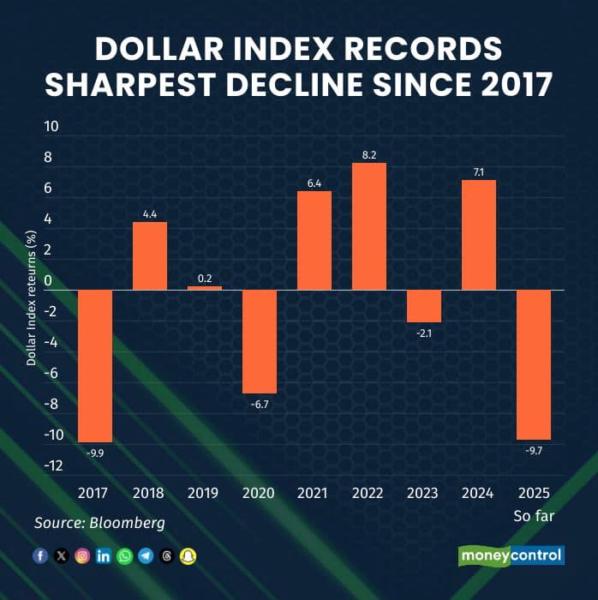

US dollar index sinks 10%, marks sharpest fall since 2017

The US dollar index has recorded its sharpest decline since 2017, tumbling nearly 10 percent in 2025 so far, as a combination of weak economic data, ballooning fiscal deficits, expectations of interest rate cuts, and rising political uncertainty weigh on the greenback. The index, which touched a three-year high of 110 this year, is now trading near 97.

The slide has been triggered by multiple factors. Weak job growth and rising unemployment in the US have fueled expectations of aggressive rate cuts by the Federal Reserve, eroding the interest rate advantage that once supported the dollar. Meanwhile, heavy Treasury issuance to fund record fiscal deficits-US debt-to-GDP has inched close to 130 percent-has dampened foreign appetite for American assets.

Adding to the turmoil, sweeping tariffs announced by President Trump on April’s “Liberation Day” sparked a global selloff of US assets, casting doubt on the dollar’s safe-haven status. Concerns over the Fed’s independence—amid political pressure and public criticism of policymakers—have further rattled investor confidence.

As a result, global capital has shifted toward gold and emerging markets. “Beyond the US, investors are reallocating to gold and other currencies, while record Treasury supply has only accelerated outflows from dollar assets,” said Amit Pabari, MD, CR Forex.

Experts noted that a negative US GDP print in the last quarter, combined with weak labour market data, forced the Fed to cut rates by 25 basis points. The central bank has signalled two more cuts this year and another in 2026, reinforcing a bearish outlook for the currency.

Impact on India

While a weaker dollar typically supports emerging market currencies, India has been an exception. Foreign portfolio investors (FPIs) have been persistent sellers of Indian equities and debt, driving the rupee lower from 83 to Rs 89 against the US dollar. Analysts attribute this to fears of weaker Indian exports to the US amid tariff-related disruptions.

“Despite a falling dollar index and strengthening Asian currencies, the rupee has underperformed due to sustained outflows,” said Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP. “This comes even as India posts strong GDP growth, robust tax collections, and moderating inflation. Equity valuations, once at 20x earnings, have corrected, but the selling pressure has kept Indian assets lagging global peers.”

The rupee is now testing key levels, with resistance at 89.00–89.20 and support at 88.40. A close below 88.20 could mark a reversal in trend. Analysts believe any easing of US trade frictions could allow the rupee to recover swiftly, supported by a weaker dollar and favourable domestic fundamentals.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.