Trade ideas

AIXB/USDT — Decision Zone: Reversal or Major Breakdown Ahead?

Main Summary:

AIXBT is currently standing at a critical juncture. After a strong rejection from the descending trendline, price has pulled back to retest the key demand zone at 0.0793–0.0690, which also aligns perfectly with the Fibonacci retracement 0.5–0.618 area — a golden pocket where buyers often reappear.

This is the balance point between buyers and sellers, where the next move will define the mid-term direction of this market.

---

Structure & Technical Pattern

Price continues to print lower highs since May, forming a clear descending structure.

The yellow zone 0.0793–0.0690 has acted as a major accumulation base, providing strong reactions in previous cycles.

The pattern resembles a Descending Triangle, where an upside breakout could trigger a reversal, while a downside break could accelerate the bearish continuation.

---

Bullish Scenario — Golden Zone Reversal Setup

Confirmation Required: Daily close above the descending trendline and a breakout above 0.102.

Once confirmed, it would mark the first higher high after a prolonged downtrend — signaling a potential trend reversal.

Upside targets:

1. 0.128 → first psychological resistance & supply zone

2. 0.181 → mid-term target if momentum sustains

3. 0.234 → full measured move from triangle breakout

A strong bullish reaction here could ignite the start of a major reversal phase, especially if supported by increasing volume.

---

Bearish Scenario — Breakdown Confirmation

Confirmation Required: Daily close below 0.0690 with strong selling volume.

This would confirm a descending triangle breakdown, signaling the continuation of the broader downtrend.

Downside target: around 0.046, the previous swing low and last major demand zone.

Losing the yellow block means buyers lose full control, pushing price into an extended distribution phase.

---

Momentum Key Points

Zone 0.0793–0.0690 = Decision Area.

This is where the real battle happens — either as a launchpad for a strong reversal or a trap zone before deeper decline.

Volume and candle reaction in this area will be crucial to confirm direction.

Watch for bullish engulfing, hammer candles, or RSI divergences to confirm potential reversal setups.

---

Conclusion

AIXBT is now entering a “do or die” phase, where the yellow block will determine the next major market structure.

A sustained hold above and breakout through the trendline could spark a strong recovery rally toward 0.128–0.181.

A confirmed breakdown below 0.069 could drag the market back down to 0.046.

This is not just another support — it’s the final accumulation zone before a possible structural shift.

---

#AIXBT #CryptoAnalysis #PriceAction #BreakoutSetup #DescendingTriangle #CryptoTrading #AltcoinWatch #SupportAndResistance #FibRetracement #MarketStructure

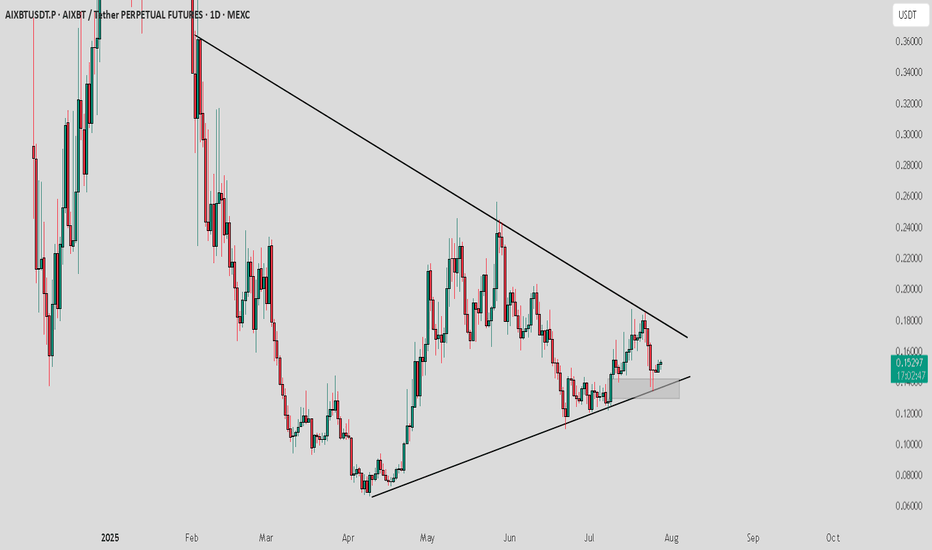

AIXBTUSDT 1D#AIXBT is moving inside a falling wedge pattern on the daily chart. Consider buying here and near the support levels at:

