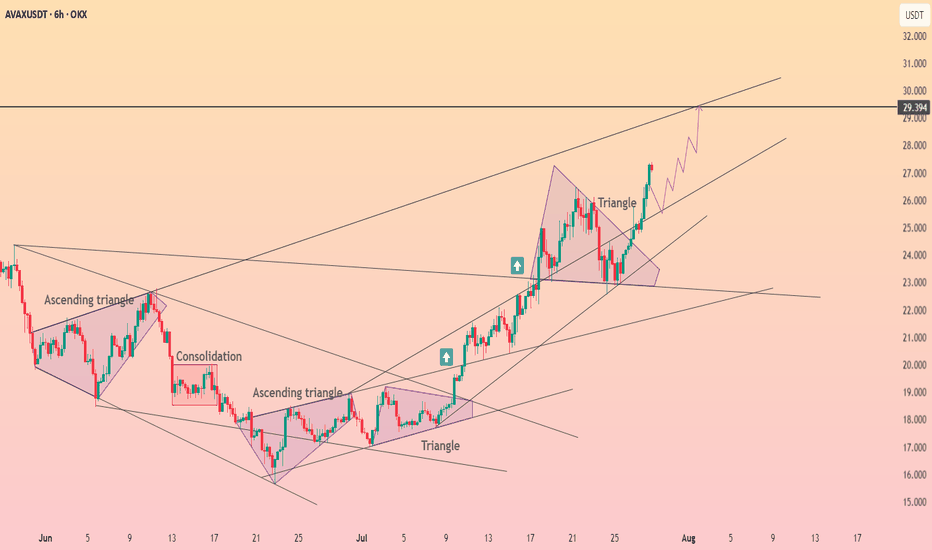

AVAX 8H – Trend-Capturing with the MACD Liquidity Tracker This AVAX 8H chart is a prime example of how the MACD Liquidity Tracker Strategy captures major trends with minimal noise. Designed for swing traders and trend followers, this system uses MACD momentum (25/60/220) and a 50-period EMA to filter entries and avoid chop.

🔍 What This Chart Shows:

A +150% long triggered in April and held cleanly through the rally

No entries during the June downtrend — thanks to bearish state filtering

A fresh +174% long in July as momentum and trend realigned

Visuals are crystal clear:

Blue candles = Bullish bias

Pink candles = Bearish bias

Arrows = Filtered entries only

MACD Histogram = Momentum strength

EMA = Trend direction

🧠 Why It Works:

Most traders struggle with second-guessing and emotional exits. This system removes the guesswork by enforcing strict momentum + trend alignment and delaying signals during unclear price action.

Ideal for crypto traders who want to follow strong trends with confidence and skip the noise in between.

AVAXUSDT.3L trade ideas

CryptoTrade: AVAXUSD Long Trade with SL and TPCOINBASE:AVAXUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

