AVAX 4H – Resistance Test Ahead, Breakout or Rejection?valanche is rebounding but now faces stacked resistance levels that will determine its next move. Price is testing the 23.5–24 local resistance, while the bigger wall remains at 25.5–26.

Immediate Resistance: 23.5–24 zone is being tested.

Major Resistance: 25.5–26 remains the key level to flip for upside continuation.

Macro Target: Breakout could send price toward 27.3.

Downside Risk: Failure here reopens 20.8 support.

Momentum: Stoch RSI is in overbought territory, suggesting possible rejection before any breakout.

AVAX is sitting right at the decision line—watching whether bulls can push through or if sellers defend the range.

AVAXUSDT.3L trade ideas

AVAX.... calm before the storm AVAX is still within range. As long as price action respects the range, so should we. If the price returns to the bottom of the range, it is the best RR opportunity. However, it is essential to be aware of the maturity of this structure, as market conditions could cause AVAX to breakout.

Avalanche · Early or Late? · Targets & TALook at AVAX. It traded at $18 for 21 days, three weeks, and now its price is already at $27, 50% higher. That's how it all changes in a matter of days. In just 19 days Avalanche is trading much higher and soon you won't be able to get a buy below $50. $18 will seen like an old dream. Gone so long ago but it was available just recently. The same will happen with the current price.

Avalanche is still cheap below $30. The all-time high is $147. We can easily aim for $100 just to see how things will go. We know this level can hit easily so buying below $30 should be an easy decision and choice. That is if you like this pair.

This is another strong project, another bullish chart but always focused on the long-term. If you are looking at it very close, we can have days red but nothing changes. This will not change the bigger path that is being travelled to a new all-time high. So only leveraged traders should be careful when opening a new LONG position because the market can shake the next day. If you trade spot, buy and hold; buy and accumulate with no worries necessary because it is still early.

You can do great in this bull market; we can all do great. More opportunities will continue to develop and the market will continue to heat up.

The next major target for this project mid-term is $64, followed by $96 and then the ATH.

Once we enter the price discovery phase, new all-time high territory, anything goes. The action can continue rising and hit levels hard to imagine, for months, or it can stop just after a few weeks. It all depends on how much money into the market flows.

Namaste.

AVAX 4H Channel Support, Bounce or Breakdown?Avalanche is pressing into channel support on the 4H chart after a steady pullback. Current price is sitting at $22.6, a level that has repeatedly acted as near-term demand.

Holding $22.6 could spark a rebound toward $25 resistance.

A breakdown targets the next demand zone at $21, with channel support extending toward $19.

Stoch RSI is oversold, giving bulls a chance to defend — but the reaction here decides whether AVAX bounces or slides deeper into the channel.

TradeCityPro | AVAX Eyes Breakout Beyond Major Resistance👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AVAX coin for you. It’s one of the popular crypto projects, with a market cap of $9.93 billion, currently ranked 18th on CoinMarketCap.

⏳ Daily Timeframe

On the daily timeframe, after AVAX was supported at the 16.46 zone and broke the 18.77 trigger, it made a bullish move up to the 26.59 high. With the break of 18.77, we could have opened a long position.

💥 There is a Maker Seller zone near the 26.59 area. This is a very important zone, and breaking it can lead to the start of the main bullish trend of AVAX.

🔔 If the 26.59 zone is broken with a trigger, I will open a long position. The first target on AVAX is 35.06, and before this area, there aren’t any major resistances.

📈 If the price does not make a lower low below 20.82, the probability of breaking 26.59 increases and the next bullish move will be easier to form.

✔️ However, if the price stabilizes below this zone, the 26.59 trigger is still valid, but we will probably have more attractive entry points. In that case, I will update the analysis for you and share those entry points.

🔽 For a short position, the first logical trigger in my opinion is breaking 16.46. Although it is far from the current price, this area is the bottom of the box, and its break could start a new bearish trend.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AVAX 4H – Holding Trendline, Can Bulls Retest 26?Avalanche continues to hold its ascending trendline while trading around 25.1. The previous local high sits above at 27.5, which remains the main upside target if momentum continues.

Support levels: 23.38 (Fib 0.5), 22.76 (Fib 0.618), 21.88 (Fib 0.786)

Resistance: 25.5–26.0, then 27.5 local high

Stoch RSI: Trending down, hinting at cooling momentum in the short term

As long as the trendline holds, structure remains bullish. A clean break above 25.5–26.0 would confirm continuation toward 27.5, while a breakdown below 23.3 risks deeper retracement into 22s.

AVAX : Low price and high potentialHello friends

Due to the decline we had, the price of this currency has decreased significantly and has reached good support areas, and the specified areas can be considered good support areas.

If it breaks through the support areas, the price can move to the specified targets.

*Trade safely with us*

AVAX 4H – Holding Trendline at 24, Bounce or Breakdown Toward 22AVAX is currently resting on its rising 4H trendline near 24.0–24.2 after rejecting from the mid-25s. This area will determine short-term direction.

