Trade ideas

Algorand (ALGO): Expecting Zone From Zone of EMAsEURONEXT:ALGO has shown us once again how strong it reacts to breakouts. Each time we had a clean break, price pushed higher with momentum.

Now we are eyeing the next major move — as soon as the local high gets taken out, we’re looking at continuation toward the $0.50–0.60 zone. As long as buyers hold this structure, the breakout setup remains intact.

Swallow Academy

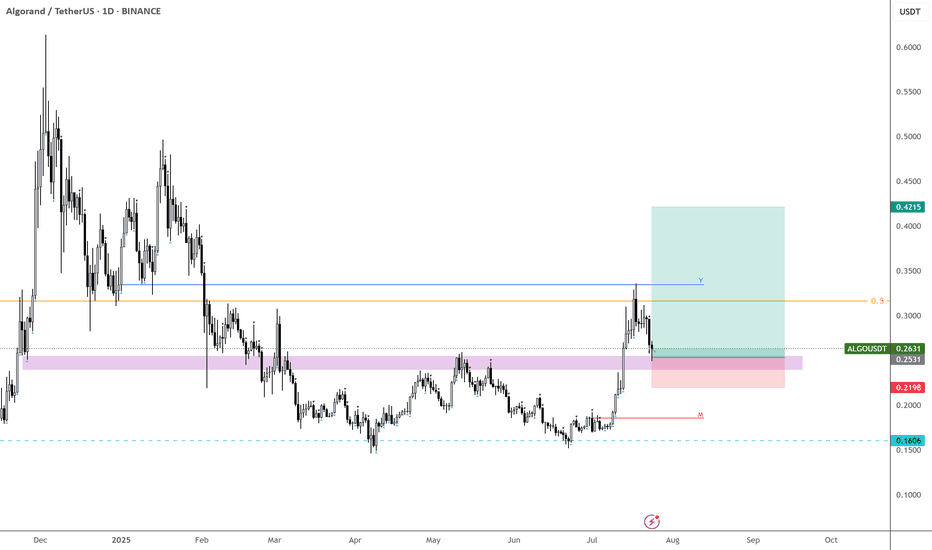

ALGOUSDT – Swing Trade Setup at Key SupportAlgorand (ALGO) recently posted an impressive 29%+ rally, showing renewed strength in the altcoin space. After topping out, price is now pulling back into a significant support zone around $0.23, aligning with previous structure and demand levels.

This retracement could offer a high-probability long setup for swing traders. The support zone has historically acted as a launchpad for upside moves. A confirmation bounce or strong bullish candle from this area could lead to the next leg up.

🔹 Trade Setup:

Entry Zone: Around $0.23

Take Profit Targets:

🥇 $0.28 – $0.33

🥈 $0.45 – $0.50

Stop Loss: Just below $0.22

A daily close below $0.22 would invalidate the setup and suggest further downside. Watch for volume confirmation and price structure near the zone.

ALGOUSDT (Weekly) – Channel Uptrend with Mid-Term Targethi traders

Let's have a look at Algorand on the weekly time frame.

To be honest, it's not what most traders expected as there's not much going on. After reaching 0,60ish high in December 2024, the price was in a strong downtrend but it's clear that it bottomed out in April 2025, but since then it's been a very steady but slow uptrend.

📊 Chart Overview

Current Price: $0.229

Major Support: $0.156

Major Resistance: $0.416

Price is trading inside a rising channel structure since early 2025.

🔎 Technical Analysis

Ascending Channel

Price has been respecting both the lower and upper bounds of the rising channel.

Trend Continuation

As long as ALGO holds above $0.156 (key weekly support), the trend bias remains bullish inside the channel.

RSI Status

Weekly RSI around 49–50, sitting at neutral levels.

No clear divergence, leaving room for further momentum in either direction.

🎯 Price Targets

First Target: $0.30–0.32 (mid-channel resistance zone).

Final Target: $0.41–0.42 (major resistance & channel top).