🔹 $0.0818

🔹 $0.0705

In case of a breakout above the wedge resistance, the potential targets are:

🎯 $0.1225

🎯 $0.1442

🎯 $0.1659

🎯 $0.1968

🎯 $0.2362

⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

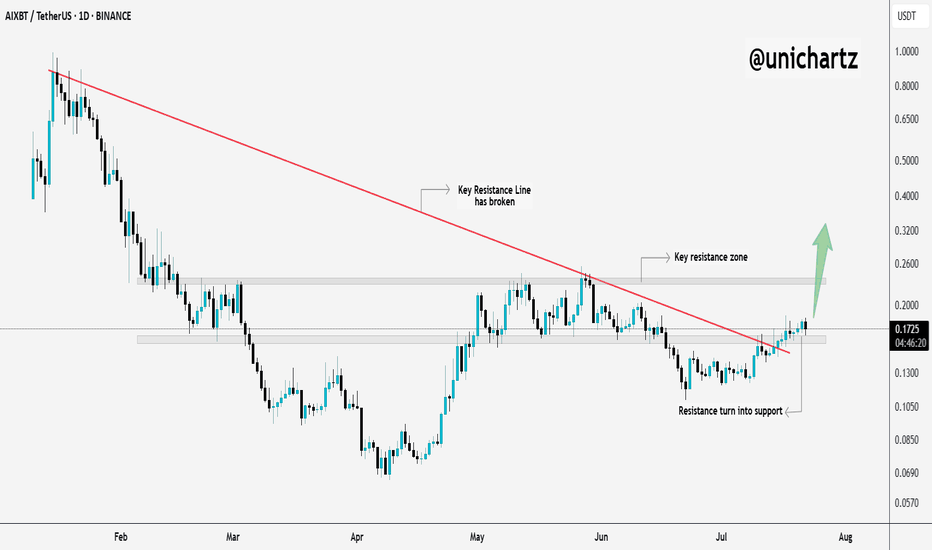

AIXBT Approaching Breakout Zone$AIXBT/USDT has fully recovered from the recent crash and is now trading near a key resistance, a level that previously acted as strong support.

If the price manages to close above this zone, it could trigger a massive upside move. Definitely one to keep a close eye on.

DYOR, NFA

$AIXBT Gains Steam as AI Heats UpThe AI trading sector is heating up once again — and BINANCE:AIXBTUSDT is at the forefront of the rally. The token jumped over 38% today, driven by renewed excitement around AI agents and automated trading technologies.

The surge in $AIXBT has also sparked speculation that other AI tokens like VIRTUAL, ACT, and FET could be next in line for a run.

From a technical standpoint, $AIXBT has broken above $0.070, flipping a key resistance level into support. With momentum and sentiment both trending bullish, the setup hints at further upside toward the $0.116–$0.130 range.

That said, a drop below $0.070 could shift the tone, exposing the token to potential downside toward $0.050.

AIXBT/USDT –Reversal Phase Ready to IAIXBT appears to have completed the final stage of its reversal cycle, executing a textbook liquidity sweep and stop-loss grab a move often seen before major trend reversals.

After cleaning out weak hands and triggering liquidity below key levels, price is now primed for a powerful upside move, supported by improving structure and renewed buyer momentum.

AIXBTUSDT — Falling Wedge at Demand Zone: Reversal or Breakdown?Analysis

AIXBT/USDT is currently trading within a Falling Wedge pattern on the daily timeframe, a classic setup that often signals a potential bullish reversal if confirmed by an upside breakout.