Bullish case: Trendline holds → a bounce toward 25.5–26 is likely, continuing the sequence of higher lows.

Bearish case: Break and 4H close under 24.0 would expose the 22–23 demand zone, where the last higher-low base formed.

Momentum (Stoch RSI) is neutral, suggesting the next pivot move will be decisive. A clean break either way will guide the next leg.

AVAX 1D – Range High Test at $28, Will Fib Zone Hold on PullbackAVAX has been trading within a well-defined range, with $27–28 acting as the key resistance and $16–17 as the major support floor. Price is currently pushing into the upper boundary, while momentum (Stoch RSI) shows signs of cooling.

A pullback into the $21.5–18.2 Fibonacci retracement zone would be a healthy retest area for continuation. Holding above this range keeps the bullish structure intact and opens the door for another breakout attempt.

Failure to hold the Fib levels could see price revisit the broader support base near $16. Range traders will be watching closely for either rejection at resistance or confirmation of a breakout.

AVAX 1D – Breakout Watch Toward Major Trendline ResistanceAVAX is pressing against the $26 range high while riding a strong ascending support from the July low. A confirmed breakout could open room toward the $36 mid-range target, with the $44 major trendline resistance as the next key level. Above that, the March 2024 high near $65.50 remains the longer-term upside target. Failure to break $26 cleanly may lead to another pullback toward ascending support around $22. Trend remains bullish while above this trendline, with momentum building for a possible higher-timeframe breakout.

Avalanche maintains an upward structure ┆ HolderStatBYBIT:AVAXUSDT is maintaining a strong bullish structure, printing steady higher highs and higher lows. After breaking out of consolidation patterns, the market shows momentum for a run toward $27–$28. Support at $23 remains a critical level for bulls to defend in order to sustain the uptrend.

AVAXUSDT 1D#AVAX is moving inside a symmetrical triangle on the daily chart. It has already broken above the daily EMA200 and is now on the verge of breaking out above the triangle resistance. If the breakout is confirmed, the potential targets are:

🎯 $29.76

🎯 $34.43

🎯 $39.10

🎯 $45.74

⚠️ As always, use a tight stop-loss and apply proper risk management.

AVAX/USDT — Symmetrical Triangle Approaching Breakout?Overview:

The daily chart shows AVAX forming a symmetrical triangle (converging trendlines) since the Dec–Jan peak. Price is now testing the upper resistance trendline (~26.1 USDT) — we’re at a critical point heading toward the apex (late September). Volume behavior and a confirmed daily candle close will be key to determining the breakout direction.

---

1) Pattern Description

Pattern: Symmetrical Triangle — characterized by lower highs (descending resistance line from the peak) and higher lows (ascending support line from the April bottom). Price range is narrowing → volatility dropping → usually leads to a strong move when the pattern resolves.

Context: The broader trend before the triangle was bearish (drop from ~55.8). Symmetrical triangles can be neutral but often resolve in the direction of the prior trend — technical confirmation is essential.

---

2) Key Levels (from chart)

Upper resistance trendline / critical level: ~26.10 USDT (red dashed line), current price ≈ 25.3 USDT.

Major resistance targets: 30.74, 35.62, 44.18, 53.70 – 55.80.

Ascending support trendline: around 18–22 USDT depending on timing.

Structural low: 14.665 USDT (chart low).

(Values estimated visually from chart — verify with live data before trading.)

---

3) Bullish Scenario (if breakout upward)

Bullish Trigger

Daily close above descending trendline (~26.1) with strong volume → breakout confirmation.

Preferably supported by bullish technical indicators (RSI, MACD bullish crossover, rising OBV).

Targets

Step targets: 30.7 → 35.6 → 44.2 → 53.7 (partial profit-taking recommended).

Measured move theoretical target:

− Height ≈ 55.800 − 14.665 = 41.135.

− Added to breakout point (~26.108) → theoretical target ≈ 67.24 USDT (for reference, not guaranteed).

Risk Management

Stop-loss: daily close back below breakout trendline or under nearest swing low (e.g., conservative SL < 21–22 USDT).

Strategy: scale in — partial entry before breakout, add after confirmation. Monitor risk/reward closely.

---

4) Bearish Scenario (if rejected / breakdown)

Bearish Trigger

Rejection at upper trendline + bearish daily candle (and/or rising sell volume) → drop to ascending support.

Breakdown confirmation: daily close below ascending trendline with strong volume.

Targets

Initial drop to ascending support ~18–22 USDT.

If breakdown continues → possible retest of 14.66 USDT low.

Risk Management for Shorts / Cut-loss

SL for shorts: daily close above resistance (~>28 USDT) or above fake breakout highs.

Beware of bull traps — volume confirmation reduces risk.

---

5) Practical Trade Plans (example)

Conservative Long: Wait for daily close > 26.1 + strong volume → enter 50% position; add after retest. Targets: 30.7 / 35.6. SL under retest zone (~21–22).

Conservative Short: If clear rejection at upper trendline → short toward lower trendline. SL above recent high (~28).

Range Trading: Buy near lower trendline, sell near upper trendline until breakout confirmed.

