OPEN-SOURCE SCRIPT

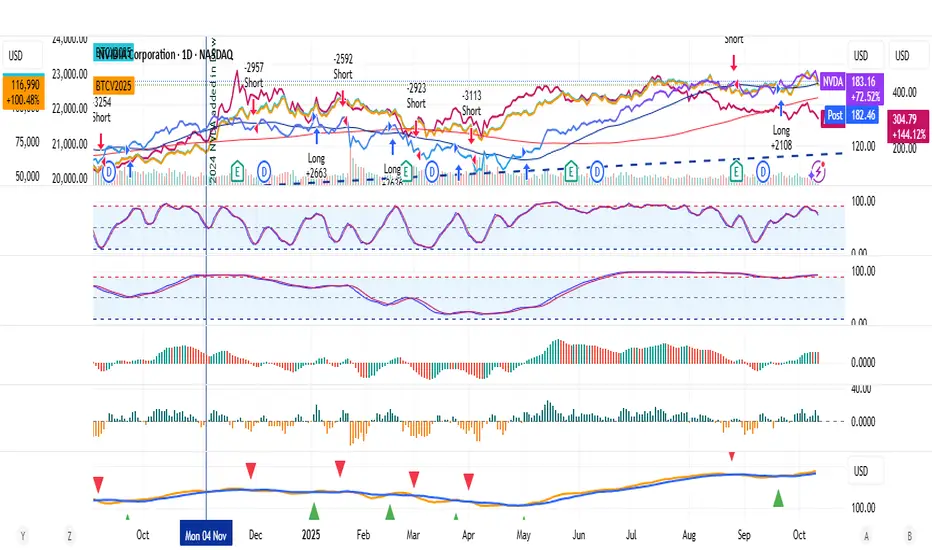

MA Crossover Strategy V6

//version=6

strategy("MA Crossover Strategy V6", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

shortLength = input.int(9, title="Short MA Length", minval=1)

longLength = input.int(21, title="Long MA Length", minval=1)

useEMA = input.bool(false, title="Use EMA Instead of SMA")

// === Moving Averages ===

shortMA = useEMA ? ta.ema(close, shortLength) : ta.sma(close, shortLength)

longMA = useEMA ? ta.ema(close, longLength) : ta.sma(close, longLength)

// === Plot MAs ===

plot(shortMA, color=color.orange, title="Short MA", linewidth=2)

plot(longMA, color=color.blue, title="Long MA", linewidth=2)

// === Entry Conditions ===

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// === Strategy Logic ===

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// === Optional: Plot Buy/Sell Signals ===

plotshape(longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

strategy("MA Crossover Strategy V6", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

shortLength = input.int(9, title="Short MA Length", minval=1)

longLength = input.int(21, title="Long MA Length", minval=1)

useEMA = input.bool(false, title="Use EMA Instead of SMA")

// === Moving Averages ===

shortMA = useEMA ? ta.ema(close, shortLength) : ta.sma(close, shortLength)

longMA = useEMA ? ta.ema(close, longLength) : ta.sma(close, longLength)

// === Plot MAs ===

plot(shortMA, color=color.orange, title="Short MA", linewidth=2)

plot(longMA, color=color.blue, title="Long MA", linewidth=2)

// === Entry Conditions ===

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// === Strategy Logic ===

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// === Optional: Plot Buy/Sell Signals ===

plotshape(longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.