Caught in the Middle: Pan American Silver Between Cost Pressures and Investor Value.

1- Introduction: Pan American Silver's 2Q25 Update Shows Resilient Production and Promising Growth Prospects

With its main office in Vancouver, Pan American Silver PAAS is one of the top producers of silver worldwide, with operations in Mexico, Peru, Argentina, Bolivia, Brazil, and Chile. This article is an update of one I wrote on May 12, 2025.

In March 2023, the company significantly expanded its asset base by acquiring several silver mines in South America from Yamana Gold for approximately $4.8 billion. This acquisition added valuable assets to Pan American's portfolio and further strengthened its position in the silver market. Despite strong silver production, gold contributes most to Pan American Silver's revenue due to its higher price per ounce.

1:1 - A quick look at the gold and silver production in 2Q25.

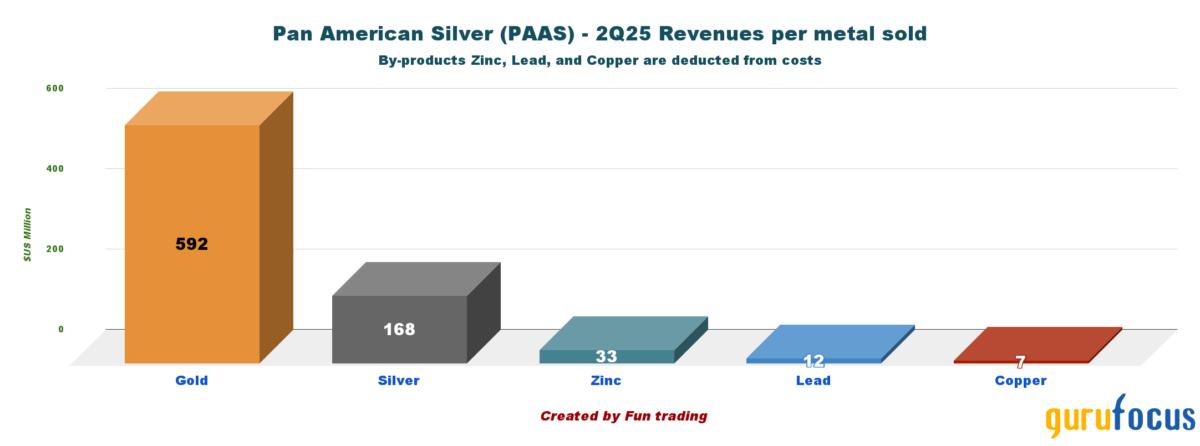

The current gold-to-silver price ratio stands at around 87 to 1, meaning one ounce of gold is worth nearly 87 ounces of silver in 2Q25. For Pan American Silver, the high gold?to?silver price ratio helps explain why even modest gold production, in volume terms, contributes significantly more to revenue compared to much larger silver output, as it is illustrated in the chart below:

