OPEN-SOURCE SCRIPT

MA Guppy Suite [BackQuant]

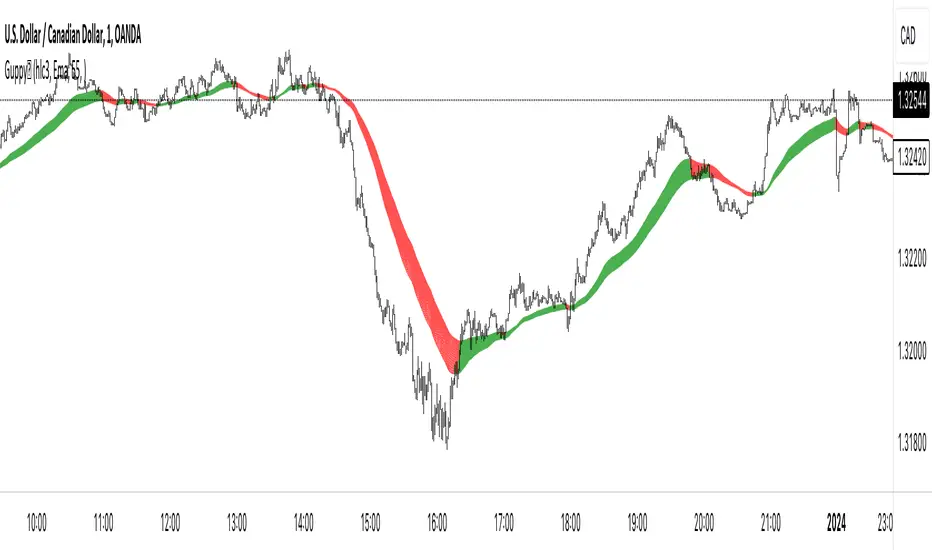

The Multi-Timeframe Moving Average Guppy is a comprehensive and versatile technical analysis tool designed for traders who seek to harness the full potential of moving averages across various time frames. This tool's unique approach lies in its integration of multiple moving average types, each tailored to provide specific insights, thereby offering a multi-dimensional view of market trends and potential trading opportunities.

At the core of this system are several types of moving averages:

Hull Moving Average (HMA): Known for its reduced lag and increased responsiveness compared to traditional moving averages. The HMA employs weighted averages to smooth price data, offering a clearer picture of the current trend.

Triple Hull Moving Average: This variant extends the principle of the HMA, applying it across three different time periods to provide a deeper analysis of trend strength and potential reversals.

Exponential Hull Moving Average: A hybrid that combines the features of the Exponential Moving Average (EMA) with the Hull Moving Average, offering a balance between sensitivity and smoothness.

Simple Moving Average (SMA): A foundational tool in technical analysis, the SMA calculates the average price over a specific period, presenting a straightforward view of the market trend.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information and quicker to react to recent price changes.

Weighted Moving Average (WMA): Similar to the EMA but with a different weighting approach, providing another perspective on market momentum.

Triple Exponential Moving Average (TEMA): Combines three EMAs to reduce lag and enhance the responsiveness of the indicator to market movements.

Volume Weighted Moving Average (VWMA): Incorporates volume into its calculation, offering insights into the strength of a trend based on trading volume.

T3 Moving Average: Developed by Tim Tillson, it uses a smoothing technique that makes it more responsive and less erratic than traditional moving averages.

In addition to these moving averages, the Multi-Timeframe Moving Average Guppy system integrates different time-frame analysis, particularly beneficial for scalping strategies. By analyzing market trends across multiple time frames, from short to long-term, traders can make more informed decisions, identifying the best entry and exit points. This multi-timeframe approach allows for a comprehensive market analysis, catering to both quick, scalping trades and longer-term position trades.

Overall, the Multi-Timeframe Moving Average Guppy is not just a tool but a sophisticated framework. It allows traders to adapt to varying market conditions, understand the strength and direction of trends, and make well-informed trading decisions. Its versatility makes it suitable for various trading styles and preferences, providing a significant edge in the fast-paced world of financial markets.

Furthermore this can be used in order to be a confluence to other trading indicators to give buy and sell signals

This will allow the trader to see positive moving average strength when the indicator is green and the stronger sell signals when it is red.

At the core of this system are several types of moving averages:

Hull Moving Average (HMA): Known for its reduced lag and increased responsiveness compared to traditional moving averages. The HMA employs weighted averages to smooth price data, offering a clearer picture of the current trend.

Triple Hull Moving Average: This variant extends the principle of the HMA, applying it across three different time periods to provide a deeper analysis of trend strength and potential reversals.

Exponential Hull Moving Average: A hybrid that combines the features of the Exponential Moving Average (EMA) with the Hull Moving Average, offering a balance between sensitivity and smoothness.

Simple Moving Average (SMA): A foundational tool in technical analysis, the SMA calculates the average price over a specific period, presenting a straightforward view of the market trend.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information and quicker to react to recent price changes.

Weighted Moving Average (WMA): Similar to the EMA but with a different weighting approach, providing another perspective on market momentum.

Triple Exponential Moving Average (TEMA): Combines three EMAs to reduce lag and enhance the responsiveness of the indicator to market movements.

Volume Weighted Moving Average (VWMA): Incorporates volume into its calculation, offering insights into the strength of a trend based on trading volume.

T3 Moving Average: Developed by Tim Tillson, it uses a smoothing technique that makes it more responsive and less erratic than traditional moving averages.

In addition to these moving averages, the Multi-Timeframe Moving Average Guppy system integrates different time-frame analysis, particularly beneficial for scalping strategies. By analyzing market trends across multiple time frames, from short to long-term, traders can make more informed decisions, identifying the best entry and exit points. This multi-timeframe approach allows for a comprehensive market analysis, catering to both quick, scalping trades and longer-term position trades.

Overall, the Multi-Timeframe Moving Average Guppy is not just a tool but a sophisticated framework. It allows traders to adapt to varying market conditions, understand the strength and direction of trends, and make well-informed trading decisions. Its versatility makes it suitable for various trading styles and preferences, providing a significant edge in the fast-paced world of financial markets.

Furthermore this can be used in order to be a confluence to other trading indicators to give buy and sell signals

This will allow the trader to see positive moving average strength when the indicator is green and the stronger sell signals when it is red.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.