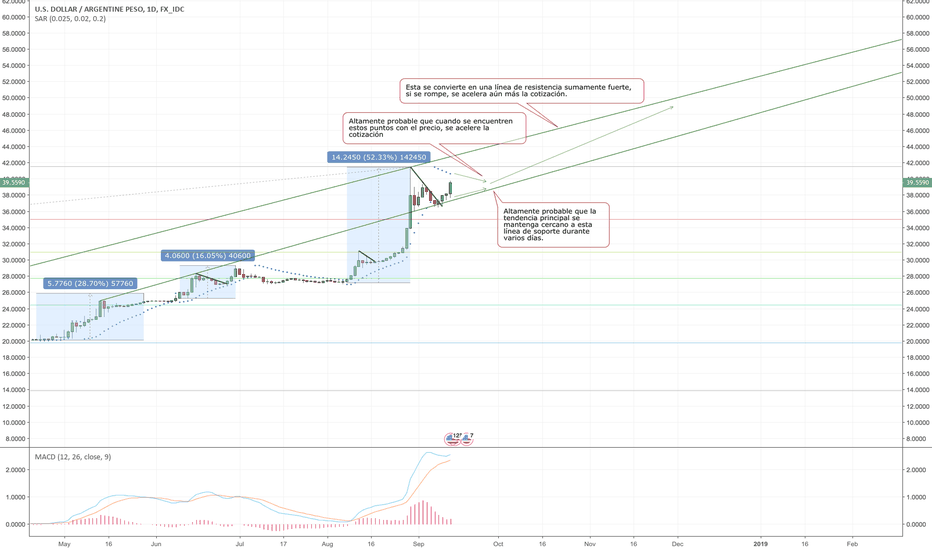

$USDARS DOLAR MAYORISTA ARGENTINA CHANCE NUEVA CORRIDA CAMBIARIAFX_IDC:USDARS

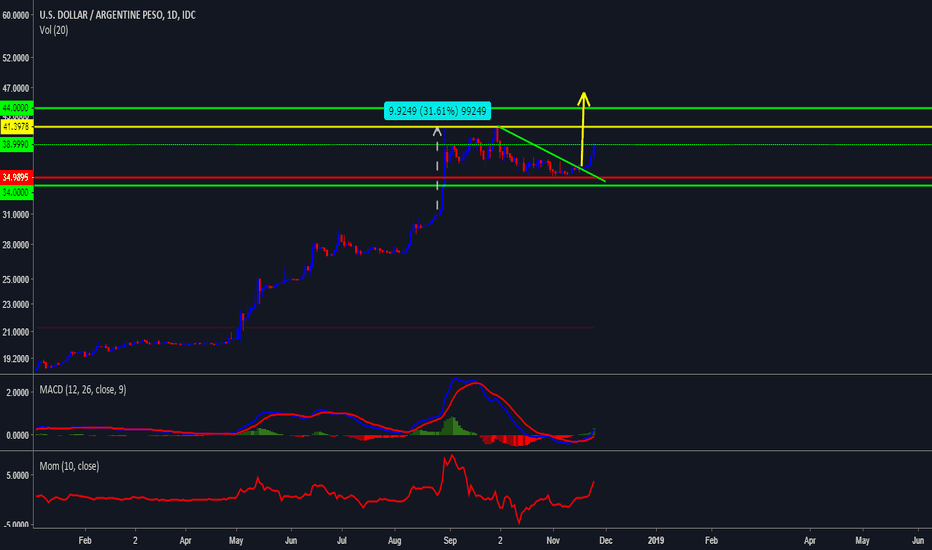

EL DOLAR MAYORISTA RECONOCIO EN MOVIMIENTO ABC DE CORRECCION ONDA 2 DE 3 ALCISTA EN EL 61,8% DE CORRECCION DE FIBONACCI EN $41,35 PARA REACCIONAR.

EL DATO INFLACION MINORISTA 4,7% DE MARZO , MUY POR ENCIMA DE LO ESPERADO EN ARGENTINA, QUE ELEVO LA MARCA ANUAL A 54,7%, DEMUESTRA LO FUERA DE CONTROL EN QUE SE ENCUENTRA INFLACION.

ESTA SITUACION TERMINARIA TECNICAMENTE EN GENERANDO UN "GOLPE DE MERCADOS", NUEVA SALIDA EN ONDA 3 -3 ALCISTA PARA EL BILLETE MAYORISTA, QUE LO ELEVE RAPIDAMENTE HACIA EL TOPE DEL NIVEL DE BANDA DE FLOTACION, 50-51 PESOS DE NIVEL DE RESISTENCIA, MANTENIENDO UN OBJETIVO DE MEDIANO PLAZO HACIA 63 PESOS.