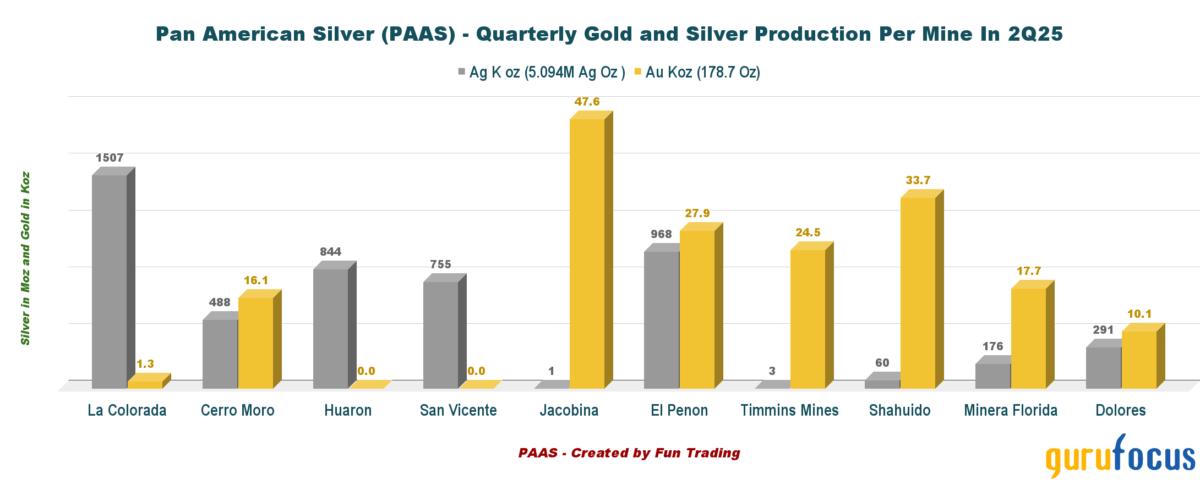

Gold's profitability is bolstered by consistently strong demand, especially during uncertain economic periods. Gold is a key contributor to Pan American's financial success, as gold-focused mines such as Timmins in Canada, Shahuindo in Peru, and Jacobina in Brazil represent a significant portion of the company's overall output. Additionally, the La Colorada mine remains the primary producer of silver, as illustrated below.

As of mid-2024, Pan American holds approximately 468 million ounces of silver reserves and nearly 6.9 million ounces of gold reserves, positioning it among the top silver producers globally. Because most of Pan American's mines are located in politically stable regions, the geopolitical risks associated with its operations are reduced. The company is well-known for its emphasis on low-risk jurisdictions.

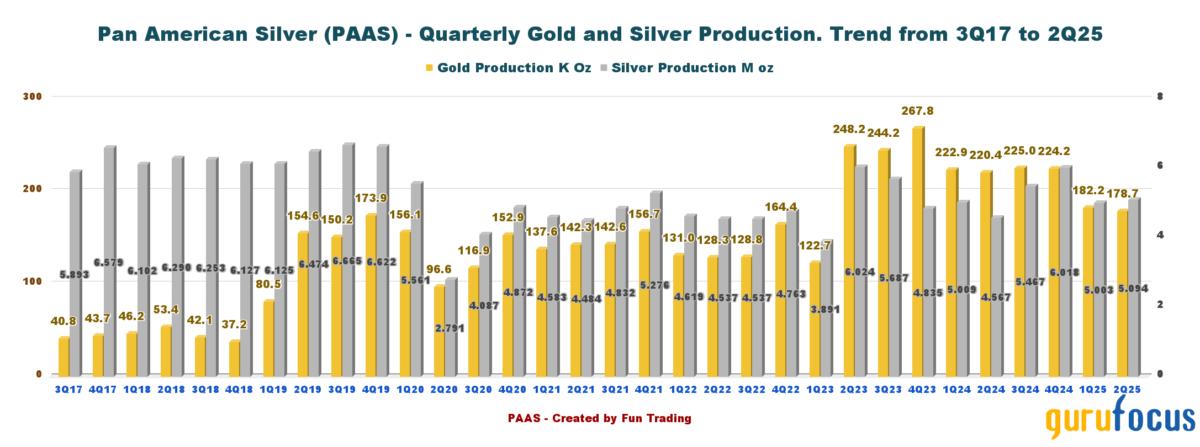

In 2024, Pan American produced an impressive 21.1 million ounces of silver and 892,000 ounces of gold, demonstrating the company's ability to deliver a substantial amount of precious metals. Looking at the second quarter of 2025, PAAS reported 5.1 million ounces of silver and 178,700 ounces of gold, which highlights how consistent their operations have been.

Notably, mines like the Timmins operations in Canada, Cerro Moro in Argentina, and La Colorada in Mexico are key contributors to this production. Each one plays a significant role in supporting the company's output of both gold and silver. For the full year of 2025, Pan American expects production levels for gold and silver to remain close to what they achieved in 2024.

1:2 - Pan American Silver is struggling with a high AISC.