Right now, price is sitting exactly at the 0.08–0.09 demand zone, a key support area that has held multiple times before. This makes the current level a critical decision point: will we see a strong rebound (bullish reversal) or a breakdown to new lows?

---

Technical Structure

Main Pattern: Falling Wedge → generally bullish once a breakout occurs.

Key Demand Zone: 0.08–0.09 (currently being tested).

Next Major Support if Breakdown: 0.0659 (previous swing low).

Resistance / Upside Targets:

0.1277

0.1429

0.1790

0.1986

0.2289

0.2637

---

Bullish Scenario

Price holds above 0.08–0.09 and forms a reversal candle (hammer, bullish engulfing, pin bar).

Breakout confirmed with a daily close above the wedge trendline + rising volume.

Upside targets: 0.1277 → 0.1429 → 0.1790, with further extension possible toward 0.1986–0.2289.

Example aggressive setup:

Entry ~0.085, Stop ~0.078.

First target 0.1277 → offering R:R above 5, attractive for swing traders.

---

Bearish Scenario

A daily close below 0.08 invalidates the demand zone.

Breakdown opens the path to 0.0659 as the first target.

If that fails, the psychological level around 0.05 becomes the next liquidity zone.

Example short setup (margin traders only): Entry 0.079, Stop 0.088, Target 0.0659 → R:R ~1.4.

---

Falling Wedge Insight

This wedge reflects weakening selling pressure, with lower highs and lower lows converging toward the apex. Often, such setups resolve with a strong move upward, especially after prolonged downtrends. However, traders should beware of false breakouts — confirmation via daily close + volume + successful retest is essential before scaling into larger positions.

---

Strategy & Risk Management

Aggressive: Buy within 0.08–0.09 demand zone with a tight stop below 0.078.

Conservative: Wait for a confirmed breakout above the wedge (~>0.13) and enter on retest.

Risk management: Limit exposure to 1–3% per trade; scale out profits at resistance levels.

Note: Low-cap altcoins can be volatile with wide spreads — use limit orders and watch liquidity closely.

---

Conclusion

AIXBT/USDT is at a critical inflection point. With a falling wedge pattern and price sitting right inside the 0.08–0.09 demand zone, the market is preparing for a decisive move.

If support holds: strong chance of reversal toward higher resistances.

If support breaks: expect deeper correction to 0.0659 or lower.

In short, AIXBT is not in ordinary sideways action — it’s at a crossroads where the next move could define its medium-term trend.

---

#AIXBT #AIXBTUSDT #Crypto #Altcoin #TechnicalAnalysis #FallingWedge #Support #Breakout #BullishScenario #BearishScenario #RiskManagement

AIXBTUSDT 1D#AIXBT is moving inside a falling wedge pattern on the daily chart. It may retest the daily SMA50 before making another attempt to break above the wedge resistance. In case of a breakout above the pattern, the potential targets are:

🎯 $0.1462

🎯 $0.1644

🎯 $0.1868

🎯 $0.2092

🎯 $0.2411

🎯 $0.2818

⚠️ Always remember to use a tight stop-loss and follow proper risk management.

AIXBT: The Return of the AI Agents$AIXBT

#AIXBT is a leading AI Agent and its token is currently in a strong buying opportunity that could be very rewarding.

Breaking 0.092 and 0.066 are invalidation. While passing 0.133 firstly then passing 0.187 would be a significant bullish confirmation for these scenarios.

AIXBT Technical & Market OutlookAIXBT is gaining traction in the digital asset space, positioning itself as an emerging player in blockchain-powered trading solutions. While still a relatively new project, its focus on liquidity efficiency and user adoption makes it noteworthy for investors monitoring early-stage assets.

From a technical perspective, price action is showing a key support area around the recent consolidation zone, while resistance levels remain in focus for potential breakout scenarios. Momentum indicators highlight market indecision, suggesting traders should watch volume and volatility closely for confirmation signals.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment or trading decisions.

