RBI's October reviews mostly quiet since 2014 with just three tweaks, shows data

The Reserve Bank of India’s October review of the monetary policy - usually a quiet affair with little change in growth or inflation projection - carries a history that suggests it hasn’t always been as predictable.

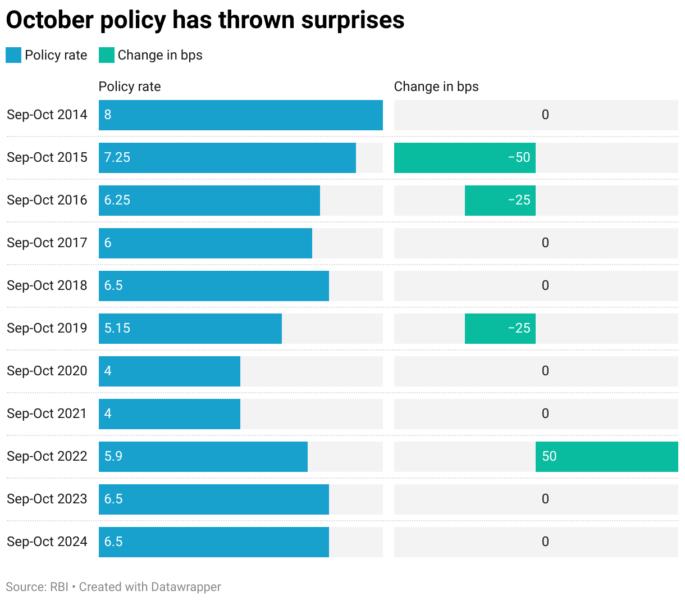

Data reviewed by Moneycontrol show that since 2014, the RBI has altered the repo rate thrice during the October policy meet, with the sharpest change seen in October 2015 when the repo rate was cut 50 bps to 7.25 percent. This was followed by a 25 bps cut each in 2016 and 2019 that lowered the benchmark rate to 5.15 percent. More recently, in October 2022, the central bank raised rates by 50 bps to 5.90 percent after inflation had surged globally.All other October reviews in the past decade - including in 2023 and 2024, when repo stood at 6.5 percent - have kept policy steady.

October - Steady Month for Projections

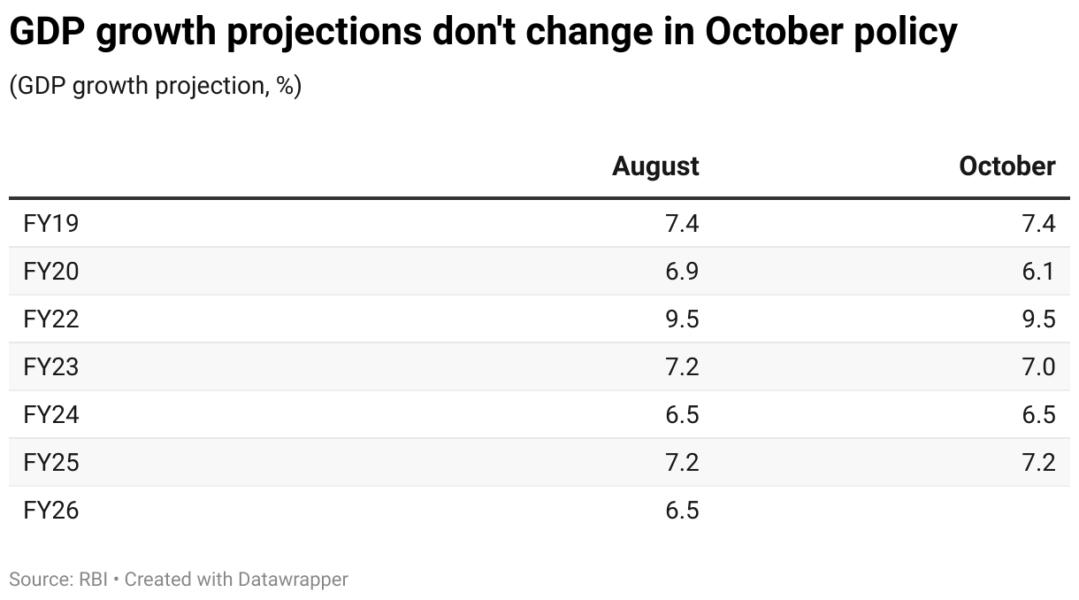

On projections, RBI's October update rarely brings major changes, as the GDP growth rate was revised only twice in recent years - down from 6.9 percent to 6.1 percent in FY20, and trimmed slightly in FY23. Inflation too has been seen as stable except in FY22 when the CPI outlook eased from 5.7 percent in August to 5.3 percent in October.

For FY25, both GDP (7.2 percent) and CPI (4.5 percent) projections were unchanged between August and October reviews, while for FY26, the RBI had pencilled in a sharp disinflation with CPI expected at just 3.1 percent by March. The CPI inflation has been 2.35 percent in the first five months of the current fiscal.

October 2025 MPC Expectations The central bank has already cut the policy rate thrice this year, lowering it by 100 bps to 5.5 percent. The August meeting left rates unchanged and most economists in a Moneycontrol poll expect a status quo in October, though a one can't rule out surprises. Consumer spending had been held back ahead of GST 2.0 reform, and there may be some merit in front-loading another 25 bps cut on October 1, the latest SBI Research note said.