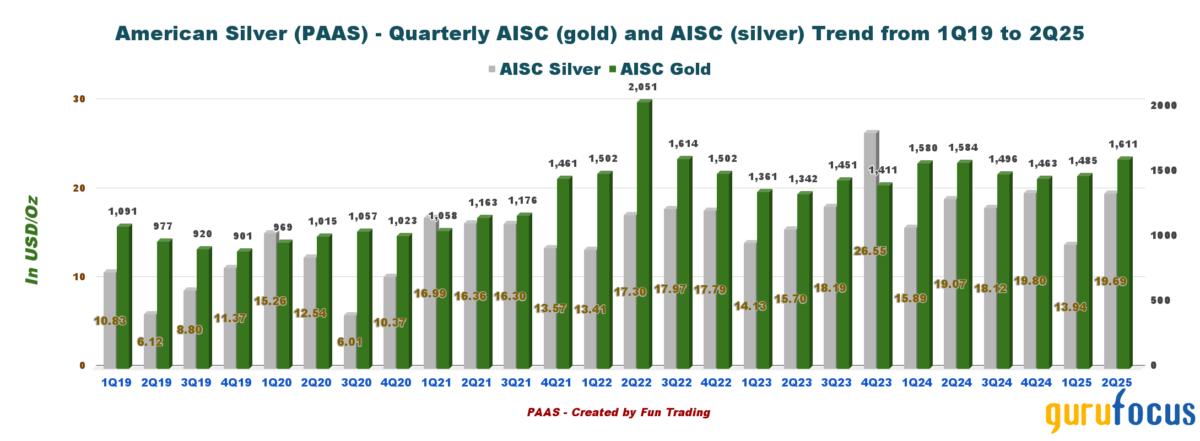

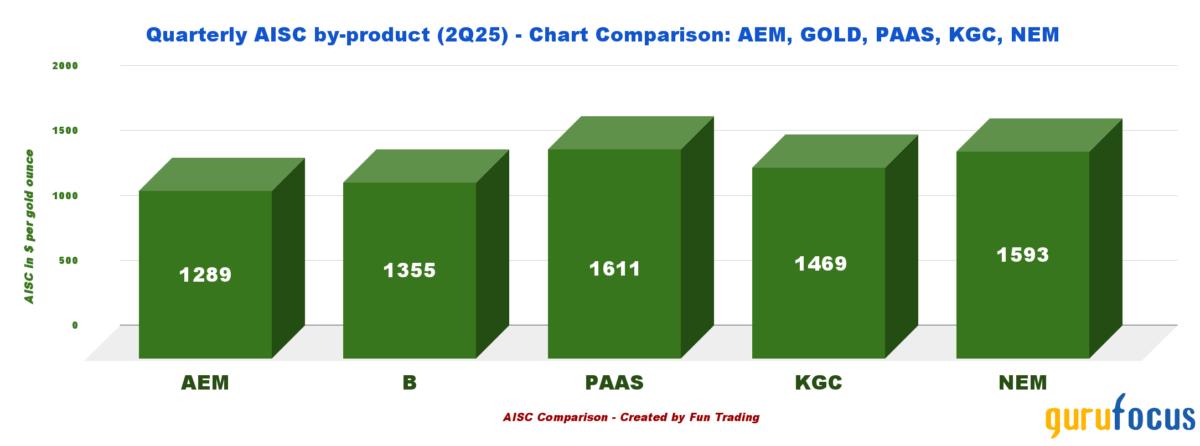

PAAS indicated an All-In-Sustaining Cost (AISC) of $19.69 per silver ounce, or $1,611 per gold ounce for 2Q25 as shown in the chart below:

Pan American Silver had a higher all-in-sustaining cost (AISC) than the majority of its peers, at $1,611 per gold oz (please look at the chart below). Additionally, PAAS all-in sustaining costs was approximately $19.69 per ounce of silver in 2Q25, making it one of the most competitive in the industry.

However, PAAS expects silver-segment AISC in the range of $16.25- $18.25 per ounce for 2025, which is still high but lower than 2024 showing some progress. Furthermore, this week, silver close at $48 an ounce , leaving a record profit margin.

Several operational factors were responsible for this. While mining lower-grade ores increased production costs per ounce at Timmins and Minera Florida, higher waste-to-ore ratios at Shahuindo led to additional expenses. Upgrading mine ventilation and replacing equipment were examples of maintenance capital expenditures that added up. I was impressed by how Pan American Silver navigated 2Q25. Even with a higher gold AISC, the company maintained strong profit margins. I realized this was largely due to the impressive surge in the average realized gold price to $3,305 per ounce, up 41% year-over-year. Silver also contributed, rising 17% to $32.91 per ounce.

Agnico Eagle AEM achieved a lower AISC of $1,289/oz, reflecting efficiency despite rising costs. Newmont

NEM delivered $1,593/oz, showing higher costs. Barrick

B reported a reasonable AISC of $1,355/oz, highlighting cost control. Kinross

KGC stood at $1,469/oz, competitive and efficient.

The company has focused on growth through strategic acquisitions, such as its purchase of a stake in MAG Silver at the Juanicipio project in Mexico, to enhance its silver production in the coming years. With its strong reserve base, diverse asset portfolio, and consistent production profile, Pan American Silver continues to be a significant player in the precious metals market, providing investors with both stability and growth potential.