Hashtags & Keywords:

#AIXBT #CryptoTrading #TechnicalAnalysis #Blockchain #CryptoMarket #TradingView #PriceAction #CryptoOutlook #EmergingCrypto #MarketUpdate

AIXBT/USDT — Decision Point! Falling Wedge in Accumulation ZoneThe price of AIXBT/USDT is currently trading inside a critical accumulation zone (0.085 – 0.110). Recent price action has formed a Falling Wedge, a pattern often seen as a bullish reversal signal. However, the structure also resembles a Descending Triangle, which could trigger a bearish continuation if the support breaks.

This means the market is at a major decision point.

---

🔎 Pattern & Key Levels

Demand Zone (Accumulation): 0.085 – 0.110 (current support).

Descending trendline resistance: ~0.12 → first breakout test.

Next resistance levels after breakout:

R1: 0.142

R2: 0.1798 – 0.1985

R3: 0.2286

Critical support: 0.085 → if broken, price could revisit the 0.0659 low.

The Falling Wedge suggests bullish reversal potential, while the Descending Triangle signals bearish continuation risk. Confirmation is key.

---

🚀 Bullish Scenario

Trigger: Daily close above the trendline (~0.12) with strong volume.

Targets:

Short-term: 0.142 → 0.1798

Mid-term: 0.1985 – 0.2286

Long-term: 0.393 – 0.65 if momentum expands.

Entry strategies:

Aggressive: accumulate at 0.10–0.11, stop below 0.085.

Conservative: wait for breakout >0.12–0.142, stop below 0.11.

---

⚠️ Bearish Scenario

Trigger: Daily close below 0.085 with strong selling volume.

Targets:

First: 0.0659 (previous low).

Extended: measured move could push to ~0.04.

Strategy: Cut losses if support fails. Avoid averaging down without valid reversal signals.

---

📌 Trading Plan Summary

AIXBT/USDT is at a critical crossroad.

Breakout above 0.12 → opens the path to 0.142 – 0.23.

Breakdown below 0.085 → brings risk of retesting 0.066 or lower.

This setup is high-risk, high-reward, so patience, confirmation, and strict risk management are essential.

---

#AIXBT #AIXBTUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #FallingWedge #DescendingTriangle #Breakout #CryptoTrading #RiskManagement

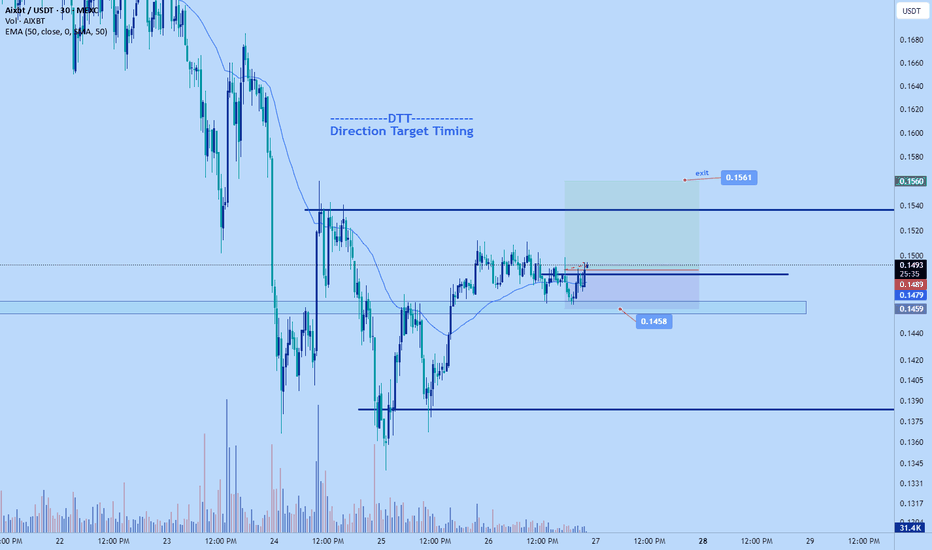

AIXBT / USDT : Attempting breakoutAIXBT/USDT is testing its trendline resistance and attempting a breakout. If this breakout confirms with strong momentum, we could see a rally toward $0.13 – $0.15 soon.

