algoat ProKit (Early Access)

⭐ Features:

Multi-Timeframe Moving Averages

Cut through the noise, identify trends and turning points with 5 multi-timeframe moving averages with a variety of settings.

Divergence Fusion Engine

Reveal, combine and display dozens of indicator divergences on your chart and rank them by their performance.

algoat TMC™ (Trend Matrix Core) algorithm visualized

Deploy our flexible Moving Average matrix, designed to assess market trend direction, strength, and shifts.

Previous OHLC data

Stay informed by analyzing current and historical Previous Open/High/Low/Close price values in your preferred timeframe.

══════════════════

Multi-Timeframe Moving Averages

This feature allows traders to simultaneously monitor moving averages across multiple timeframes, providing a comprehensive perspective on market trends. It helps identify dynamic support and resistance zones, key levels where price movements are likely to slow down or reverse. This function not only aids in planning potential trade entries and exits, but also calculates the precise percentage distance to these levels. Can also be crucial for risk management, as they allow traders to set stop losses and profit targets based on solid, data-driven analysis. The Multi-Timeframe Moving Averages function is a versatile tool that combines strategic planning and risk control into a single, easy-to-use feature.

SNAPSHOT

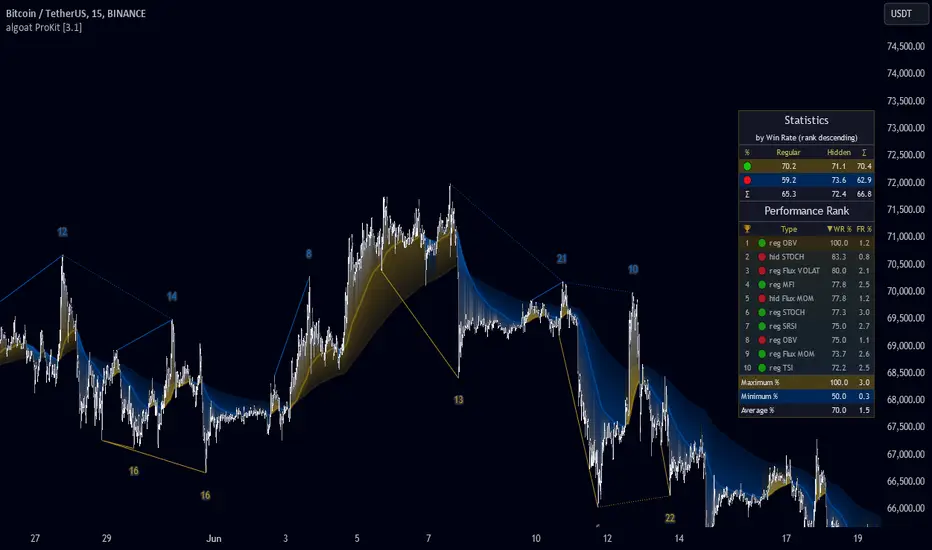

Divergence Fusion Engine

The engine allows the use of unique indicators along with our proprietary ones to detect potential price reversals. Additionally, set theory's Union and Intersection operators simplify the exploration of divergence combinations. For example, if you're interested in identifying rare situations where selected indicators diverge simultaneously, it's just a few clicks away.

As each asset has a different market maker, divergences can vary greatly across different charts and timeframes. With our Divergence Performance Rank, you can quickly determine which divergences have the highest success rates and which are the least successful on a given chart. This feature allows you to adapt your strategies to the most effective signals, enhancing your trading decisions and boosting your potential profits.

SNAPSHOT

Trend Matrix Core

This 21st-century tool utilizes simple visualization techniques to present trend information in an intuitive, easily interpretable manner. It is tailored for the modern trader who values both precision and simplicity. The calculation is based on our unique algoat TMC™ (Trend Matrix Core) algorithm: a flexible Moving Average matrix, designed to assess market trend direction, strength, and shifts. It complements algoat SMC Core™ as confluence.

The general trend direction of the asset can be identified by looking at the slope of the Trend Matrix Core: pointing up, the asset is in an uptrend, pointing down, the asset is in a downtrend. The indicator can also be used to assess the strength of a trend, identify potential resistance and support levels, and manage risk. Trend edges (lines) can be used as potential entries or targets, depending on the situation.

SNAPSHOT

SNAPSHOT

══════════════════

🧠 General advice

Trading effectively requires a range of techniques, experience, and expertise. From technical analysis to market fundamentals, traders must navigate multiple factors, including market sentiment and economic conditions. However, traders often find themselves overwhelmed by market noise, making it challenging to filter out distractions and make informed decisions. By integrating multiple analytical approaches, traders can tailor their strategies to fit their unique trading styles and objectives.

Confirming signals with other indicators

As with all technical indicators, it is important to confirm potential signals with other analytical tools, such as support and resistance levels, as well as indicators like RSI, MACD, and volume. This helps increase the probability of a successful trade.

Use proper risk management

When using this or any other indicator, it is crucial to have proper risk management in place. Consider implementing stop-loss levels and thoughtful position sizing.

Combining with other technical indicators

Integrate this indicator with other technical indicators to develop a comprehensive trading strategy and provide additional confirmation.

Conduct Thorough Research and Backtesting

Ensure a solid understanding of the indicator and its behavior through thorough research and backtesting before making trading decisions. Consider incorporating fundamental analysis and market sentiment into your trading approach.

══════════════════

⭐ Conclusion

We hold the view that the true path to success is the synergy between the trader and the tool, contrary to the common belief that the tool itself is the sole determinant of profitability. The actual scenario is more nuanced than such an oversimplification. A word to the wise is enough: developed by traders, for traders — pioneering innovations for the modern era.

Risk Notice

Everything provided by algoat — from scripts, tools, and articles to educational materials — is intended solely for educational and informational purposes. Past performance does not assure future returns.

- SMC Core and TMC algorithm update: sensitivity adjustments.

- Divergence signals are now entirely tied to confirmed temporal structural highs and lows (SMC Core algorithm).

- Flux indicators added (sentiment, momentum, trend strength, volume, volatility).

- New filters: Bullish, Bearish, Regular, Hidden, and single indicator instances.

- Fine-tuned combinatorics: filter to minimum divergence combinations.

- Fusion with intersection: show only those indicator divergences where both regular and hidden are present at the same time.

- Statistics: Totals, Aggregations (min, max, avg) by Win Rate or Frequency.

- Performance Rank: Order by Win Rate, Frequency; Limit results.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact algoat directly.

Note that this private, invite-only script has not been reviewed by script moderators, and its compliance with House Rules is undetermined. TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact algoat directly.

Note that this private, invite-only script has not been reviewed by script moderators, and its compliance with House Rules is undetermined. TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.