Regrettably, Guatemala's Escobal silver mine remains closed. It was suspended in 2017 after courts determined that local Xinka Indigenous communities had not been adequately consulted. Since then, the mine has faced numerous challenges. The mine's owner, Pan American Silver, has maintained the site and participated in a government-led consultation process. However, no timeline for resuming operations has been established, despite years of discussions. In early 2024, the Xinka formally opposed the mine's reopening, stating that it would threaten their way of life, environment, and cultural rights. This situation highlights the difficulty of balancing community consent with resource development.

1:3 - Dividends have been raised in 2Q25. A small step in the right direction.

In 2Q25, Pan American Silver reaffirmed its commitment to rewarding shareholders through dividends and share buybacks. The company increased its quarterly dividend by 20%, raising it from $0.10 to $0.12 per common share. Additionally, PAAS repurchased 459,058 shares at an average price of $24.22 each, investing approximately $11.1 million in its stock. These actions highlight the company's strategic approach to capital allocation, balancing shareholder rewards with long-term value creation. The diluted shares outstanding totaled 362.12 million in 2Q25.

1:4 - Reflecting on the Gold and Silver Outlook for 2025.

Observing the prices of gold and silver in 2025 has been truly fascinating. Gold has risen to around $3,750 per ounce, and I am struck by how geopolitical tensions and economic uncertainty continue to enhance its appeal. To me, gold represents more than just a commodity; it symbolizes stability during unpredictable times. With interest rate cuts starting in September, gold's momentum could continue, reaching potentially $4,000 per ounce by next year. More importantly, I do not foresee any reason why gold or silver would suddenly drop back below $3,000 per ounce, although that could happen in extreme circumstances.

Recently, I have been closely monitoring U.S. inflation, which has been increasing due to a puzzling US tariff policy. The 0.9 percent jump in producer prices in July, the largest increase in over three years, made me realize how quickly costs can rise beyond just tariffs and supply chain issues. This situation hits home because it impacts everyday life; groceries, rent, and even simple plans feel more expensive and uncertain.

I keep thinking about the Federal Reserve and the difficult position it faces. Lowering interest rates could help stimulate growth, but it might also allow inflation to spiral out of control. Following these trends has made me more aware of how careful and complex economic decisions are. It serves as a reminder that policy, markets, and everyday life are deeply interconnected, and even small changes can ripple through the economy in ways that we all experience.

Silver has also attracted my attention, now trading near $46 per ounce. Its unique role as both an industrial metal and a haven makes it especially puzzling. The growing demand in electronics and solar energy, combined with limited new mining projects, suggests that supply could struggle to keep up, which excites me as an investor.

Overall, tracking these metals reminds me that markets are influenced not only by numbers but also by human behavior, uncertainty, and opportunities. For the rest of 2025, both gold and silver will stay strong, offering insights, protection, and potential rewards for those who invest in this sector.

1:5 - What is my perspective on PAAS stock, given a $3,700 gold price and a possible $46 per ounce silver scenario?

When I consider Pan American Silver in the context of a $3,700 gold price and a $46 silver price, my outlook is both optimistic and cautious. On the hopeful side, these price levels indicate a significant shift in the precious metals market. For a company like PAAS, which has strong leverage to silver and substantial exposure to gold, such a scenario would likely lead to sharply higher cash flows, expanding profit margins, and improved balance sheet strength. I can easily envision the market rewarding the stock with a higher valuation as investors seek exposure to hard assets during times of currency weakness or financial instability.

However, I don't see this just as numbers on a spreadsheet. To me, PAAS is one of those rare mining companies with the scale, geographic diversity, and operational history to deliver results when metal prices rise. Many smaller or speculative mining companies may struggle with costs or political risks, but PAAS has proven it can handle these challenges effectively. If silver reaches $50 an ounce or higher, I believe PAAS could become a top choice for both institutional and retail investors.

That said, I temper my excitement with a dose of realism. Precious metals are volatile, and PAAS has experienced fluctuations, too. If the optimistic outlook for gold and silver happens, PAAS is a strong core investment. But I remind myself to invest wisely and stay aware of the cyclical nature of this sector, especially with the high stock valuation that we have today.

Looking at the business perspective. Pan American Mining's competitive advantages stem from its scale, geographic diversification, and a portfolio of long-life, high-quality assets. The by-product production of gold and base metals helps mitigate silver costs, maintaining operational efficiency even during price fluctuations. The company's diverse portfolio includes long-life assets such as La Colorada, Dolores, and Shahuindo, which provide stable production and low geopolitical risk.