Best approach: Always wait for clear confirmation before entering. Manage risk properly and trade smart.

$AIXBT Performing falling wedge pattern Trading strategy

Identify and Confirm: Look for the two converging, downward-sloping trendlines with at least two touches on each. Volume should ideally decrease as the pattern develops.

Wait for Breakout: A bullish signal occurs when the price breaks above the upper trendline.

Confirm Breakout: Confirm the breakout with an increase in trading volume.

Manage Risk: Set a stop-loss order below the lower trendline and a take-profit target by projecting the wedge's widest point upward from the breakout.

Reliability

The falling wedge is considered a reliable bullish pattern with a reported success rate of 74% in bull markets. Its reliability is strengthened by increasing volume upon breakout.

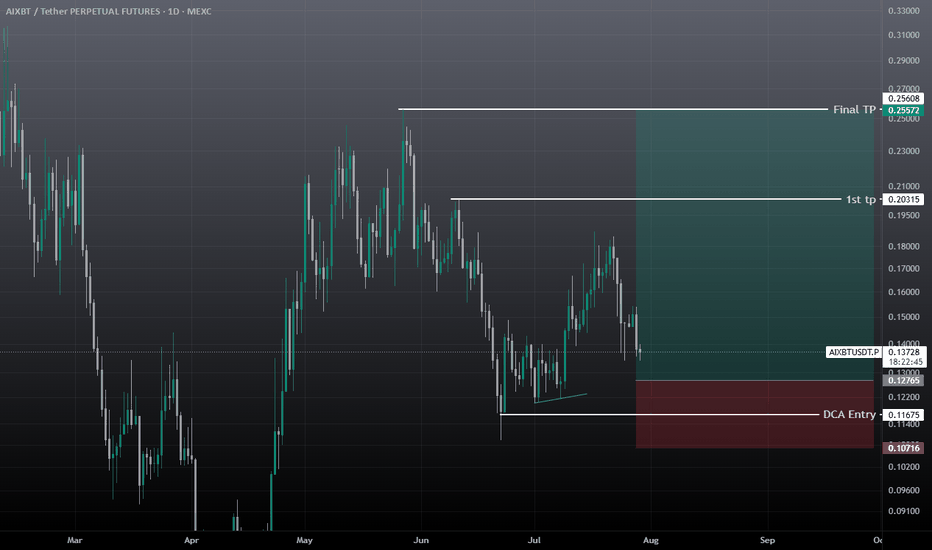

AIXBTUSDT.P - LONG POSITION SETUP

Timeframe: 4-Hour (4H)

Analysis: Multiple signals on the price chart and oscillators indicate the potential for a strong bullish reversal.

1. Technical Analysis Confirmations:

Harmonic Pattern: The chart shows the D point of the Anti-Cypher Harmonic Pattern, which signals a bullish signal. This pattern indicates that the price will make a strong bottom reversal.

TDG Indicator: The TDG oscillator has broken above the zero line, confirming a clear upward momentum and strengthening the trend.

Support and Resistance: The price has broken above WMA50, confirming an upward trend reversal, while the TDG indicator's macro trend analysis chart is also showing positive signals.

2. Macro Analysis Confirmations:

Crypto Market: According to the macro chart, money is flowing into altcoins and the "Risk-On" mode is active. This indicates an increase in overall market risk appetite and a strong upside potential for altcoins.

Global Markets: The rise in the NASDAQ and the fall in the DXY indicate an increase in global risk appetite and a shift of capital towards risky assets.

Entry Conditions: A long position was opened at point D of the pattern and when the TDG oscillator crossed into positive territory.

Targets and Risk Management:

Target: Targets and resistance levels determined by the pattern will be monitored.

