they're signals of a structural advantage.

The balance sheet is healthy. As of June 2025, Moody's holds roughly $2.3 billion in cash and short-term investment, and maintains net leverage around 1.46 EBITDA. Interest coverage is high. There's no refinancing risk or liquidity trap here.

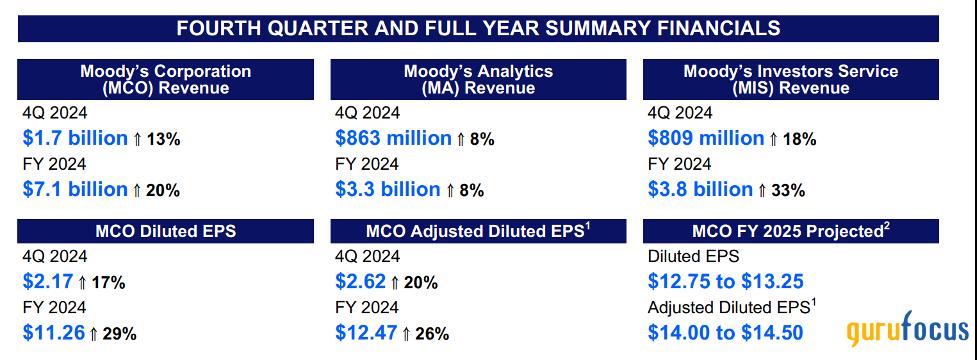

And growth? Adjusted EPS rose 26% in 2024 to $12.47. Management expects $14.0014.50 in 2025 another 1216% jump. That would mark three straight years of double-digit earnings growth despite macro volatility.

Source: Moody's earnings release

5. Valuation: Wonderful Business, Full Price

Moody's trades at roughly 35 forward earnings. That's not cheap and it shouldn't be.

Over the past 10 years, its average multiple has hovered around 26x. Today's premium reflects both the rebound in debt issuance and the high quality of the analytics business, which now makes up nearly half of revenue.

At the current price of $513 , if Moody's compounds earnings at just 5% a year and the market trims its multiple down to 30, you're staring at a 1.4% IRR over five years or 0.5% if you count dividends. That's the penalty for paying up when growth slows and the market stops believing.

If the company sticks to its long-term average 10% annual EPS growth and a 35 multiple your price-only IRR lands at 6.5%. Assuming Moody's keeps paying out 30% of earnings which it has for years those dividends push your total return closer to 7.5%. Not life-changing, but quietly solid for a business this durable.

But here's where it gets interesting. If Moody's compounds at 14% a year well within historical bounds and the multiple holds, you're looking at a 10.5% return on price alone, and 11.5% total IRR with dividends included.

No story stock here. No hockey-stick assumptions. Just clean math and a cash-printing business that's done the same thing for decades.

This is what you're buying with Moody's: not a lottery ticket a tollbooth. There's little margin of safety here. But there's immense durability.

This isn't a situation where you're trying to double your money in three years. It's one where you buy quality, sit tight, and let time do the heavy lifting.

6. The Smart Money Knows

Big money is already here and it's not chasing a story.

Berkshire Hathaway owns 13.75% of Moody's a position worth over $12.6 billion. It's one of Buffett's longest-held investments, dating back to 2000 when Moody's was spun out of Dun & Bradstreet. He hasn't added in years. He hasn't needed to. He just holds it quietly, relentlessly while it compounds.

And he's not alone.

Akre Capital, one of the best business-focused investors around, owns 2.4 million shares worth over $1.2 billion. They trimmed their stakes by 20% in the first quarter, but still sit with a full-size position.

Even some quant funds have taken notice. WorldQuant Millennium ramped its stake by over 5,200% in Q1 now holding nearly 194,000 shares. That doesn't mean they're in it for the long haul. But when both Buffett and the algos line up behind the same stock, it tells you something's working.

Moody's may be old and boring. But the shareholder base is a who's who of people who understand one thing: this business compounds.

7. Risks: Known, Visible, Manageable

Moody's biggest risk is cyclicality. Its ratings business depends on debt issuance. When credit markets freeze like they did in 2022 revenue can fall sharply. In fact, MIS sales dropped 29% that year. But they bounced back fast. Surveillance fees provide ballast, and analytics provides consistency.

Regulatory scrutiny is another concern. The issuer pays model draws criticism, especially during credit crises. But Moody's has survived lawsuits, fines, and political pressure before. It paid nearly $864 million in 2017 to settle claims tied to the financial crisis. That chapter is closed and the business has only grown since.

There's also the risk of technological disruption. Could AI replace traditional credit analysis? Maybe in part. But Moody's has already embraced machine learning and is embedding AI across its analytics offerings. More importantly, the moat isn't just technical it's institutional. Replacing Moody's in the financial system would take years and regulatory overhaul.

In short, these risks are real but manageable. And most are priced in.

The Final Word

Moody's isn't the kind of stock that excites crowds or generates headlines. But for long-term investors, that's exactly the point. It's a wide-moat, capital-efficient, structurally advantaged business with elite returns, disciplined leadership, and a recurring revenue engine that gets stronger by the year. Warren Buffett (Trades, Portfolio) once said, Time is the friend of the wonderful business. Moody's fits that description better than almost anything else in financial markets today. At current prices, it's not a fat pitch. But it's a durable, dependable franchise that belongs on every serious investor's compounder list and maybe even in their portfolio. If Moody's ever drops below the 10-year earnings valuation of 26x, you'll want to be ready.