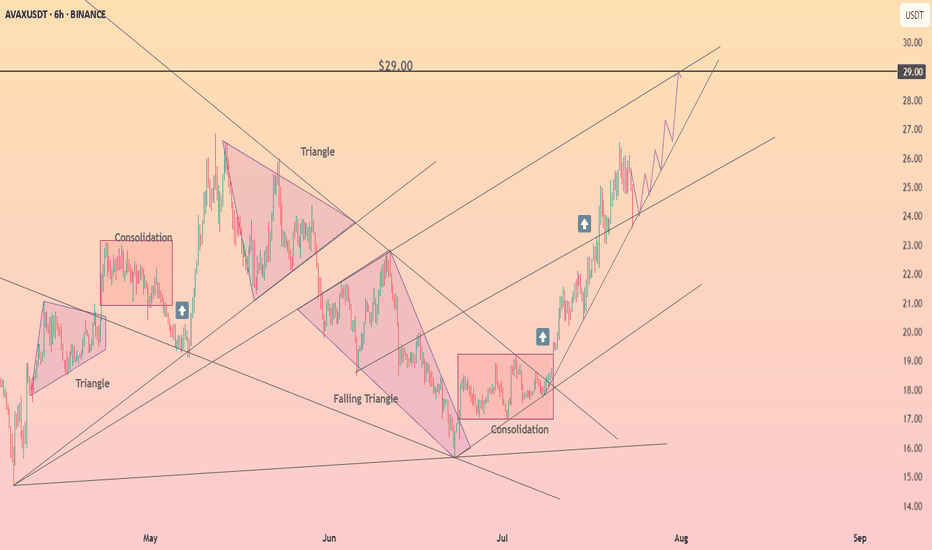

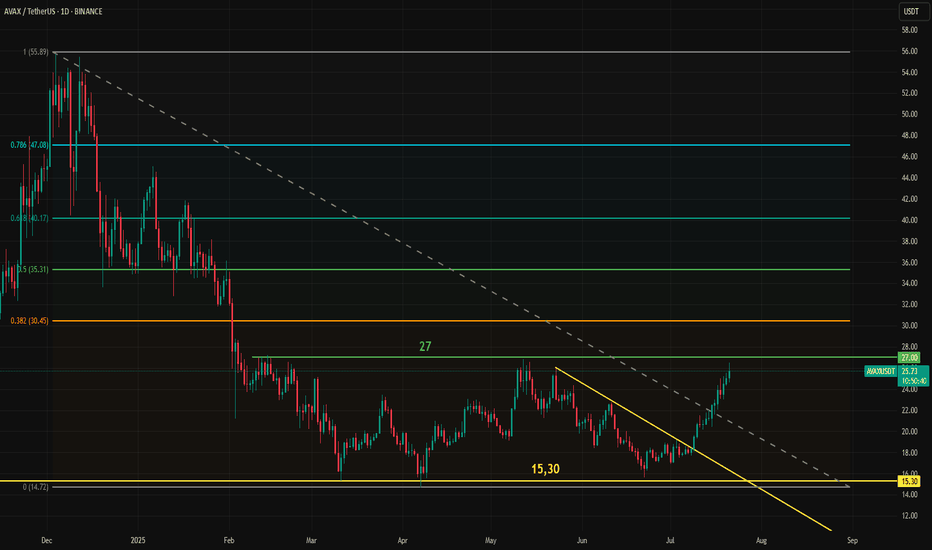

AVAX | Final Accumulation & Potential ReversalContext:

Price is in a major accumulation range, showing similarities to the October 2024 setup.

Green zones indicate strong demand/support; blue is key structural support.

Step-by-Step Scenario:

Accumulation Phase:

Price is consolidating above the $20 level, with repeated defenses of the support zone.

Spot Buys:

Orders set in the $19–$20 area to capture a potential “final shakeout.”

Spring/Reversal:

If price sweeps below $20 and quickly reclaims the level, this signals the final flush before reversal — mirroring the October 2024 bottom structure.

Upside Target:

First major resistance at $38, but the big objective is the $54–55 range, marking previous macro highs and supply.

Invalidation:

A sustained close below $14.1 would break the accumulation structure and invalidate the bullish scenario.

Avalanche broke through the $26 level ┆ HolderStatBINANCE:AVAXUSDT is consolidating just beneath the $33 resistance after reclaiming a prior range high. Price action is forming a classic bull flag while higher lows continue to support the structure. A breakout above $33 could confirm bullish continuation toward $35 and $36. Momentum remains strong as long as the $31.5 support holds, making AVAX one of the key watchlists this week.

AVAXUSDT 8H — Trendline Break Confirmed, Retest in ProgressAVAX just closed above a 7-month macro downtrend and is now pulling back into a high-confluence retest zone. With the prior trendline now acting as potential support — and price holding above a multi-tap demand level — this is a high-stakes inflection point.

📊 Technical Breakdown:

Breakout:

The descending trendline that defined AVAX’s entire bear structure since January has finally broken. A clean candle close above that line marked a shift in control from sellers to buyers.

Retest Zone:

Price is now sitting directly on top of the broken trendline and the horizontal demand zone that’s held since Q1. This dual-level confluence offers a high-probability bounce area — or a decisive invalidation if lost.

Momentum Check:

Stochastic RSI is resetting — not overbought — giving bulls room to push higher if this retest holds.

Targets to the Upside:

$30 – Local breakdown zone from late Jan

$38 – Pre-capitulation base (March)

$44 – Major structural resistance

$52–53 – Full retracement target from the December high

🧠 Trade Context & Bias:

Bullish case:

A bounce here with strong volume confirms the trendline flip and opens the door for midterm continuation toward the $38–$44 zones.

Bearish case:

If AVAX breaks below $22 with momentum, this would invalidate the breakout structure and shift bias back toward range-bound or bearish continuation.

This is where structure meets opportunity. A successful retest could place AVAX at the front of the next altcoin rotation — but only if buyers defend this level with conviction.