---

6) Risk & Confluence Checks

Broader market/Bitcoin sentiment: AVAX is often correlated, which can amplify moves.

Supporting indicators: check volume, RSI, MACD, EMA(50/200) for confirmation.

Watch for false breakouts — confirm with volume + retests.

---

7) Summary

> AVAX is forming a Symmetrical Triangle. Critical resistance at ~26.1 USDT — daily close + volume will decide the next move. Valid breakout → step targets at 30.7 / 35.6 / 44.2 (measured move theoretical ~67.2). Rejection / breakdown → support at 18–22 and possible drop to 14.66. Manage risk with confirmation, stop-loss, and partial profit-taking.

#AVAX #AVAXUSDT #Crypto #TechnicalAnalysis #Triangle #Breakout #SupportResistance #Altcoin #SwingTrading

AVAX/USDT – WeeklyTracking 2 scenarios:

1️⃣ ABCDE Triangle – Currently in wave E. Break above $42.88 could trigger breakout. and triangle will be invalidated

2️⃣ Impulsive (Blue 1–5) – Possible wave (2) completed, upside targets $71.76, $106.93, $159.10, $251.87.

well all in all I'm looking for upside but we have to be cautious

Key Levels: Support $24.07–$25.00, Resistance $29.13, $36.84.

Breakout = bullish continuation, rejection = triangle completion.

AVAX Technical Setup Signals 13% Upside Target $27Hello✌️

Let’s analyze Avalanche’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Avalanche’s July Octane upgrade cut C-Chain fees by 98% and boosted daily transactions 170% to 10.1M. New subnets, like FIFA NFTs and VanEck’s $100M RWA fund, could lift AVAX demand. 🚀

📊Technical analysis:

BINANCE:AVAXUSDT is holding a strong daily support and a key monthly trendline 📊. If these levels hold, a 13% upside toward $27 looks likely 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

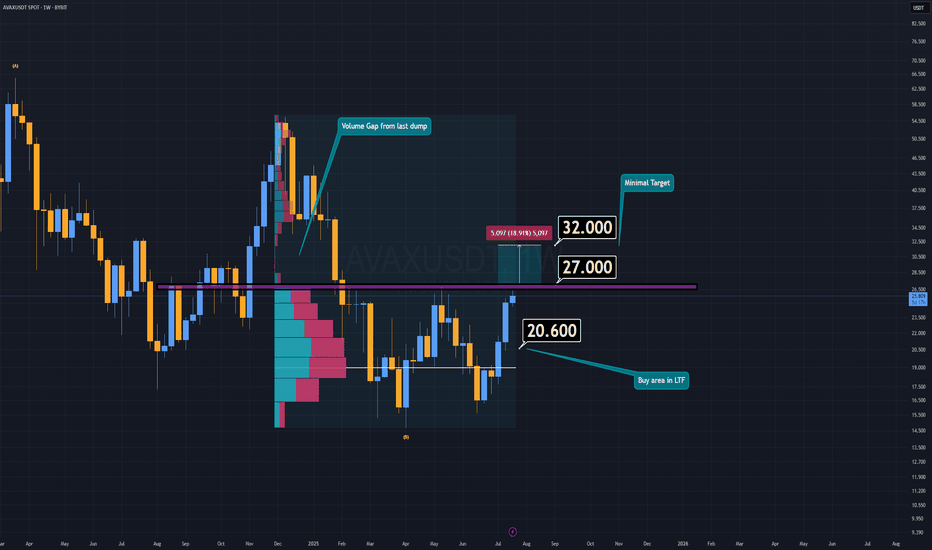

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

Avalanche (AVAX): Expecting a Good Buy-side Movement | CME GAPAvax looks strong;after the break of 200 EMAs, we switched the trend and with the recent retest of that same EMA, we are seeing good buyside dominance.

What actually caught our attention here is that huge CME gap that we formed in the beginning of February, which we intend to fill very soon!

Swallow Academy

AVAXUSDT ( You think it’s out of mind , But you have to believe Hello dear traders.

Good days.

First of all thanks for your support and comments.

————————————————————————

Sometimes numbers are enormous and fist think which come in your mind is , oh my god it’s crazy . You could not believe crypto market will grow up this much ever .

But it’s real and you have to believe it .

AVAXUSDT on weekly Gann square could hold price above 0.5 Gann price zone which is a great signal for future .

End of Daily bearish Gann Square box exactly matched with weekly Gann reversal time zone and as you can see on longe term price form and wedge and collect spring for breaking up and experience new ATH .

Hope to analysis be helpful for you .

Good luck and safe trades.

AVAX 1D Trading Mid-Range, Will Bulls Push Toward Resistance?Avalanche continues to respect its long-term range, with price currently rebounding from the $16 support zone toward the mid-range near $21. The upper boundary around $26–27 has repeatedly acted as a strong rejection point, while the lower $15–16 zone has provided reliable support. A daily close above mid-range would strengthen the case for a move toward the highs, while failure to hold could see a return toward range support.