Crypto investment products log $3.17 billion in weekly inflows despite historic liquidation event: CoinShares

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares generated net inflows of $3.17 billion last week, according to CoinShares' data.

As a result, year-to-date inflows have now surpassed last year's record tally, totaling $48.7 billion so far in 2025 — notwithstanding the chaotic end to last week, when cascading liquidations wiped billions of dollars in value from the crypto sector.

"Despite the significant price correction caused by the China tariff threats by the U.S., Friday saw little reaction with a paltry $159 million outflows," CoinShares Head of Research James Butterfill wrote in a Monday report.

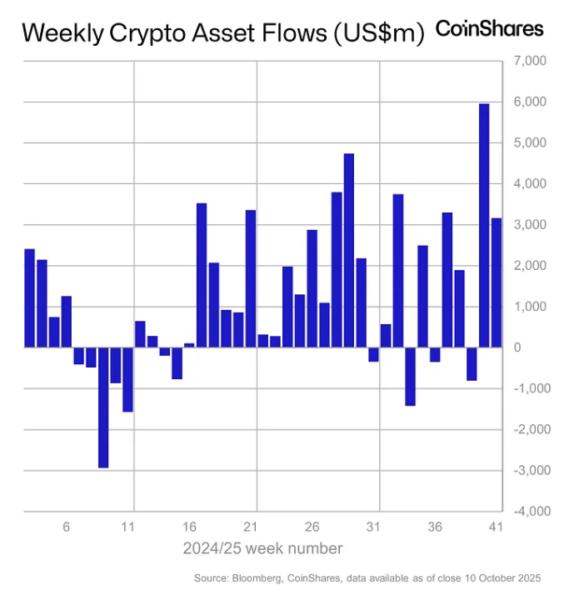

Weekly crypto asset flows. Images: CoinShares.

Weekly trading volumes in digital asset exchange-traded products also surged to a record $53 billion — more than double the 2025 weekly average — while Friday alone saw an all-time-high $15.3 billion in daily turnover, Butterfill noted. However, following President Trump's tariff announcement, total assets under management slipped 7% from last week's peak to $242 billion, though his comments were later walked back to some extent.

At least $20 billion of positions were wiped out on Friday as some cryptocurrencies briefly fell literally to zero — the largest crypto liquidation event in history in U.S. dollar terms. However, as liquidation data is imperfect — with Bybit publishing in full, but Binance and OKX still underreporting in incomplete bursts, for example — the true figure is likely far higher.

Nevertheless, major cryptocurrencies were more resilient, with BTC and ETH falling 6.8% and 8.3%, respectively, over the past week, according to The Block's price page.

Bitcoin and US lead the flows

U.S.-based digital asset investment products continued their dominance, accounting for $3.01 billion of net inflows alone. Crypto funds in Switzerland and Germany also continued to fare well, adding another $132 million and $53.5 million last week. However, products in Sweden, Brazil, and Hong Kong all witnessed outflows.

Bitcoin-based funds again led the weekly inflows by asset, adding $2.67 billion and bringing year-to-date inflows to a record $30.2 billion. "Volumes on Friday's price correction were the highest on record at $10.4 billion for the day, while flows on Friday were only $0.39 million," Butterfill noted.

The U.S. spot Bitcoin exchange-traded funds saw $2.71 billion in net inflows alone, according to data compiled by The Block, offset by outflows from other regions. They witnessed just $4.5 million in net outflows on Friday, potentially benefitting from the tradfi market close, though it remains to be seen if outflows will escalate following the weekend.

Ethereum products also added $338.3 million last week, pushing year-to-date inflows to a record of nearly $14 billion. However, they witnessed outflows of $172 million on Friday — the largest of any digital asset — suggesting investors saw it as being the most vulnerable in this correction, Butterfill said.

The U.S. spot Ethereum ETFs brought in $488.2 million overall last week, but lost $174.9 million on Friday.

Meanwhile, despite growing hype around the upcoming U.S. SOL and XRP ETF launches, inflows for existing ETPs linked to those assets cooled to $93.3 million and $61.6 million, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.