Avalanche (AVAX): Looking For Buy Entry | Potential Fill of CMEAvalanche is still hovering above the 100EMA, which means we are still looking for buy-side entries on the coin.

What we see is the bearish CME gap, which we intend to see filled and where also our buy entry will be sitting, so eyes on that zone for now.

Swallow Academy

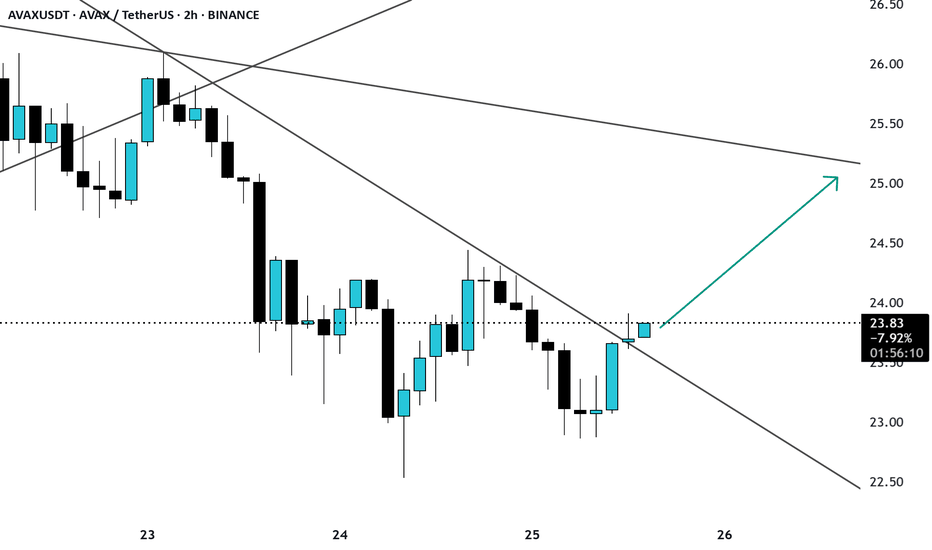

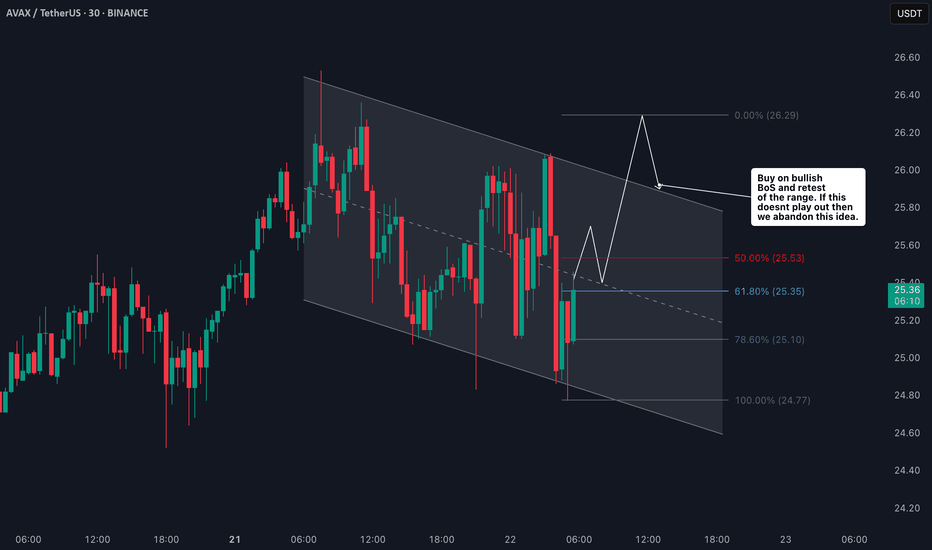

AVAXUSDT Corrective Move In The MarketAVAXUSDT

retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

Lingrid | AVAXUSDT Corrective Move In The MarketThe price perfectly fulfilled my previous idea . BINANCE:AVAXUSDT retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

