OPEN-SOURCE SCRIPT

[blackcat] L3 Magic-9 MACD Setup

OVERVIEW

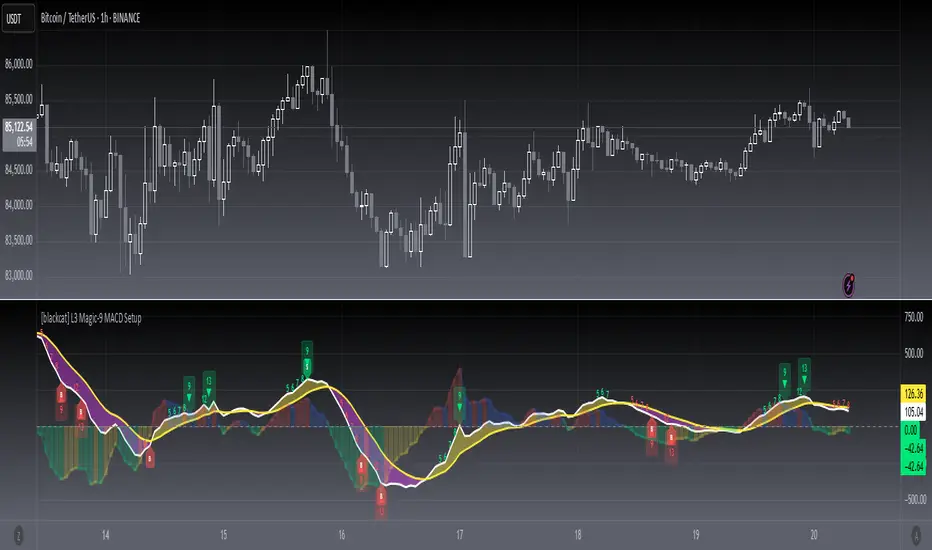

The [blackcat] L3 Magic-9 MACD Setup indicator is meticulously crafted to assist traders in identifying precise buy and sell signals through an enhanced Moving Average Convergence Divergence (MACD) methodology. This advanced tool integrates the Magic-9 Sequential technique to refine signal accuracy by filtering out market noise. By providing clear visual cues via labeled charts and real-time alerts, it empowers users to make informed trading decisions swiftly and confidently 📈✅.

FEATURES

Customizable MACD Parameters:

Fast Length: Adjustable parameter to control the sensitivity of the fast moving average.

Slow Length: Configurable setting for the slow moving average to balance responsiveness and stability.

Signal Length: Modifiable value to determine the smoothing factor applied to the MACD line.

Dynamic Plot Visuals:

MACD Line: Representing the difference between short-term and long-term EMAs.

Signal Line: A smoothed version of the MACD line used to generate crossover signals.

Histogram: Illustrating the distance between the MACD and Signal lines, highlighting momentum changes.

All elements feature adjustable colors and styles for personalized visualization preferences 🎨.

Advanced Filtering Mechanism:

Utilizes the Magic-9 Sequential method to analyze consecutive price movements, enhancing signal reliability.

Counts sequential occurrences above or below initial values to detect trends more accurately 🔍.

Sequential Labels:

Displays numerical labels (e.g., '5', '6', etc.) at key points where sequential conditions are met, offering insights into trend strength.

Highlights significant reversals with special labels like '9' and '13' for critical decision-making moments 🏷️.

Buy/Sell Signals:

Generates clear 'B' (buy) and 'S' (sell) labels based on predefined conditions derived from sequential analysis.

Provides actionable trade suggestions directly on the chart for easy interpretation.

Alert System:

Supports customizable alerts to notify users instantly when buy/sell conditions are triggered.

Ensures timely responses to market movements without constant monitoring 🔔.

HOW TO USE

Add Indicator to Chart:

Access the TradingView platform and navigate to the indicators section.

Select '[blackcat] L3 Magic-9 MACD Setup' from the list and add it to your desired chart.

Configure Settings:

Open the settings panel to adjust MACD parameters such as Fast Length, Slow Length, and Signal Length according to your trading strategy.

Modify plot colors and styles to suit your visual preferences for better readability.

Analyze Chart Labels:

Monitor the chart for sequentially numbered labels indicating trend strength and potential reversal points.

Pay close attention to special labels like '9' and '13' for crucial trading signals.

Combine with Other Tools:

Use additional technical indicators or fundamental analysis to confirm signals generated by the [blackcat] L3 Magic-9 MACD Setup.

Enhance decision-making accuracy by cross-verifying multiple data sources.

LIMITATIONS

Market Conditions Sensitivity:

The indicator may produce fewer reliable signals during periods of low volatility or range-bound markets.

Traders should be cautious of false positives in highly choppy environments 🌪️.