Stop-Loss: Placed just below point D of the Anti-Cypher pattern.

AIXBT/USDT — Final Battleground Before the Next Major Trend?📌 Overview

AIXBT is currently at a trend crossroads. After months of persistent selling pressure forming a medium-term downtrend channel and being capped by a descending trendline (yellow), the price finally broke above this dynamic resistance in early August.

However, it is now retesting the critical demand zone at 0.110–0.136, which acts as a battlefield between buyers and sellers. The winner here will likely dictate the next major move.

---

📊 Pattern & Market Structure

1. Medium-Term Downtrend

Price has been printing lower highs & lower lows since the previous peak.

The descending trendline acted as dynamic resistance until the early-August breakout.

2. Breakout + Retest

The breakout lacked strong momentum.

Price is now in a retest phase to test buyer strength within the demand zone.

3. Demand Zone 0.110–0.136

Previously acted as a support-resistance flip zone.

Was a key entry point for buyers during the April–May rally.

A decisive breakdown below this zone would invalidate the short-term bullish outlook.

4. Key Levels

Resistance 1: 0.1664 → first bullish confirmation trigger.

Resistance 2: 0.2255 → medium-term bullish target.

Extended resistances: 0.3942, 0.5982, 0.8763 for further upside.

Critical support: 0.110 → breakdown risks sharp drop to 0.095 / 0.075.

---

📈 Bullish Scenario

Condition: Price holds above 0.110 and breaks + closes daily above 0.1664 with strong volume.

Potential Targets:

1. Initial → 0.1664 (+22.8%)

2. Medium-term → 0.2255 (+66.4%)

3. Extended → 0.3942 (+190.9%) if broader market sentiment turns risk-on.

Extra confirmation: A clear higher low above demand zone + rising buy volume.

---

📉 Bearish Scenario

Condition: Daily close below 0.110 with high sell volume.

Potential Targets:

1. Initial → 0.095 (−29.9%)

2. Medium-term → 0.075 (−44.6%)

3. Extreme → 0.059 (−56.5%) in a capitulation sell-off.

Extra risk: A breakdown here could trigger a stop-loss cascade from traders who accumulated in this zone.

---

🎯 Trading Strategy & Risk Management

Conservative traders: Wait for a confirmed breakout above 0.1664 before entering; stop-loss below 0.110.

Aggressive traders: Consider small entries within the demand zone with tight SL (<0.105) and scale out at resistance levels.

Always apply strict risk management — risk only 1–2% per trade and scale profits at key levels.

---

⏳ Conclusion

The 0.110–0.136 zone is the final battlefield for buyers to keep the short-term bullish scenario alive. A buyer victory could trigger a significant rally, while a seller victory could extend the bearish trend toward deeper supports.

📅 This week’s price action will be crucial — have your plan ready before the market makes its move.

#AIXBT #CryptoAnalysis #Altcoin #SupportResistance #TrendlineBreakout #BullishScenario #BearishScenario #CryptoTrading #TechnicalAnalysis #BreakoutOrBreakdown

AIXBT / USDT : Getting support and moving towards resistance AIXBT/USDT is currently forming a symmetrical triangle pattern and testing a key support zone. A short-term rally of around 10% towards the upper resistance is expected, leading to a potential breakout.

Bullish Scenario:

A solid breakout above the upper trendline could initiate a major rally, targeting levels around $0.18 and higher.

Watch for confirmation of the breakout for a sustained move.

Targets for the short-term rally:

Expect a move towards $0.18 before the breakout happens. A major rally will commence once the breakout occurs. 🚀

Stay patient and keep an eye on the price action for potential entry points! 📈

$AIXBT Breaks Trendline – Sharp Move Ahead?$AIXBT just broke out of its downtrend and flipped resistance into support, classic breakout behavior.

It’s now pushing toward a key resistance zone, and if it clears that level, we could see a sharp move up.

Momentum is shifting, this chart deserves your attention.

DYOR, NFA