Cocoa Futures (ICE) – Long Trade Setup🍫 Cocoa Futures (ICE) – Long Trade Setup

Direction: Long Bias

Contract: Cocoa (NY / ICE)

Current Price: ~7,437

🔍 Technical Setup

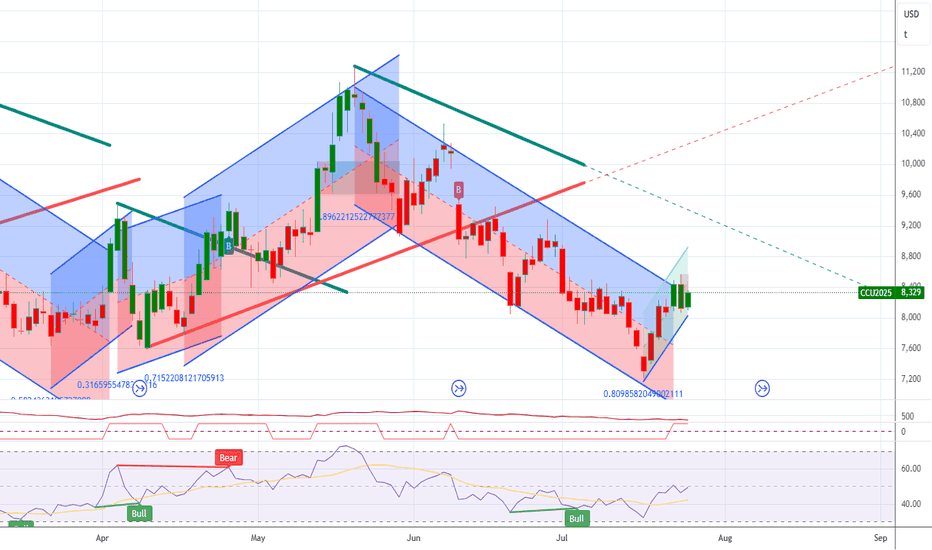

Price has been consolidating after the sharp run-up and has now pulled back into a key long-term trendline (yellow support).

A downtrend channel breakout is forming –

Related commodities

Long Chocolate📌 Cocoa Futures: Seasonality, Trading Strategies & Market Drivers

Cocoa is more than just the foundation of chocolate; it’s a soft commodity with centuries of economic significance. Once used as currency by ancient civilizations in Central and South America, cocoa became a global commodity after th

Cocoa Futures: CC1! Potential Pullback at Familiar Supply ZoneCocoa futures (CC1) are approaching a key demand zone previously tested in March 2025. This area, highlighted on the chart, presents a potential for a pullback, fueled by likely buy orders from commercial traders, as indicated by bullish sentiment evident in the latest Commitment of Traders (COT) r

Cocoa $CC Evidence leans toward a bearish scenario due to the breakout below 9,200 and seasonal weakness in summer months. However, traders should remain open to bullish reversals, especially if institutional buying continues, and consider range-bound strategies if volatility stabilizes. Monitoring fundamenta

Cocoa Bounce From Demand – Can This Lead to a New 2025 High?On June 11th, price reacted sharply to a key demand block around the 8,880–9,000 zone, which aligns with:

Golden Pocket Fib (0.705–0.78) between 8,420 and 9,006

The midpoint of a previous consolidation range

A liquidity sweep followed by a strong bullish rejection

The RSI is showing a bullish di

See all ideas

Frequently Asked Questions

The nearest expiration date for Cocoa CFD is Nov 14, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Cocoa CFD before Nov 14, 2025.