Trade ideas

APT : an Ethereum Layer 2 project | Univers Of SignalsLet's take a quick look at APT, an Ethereum Layer 2 project with a market cap of $3.3 billion, currently ranked 31st in coin market cap.

🔍 In the 4-hour timeframe, we're witnessing a bearish trend where the price has reached a support level at $5.16, forming a range between $5.16 and $6.49. This coin has managed to maintain its crucial support at $5.16 during Bitcoin's recent price drops, staying above this level.

☄️ Following the Bybit exchange hack news, the price, which had broken above $6.49, sharply reversed, faking out that breakout and reintroducing bearish momentum into the market. However, the support at $5.16 has held strong, preventing further price declines and proving itself as a significant support level.

📉 Given the importance of this support, breaking below $5.16 could initiate the next bearish leg, and I would personally consider opening a short position if this level is breached.

📈 On the flip side, given the resilience shown by the $5.16 area, there's a possibility that the price could rebound from here. In such a scenario, if $6.49 is breached, it could be a good opportunity to enter a long position, banking on a recovery and potential uptrend continuation.

APT target $8.64h time frame

-

Entry: $5.95

TP: $8.6

SL: $5.77

RR: 14.3

-

(1) APT has broken out the wedge structure on 19th Feb.

(2) Currently retesting this wedge and fibonacci 0.382 at $5.95

(3) One more time to retest $5.95 with effective support is our entry opportunity

(4) Targets analyzed from structure and fibonaaci are $7.27 and $8.76

(4) Stop loss once going below $5.77

APT SHORT targeting further downside continuation.[MICRO OUTLOOKAPTUSDT is respecting a clear downtrend structure, consistently rejecting the descending trendline. Price recently tapped the 6.12 resistance zone, aligning with the 0.786 Fibonacci retracement, reinforcing bearish sentiment. The market structure suggests a continuation to the downside, with a potential short setup targeting the -0.5 Fibonacci extension at 5.67. A break above 6.18 could invalidate this bearish outlook.

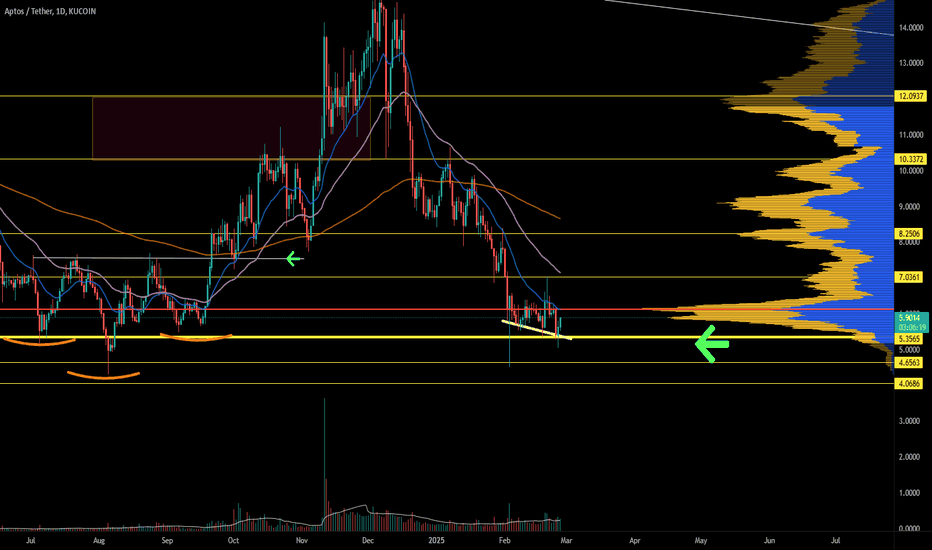

[LONG] APTOS' time to shineAPTOS started the year in free fall, the so called "SOLANA killer" is testing the $5 support for the 3rd time since 2023. APTOS needs buyers ASAP and this week so far is finding them.

