August auto sales numbers indicate mixed trend

Highlights:

- Bikes continue to see uptick in demand

- Tractor segment sees subdued demand

- Ola Electric losing market share to incumbents

- Export market picking up

The automotive sector posted a mixed performance in August. There was sustained demand momentum for two-wheelers (2Ws), and premium cars and the export market revived. However, the other segments experienced a subdued performance.

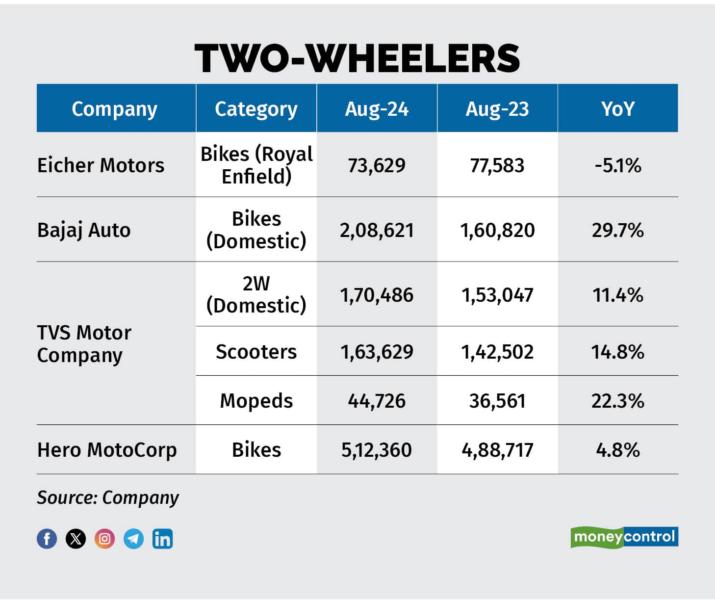

Continuous improvement in demand for bikes

The wholesale numbers of bike OEMs (original equipment manufacturers) for August 2024 outperformed other segments. The demand for executive and entry-level motorcycle segments saw accelerated growth, attributed to the improvement in the rural economy. Bajaj Auto and TVS Motors provide the best clue.

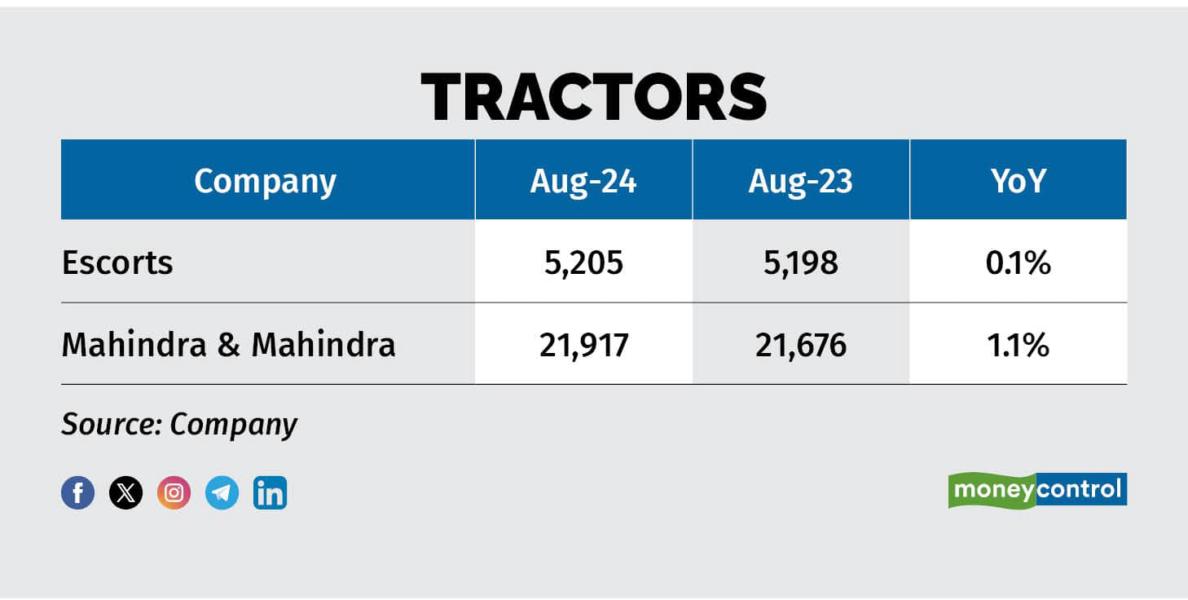

Muted tractor demand

The erratic distribution of rainfall this monsoon season has dampened the demand for tractors. On a yearly basis, the demand for both M&M and Escorts remained muted.

