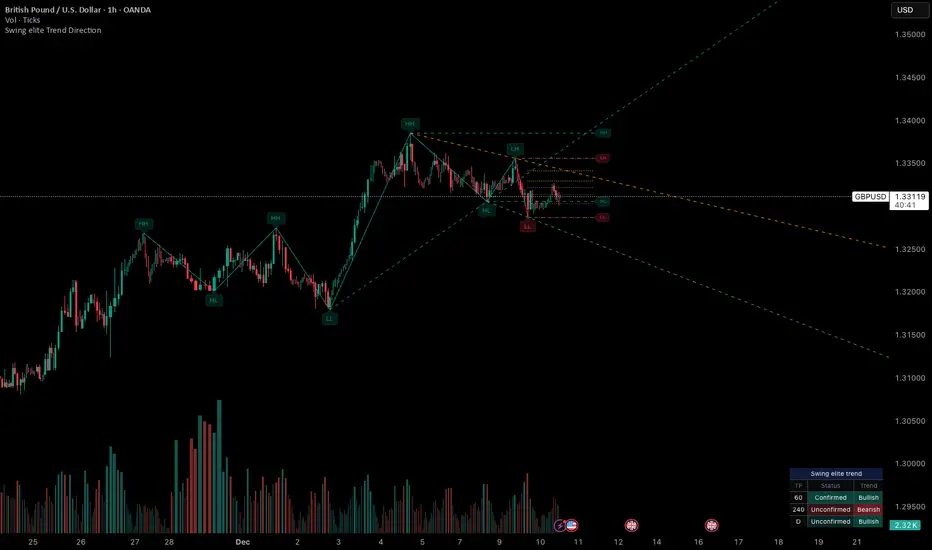

Swing elite Trend direction

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

3 hours ago

Release Notes

Swing elite Trend direction

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

3 hours ago

Release Notes

Swing elite Trend direction

A comprehensive market structure indicator that identifies swing highs/lows, labels them with HH/HL/LH/LL structure, draws dynamic trendlines, and provides multi-timeframe trend analysis.

🔹 FEATURES

Market Structure Analysis

Automatically detects swing highs and swing lows

Labels each pivot with its structure type: HH (Higher High), HL (Higher Low), LH (Lower High), LL (Lower Low)

Color-coded zigzag lines based on confirmed trend direction

Structure Trendlines

Downtrend Line: Connects HH to LH (resistance in bearish structure)

Uptrend Line: Connects LL to HL (support in bullish structure)

Extended projection for potential future price interaction

Swing Trendlines

Connects the last 2 swing highs (resistance trendline)

Connects the last 2 swing lows (support trendline)

Optional extension to project future levels

Break Levels

Horizontal lines at key structure points (HH, HL, LL, LH)

Visual reference for potential breakout/breakdown levels

Customizable colors for bullish and bearish breaks

Fibonacci Retracement

Auto-drawn between the last two pivots

Customizable levels: 0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0

Individual toggle and color settings for each level

Multi-Timeframe Dashboard

Displays trend status across 3 customizable timeframes

Shows trend direction: Bullish / Bearish / Neutral

Shows confirmation status: Confirmed / Unconfirmed

Color-coded for quick visual analysis

Trend Confirmation Logic (ICT/SMC Concepts)

Bullish Confirmed: HL followed by HH (Higher Low → Higher High pattern)

Bearish Confirmed: LH followed by LL (Lower High → Lower Low pattern)

Unconfirmed: Counter-structure appears (potential reversal signal)

🔹 SETTINGS

Swing Settings

Depth: Lookback period for pivot detection

Display

Toggle zigzag lines, labels, price on labels

Adjust label size and number of visible swings

Zigzag Settings

Line style: Solid, Dashed, Dotted

Thickness and colors for bullish/bearish trends

Swing Trendlines

Toggle high/low trendlines independently

Customizable colors, style, thickness

Option to extend trendlines

Structure Trendlines

Toggle HH→LH and LL→HL lines independently

Customizable colors, style, thickness

Option to extend trendlines

Break Levels

Toggle HH, HL, LL, LH break levels independently

Customizable colors for each level

Fibonacci

Toggle individual fib levels

Customizable colors and line style

Dashboard

Position: Top Left, Top Right, Bottom Left, Bottom Right

Size: Tiny, Small, Normal, Large

3 customizable timeframes

🔹 ALERTS

HH Broken: Price breaks above recent Higher High

HL Broken: Price breaks below recent Higher Low

LL Broken: Price breaks below recent Lower Low

LH Broken: Price breaks above recent Lower High

🔹 USE CASES

✅ Identify market structure and trend direction

✅ Spot potential trend reversals (unconfirmed status)

✅ Find key support/resistance levels

✅ Multi-timeframe trend alignment for trade confirmation

✅ Breakout/breakdown trading with break levels

✅ Fibonacci retracement entries

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact Swing_elite directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact Swing_elite directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.