US clean power reversal comes with a hefty emissions price tag: Maguire

By Gavin Maguire

The abrupt cuts to U.S. federal clean energy incentives alongside fresh support for coal and gas-fired power will trigger a swell in North America's emissions in the coming decades as the U.S. generation mix remains fossil fuel reliant.

Indeed, consultancy DNV projects that North America's power emissions from 2025 to 2050 will be 3 billion metric tons more than was projected in 2022, when the previous U.S. administration rolled out aggressive clean power goals.

The higher pollution totals reflect a combination of slower growth in U.S. clean power generation - now stifled by the planned phase-out of tax breaks - and the extended use of coal and gas-fired power plants planned by the Trump administration.

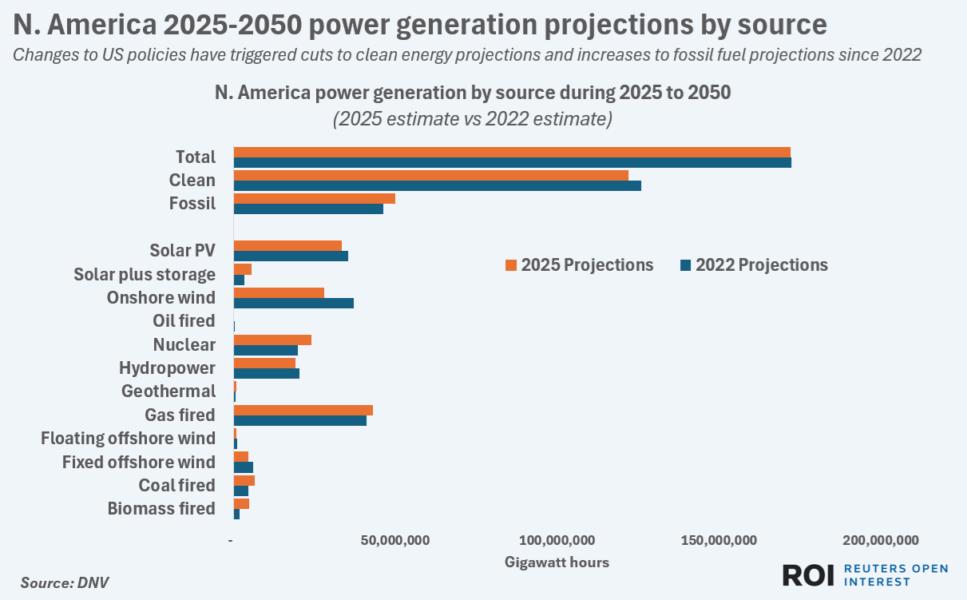

Expanded use of fossil fuels, however, will result in a faster climb in total power generation from now through 2040 compared to 2022's projections, which contained a steep drop-off in estimated coal-fired output over the coming years.

COAL'S LONGER LIFE

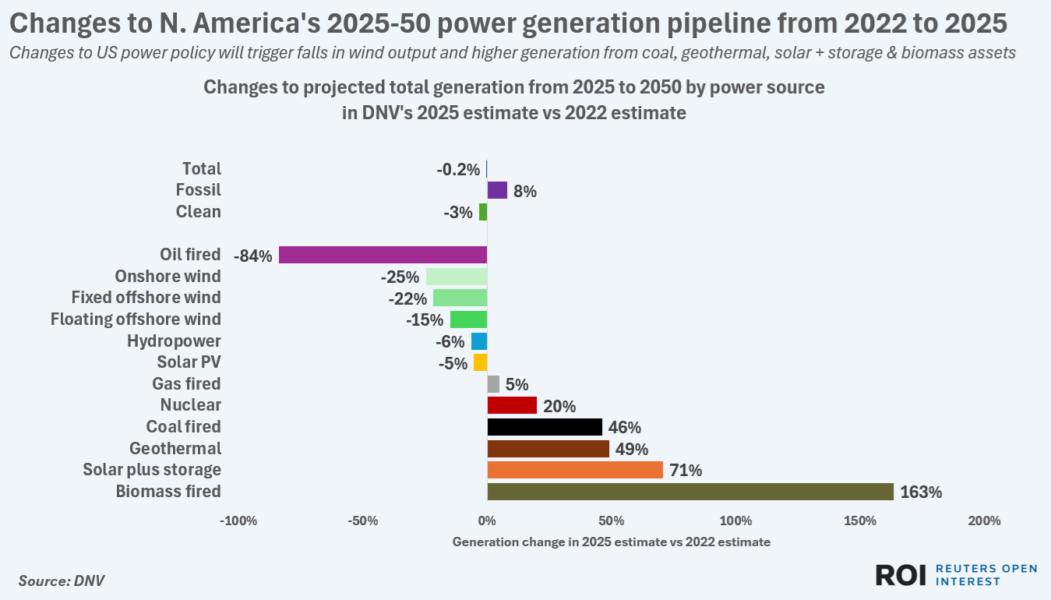

North American power generation by fossil fuel power sources from 2025 to 2050 will grow by around 8% compared to DNV's 2022 estimates, due mainly to the Trump administration's stated expansions to coal and gas-fired power.