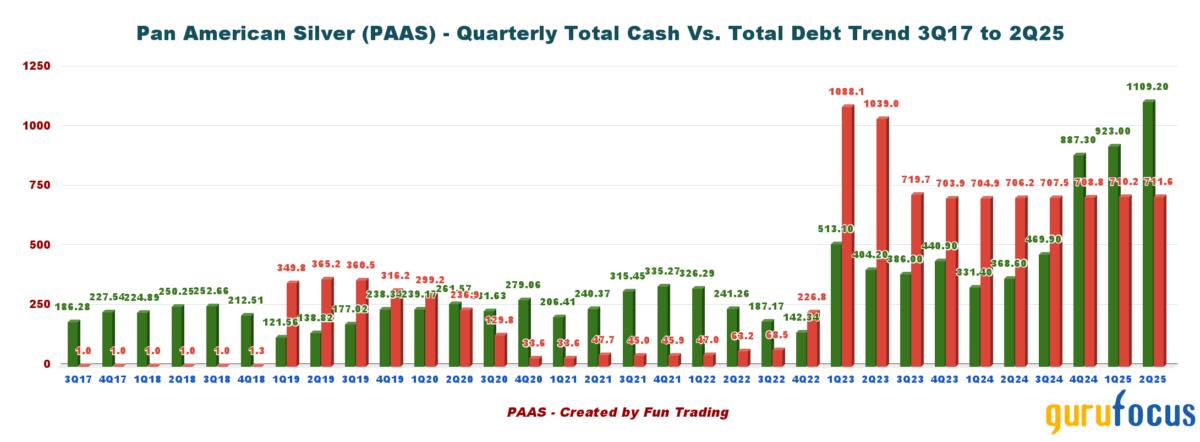

Another plus. The management team adheres to a disciplined capital allocation strategy, reinvesting in high-return projects like the La Colorada Skarn development while divesting non-core assets, such as La Arena, to enhance liquidity. Currently, the company has a record total cash balance of $1.11 billion.

Finally, the potential re-opening of Escobal mine in Guatemala could push the stock to new high. However, given the Xinka people's firm stance and the legal complexities involved, the near-term reopening of the Escobal mine appears unlikely.

2: Critical analysis of the second quarter results.

When I examine Pan American Silver's second-quarter 2025 results, I see more than just strong financial figures. The numbers reflect a company that is gaining momentum while striking a balance between discipline and ambition.

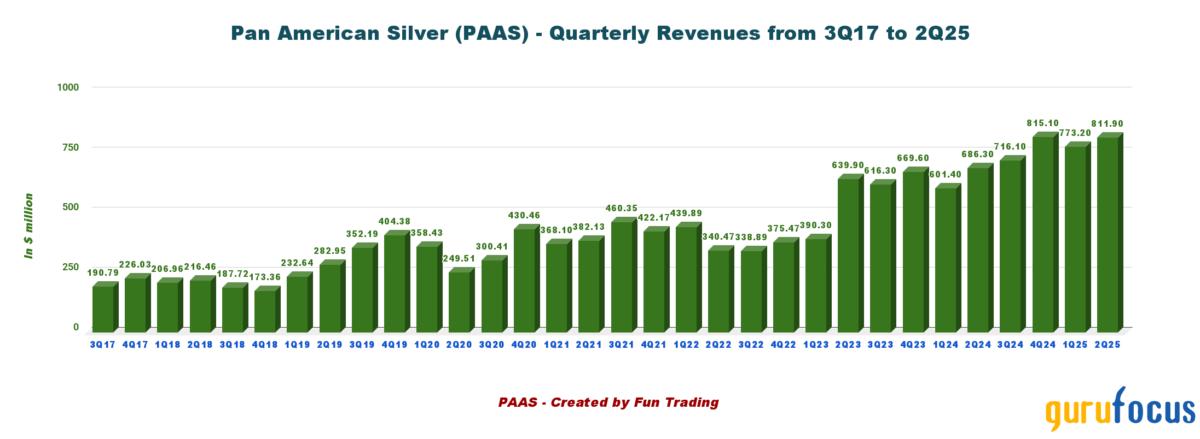

Revenue reached an impressive $811.9 million, supported by steady operations and favorable metal prices. Net earnings climbed to $189.2 million, or $0.52 per share, marking a record performance. Adjusted earnings of $155.4 million further underscore the consistency of operations and the company's ability to convert higher metal prices into actual profitability.

