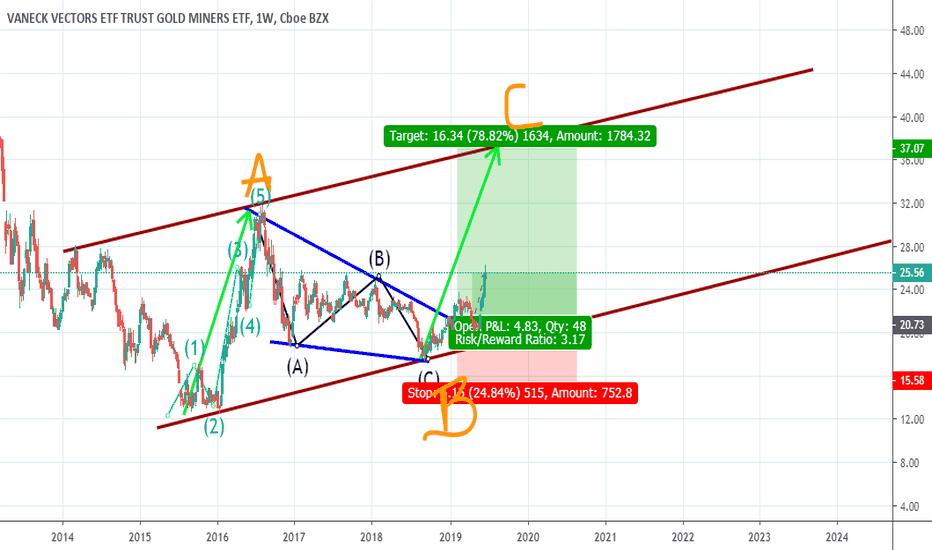

Long on ValueAs a follow up on my last post, I felt a deeper analysis was necessary to ascertain true risk and reward associated with GDX.

Here is GDX and it's top holdings. However, there is very little lines on a chart can't tell you, and it is definitely no substitute for indepth research.

No one can predict the future by dividing chart patterns except for seeing patterns that might or might not be there. If you are influenced by such superstitious notions, you will have better luck going to a fortune teller, you would have better odds picking winners and losers that way.

My thesis is simple and is based on research anyone can do. Gold will continue to rise and Gold miners along with them for the duration of this pandemic and GDX is well positioned to take advantage of this trend (simple right, because it isn't complicated).

The case for gold

if you are interested in gold it's because there is uncertainty in the markets. So if the markets are in stormy seas and covid is the storm of the century, you need an anchor to ascertain the true value of things and an anchor recognized the world over is Gold.

The case for miners

Right now Gold miners are the worlds printing presses. The process of mining gold is a capital intensive and like any capital intensive activity, mining gold requires the careful measuring of risk over much longer periods of time. So increasing production is no simple task. So unless you are King Midas, you can't just order the printing press to print more gold. So as the value of gold increases miners will be he only new source of gold into the market.

The case for GDX

Returns compared to their peers has been good

1 year is 60.03 %

3 years is 53.03 %

5 years is 80.43 %

Lipper Leader ratings score are out of 5 and they score well in almost all categories

Total Return 4 out of 5

Consistent Return 5 out of 5

Preservation 1 ( to be expected with gold since it does not move with inflation)

Tax Efficiency 5 out 5

Expenses are 5 out 5

They hold shares in mines all over the world, and their largest holdings are in Canada and US but are well distributed all over the world.

Holdings by Region %:

55.1% are in Canada and United States. 0.73% south America. 6.76% in South Africa, 1.29% in Europe, 0.97% in the United Kingdom, Asian pacific 14.3% and 1.31% in emerging markets.

So GDX ranks high in reliably and it is well distributed to mitigate risk. It is the Costco of Gold miners, profitable, affordable, predictable and more importantly boring.

but i would like to extend this thesis to include, that gold will continue to rise to levels higher than the previous recession and will remain there for the foreseeable future even after the dust has settled from covid19. The Price of Gold was already rising before covid and there is evidence indicating this trend will continue, so if confidence in the dollar continues to diminish it wouldn't be a bad idea holding on to GDX for the foreseeable future, but that's speculation and you will need to do your own research and arrive at your own conclusions, but until then GDX is a solid buy and hold.