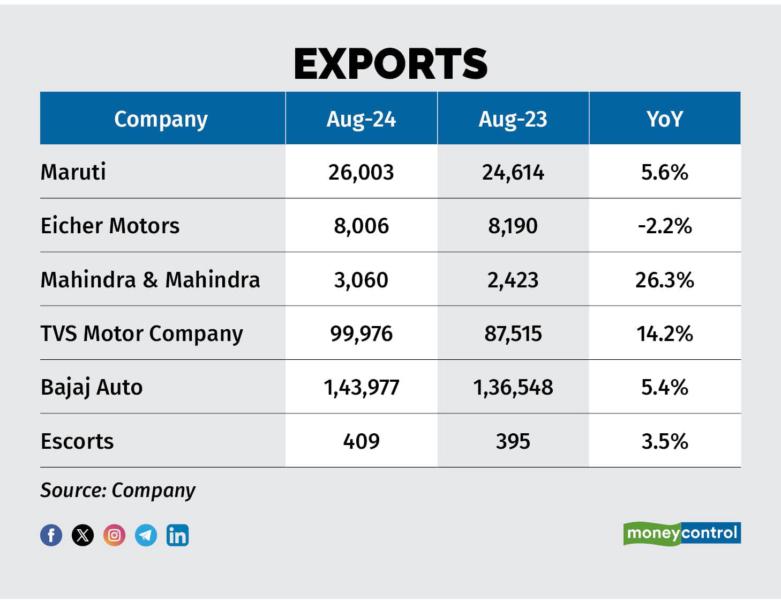

Export market growth momentum continues

Export demand is showing an uptrend for the last 2 months. The revival in the global economy is reflecting in the numbers of some of the leading automobile exporters. All auto majors, except Eicher Motors, posted strong YoY growth in the overseas market.

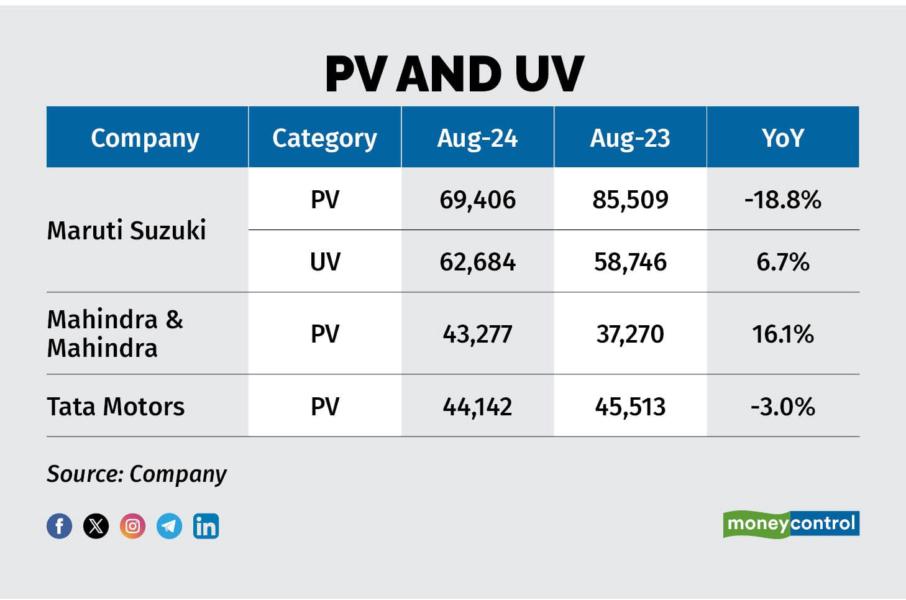

PV and UVs

The passenger car segment exhibited a clear preference for mid- to high-range UVs. This preference resulted in Mahindra & Mahindra (M&M) posting a 16.1 percent year-on-year (YoY) growth. Maruti’s numbers were driven by strong UV sales on the back of recent product launches.

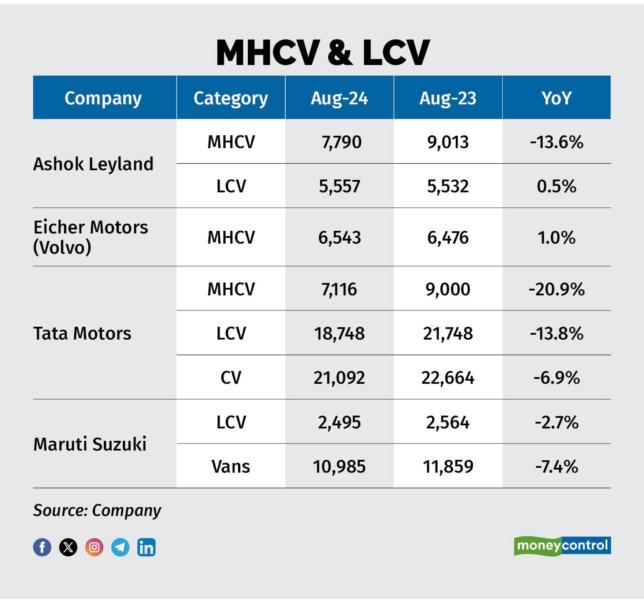

Downward trend for commercial vehicles

In August 2024, sales of commercial vehicle (CV) saw a declining trend as the erratic distribution of rainfall led to uncertainties in economic activities, delaying investments and expansion plans.