⚠️ Risk Management

Stop-loss: Below $0.156 (breakdown of weekly channel support).

Risk/Reward: ~1:2.5 toward $0.41 resistance.

📈 Trading Idea

ALGO is currently consolidating inside a weekly ascending channel, showing steady higher lows. A bounce from current levels could drive price toward the $0.41 target zone, with interim resistance around $0.30. Failure to hold $0.156 support would invalidate the bullish setup.

WARNING: NO ALT SEASON YET!!Everyone’s waiting for Alt Season… but I don’t think it’s happening just yet. In this video, I break down the Total Market Cap chart and BTC, to show why the timing isn’t right.

I’ll also reveal the one altcoin I’m watching closely — including exactly where and when I plan to buy it.

📊 In this video you’ll learn:

Why Alt Season hasn’t started yet

The truth behind the Total Market Cap vs BTC setup

How BTC dominance is impacting alts

The specific altcoin I’m targeting and my entry levels

💬 Do you agree — no Alt Season yet? Or are you already loading up on alts? Comment below 👇

⚠️ Disclaimer: This video is for educational purposes only and does not constitute financial advice. Always do your own research before trading or investing in cryptocurrency.

AlgoUsdt IdeaALGOUSDT UPDATE:

ALGO is currently trading around $0.2350. ALGO is breaking down a symmetrical triangle on the daily time frame. The possible scenarios are if the price successfully breaks the triangle and gives a daily close, then we may see bearish momentum in #ALGO. Otherwise, if it pumps from here and trades inside the triangle again, then it may go towards the upper resistance trendline of the triangle. Keep an eye on it.

Algorand (ALGO): Going For Long | Good R:R PositionALGO has broken below the local support range that has been holding for weeks, and now we’re sitting in a pretty decisive zone.

Here’s the setup:

• If buyers manage to reclaim the support zone (around $0.24–0.245), then we’ll be looking for a proper bounce to the upside.

• If they fail, the bearish CME gap around $0.22 is the next logical target, and that would open the door for another bounce zone for us.

For now, we are simply observing whether this is a fakeout/liquidity sweep or a confirmed breakdown. Either way, risk management is key so that's why we have seen multiple entries that we are going to keep an eye on.

Swallow Academy

ALGO/USDT 4H Technical OutlookALGO is trading around the mid-range, with S1 (50.37%) acting as immediate support. A deeper pullback may target S2 (34.77%) and S3 (-4.24%) if selling pressure increases. On the upside, R1 (63.08%) and R2 (70.58%) are the key resistance zones to watch. A confirmed breakout above R1 could strengthen bullish momentum toward R2, while a breakdown below S1 may expose the price to further downside. Monitoring volume and candle confirmations is recommended before entry.

Algorand (ALGO): Looking For Break of Structure For LongALGO has established a decent support zone, where recently we also had a smaller BOS,,, which is a pretty choppy one, so we are looking for another BOS to form, which would give us additional confirmation for our long position.

After that, we would be getting a potential 1:3 RR setup.

Swallow Academy

Algorand Trading Volume Signals Potential 20% Gain To 0.33Hello✌️

Let’s analyze Algorand’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Algorand has updates coming new wallet, quantum-proof security, and enterprise tools.

Big moves like 100M USDC minted and partnerships with FIFA & TravelX show real-world use.

If the roadmap works out, demand might rise, but ALGO’s still far from its all-time high. 📈🚀

📊Technical analysis:

BINANCE:ALGOUSDT shows solid trading volume with a nearby daily support level. If this zone holds, a potential 20% upside could be expected, aiming for $0.33. Monitor the price closely and manage risk accordingly. 📈🛡️