On the daily chart some signs of strength and a more consistent volume are giving hope for the bull case

On the 4H chart price broke bellow $5.50 but quickly found buyers and went to try and break the top of the descending channel. It failed, but was expected, now buyers need to commit on this pullback for a definitive breakout and continuation

Entry: $6.00

current price

1st target: $7.10

at this price bulls are in control, move SL to break even point

1st take profit: $8.80

big volume node and 200d EMA, this can be a hard nut to crack

2nd take profit: $12.45

sellers took control here last December and most likely will be there again

Stop loss (conservative): $5.25

bellow the last swing low

Stop loss: $4.85

is $5 is lost I'm giving up my hopes on APTOS for the time being

APTUSDT Analysis & Signal📢 APTUSDT Analysis & Signal 📢

🔍 Market Condition: Distribution Phase 📉

📊 Timeframe: 4H (Heikin Ashi)

💰 Entry: Around 6.80 - 7.00 USDT

🎯 Target 1: 10.50 USDT

🎯 Target 2: Higher breakout possible

❌ Stop Loss: 4.49 USDT

📈 Analysis:

APTUSDT appears to be breaking out of an accumulation zone, but given the strong resistance above, we could be entering a distribution phase. If price struggles to break above 7.00-7.50 USDT and starts forming lower highs, we might see a rejection and a potential drop back to the range lows.

🔹 If the price holds above 7.00, it could push towards 10.50.

🔹 If rejection happens, expect a retest of 6.30 - 6.50 support zone.

💡 Risk Management:

🔸 If price fails to sustain momentum, trailing stop recommended.

🔸 Monitor volume—decreasing volume near resistance signals weakness.

📊 React & Engage! Your feedback motivates us to share more signals! 📢🚀

⚠️ Not a financial advice! do your own research as well

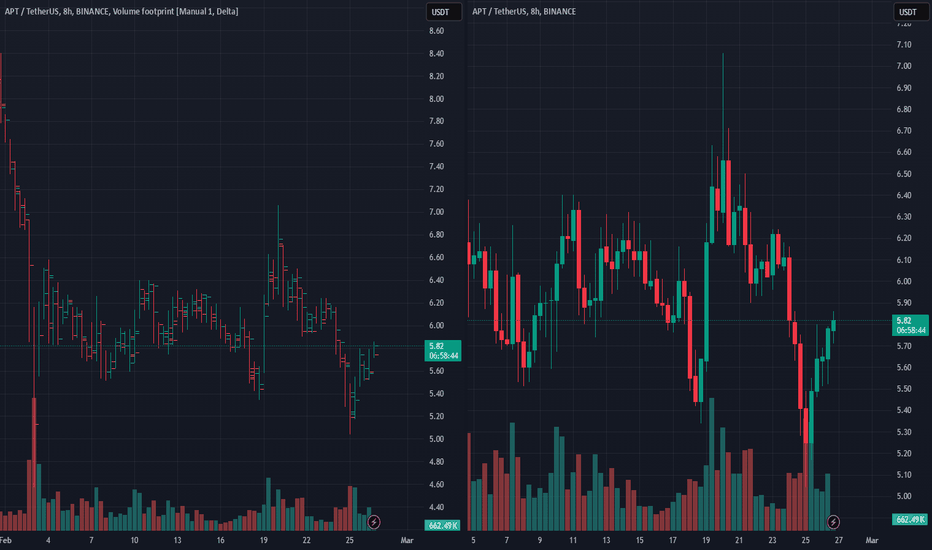

APTUSDT Analysis: Waiting for Lower LevelsI see no reason not to wait for lower levels in APTUSDT. The market conditions suggest that there might be a better opportunity for entries at these levels.

Key Points:

Lower Levels: Waiting for lower levels might provide better risk/reward setups.

Market Conditions: Keep in mind that market conditions can change quickly, so stay cautious.

Confirmation Indicators: Use CDV, liquidity heatmaps, volume profiles, volume footprints , and upward market structure breaks in lower time frames for validation.

Learn With Me: If you're interested in learning how to use these tools for accurate demand zone identification, feel free to DM me.

If this analysis helps you, please don’t forget to boost and comment. Your support motivates me to share more insights!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Aptos (APT) Surge 16% as Token Unlocks Spark Market AnticipationAptos (APT), one of the emerging Layer 1 blockchain networks, saw a remarkable 16% price surge today despite the upcoming release of 11.31 million APT tokens—representing 1.97% of its total supply—on February 10, 2025. This release, valued at approximately $71.25 million, had initially created uncertainty, causing APT to dip 6.08% last week to $5.80, with a 20.62% drop in trading volume to $219.93 million. However, today’s bullish movement suggests traders have already priced in the token unlock event and are positioning for potential gains.

Token Unlock and Market Sentiment

Token unlocks can often introduce downward pressure due to an increase in circulating supply. However, in the case of Aptos, previous major unlock events have historically led to significant trading activity and, in some cases, price recoveries. The anticipation surrounding this unlock indicates that investors are still confident in Aptos’ long-term fundamentals and its position in the Layer 1 blockchain space.