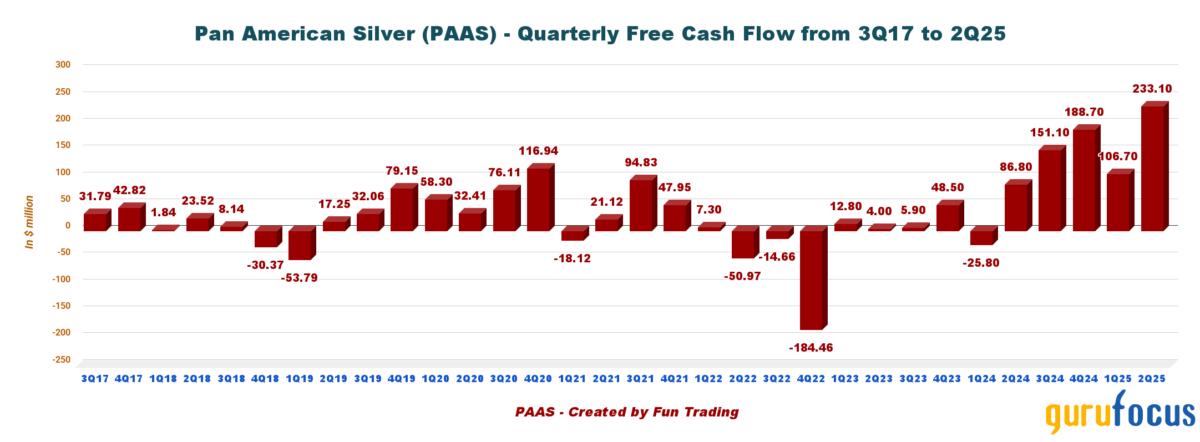

What stands out most to me is the company's cash generation. Operating cash flow came in at $293.4 million, with free cash flow reaching a record $233.1 million. These figures suggest strength and resilience, giving the company the flexibility to seize opportunities without compromising its balance sheet.

Pan American is in a robust financial position with $1.109 billion in cash and nearly $1.9 billion in total liquidity, offering both security and flexibility. Notably, the company chose to share its success with shareholders by increasing the quarterly dividend by 20% to $0.12 per share. Additionally, over $103 million was returned to investors through share buybacks in the first half of the year. Furthermore, Pan American has committed $500 million to acquire full ownership of the Juanicipio project, which is expected to boost silver production and lower costs. Currently, the company has a net cash position of $397.6 million, marking solid progress in 2023.

This quarter signifies more than just strong performance; it exemplifies a company that is rewarding its shareholders today while also strategically investing in growth for the future. Although this approach may seem slow and overly cautious, it represents the best long-term strategy.

3: Technical Analysis: Ascending Channel Pattern.

Note: The chart has been adjusted to account for the dividend.

PAAS is currently trading within an ascending channel pattern, with resistance around $39.25 and support near $36.85. The Relative Strength Index (RSI) is at 67 and is decreasing, indicating an overbought situation. This suggests a potential first support level at $37. Please refer to the chart above for additional context.

I recommend selling about 50% of your position, targeting an initial range between $38 and $40 using a Last-In-First-Out (LIFO) strategy, with a secondary target at the upper resistance level of $42 (not likely in the short term). While a rising channel typically signals a bullish continuation pattern, traders should remain cautious. Although a breakdown may not happen immediately, such formations can reverse sharply under pressure. Recent reversals have been observed, and more could occur in the future.

I've been paying closer attention to economic trends, particularly regarding the labor market and inflation, and how they influence investments like gold and silver (both at record high now).

Recent reports show that the U.S. labor market is quickly softening. Job growth has slowed, unemployment is rising, and wage increases are no longer keeping pace. This suggests that the economy might be losing momentum.

Inflation remains persistent, partially due to tariffs. Tariffs on imported goods have raised prices for items like electronics and household appliances, putting pressure on consumer costs and keeping inflation elevated despite a cooling job market.

For precious metals, these trends are favorable. Gold tends to benefit from lower interest rates and increased economic uncertainty, serving as a safe haven for investors. Silver shares these qualities but also responds to industrial demand, giving it a dual role as both a hedge and an economic indicator. Silver is now at a multi-year record of $48 per ounce.

Maintaining a healthy cash position is a prudent strategy in the current environment. Traders should wait to accumulate again between $36.85 and $33.5. If a breakdown occurs, a more attractive accumulation zone could develop within the $29 to $26 range.

Note: It is important to monitor and frequently update your technical analysis (TA) charts, given the fast-changing market landscape.