Additional trends

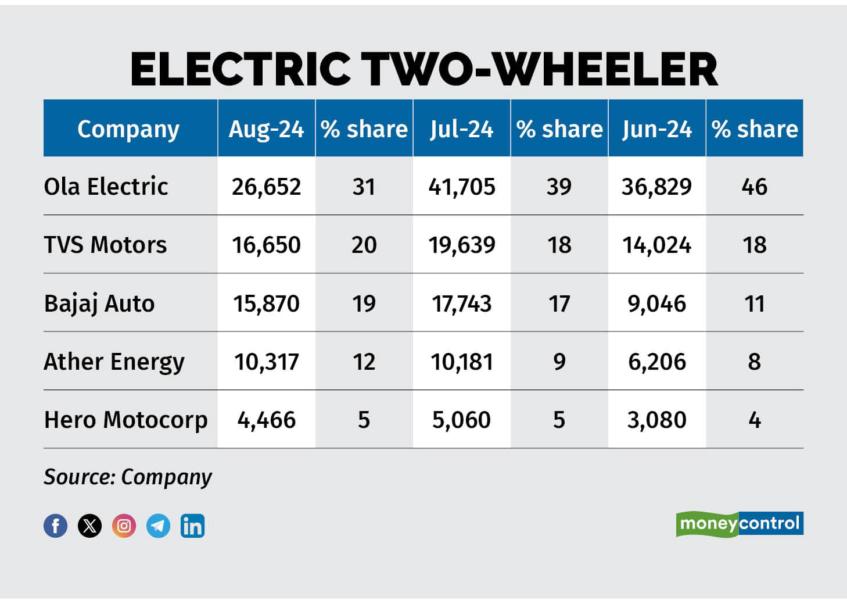

Ola Electric is facing stiff competition from incumbents

There was a moderation in EV purchases due to the expiry of FAME II. The transition from FAME II to Fame III may reduce the growth pace.

In August, the combined retail sales of electric scooters by TVS Motors and Bajaj Auto surpassed those of Ola Electric, owing to the higher discount offered. This caused Ola's market share to drop significantly from 52 percent in April to 31 percent in August. Despite this decline, Ola remains the leading player in the electric two-wheeler segment, with total sales of 176,716 units between April and August.

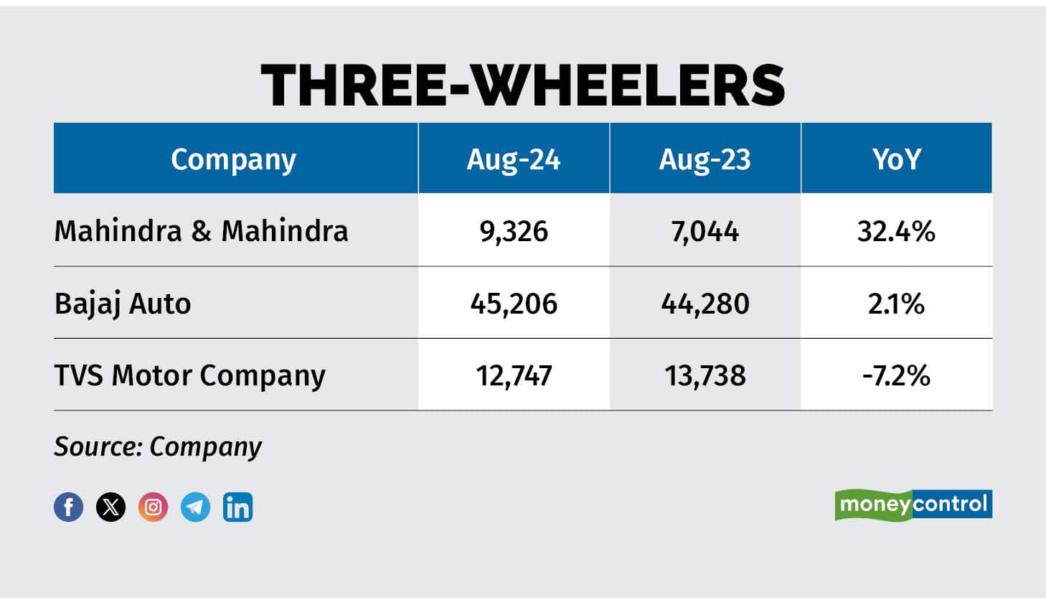

Moderate growth trend in three-wheeler demand

The demand for three-wheelers (3Ws) has moderated after recording strong post-pandemic growth. This resulted in a decline in TVS Motors sales and a subdued growth in Bajaj Auto numbers.

Outlook

With the general election over, the outlook for commercial vehicles (CVs) is improving, given the government's emphasis on infrastructure, construction, and mining activities.

With expectations of a near-normal monsoon, there is a favourable uptick in demand across two-wheelers (2Ws).With the upcoming festive season, a near-normal monsoon, bumper Kharif harvest, and favourable terms of trade for farmers, the demand for tractors, passenger vehicles, and utility vehicles is expected to rise.