PROTECTED SOURCE SCRIPT

SessionPrep

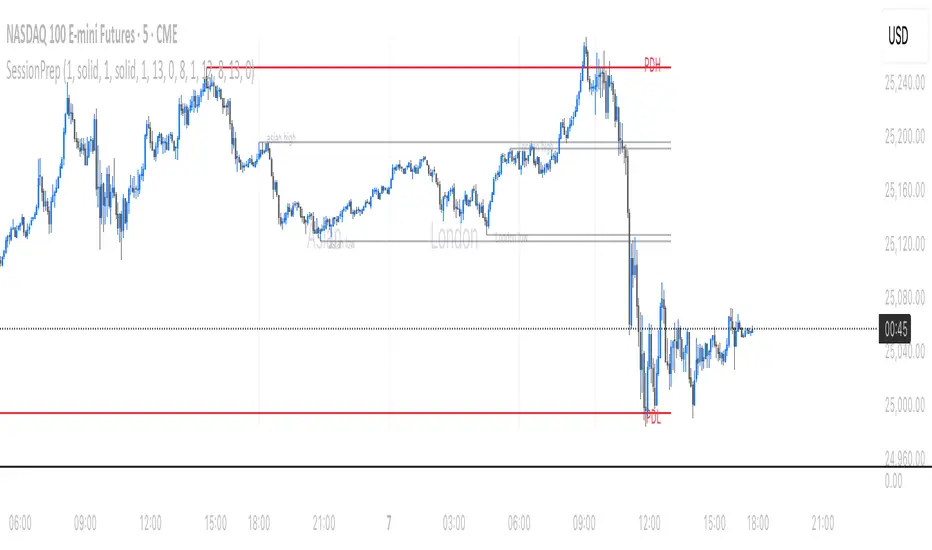

This indicator is designed for day traders, especially those who follow ICT (Inner Circle Trader) concepts and focus on session-based trading setups.

It automatically marks the key session ranges — including:

• Asian Session: 6:00 PM – 12:00 AM

• London Session: 12:00 AM – 6:00 AM

• New York Session: starting at 9:30 AM (highlighted with a pink vertical line)

Each session’s highs and lows are plotted clearly on the chart, giving traders a quick visual map of liquidity zones, potential breakout areas, and key market reactions. This helps traders identify high-probability areas where price may draw toward or reverse from, following ICT-style logic.

The indicator can also include an optional alarm at the 9:30 AM New York open, helping you stay aware of the most volatile and active trading period of the day.

Whether you’re trading indices, forex, or crypto, this tool provides a clean and ready-to-trade layout each morning — no manual drawing or guesswork needed. It’s especially useful for traders who study session highs/lows, liquidity grabs, and market structure shifts common in ICT-based strategies.

It automatically marks the key session ranges — including:

• Asian Session: 6:00 PM – 12:00 AM

• London Session: 12:00 AM – 6:00 AM

• New York Session: starting at 9:30 AM (highlighted with a pink vertical line)

Each session’s highs and lows are plotted clearly on the chart, giving traders a quick visual map of liquidity zones, potential breakout areas, and key market reactions. This helps traders identify high-probability areas where price may draw toward or reverse from, following ICT-style logic.

The indicator can also include an optional alarm at the 9:30 AM New York open, helping you stay aware of the most volatile and active trading period of the day.

Whether you’re trading indices, forex, or crypto, this tool provides a clean and ready-to-trade layout each morning — no manual drawing or guesswork needed. It’s especially useful for traders who study session highs/lows, liquidity grabs, and market structure shifts common in ICT-based strategies.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.