💡 Risks

Downward trendline still active and could act as resistance

Potential for bearish fakeout before breakout

Failure to reclaim 25.30 quickly weakens bullish scenario

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

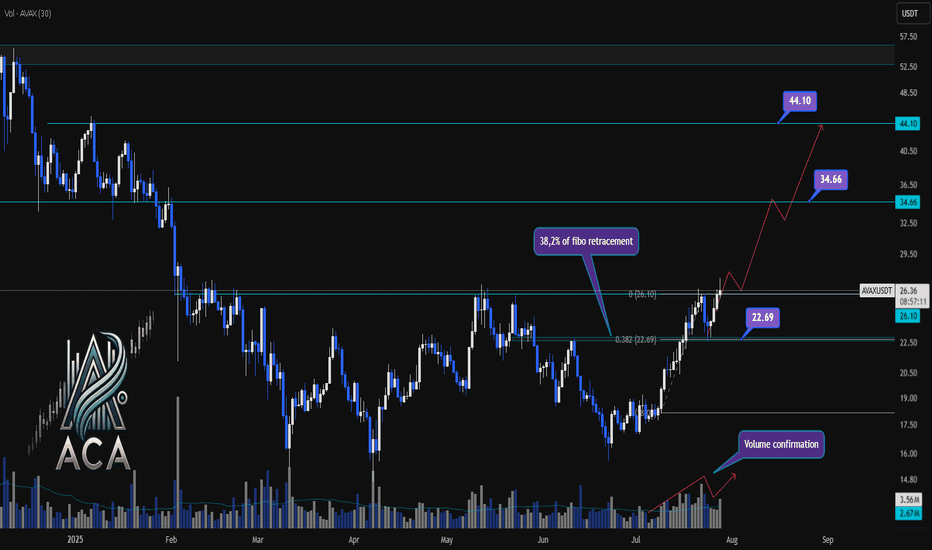

AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?

🔍 Let’s break down the AVAX/USDT setup, examining its technical structure and mapping out key opportunities as it gears up for a decisive move.

⏳ Daily Overview

AVAXUSDT has been exhibiting a bullish structure, recently reacting to the 0.382 Fibonacci retracement level (around 22.69USDT) where price paused for a correction. This correction was technically healthy, as it occurred with declining volume, while upward impulses were marked by notable volume surges—signaling strong bullish participation and confirming accumulation phases.

🔺 Bullish Scenario:

The next area to watch is the resistance at 26.10USDT, which has acted as a major barrier in recent trading sessions. A decisive daily close above this level—preferably supported by a clear uptick in volume—would confirm breakout momentum and set the stage for further advances.

Upon confirmation, the chart points to medium- and long-term targets at 34.66USDT and eventually 44.10USDT. These levels are derived from key Fibonacci extensions and historic price reactions, offering logical take-profit zones for trend-following strategies.

📊 Key Highlights:

- 0.382 Fibonacci level (22.69USDT) acted as a reaction zone and healthy correction point.

- Volume profile validates trend: increased buying volume during upswings, decreased volume on dips.

- 26.10USDT is the next crucial resistance for confirmation.

- Breakout (with volume) opens path to 34.66USDT and 44.10USDT targets.

- Failure to clear 26.10USDT could result in consolidation or another retest lower.

🚨 Conclusion:

All eyes are on the 26.10USDT resistance. Wait for a clear daily close and volume confirmation before considering entries. A breakout above this level could propel AVAXUSDT towards higher Fibonacci targets, while a rejection may prompt another retest of prior supports or consolidation.

Stay sharp and plan your trades with discipline!

