More than 40 smallcaps gain between 10-36% as broader indices outperform

The broader indices outperformed the main indices in the volatile week ended October 24 with BSE Mid and Smallcap indices rising 0.5 percent and 1 percent respectively in the truncated Diwali week amid support from FII and better Q2 earnings so far.

For the week, BSE Sensex index jumped 259.69 points or 0.30 percent to end at 84,211.88 and Nifty50 rose 85.3 points or 0.33 percent to end at 25,795.15. However, for thr month of October till now, both the benchmarks added nearly 5%.

The Foreign Institutional Investors' (FIIs) turned net buyers for week as they bought equities worth Rs 342.74 crore, while Domestic Institutional Investors (DII) continued their buying on 27th week, as they purchased equities worth Rs 5945.31 crore.

In this month, FII sold equities of Rs 244.02 crore, while DII bought equities worth Rs 33,989.76 crore, till now.

Among sectors, Nifty IT index gained 3%, PSU Bank added 2%, Nifty Metal index gained 1.5%, Nifty Media index up 1.3%, Nifty Oil & Gas index up 1%, while Nifty FMCG and Auto indices down 0.5% each.

"The week welcomed the Samvat 2082 with festive-driven optimism and upbeat consumer sentiment. However, the momentum gradually lost its steam, as geopolitical tensions and profit-taking weighed on investor confidence. Record festive sales underscored India’s surge in consumer demand this season, powered by resilient household spending and GST-driven affordability. PSU banking stocks led the rally, buoyed by news of potential consolidation and better-than-expected results," said Vinod Nair, Head of Research, Geojit Investments.

"Meanwhile, the precious metals market faced extreme volatility, suffering its sharpest single day fall in over a decade, driven by profit booking and a strengthening USD. Crude oil prices surged sharply following fresh sanctions from the US and EU on Russian oil majors, sparking heightened fears of tightening global supply and renewed inflation concerns. This could negatively impact India, as elevated crude prices may widen the fiscal deficit and strain the import bill."

"Investors remain watchful of developments in the India-US trade negotiations, as both sides edge closer to finalizing a deal. Global market sentiment will largely hinge on key interest rate decisions from the FED & ECB by next week, which are expected to influence market direction in the near term," he added.

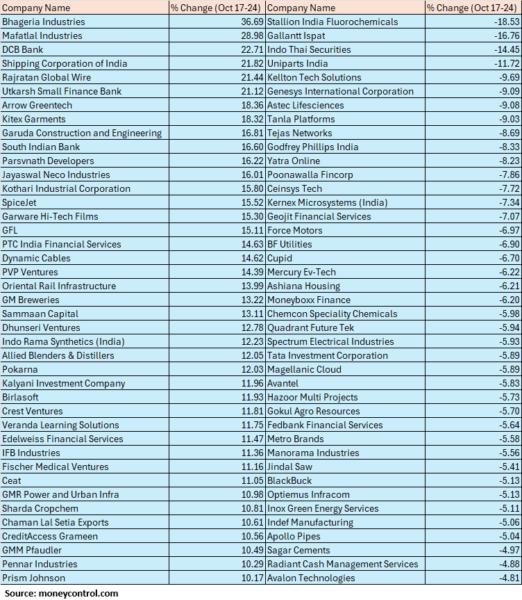

The BSE Small-cap index added nearly 1 percent with Bhageria Industries, Mafatlal Industries, DCB Bank, Shipping Corporation of India, Rajratan Global Wire, Utkarsh Small Finance Bank rising between 21-36 percent, while losers were Stallion India Fluorochemicals, Gallantt Ispat, Indo Thai Securities, Uniparts India, Kellton Tech Solutions, Genesys International Corporation, Astec Lifesciences, Tanla Platforms.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty in the next 1–2 sessions might remain volatile; however, a sustained rally looks possible thereafter.

On the higher end, resistance is placed at 25,850, above which a rally towards 26,000–26,200 looks possible.

Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services

Markets on Monday would react to the quarterly result of banking heavyweight Kotak Mahindra Bank to be announced over the weekend. Overall, we expect Indian equities to remain range bound, tracking global cues, upcoming Q2 results and macro-economic data.

FII inflows and upbeat management commentaries could help sustain positive market momentum, though intermittent profit booking cannot be ruled out. Meanwhile, any progress on the India-US trade deal front, could further uplift investor sentiments.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

Nifty on the weekly chart formed a small negative candle with long upper shadow, which signals consolidation movement at the highs.

The overall near-term trend of Nifty remains positive but the market is facing selling pressure as per short-term basis. Further weakness from here could bring crucial support around 25600-25500 levels, which could be a buy on dips opportunity for the next week. Immediate resistance is placed at 25950.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.