Dependency on Historical Data:

Accurate performance requires sufficient historical price data; insufficient data may lead to inaccurate calculations.

Regular updates and backtesting are essential to maintain effectiveness over time.

Single Indicator Risk:

Relying solely on MACD-based signals can miss broader market context; combining with other analytical tools is recommended.

Always validate signals through multiple lenses to mitigate risks associated with single-indicator strategies.

NOTES

Data Sufficiency:

Ensure your chart has enough historical data loaded to support robust MACD computations.

Periodically review and update data inputs to reflect current market dynamics.

Testing and Validation:

Conduct thorough testing on demo accounts before deploying the indicator in live trading scenarios.

Backtest across various market cycles to assess its resilience under different conditions.

Parameter Optimization:

Experiment with different parameter settings tailored to specific asset classes or trading styles.

Fine-tune the lookback period and other configurable options to align with personal trading objectives.

The [blackcat] L3 Magic-9 MACD Setup indicator is meticulously crafted to assist traders in identifying precise buy and sell signals through an enhanced Moving Average Convergence Divergence (MACD) methodology. This advanced tool integrates the Magic-9 Sequential technique to refine signal accuracy by filtering out market noise. By providing clear visual cues via labeled charts and real-time alerts, it empowers users to make informed trading decisions swiftly and confidently 📈✅.

FEATURES

Customizable MACD Parameters:

Fast Length: Adjustable parameter to control the sensitivity of the fast moving average.

Slow Length: Configurable setting for the slow moving average to balance responsiveness and stability.

Signal Length: Modifiable value to determine the smoothing factor applied to the MACD line.

Dynamic Plot Visuals:

MACD Line: Representing the difference between short-term and long-term EMAs.

Signal Line: A smoothed version of the MACD line used to generate crossover signals.

Histogram: Illustrating the distance between the MACD and Signal lines, highlighting momentum changes.

All elements feature adjustable colors and styles for personalized visualization preferences 🎨.

Advanced Filtering Mechanism:

Utilizes the Magic-9 Sequential method to analyze consecutive price movements, enhancing signal reliability.

Counts sequential occurrences above or below initial values to detect trends more accurately 🔍.

Sequential Labels:

Displays numerical labels (e.g., '5', '6', etc.) at key points where sequential conditions are met, offering insights into trend strength.

Highlights significant reversals with special labels like '9' and '13' for critical decision-making moments 🏷️.

Buy/Sell Signals:

Generates clear 'B' (buy) and 'S' (sell) labels based on predefined conditions derived from sequential analysis.

Provides actionable trade suggestions directly on the chart for easy interpretation.

Alert System:

Supports customizable alerts to notify users instantly when buy/sell conditions are triggered.

Ensures timely responses to market movements without constant monitoring 🔔.

HOW TO USE

Add Indicator to Chart:

Access the TradingView platform and navigate to the indicators section.

Select '[blackcat] L3 Magic-9 MACD Setup' from the list and add it to your desired chart.

Configure Settings:

Open the settings panel to adjust MACD parameters such as Fast Length, Slow Length, and Signal Length according to your trading strategy.

Modify plot colors and styles to suit your visual preferences for better readability.

Analyze Chart Labels:

Monitor the chart for sequentially numbered labels indicating trend strength and potential reversal points.

Pay close attention to special labels like '9' and '13' for crucial trading signals.

Combine with Other Tools:

Use additional technical indicators or fundamental analysis to confirm signals generated by the [blackcat] L3 Magic-9 MACD Setup.

Enhance decision-making accuracy by cross-verifying multiple data sources.

LIMITATIONS

Market Conditions Sensitivity:

The indicator may produce fewer reliable signals during periods of low volatility or range-bound markets.

Traders should be cautious of false positives in highly choppy environments 🌪️.

Dependency on Historical Data:

Accurate performance requires sufficient historical price data; insufficient data may lead to inaccurate calculations.

Regular updates and backtesting are essential to maintain effectiveness over time.

Single Indicator Risk:

Relying solely on MACD-based signals can miss broader market context; combining with other analytical tools is recommended.

Always validate signals through multiple lenses to mitigate risks associated with single-indicator strategies.

NOTES

Data Sufficiency:

Ensure your chart has enough historical data loaded to support robust MACD computations.

Periodically review and update data inputs to reflect current market dynamics.

Testing and Validation:

Conduct thorough testing on demo accounts before deploying the indicator in live trading scenarios.

Backtest across various market cycles to assess its resilience under different conditions.

Parameter Optimization:

Experiment with different parameter settings tailored to specific asset classes or trading styles.

Fine-tune the lookback period and other configurable options to align with personal trading objectives.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.