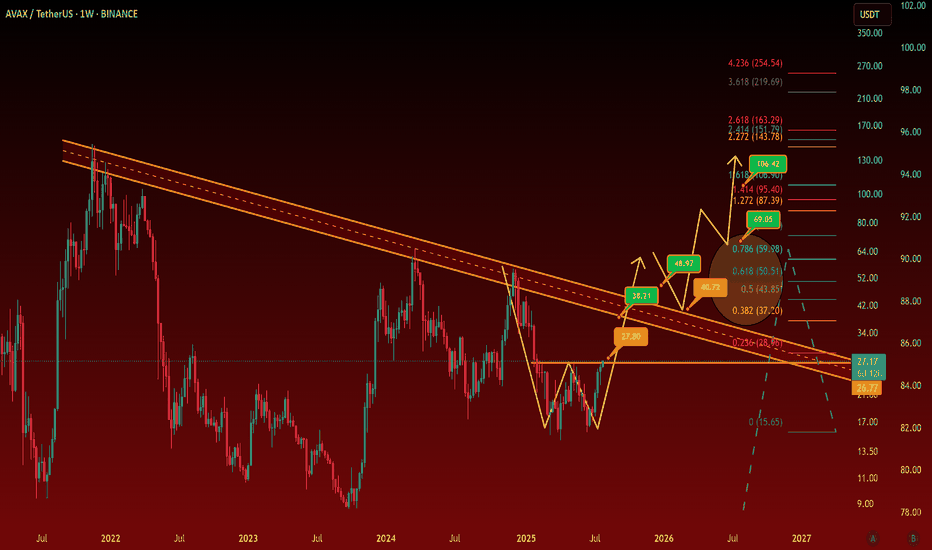

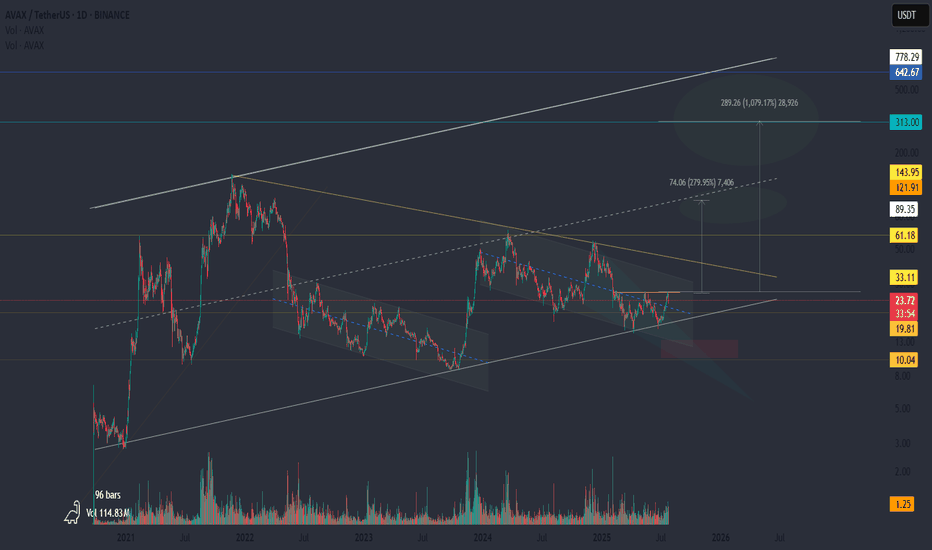

Will AVAX (Avalanche) reach $100?Avalanche (AVAX) has been steadily growing across various sectors for quite some time.

We are also witnessing the silent rise of Avalanche's DeFi ecosystem, which continues to expand quietly yet steadily.

If the daily candle closes above this resistance level, we could start moving toward higher targets.

Don’t forget that breaking the long-term trendline is a crucial event — and with Bitcoin dominance on the decline, it might finally be AVAX’s time to shine.

Let’s also not forget that AVAX ETFs are on the way.

AVAXUSDT Double Bottom Confirmation.AVAX has formed a textbook double bottom pattern on the daily chart, signaling a potential reversal after months of downtrend. The neckline around the $27 zone has been broken decisively, confirming the bullish breakout.

Key Points:

- Double Bottom Structure: A strong bullish reversal pattern with a clean neckline breakout.

- Breakout Level: $27, which was acting as resistance for the past several weeks.

- Volume Surge: Noticeable increase in volume during the breakout, adding strength to the move.

- Target: $48–$50 region. ( Channel resistance)

-Stop-Loss Idea: Below $22.0

AVAX appears ready to trend higher as momentum builds. If bulls hold above the breakout zone, the rally may accelerate in the coming weeks.

Cheers

Hexa

Avalanche (AVAX): Waiting For Proper Breakout | 3 Step BreakAvalanche is slowly gaining some kind of bullish volume, where we are expecting to see smaller upward movement.

On bigger timeframes we are sitting just at the major neckline area so this is why we also considered the current zone to be a good bounce area, so let's wait for a proper breakout now.