So if you got into GDX you are in a solid position but hold on tight. Speculators who are late to the game are going to want to rock the boat and shake you off, but as long term investors pile on those swings will become less violent and the cost of shorting becomes more prohibitive.

GDX trade ideas

GOLD, GDX and GDXJ - when will the Juniors break to the upside?GOLD has made a multi year basing pattern , commencing in 2013 and finally breaking out in mid 2019. The gold miners, GDX followed in April this year. Based on the market direction and momentum for GOLD and GDX we would expect that the gold juniors, GDXJ will follow shortly.

GDX Longcountries started the repatriation of gold from major reserves right before corona struck. I imagine this trend will only accelerate in light of corona and other trends. The Fed and other major reserves are going to want to make for those losses. gold miners are undervalued, we should expect GDX continue it's steady growth irrespective of any minor deviation from the trend.

GDX - Ready to Attack!After consolidating for the better part of two months, GDX is set to attack the next FIB levels. I expect it will be successful given the indicators. MACD crossover and RSI turning up. Selling on lighter volume through the bull flag. Moving averages all turning up. Really not much not to like.

GDX Clearly broken out - Targeting 46As shown in the daily GDX chart, the turquoise trend lines mark the support resistance trend lines, as well as show a standard flag pattern. Previous upside target in 2019 was 36, it now is upgraded to 46, based on chart pattern and Fibonacci projections.

Recent price action saw a gap above the trend line resistance, and consolidation before yet another gap up (over a minor parallel trend line resistance).

Also observed that MACD is supportive with a break up cross into the bullish territory, and a break above the MACD trend line at about the same time.

Bullish, target 46, around mid-August 2020.

Keep an eye on GDXGDX is the ETF for gold miners.

This sector has been beaten down severely since its 2010-11 highs, when everyone was hedging against printing from Bernanke. If only we knew then what Powell would have become...

GDX has broken out the $32 resistance, which has acted as a strong support in the last month.

If Gold AUG futures (left axis, in orange) manage to get through the $1800 resistance, it is just a matter of time before we get in the mid 40s. That would represent my target in a few months, especially given that the equities market is not pricing in at all the possibility that Democrats take Senate and Presidency.

Buy GDX or even better long term calls dur to the recent consolidation.

Gold Miners GDX just broke out - Target 46With almost a 30% upside full potential, the GDX broke out of a down trend resistance line, with MACD crossing over into the bullish territory. The GDX also nicely bounce off the 55EMA and registered a recent higher high.

System Buy signal activated.

Rather bullish signal, don’t you think?

Projections put the upside target at 46, with pauses along the way.

Gold Miners Looking to Confirm the Bullish BreakoutGDX has broken out of multi-year triangle that formed a solid base since 2015. If gold continues marching towards all time highs, I think GDX can hold the breakout here. Perhaps it will cool off for a couple weeks after the rapid rise, but then I'm looking for the move to low $40's on the way to $60+

Positions:

GDX 1/15/21 40c

GDX shares

Reassess if falls back into the triangle (convincingly <$30)

GDX hedge / shortIf GDX can not get above 35.5 (yellow tile), there is a chance the prior down wave from 38-31 is five and 35.5 is prior 4th wave.

GDX really has to get above it, otherwise we may face the so called 3rd wave.

I'd like to use Aug 28 or 29 as hedge (already loaded some today, and I already convert my long to vertical spread), if truly 3rd wave, target is 25 ish. Can be 6-7x easily.

GDX : HEDGE FOR MARKET UNCERTAINTIESGDX is a fund that invests at least 80% of its total assets in common stocks and depositary receipts of companies involved in the gold mining industry. Miners have lagged actual Gold prices (XAUUSD) potentially due to operational risks affected by COVID19. The chart now looks set-up for a move higher to catch up with gold spot price as it breaks out from consolidation.

In times of an extended market and uncertainties, it's never a bad idea to hedge positions with exposure in gold to be well-prepared when the market turns.