OPEN-SOURCE SCRIPT

VWAP Trend

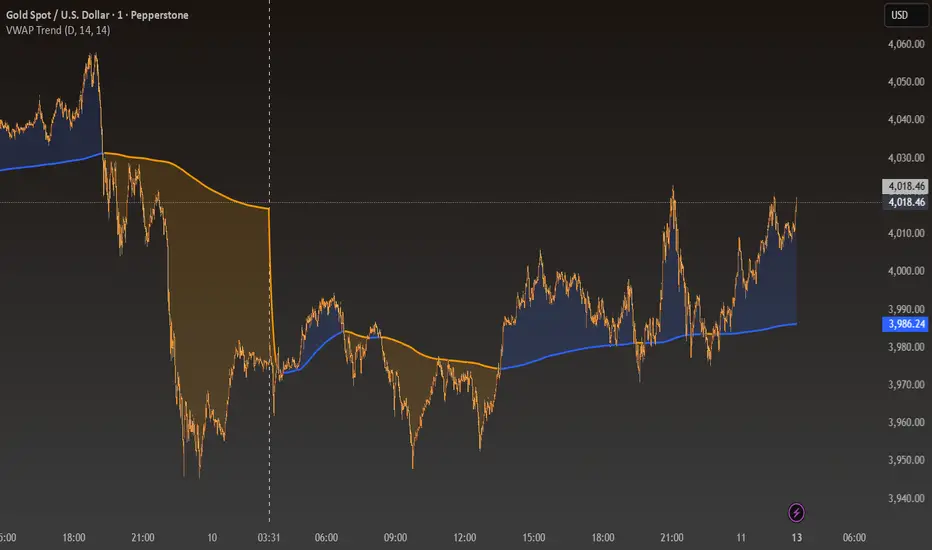

The VWAP Trend indicator is a powerful visualization tool that blends a smoothed Volume-Weighted Average Price (VWAP) with a trend-following EMA to reveal the underlying market bias in a clear, color-coded format.

Unlike a standard VWAP that only resets intraday, VWAP Trend allows traders to anchor VWAP calculations to Daily, Weekly, or Monthly sessions. This flexibility makes it suitable for all trading styles — from intraday scalping to long-term swing analysis.

The smoothed VWAP provides a stable representation of the true average price weighted by volume, while the EMA reflects the prevailing market trend. When the EMA remains above the VWAP, the indicator highlights bullish conditions with blue tones. When it moves below, bearish momentum is displayed with orange tones.

Features

Adjustable VWAP anchor timeframe (Daily, Weekly, or Monthly)

Smoothed VWAP for reduced noise and improved accuracy

Dynamic EMA overlay for real-time trend detection

Color-coded shading between price and VWAP

Minimalist design ideal for clean chart analysis

How to Use

Select your preferred VWAP anchor timeframe.

Observe how the shading color shifts between blue (bullish) and orange (bearish).

Use these transitions to gauge market bias, confirm trade setups, or identify potential mean reversion zones.

Unlike a standard VWAP that only resets intraday, VWAP Trend allows traders to anchor VWAP calculations to Daily, Weekly, or Monthly sessions. This flexibility makes it suitable for all trading styles — from intraday scalping to long-term swing analysis.

The smoothed VWAP provides a stable representation of the true average price weighted by volume, while the EMA reflects the prevailing market trend. When the EMA remains above the VWAP, the indicator highlights bullish conditions with blue tones. When it moves below, bearish momentum is displayed with orange tones.

Features

Adjustable VWAP anchor timeframe (Daily, Weekly, or Monthly)

Smoothed VWAP for reduced noise and improved accuracy

Dynamic EMA overlay for real-time trend detection

Color-coded shading between price and VWAP

Minimalist design ideal for clean chart analysis

How to Use

Select your preferred VWAP anchor timeframe.

Observe how the shading color shifts between blue (bullish) and orange (bearish).

Use these transitions to gauge market bias, confirm trade setups, or identify potential mean reversion zones.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.