Moreover, Aptos’ past all-time high (ATH) of $44 demonstrates its potential upside, and with market sentiment stabilizing, analysts suggest a potential rally towards $20 in the coming weeks. The broader crypto market’s resurgence and increasing demand for high-performance Layer 1 networks further support this bullish outlook.

Technical Analysis

Currently, APT is trading within a bullish zone, up 13.82% at the time of writing, with the Relative Strength Index (RSI) at 61.44—indicating strong momentum but still within a range that allows further upside movement.

- Support Level: The one-month low is serving as a key support point. If APT were to break below this level, it could test the $3 mark.

- Resistance Level: The 38.2% Fibonacci retracement level is acting as a significant resistance point. A breakout above this level could propel APT towards $10 and potentially $15.

Conclusion

Technical indicators suggest APT could target $10–$15 in the near term. As the market adjusts to the increased supply, Aptos remains one to watch in the coming weeks, with a possible move toward $20 if bullish momentum persists.

Aptos APT price analysisAMEX:APT price was bought back quite nicely overnight, although buyers still have a lot of work to do before a confident return to the ap trend.

‼️Do you believe in a bright future for #Aptos? Then there are two types of purchases for you:

1️⃣ risky - as close to $5.50 as possible

2️⃣ conservative purchase only after the price of OKX:APTUSDT is confidently fixed above $8

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Apt, my notes for long-termAn excellent project but the price was always disappointing, it is still the same. There is not much to say about the chart, for now 5.5 is strong support, 6.7-7.3 is strong resistance. When this level is exceeded, 10.7 - 13 - 19 are important and strong resistances that I need to take profit respectively. If the 19-21 range is exceeded, the first ATHs can be considered as 26 - 42 - 55. Targets such as 65 - 81 - 100 dollars are not realistic for now but it is an excellent project, I hope it reaches those prices in the future.

not investment advice.

APT Update - Who else was a great painter?After the brutal 3rd Feb drop (explanation in USDT.D chart - link at the end of post), the downward wedge failed but EW count is still valid)

After the brutal 3rd Feb drop (explanation in USDT.D chart - link at the end of post), the downward wedge failed but EW count is still valid

I've explained in detail what I'm expecting in this year. Please refer to the previous posts for in-depth analysis and thoughts. Too tired to write anything now :)

TLDR for the lazy ones: Late Feb-April, I'm expecting a massive rally. 100% loaded here personally!

Why Aptos? Why A Super Bottom? Why Is The Market Going Up?What do we have here? Let's call it a super-bottom.

Good evening again my friend, why do you choose to read?

No need to answer, whatever is the reason for your choice just know that I am grateful for your support. Just make sure to comeback for more. It is entertainment for the mind, for your pockets and for your soul.

Imagine being entertained while making money at the same, that's Cryptocurrency in the year 2025. That's Crypto-gaming. That's Crypto trading. Thanks a lot for your support. It is all possible just because of you.

What do we have here? Let's call it a triple-bottom.

The support level that supported APTUSDT (Aptos) in October 2023, worked as support again in August 2024. The support level that supported Aptos in August 2024, worked as support again in February 2025. We have a triple-bottom, why is this good? Why is this nice?

Many reasons one being money of course.

Because the last low is a higher low compared to the previous low. That is, the low in February 2025 ended higher than the low in August 2024. Why is this good news? Because as a chart Master this reveals that the bottom is likely in. And why the bottom being in is good news?

It is good because once the bottom is in we can experience growth.

And why is it any good to experience growth?

Because when the market is growing, our money grows...

Why?

Wait... I get it now; I should just buy and hold!

Why should I buy and hold?

Because it is the best and easiest way to make money in the 2025 Cryptocurrency bull-market and bull-run.

Why?

Because I say so!

Namaste.

APTUSDT CHART ANALYSİS- EDUCATIONAL POSTThe NFT Concept

You may already know that each unit of value in a blockchain is called a token. In an open blockchain, all tokens are equal and interchangeable. For example, one bitcoin can be easily replaced with another, and nothing will change.

Non-fungible tokens are a game-changer, which work differently. An NFT is a digital asset that cannot be replaced with another token without changing the value and basis of the object.

Like cryptocurrency, NFTs are created on a blockchain, which acts as a database to record all transactions. The blockchain guarantees the uniqueness, safety, and anonymity of non-fungible tokens. Thanks to this system, any user can verify the originality and transparency of the history of a particular NFT through the blockchain.