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

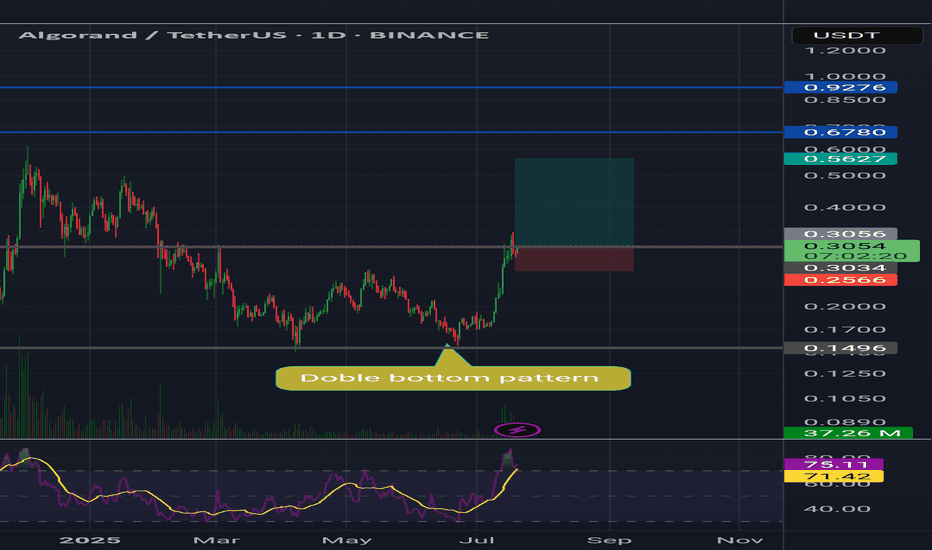

Algorand Algo usdt Daily analysis

Time frame daily

Risk rewards ratio >5.2 👈👌

Target =0.56 $

Double bottom pattern is created and algo pumped to the first target on 0.305

Daily candle closed over the target and 3 days was there for save energy of pump.

I guess next target is 0.6 $ and we have no resistance in the way .

Have a wonderful benefit my 🧡 friends

ALGO – Finally Getting the Retrace

Back at EURONEXT:ALGO —missed the lows, but finally seeing the retrace I’ve been waiting for.

Should’ve entered alongside CRYPTOCAP:HBAR , but this is the next best spot.

If this level doesn’t hold, we’re likely heading back below 20c, and many alts could retrace their entire impulse moves.

Starting to bid here—let’s see if it holds. BINANCE:ALGOUSDT

ALGOUSDT Forming Bullish WaveALGOUSDT is currently demonstrating a Bullish Wave Pattern, a strong technical signal that often precedes a significant upward price movement. This pattern typically forms in trending markets, suggesting a series of higher highs and higher lows that indicate sustained buying interest. With this wave structure unfolding, the market appears to be favoring a continuation of the current uptrend, making ALGO an appealing candidate for mid-term gains.

The volume profile is showing a steady increase, which supports the pattern’s validity and hints at rising momentum. A strong volume base during the formation of bullish wave patterns is often an early indication of institutional accumulation or renewed retail participation. With key support levels holding firm and resistance levels gradually weakening, the setup points to a potential price surge of 50% to 60% or more if bullish momentum continues.

Algorand’s fundamentals are also contributing to growing investor interest. Known for its scalable blockchain technology and low transaction fees, ALGO has seen increasing adoption in DeFi and enterprise-level blockchain solutions. This growing utility, combined with the current bullish technical setup, enhances the coin’s attractiveness for both swing traders and long-term holders.

In summary, ALGOUSDT’s bullish wave pattern coupled with rising volume and positive sentiment could signal the start of a powerful upward move. Traders should keep an eye on breakout zones and confirmation candles to capitalize on this emerging opportunity.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ALGOUSDT 12H#ALGO is moving inside a bullish flag on the 12H timeframe. It is currently facing resistance from both the Ichimoku Cloud and the 12H EMA50.

📌 In case of a breakout above these levels, the potential upside targets are:

🎯 $0.2653

🎯 $0.2851

🎯 $0.3041

🎯 $0.3231

🎯 $0.3503

🎯 $0.3848

⚠️ As always, use a tight stop-loss and apply proper risk management.