Swallow Academy

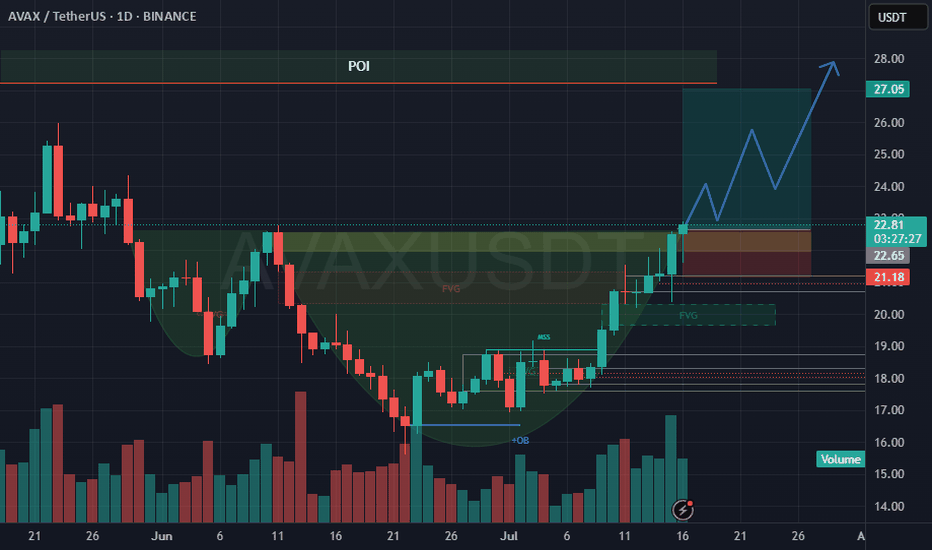

LONG ON $AVAXThe AVAX/USDT chart presents a bullish continuation setup supported by a completed cup formation, bullish market structure shift (MSS) and fair value gap (FVG) fills. With rising volume on the right side of the cup and a clean break above recent resistance, the market shows clear signs of institutional interest and buyer strength. The price is approaching a Point of Interest (POI) near $27, which is likely to serve as a target zone or temporary supply barrier.

A long trade setup is valid between $21.50 and $22.60 which aligns with the retest of the FVG zone, previous structure breakout and early handle development. Stop loss should be placed at $20.9, protecting the setup from invalidation while maintaining a strong risk-reward profile. Target levels include $24.50 (TP1) for an early exit, $26.80 (TP2) near the POI base and $27.05\$27.20 (TP3) at the top of the expected move. R:R range from 2:1 up to 5:1 depending on point of entry.

To execute, traders should watch for bullish confirmation on lower timeframes (1H–4H) within the entry zone, such as a bullish engulfing candle, BOS or a volume-backed rejection. A scaling entry strategy can improve average price and partial profit-taking at key levels ensures the position remains protected as the trade unfolds. Overall, the structure, volume, and Smart Money signals support a high-probability long from the $21.50\$22.60 range toward the $27 POI.

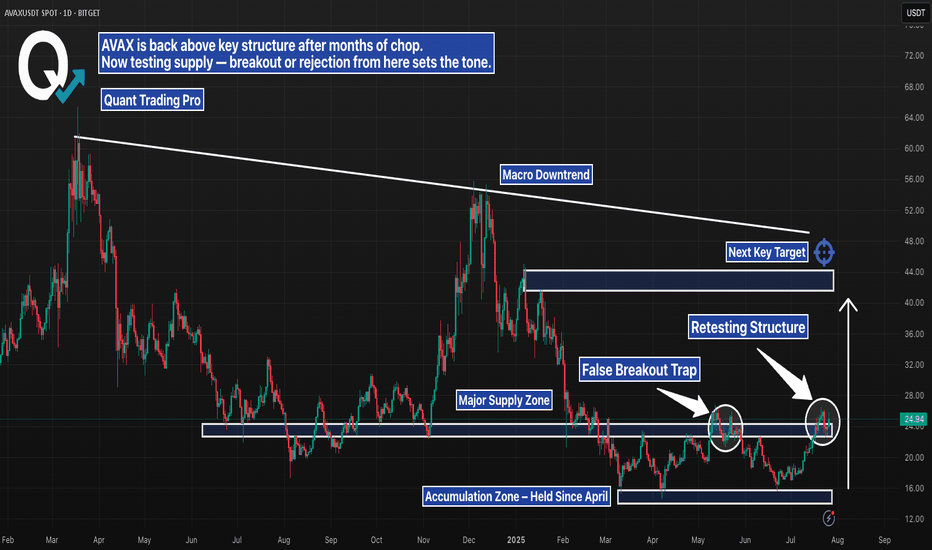

AVAX Daily – Breakout or Another Trap?AVAX just pushed into a major supply zone, testing structure that’s capped price since early 2024. After months of chop and accumulation, bulls have finally reclaimed key support — but the real test is happening now.

Here’s the setup:

– Retesting structure after first rejection

– Sitting below a clear macro downtrend line

– Above an accumulation zone that held for months

– Next key target sits near $40–44, with confluence from prior highs and trendline resistance

This is the kind of move that either builds serious momentum — or turns into another trap. Wait for confirmation. Volume and reaction here will say everything.