When you buy an NFT token, you are obtaining a certificate for a digital or real object. However, the work itself doesn’t move anywhere. You only use its digitized file or a certificate of ownership. Once created or purchased, the token sits in perpetual storage. This certificate is just lines of code that confirm it is the token owner who has the original copy of the object.

An NFT token can be compared to a painting, which may belong to a gallery, museum, or individual, but the audience can see it in a catalog or exhibition.

NFT tokens are sold in online marketplaces that operate like Amazon. The creators put them on marketplaces and wait for bids from buyers.

An NFT token can be created by you or by anyone for that matter. To do this, you need to take a digital object (picture, music, photo, etc.), register in a particular marketplace on a platform such as Rarible or OpenSea, and upload the object with a description and price. You will have to pay a fee for creating a blockchain entry on many platforms. However, the costs pay off in most cases, as NFTs are #1 in the crypto world today.

TradeCityPro | APTUSDT Reaching the Bottom of the Range👋 Welcome to the TradeCityPro channel!

Let’s analyze APT, the so-called "Solana Killer", which was expected to replace Solana but is now hugging its support level.

🌐 Overview Bitcoin

Before diving into APT, let's first check Bitcoin’s 1-hour timeframe. Currently, BTC is sitting on a strong support trigger, making it a good zone for potential positions. Setting alerts in this area is logical and necessary these days.

If $95,747 breaks, I will personally look for a short position, provided there is an increase in volume, as it could lead to a test of the $92,701 support. If, at the same time, Bitcoin dominance is rising, I would also short an altcoin like Ethereum, which is relatively weaker against BTC.

🕵️♂️ Previous Analysis

Earlier this year, we publicly shared a bearish scenario for APT. Once $7.51 broke, a sharp decline followed, and now there is a possibility of moving toward $4.89.

📊 Weekly Timeframe

APT remains inside its large, volatile range, frequently bouncing between its highs and lows. However, this time, it has formed a lower high, which is not a positive sign.

Additionally, after breaking $7.78, sellers completely engulfed the weekly candle, and for the past five weeks, all candles have been red with high selling volume, confirming the downtrend.

There is no buy trigger at the moment, and I cannot recommend a buying opportunity until the market forms a new structure.

For selling, if APT drops below $4.97, it makes sense to exit and accept the loss instead of holding onto a losing position.

📈 Daily Timeframe

On the daily timeframe, APT failed to break the $14.61 resistance. Even worse, it couldn't even reach the previous high before getting rejected earlier, signaling weakness.

After breaking below $8.46, the market entered an MWC (Market Weakness Confirmation) downtrend.

Following the breakdown, a pullback retest occurred, and the daily candle engulfed the previous two days' candles, leading to further decline. Currently, APT is at $5.70, with RSI in the oversold zone, suggesting a possible short-term slowdown in selling pressure.

I personally feel that APT’s drop is sufficient for now, and we might enter a range here before a final move toward the $4.95 support. However, this does not mean it’s a buy signal. We need to wait for a new market structure before considering spot entries.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#APTUSDT expecting further decline📉 SHORT BYBIT:APTUSDT.P from $5.5950

🛡 Stop Loss: $5.7250

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:APTUSDT.P remains in a downtrend, forming lower lows. The price broke key support at $5.6600 and continues downward.

➡️ POC (Point of Control) at $5.94 indicates the highest liquidity zone, confirming a bearish market sentiment.

➡️ A breakdown of $5.5950 strengthens the downtrend, opening the way toward $5.2950, where buyers previously showed interest.

➡️ Holding below $5.5950 will likely accelerate selling pressure.

⚡ Plan:

➡️ Enter SHORT after confirming a breakdown below $5.5950, signaling further downside.

➡️ Risk management through Stop-Loss at $5.7250, placed above resistance.

➡️ Primary downside target – $5.2950, where buyers may step in.

🎯 TP Targets:

💎 TP1: $5.2950 – key support level.

📢 BYBIT:APTUSDT.P remains in a strong downtrend with no clear signs of reversal. If the $5.5950 level breaks with increasing volume, the decline may accelerate.

📢 It is crucial to watch the reaction at $5.2950—if significant buying interest appears, a short-term bounce is possible. However, if selling pressure persists, the price may continue to fall toward $4.3450.

🚀 BYBIT:APTUSDT.P remains weak - expecting further decline!