Lear Review: Cautious Observation Rather Than Confident Conviction

Introduction

Lear Corporation (NYSE: LEA) is back in the spotlightand this time, it's not because of a breakout earnings beat or a bullish announcement. Instead, it's the quiet exit of a top executive that's raising questions. A large, discretionary insider stock sale recently took placeright around a zone where the stock has shown signs of weakness.

This kind of move doesn't always spell trouble. People inside a company sell shares for all sorts of reasonspersonal finances, taxes, rebalancing. But when the timing overlaps with technical pressure and there's no obvious upside driver, it's hard not to wonder if the leadership is signaling caution.

Before jumping to conclusions, let's walk through where Lear stands: from its operations to its books, the sales picture, and what the charts are really saying.

Lear's Core Business: It's Just Standing, It's No Longer Marching

Lear is one of the largest suppliers of seating systems and electronic systems for the automotive industry. Having customers such as General Motors, Ford, Stellantis, and increasingly, EV-focused OEMs, the company is still deeply embedded in the heart of vehicle production globally.

Recently, the automotive industry hasn't been stable, from supply chain issues to persisting inflation of important raw materials such as copper and steel, coupled with demand slowing down in key markets such as European and Chinese markets, companies like Lear Corp. has been on an edge. Lear Corp. has made attempts to pivotespecially in areas like EV architecture and next-gen connectivity modules, but these moves haven't translated to any visible margin expansion or a top-line acceleration yet. This may change, this may not.

In short, Lear's core business is stable, but it's not moving forward, at least not quickly. It's in a holding pattern, which reflects the larger auto industry's cautious standing.

A Closer Look at the Balance Sheet: Manageable, But Not Defensive

Lear's most recent earnings report showed cash and cash equivalents of $888 million and total liquidity of about $2.9 billion (Lear Corporation, AInvest). The principal value of debt as of March 29, 2025, was $2.8 billion (Fitch Ratings)meaning net debt is still material, though not alarming in isolation.

While net debt isn't overwhelming, the lack of a fortress balance sheet means flexibility could erode in a prolonged downturn or persistent cost pressure. Interest payments and capex demands for E-systems investments could squeeze free cash flow if unexpected headwinds emerge.

Sales and Guidance: Treading Water

Revenue for Q2 2025 came in at $6.0 billion, essentially flat year-over-year (Lear Corporation, AInvest, Investing.com). Q1 was softer at $5.6 billion, also showing no breakout growth (Lear Automotive).

Analyst estimates project full-year 2025 revenue of $22.47 billion with EPS of $11.85 (ChartMill, AInvest). These numbers represent modest growth, aligning with how the company is executing given current conditions.

Now the Real Trigger: Insider Selling Raises Eyebrows

In early Q3, CEO Raymond E. Scott sold 5,000 shares on July 29, 2025, at weighted-average prices between $96.58$98.84, for proceeds of about $485K (Stock Titan). CFO Jason M. Cardew also sold 5,000 shares that same day across two tranches at $99.50 and $96.69, bringing in roughly $490K (Stock Titan). Neither trade was disclosed as part of a Rule 10b5-1 plan.

These are not transactions that devastate credibility, but their timing and lack of pre-scheduling raise eyebrowsespecially given the stock's sideways to slightly bearish price action.

Technical View: Trapped in a Downtrend With No Clear Exit

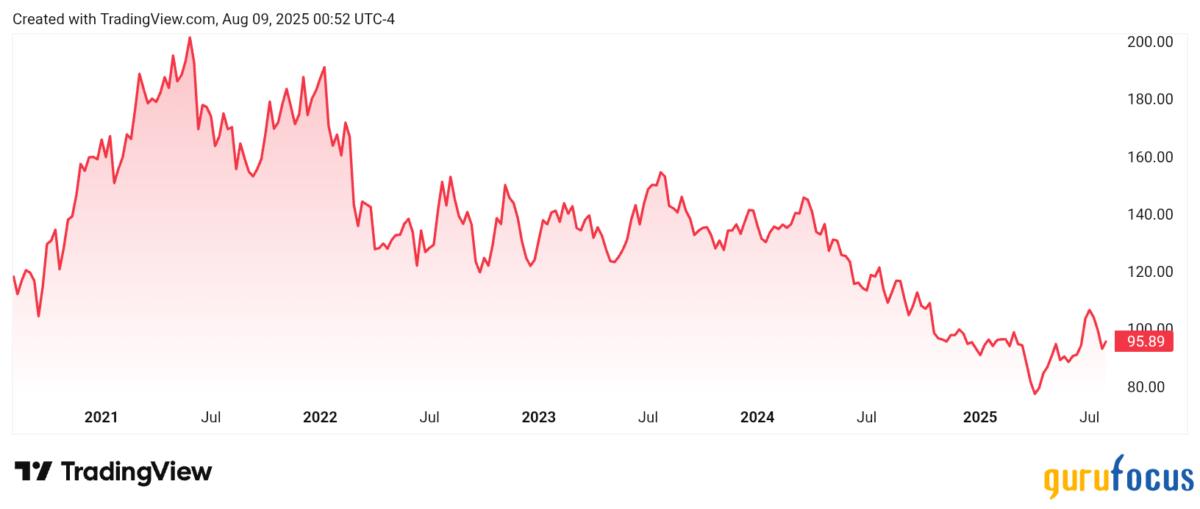

Short-term, Lear has struggled to rise above the $92$94 range. Price is currently around $96, with prior failures at these levels adding to the technical hesitation.

Longer term, the stock has slumped from highs north of $190 in 2021 to around the mid-$90s todayover a 50% decline with no sustained rebound in sight .

Without a reclaim and hold above $100, the technical picture suggests continued pressure and no clear path to breakout.

Final Thoughts: Hold, But Eyes Wide Open

Lear isn't a disaster story. It's a decent business with durable customer relationships and operational scale. But that doesn't mean the stock is ready to run.

With insider selling clouding sentiment, and both the balance sheet and revenue trend showing more of the same, it's hard to argue for fresh upside. This isn't a sell everything momentbut it's definitely not a strong buy either.

The smart approach here is to Hold, but stay alert. If Lear fails to hold support or releases weaker guidance next quarter, it may be time to gradually reduce exposure. On the other hand, if the stock holds firm and insider sales stop, the case for patience strengthens.

Until then, this is a story of cautious observation rather than confident conviction.