Coal-fired power generation from now through 2050 is projected to be 46% more than was estimated by DNV in 2022, following the Trump administration's new policies that will extend the life of U.S. coal power plants by several years.

North American gas-fired generation through 2050 will grow by around 5% from DNV's 2022 estimate, due in large part to expectations that new gas capacity will be developed over the coming decade in response to gas-friendly policies in the U.S.

WIND WOES

Generation from clean power sources during 2025 to 2050 will decline by around 3% from 2022's estimates, again due to U.S. policy changes that have resulted in sharp drops to federal incentives for clean power deployment.

Total power generation from wind farms in North America is estimated to fall by around 24% from DNV's 2022 estimate, following the aggressive slashing of U.S. federal support for wind development since President Trump returned to office.

Power generation from solar photovoltaic installations is also expected to shrink compared to 2022's estimates due to the Trump policy u-turn, although only by 5%.

Steady declines in solar system costs, coupled with the fact that solar systems remain the fastest source of new electricity for grid managers, are expected to keep solar capacity growth relatively firm despite the policy shifts.

Continued federal support for battery systems going forward is expected to result in a 71% surge in generation from solar-plus-storage systems compared to DNV's 2022 estimates.

Sharply lower battery costs compared to 2022 are another factor driving expected solar-plus-storage uptake compared to 2022.

EMISSIONS IMPACT

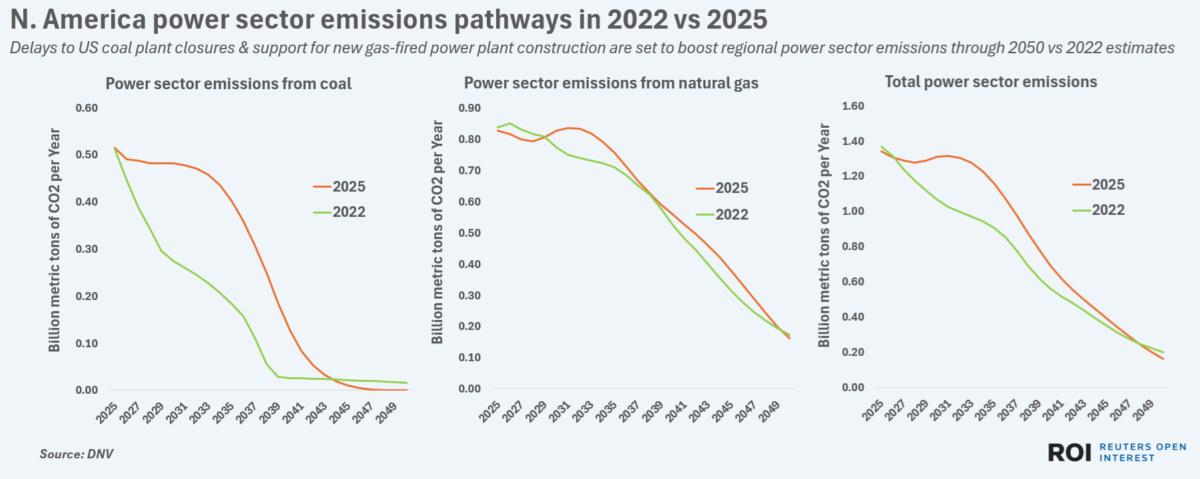

In its 2022 outlook for global energy generation and emissions, DNV estimated that North America's power emissions after carbon capture sequestration and storage were likely to steadily decline from around 1.2 billion tons of CO2 a year in the 2020s to around 360 million tons a year by the 2040s.

In its 2025 report, however, those emissions estimates veer higher for the next decade or so due to the extension of coal use within the United States, and average around 100 million tons of CO2 more than the 2022 emissions estimates.

Emissions from coal-fired generation had been projected to average around 310 million tons of CO2 a year through 2035 in the DNV 2022 report.

In this year's report, coal-fired emissions are seen averaging around 470 million tons a year through 2035, which marks a more than a 50% increase.

Between 2025 and 2050, that sustained higher level of coal-fired generation is expected to result in 2.6 billion tons of CO2 more than was projected in 2022, and around 3.2 billion tons more of total power sector emissions.

To justify the extended use of coal plants, the Trump administration has argued that rapidly rising electricity demand from data centres and other businesses could result in potential power shortages unless output from fossil fuel plants increased.

And it is clear from DNV's generation projections that total power output in North America will rise faster through 2040 under the current administration's policy scenario than under the policies that governed DNV's projections in 2022.

A major takeaway, however, is that the higher generation peak comes with a sharp rise in power emissions that could be avoided if a cleaner power mix was deployed instead.

The opinions expressed here are those of the author, a columnist for Reuters.

Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn and X.