TECNICAMENTE MANTENGO EXPECTATIVAS DE UN COLAPSO ECONOMICO FINANCIERO CAMBIEARIO PARA ARGENTINA ANTES DE LAS ELECCIONES, LA NUEVA PIERNA ALCISTA DEVALUATORIA EN MERCADOS EMERGENTES ( LA MAYOR EN LA DECADA) POTENCIARA EL CICLO ADVERTIDO.

ARGENTINE PESO / U.S. DOLLAR

No trades

What traders are saying

Argentine Peso going to shit (deeper shit)?Just breaking out of a bull pennant continuation pattern with lots of FUD in the economy. Been inside a parabolic channel for the past year, and will likely test the channel's resistance next at aprox. 50 pesos.

Will Macri's popularity be enough to stay in presidency for another term if this scenario plays out...?

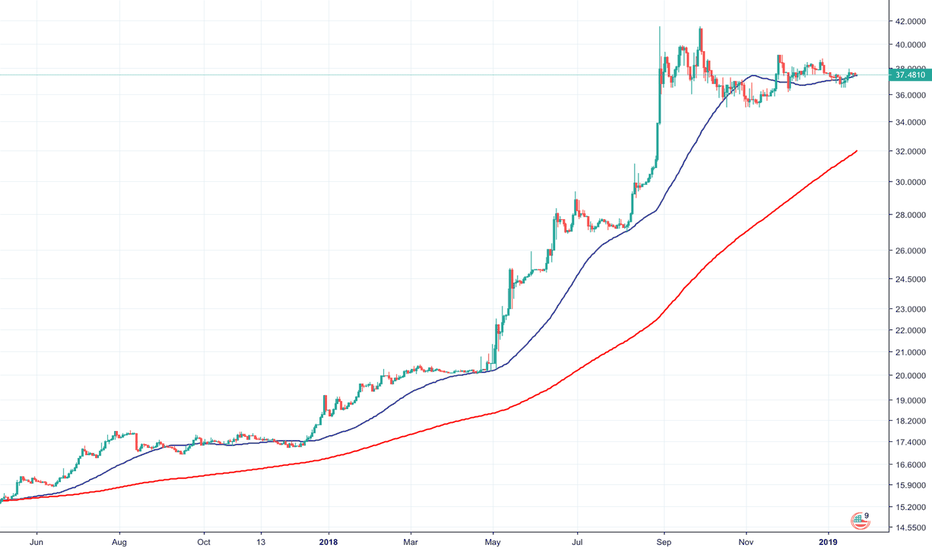

USDARS: Might be about to trend up sharply...As everyone has been saying, $USDARS will likely get close to the $50 mark, a 2W timeframe Time@Mode signal kicked off, and it's already active for 2 bars, out of 10 that are forecasted as part of the uptrend. This rally has 3 possible targets which are laid out on chart, valid for as long as the time lasts, or as long as $USDARS trades above the 37 mark.

I wouldn't reccomend to hold ARS for long if you have income in pesos.

Best of luck,

Ivan Labrie.

Argentina PesoARS should go up against its peers only due to electionary effect (till October). Why? due to a tight monetary policy which Sandleris is taking into effect. Bear in mind that he enter office in late Septmber 2018 and Just look at the effects to Monetarist theory applied to excess of monetary base produces by Keynesian economic thought. Scenario of ARS above 55 and so on are lunatic if a non-right goverment wins. Under a political analysis Macri's gvt wouldn't a center gvt but rather a center-left.The only positive thing about Macri's is Central's Bank Montary tight policy.

tgt: 42.2 for sure

tgt worst case scenario: 47

Bear in mind that a supre cycle can help EM's until FED dcides to start moving up again with a tighter montary policy via quantitative tightening and intrest rate hikes.

trade safe,

Shorts remain under pressure here...=> Here we are tracking for a short-term high to be set, whilst bulls remain above resistance at 39.35 the yearly highs are open for a test.

=> Here we can either trade crumbs to the highs or look for opportunities at 41.50x as we begin to set a secular high.

=> Whilst we don't see EM out of the woods yet, we are expecting some recovery into 2019.

=> A very complex environment here so good luck to all those involved.

USDARS - Emerging Markets in TroubleThe collapse of the Peso has accelerated after President Macri called yesterday for the IMF to accelerate disbursement under its standby programme amid rapidly deteriorating market sentiment. The Argentinian central bank hiked rates from 45% to 60% in a forceful attempt to shore up confidence. However, despite the hike, the Peso has continued to weaken. The ball is now clearly in the IMF's court...