Algorand (ALGO): Seeing Signs of RecoveryAlgorand has made a market structure break (MSB) on smaller timeframes, which is indicating a potential trend switch here.

Now in the current timeframe we are looking for a break of that 200 EMA, as once we see the buyers take full control over it, we will look for buyside movement so eyes on it!

If for any reason we see further movement to lower zones, and we break local low on small timeframes, we are going to aim for that bearish CME, but for now, we are bullish.

Swallow Academy

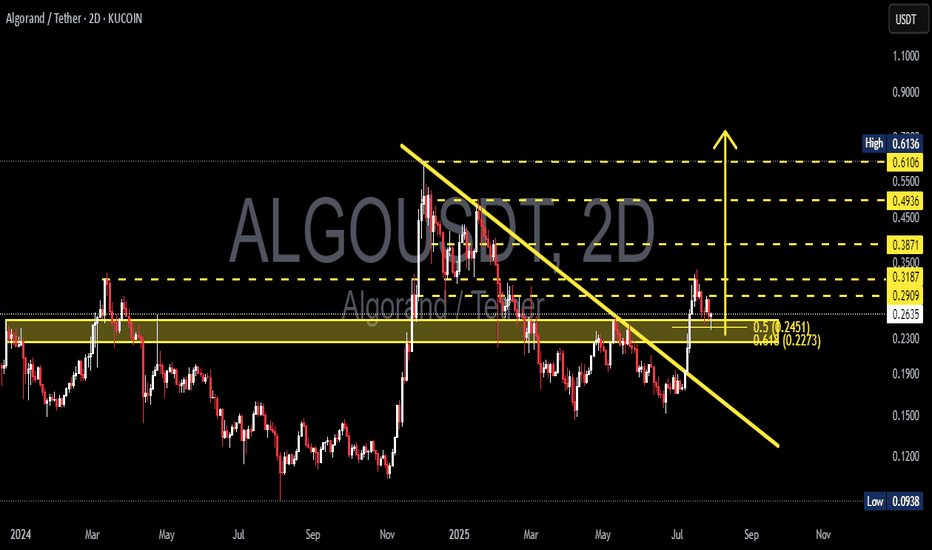

ALGOUSDT Break Downtrend – Reversal in Progress or Just a Retest📊 Technical Analysis Overview:

The Algorand (ALGO) / Tether (USDT) pair has shown a notable technical development by successfully breaking above a medium-term descending trendline that has acted as resistance since early 2025.

---

🔍 Pattern & Structure:

A clean breakout above the descending trendline (yellow sloped line) indicates a potential shift in trend from bearish to bullish.

Price is currently undergoing a retest of the breakout zone, aligning with the Fibonacci retracement levels 0.5 ($0.2451) and 0.618 ($0.2273).

The yellow horizontal zone ($0.25–$0.29) has been a significant support/resistance flip zone, showing strong historical reaction throughout 2024 and early 2025.

A higher high and higher low structure is starting to form — an early signal of a potential bullish reversal.

---

📈 Bullish Scenario:

If the price holds the support zone between $0.2451 and $0.2273, we could see a continuation of the upward move toward the following resistance levels:

$0.2909 (current minor resistance)

$0.3187

$0.3500

$0.3871

Mid-term targets: $0.4936 and $0.6106

A daily or 2D candle close above $0.3187 with strong volume would confirm a bullish continuation.

---

📉 Bearish Scenario:

On the other hand, failure to hold above the $0.2451–$0.2273 support zone could lead to a renewed bearish move with potential targets at:

$0.1900 (weekly historical support)

$0.1500

Extreme support: $0.0938 (2024 cycle low)

A break below $0.2273 would invalidate the breakout and may signal a bull trap.

---

📌 Summary:

ALGO is at a key inflection point. The current pullback could be a healthy correction after a breakout or a failed retest. Watch for price action and volume reaction near $0.2451–$0.2273 to confirm the next move.

#ALGO #Algorand #ALGOUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #BullishReversal #Fibonacci #SupportResistance #Altcoins #CryptoSetup #PriceAction