#AVAX #Altcoins #CryptoBreakout #SupplyZone #TrendlineResistance #TechnicalAnalysis #QuantTradingPro #PriceAction

AVAX: A Quiet Rocket?This might be the calm before the cycle.

📍 All the liquidity is above.

Levels like 33 and 61 aren’t just resistance — they’re fuel. Clusters of short liquidations and forgotten limit orders are sitting right there. If we get a breakout, it could be sharp. And if there’s another pullback? Don’t panic. That would be the test — the shakeout before the move.

🚀 If the cycle kicks in, AVAX could be one of the silent leaders.

While the crowd is focused elsewhere, AVAX has been building quietly: structure, accumulation, time. The kind of setup that doesn’t scream hype, but whispers opportunity.

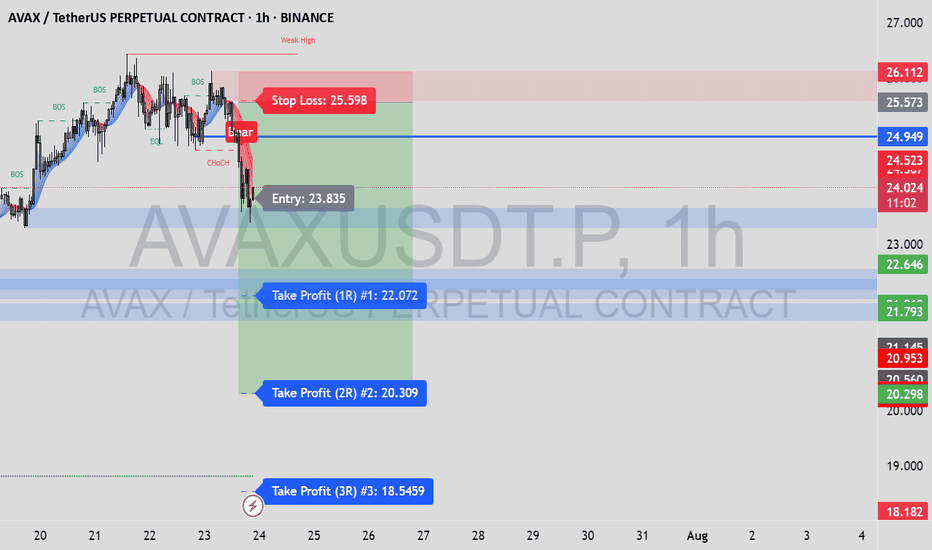

AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H📉 AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H)

🔍 Trade Type: Short

🕐 Timeframe: 1-Hour (1H)

📊 Entry Trigger: Change of Character (CHoCH) after Equal Highs

🎯 Target: 20.298

🛑 Stop Loss: 25.573

💰 Risk/Reward Ratio: 9.79

📌 Trade Breakdown:

This AVAX short was taken based on Smart Money Concepts, using a combination of liquidity structures and market psychology:

✅ Key Confluences:

Equal Highs (EQL) formed above internal structure – clear inducement/liquidity pool.

CHoCH confirmed as price broke below a major internal low → bearish intent confirmed.

Retracement into Bearish Order Block in the Premium Zone offered an optimal entry.

Strong follow-through from institutional selling after liquidity grab.

🧠 Why I Took This Trade:

This setup offered a clean narrative:

Liquidity above = taken

Internal structure = broken

OB in premium = respected

Imbalance/fair value gap below = price magnet

This alignment made it a high-confluence short with an excellent R:R ratio.

🎯 Target Zone (20.298–20.953):

This area contains unmitigated demand and prior support. I anticipate price to:

Tap into this zone to rebalance price inefficiency

Potentially react from there (watch for reversal setups)

⚠️ What I'm Watching:

Possible reaction around 21.793 support – consider partial profits

Maintain awareness of higher timeframe trend (H4/D1)

Volume shift or bullish CHoCH may signal exit before TP

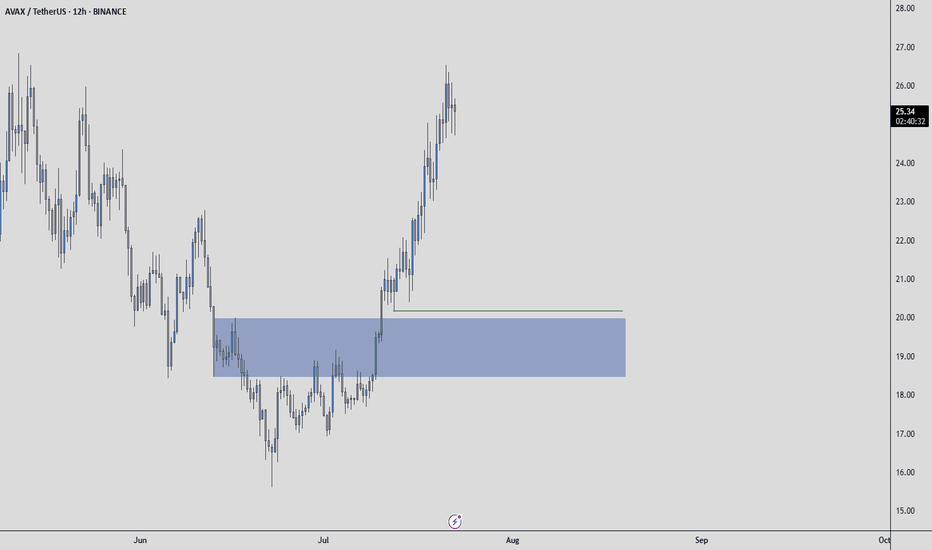

AVAXUSDT: Mid-Term AnalysisThe blue box under liquidity may do the job.

📍 Plan

If price drops into the blue box:

✅ Watch for footprint absorption (buyers stepping in)

✅ Look for CDV support or bullish divergence

✅ Confirm with a structure reclaim before entry

⚡ Reminder

No chasing. No forcing trades.

If the setup aligns, I’ll take it with clear risk.

If not, I’ll wait.

The right price, or no trade.

AVAX Long Swing Setup – Waiting for Support RetestAVAX has been rallying for two straight weeks, showing strong momentum. We’re watching for a healthy pullback into the $22.50–$24.00 support zone to position for continuation. If this zone holds, the risk/reward setup favors bulls with clear upside targets.

📌 Trade Setup:

• Entry Zone: $22.50 – $24.00

• Take Profit Targets:

o 🥇 $27 – $29

o 🥈 $33 – $35

o 🥉 $40 – $44

• Stop Loss: Daily close below $20.50

AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

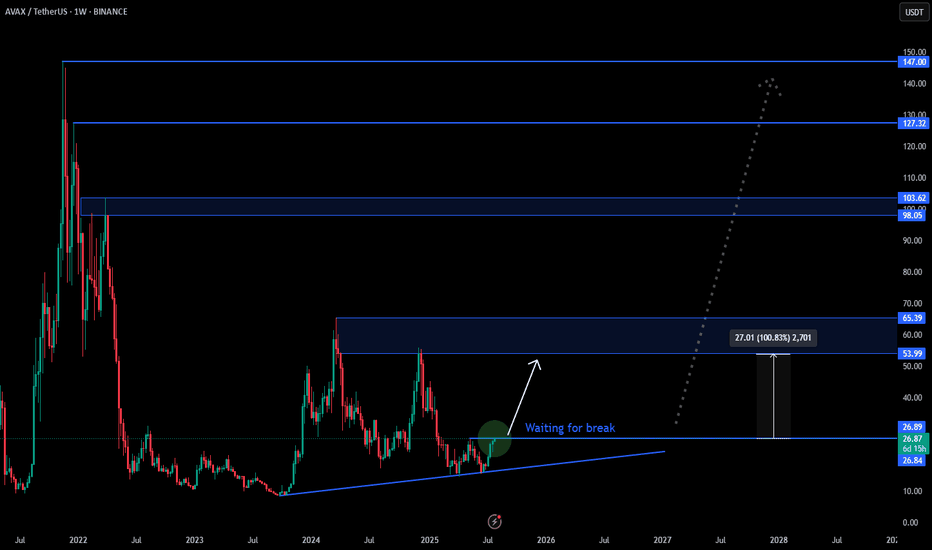

Avax Tests Key Resistance at 27 for the Third TimeAvax is once again testing the 27 resistance level. The first attempt lasted over a week, and the second one held for a couple of days, but in both cases, Avax failed to break through. This time, however, it has stronger support from market-wide momentum.

Bitcoin has reached 120,000, Ethereum is posting sharp gains, and most notably, Chainlink (LINK) has already broken through its own resistance. Avax and LINK have shown a high degree of correlation, nearly 89% over the past two months. This strong relationship, while occasionally fluctuating, has been in place for several years.

A breakout for Avax may take time, but it now has more momentum and supportive conditions behind it. Still, as long as the 27 resistance holds, bulls should approach with caution before entering long positions.